Toll Goods Differ From Public Goods In That

Imagine a sun-drenched highway, snaking its way through rolling hills. Cars hum along, a steady stream of travelers eager to reach their destinations. Some glide effortlessly through designated express lanes, while others patiently navigate the regular flow of traffic. This simple scene encapsulates a fundamental concept in economics: the distinction between toll goods and public goods.

At the heart of this difference lies the principle of accessibility and funding. While public goods are available to all, funded through collective means like taxes, toll goods operate on a user-pays system, offering exclusive access in exchange for a fee. Understanding this divergence is crucial for informed policy decisions, efficient resource allocation, and a fair distribution of societal benefits.

Understanding Public Goods

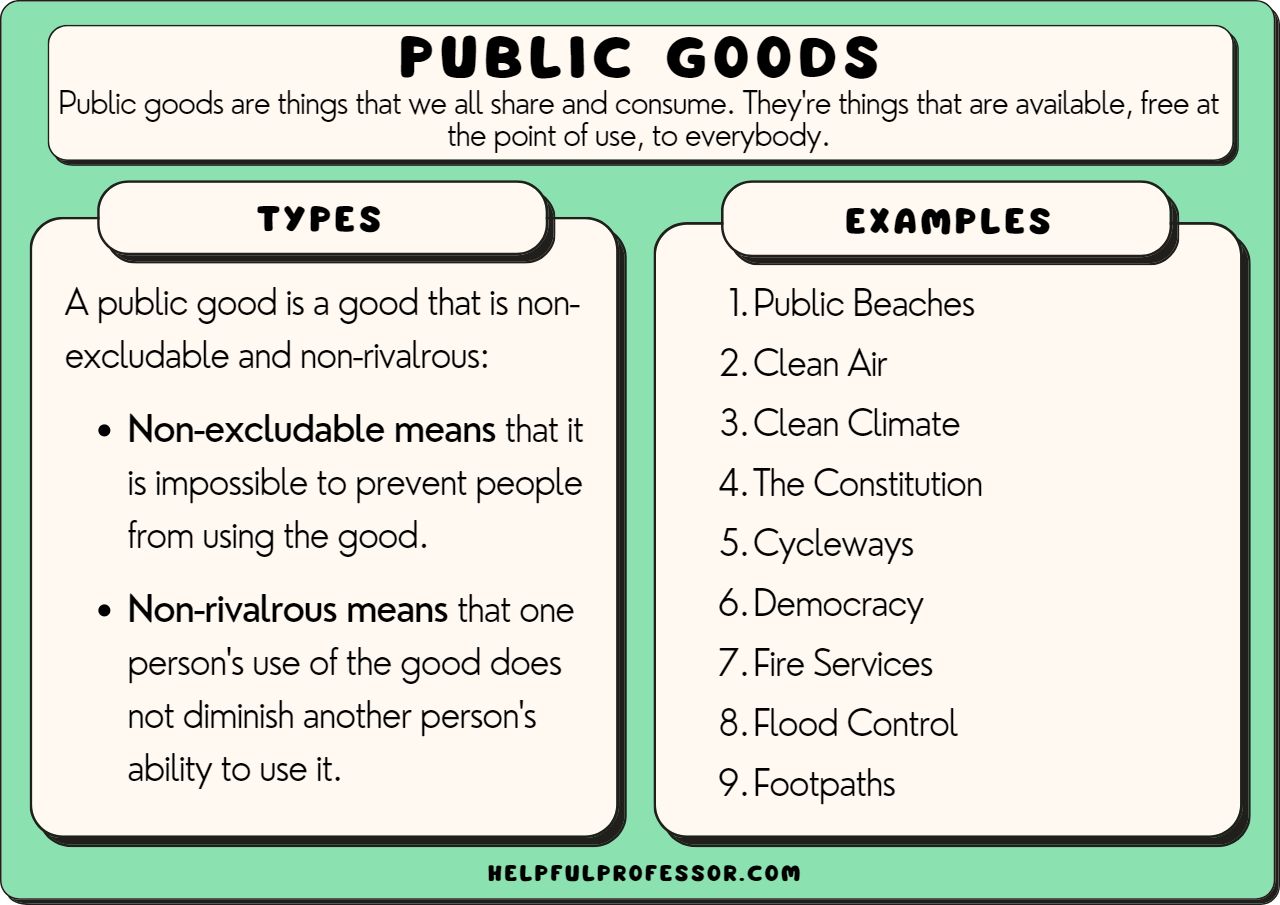

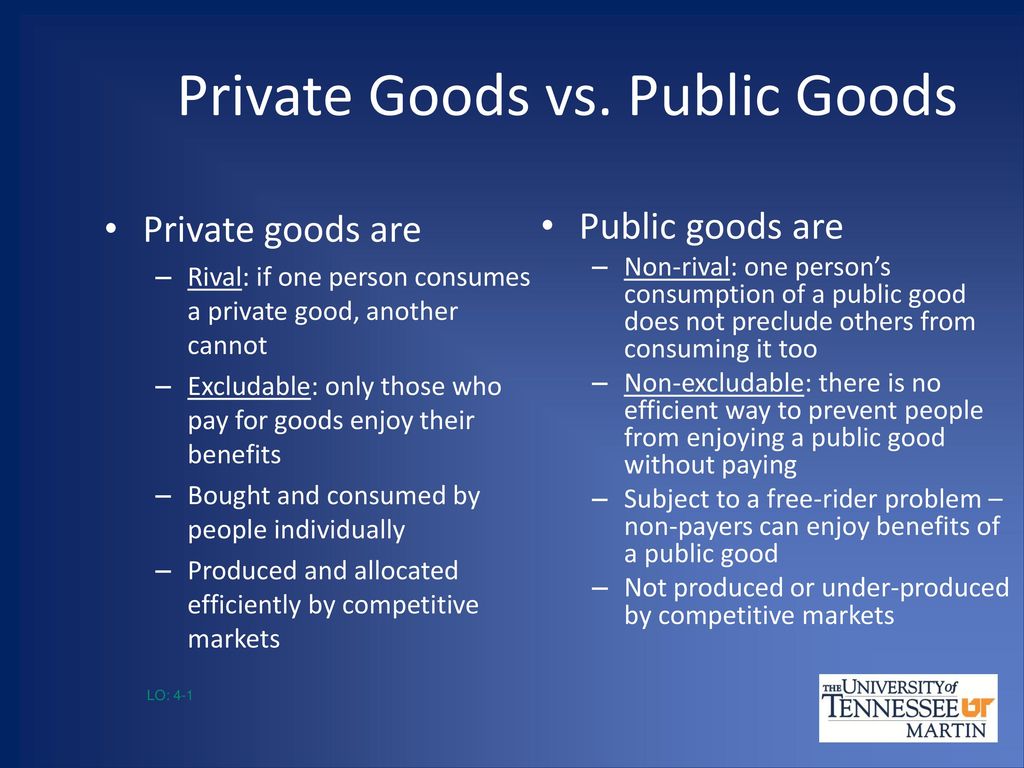

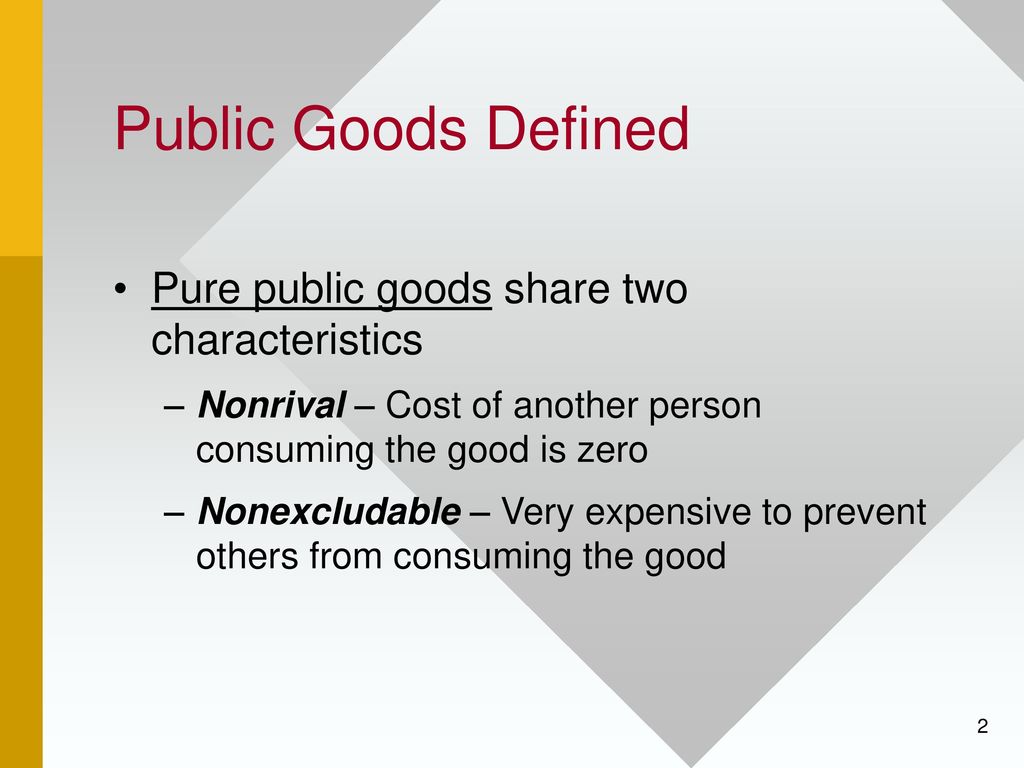

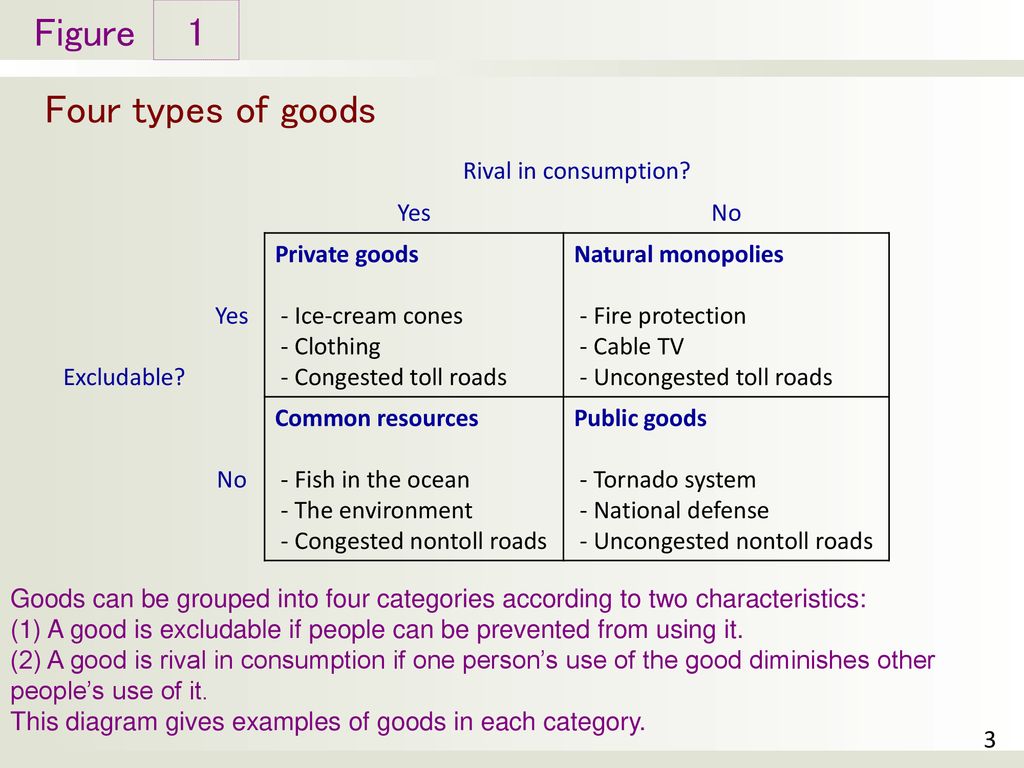

Let's begin with public goods. These are commodities or services that exhibit two key characteristics: non-excludability and non-rivalry. Non-excludability means that it's difficult or impossible to prevent people from enjoying the benefits of the good, even if they haven't paid for it.

National defense is a classic example. Everyone within a country benefits from the protection provided by the military, regardless of whether they've directly contributed to its funding through taxes. Clean air is another. It's practically impossible to prevent someone from breathing clean air, even if they haven't paid for pollution control measures.

Non-rivalry, on the other hand, means that one person's consumption of the good doesn't diminish its availability to others. Consider a lighthouse. The light it emits guides all ships safely, and one ship's use of the light doesn't prevent other ships from benefiting from it simultaneously.

Because of these characteristics, public goods often face the free-rider problem. Individuals may be tempted to enjoy the benefits without contributing to the cost, knowing that the good will be provided regardless. This is why governments typically step in to provide public goods, funding them through taxation, ensuring collective benefit.

Exploring Toll Goods

Now, let's turn our attention to toll goods. Unlike public goods, toll goods are excludable. Providers can prevent people from accessing them if they haven't paid the required fee. And in some, but not all cases, they are rivalrous, meaning that one person's use can diminish the availability or quality for others.

That express lane on the highway we envisioned earlier serves as a perfect example. Only those who pay the toll are granted access to the faster-moving lane, excluding those who choose not to pay. The more people using the express lane, the slower it becomes for everyone.

Think of bridges, tunnels, or even subscription-based streaming services. Access is contingent upon payment. While a bridge or tunnel can become congested, indicating rivalry, a streaming service may accommodate numerous users simultaneously, exhibiting non-rivalrous characteristics up to a certain server capacity.

The key difference, therefore, lies in the mechanism of access. Public goods are freely available to all, while toll goods are accessed through payment.

The Significance of the Distinction

Understanding the difference between toll goods and public goods is crucial for a variety of reasons. First, it informs resource allocation. Governments need to decide which goods and services should be provided as public goods, funded through taxes, and which can be provided as toll goods, funded by users.

Second, it impacts economic efficiency. Toll goods can provide a more efficient way to finance certain infrastructure projects, particularly when there's a clear benefit to those who use them. The user-pays system ensures that those who directly benefit from the good bear the cost, reducing the burden on taxpayers who may not use it.

Third, it has implications for equity and fairness. Toll goods can potentially create inequities if they disproportionately burden low-income individuals who may be unable to afford the fees. Policymakers must carefully consider the potential impact on different segments of society when implementing toll-based systems.

Consider the debate surrounding toll roads. Proponents argue they provide a faster, more efficient transportation option, funded by those who use them. Critics, however, contend that they create a two-tiered system, favoring those with the financial means to pay, while disadvantaging those who cannot.

The Blurring Lines

While the distinction between toll goods and public goods is generally clear, there are instances where the lines can become blurred. Some goods may exhibit characteristics of both, making classification challenging. For instance, a public park could be considered a public good if it's freely accessible to all.

However, if the park charges an entrance fee for certain amenities, like a swimming pool or a special event, it then takes on characteristics of a toll good for those specific features. Similarly, some public goods may have limited capacity, leading to congestion and reduced benefit for each user, thus exhibiting some rivalry.

The internet is an interesting case study. While access to the internet itself isn't always a public good, in many countries access is increasingly recognized as a basic necessity. Governments are investing in infrastructure to expand broadband access, particularly in underserved areas, blurring the line between a private service and a quasi-public good.

Looking Ahead

The debate surrounding toll goods and public goods is likely to continue as societies evolve and new technologies emerge. As populations grow and infrastructure demands increase, policymakers will need to carefully consider the optimal mix of funding mechanisms to ensure efficient resource allocation, equitable access, and sustainable development.

The decisions we make today regarding the provision of public and toll goods will shape the future of our communities and the opportunities available to all. By understanding the fundamental differences between these concepts, we can engage in more informed discussions and advocate for policies that promote a more just and prosperous society.

The choices we make today—investing in public infrastructure or embracing user-funded toll systems—will resonate for generations to come. Finding the right balance, one that fosters both individual opportunity and collective well-being, is the challenge that lies ahead.