Tortoise Power And Energy Infrastructure Fund Inc

Shares of the Tortoise Power and Energy Infrastructure Fund Inc. (TPZ) plummeted today following a disappointing earnings report and revised investment strategy. Investors are scrambling as the fund faces increased scrutiny over its future performance and direction.

This downturn raises critical questions about the fund's ability to navigate the volatile energy market and deliver expected returns to shareholders, prompting a wave of sell-offs and uncertainty surrounding its long-term viability.

Earnings Miss Fuels Investor Anxiety

The fund reported a significant earnings shortfall for the quarter ending September 30, 2024. Net investment income fell to $0.15 per share, substantially below the anticipated $0.22 per share. This underperformance is attributed to lower-than-expected distributions from several of its key portfolio holdings in the energy infrastructure sector.

According to the official release, the drop in income stems from challenges within the midstream energy sector, specifically lower throughput volumes and decreased demand for certain energy commodities. The report also cited increased operating expenses as a contributing factor.

The fund's net asset value (NAV) also experienced a decline, decreasing by 5% over the quarter, further eroding investor confidence. This has triggered immediate concern among those relying on TPZ for steady income.

Strategic Shift Sparks Debate

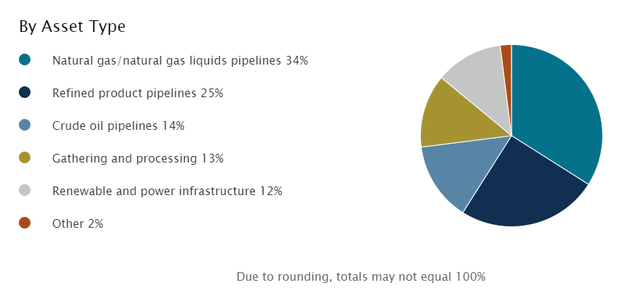

In conjunction with the earnings announcement, Tortoise Power and Energy Infrastructure Fund unveiled a revised investment strategy aimed at diversifying its portfolio and mitigating risk. The new strategy involves a gradual shift away from traditional fossil fuel infrastructure towards investments in renewable energy and sustainable infrastructure projects.

This pivot has been met with mixed reactions from investors, some of whom applaud the move towards a more sustainable future, while others express concern about the fund's expertise in navigating the renewable energy landscape.

"The sudden shift raises questions about the fund's core competency and ability to generate comparable returns in a completely different sector,"commented a leading financial analyst.

The strategic shift is slated to take place over the next 12-18 months, with specific allocation targets to be disclosed in the coming weeks. Details surrounding the exact proportions of each sector remain unclear.

Market Reaction and Stock Performance

The news sent shockwaves through the market, resulting in a sharp decline in TPZ's stock price. Shares of the fund closed down 15% today, trading at their lowest level in over five years. The trading volume surged as investors rushed to sell off their holdings.

Analysts at Raymond James downgraded their rating on TPZ from "Market Perform" to "Underperform," citing concerns about the fund's near-term earnings prospects and the uncertainty surrounding its strategic transition. This action fueled further selling pressure.

Several major institutional investors have reportedly reduced their positions in TPZ, further exacerbating the stock's downward spiral. The volatility surrounding TPZ’s stock is expected to continue in the short term.

Management's Response and Future Outlook

In a press release, management acknowledged the challenges facing the fund and reiterated its commitment to delivering long-term value to shareholders. They emphasized the importance of adapting to the evolving energy landscape and believe the strategic shift will ultimately position the fund for greater success.

“We understand the concerns expressed by investors and are actively working to address the challenges and deliver improved performance,” stated the CEO during a conference call. The management is trying to regain trust with it's shareholders.

The fund plans to host a shareholder conference call next week to provide further details on the strategic plan and answer questions from investors. The details of the call will be released shortly.

Next Steps and Investor Considerations

Investors are advised to closely monitor the fund's performance and the implementation of its new investment strategy. Careful consideration should be given to their individual risk tolerance and investment objectives before making any decisions regarding their holdings in TPZ.

The shareholder conference call next week will provide a crucial opportunity for investors to gain clarity on the fund's future direction and assess the potential impact on their investments. Investors are urged to attend or review the replay.

The situation surrounding Tortoise Power and Energy Infrastructure Fund Inc. (TPZ) remains fluid, and ongoing developments should be closely monitored. The developments remain crucial for existing and potential investors alike.