Tower Semiconductor Ltd. Earnings Report Q2 2024

Tower Semiconductor Ltd. (TSEM) announced its Q2 2024 earnings, revealing a revenue decline amidst ongoing market headwinds. The report, released August 8, 2024, highlights the company's efforts to navigate a challenging semiconductor landscape.

Despite the revenue dip, Tower Semiconductor is implementing strategic initiatives to strengthen its market position. The company remains focused on key growth areas and operational efficiencies.

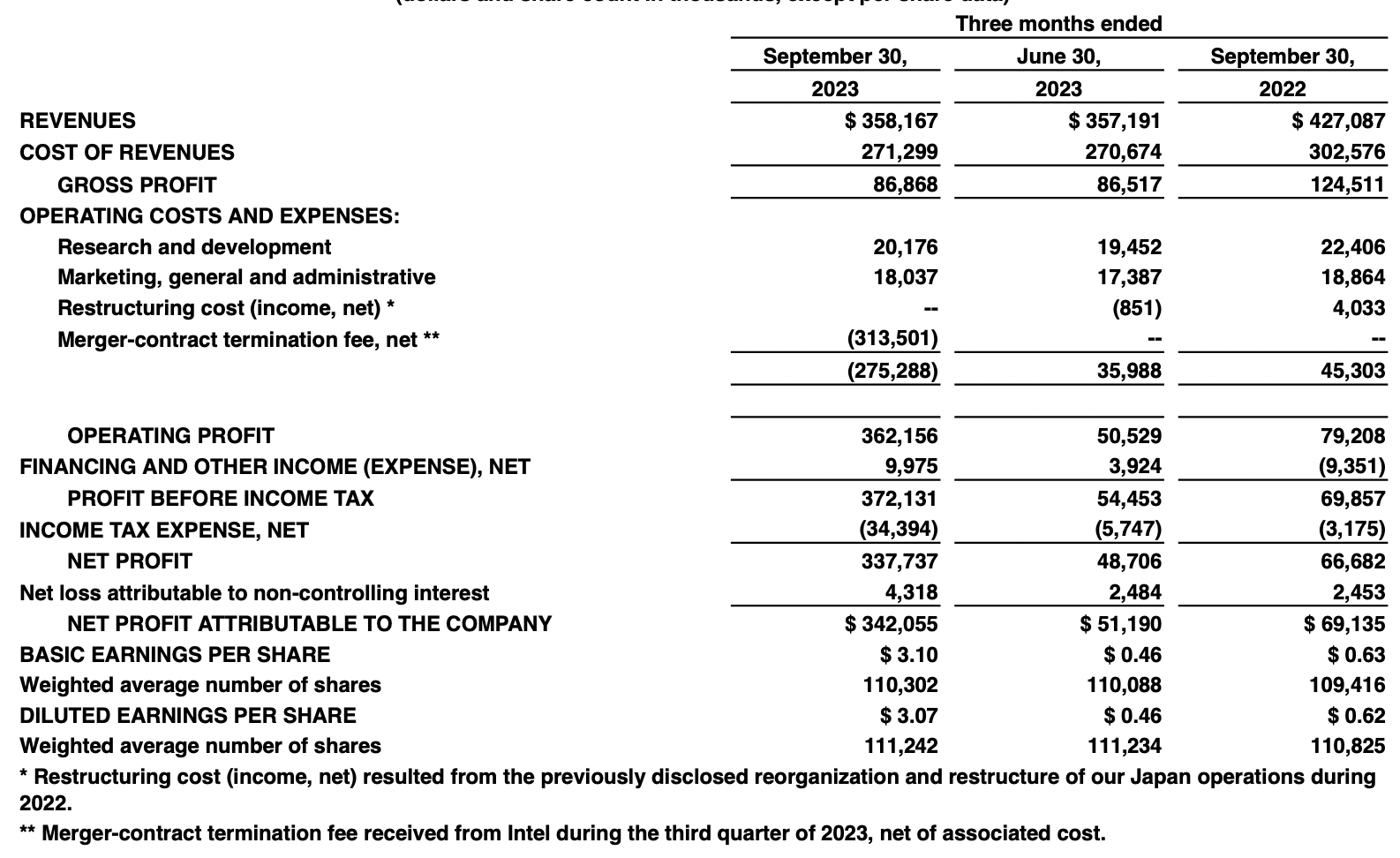

Q2 2024 Financial Highlights

Tower Semiconductor reported revenue of $326.5 million for Q2 2024. This represents a decrease compared to the $420.6 million reported in Q2 2023.

Gross profit for Q2 2024 was $57.4 million, down from $102.1 million in the same period last year. The gross margin stood at 17.6%, compared to 24.3% in Q2 2023.

Operating loss reached $6.6 million, a significant shift from the operating income of $42.9 million reported in Q2 2023.

Net loss for Q2 2024 totaled $16.2 million, or $0.15 per share, compared to a net income of $34.2 million, or $0.31 per share, in Q2 2023.

Cash flow from operations was $51.1 million, down from $82.8 million in Q2 2023. Capital expenditures amounted to $54.4 million.

Key Business Updates

The company is actively engaged in expanding its presence in high-growth markets. Focus areas include power management, radio frequency (RF), and industrial sensors.

Tower Semiconductor continues to collaborate with strategic partners to develop innovative solutions. These partnerships aim to enhance the company's technological capabilities and market reach.

The company is making progress in optimizing its manufacturing processes and cost structure. Initiatives are underway to improve operational efficiencies across its global facilities.

According to the earning call, the impact of the failed Intel merger is still being absorbed. Tower is seeking new avenues for growth and development.

Segment Performance

RF and High Performance Analog showed some resilience. However, overall demand slowdown impacted most segments.

Power Management experienced weaker demand due to inventory corrections at customers.

CMOS Image Sensors (CIS) saw moderate growth, supported by specific customer programs.

Management Commentary

"Despite the challenging market environment, we are focused on executing our strategic plan," said Russell Ellwanger, CEO of Tower Semiconductor.

Ellwanger emphasized the company's commitment to innovation and customer collaboration. He stated that Tower is positioning itself for long-term growth.

"We are taking proactive measures to manage costs and optimize our operations," added Ofer Tamir, CFO of Tower Semiconductor. Tamir highlighted the importance of maintaining financial discipline during this period.

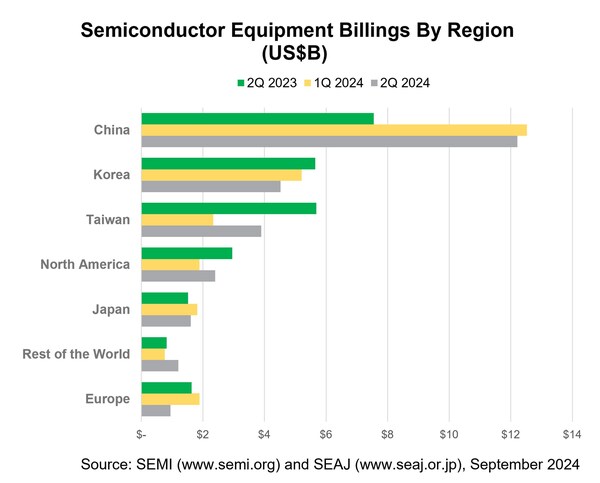

Geographic Performance

The Asia Pacific region continued to be a significant contributor to revenue. However, the overall revenue from this region decreased compared to the previous year.

North America and Europe also experienced a decline in revenue. The global economic slowdown impacted demand across various geographies.

Financial Outlook

Tower Semiconductor expects revenue for Q3 2024 to be approximately $330 million, plus or minus 5%.

The company anticipates continued market volatility in the near term. Tower is closely monitoring global economic conditions and adjusting its strategy accordingly.

Capital expenditures for 2024 are projected to be in the range of $220 million.

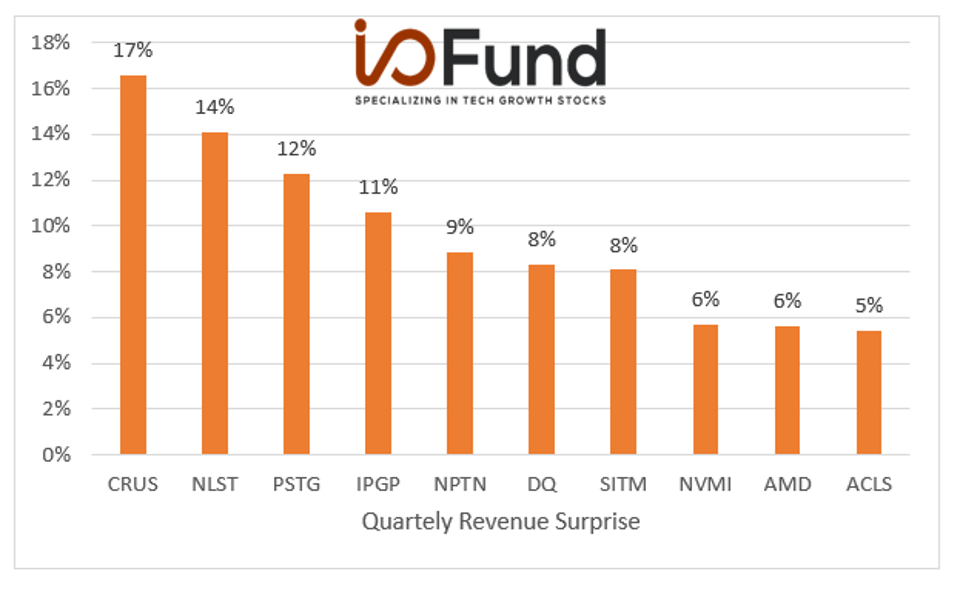

Analyst Reactions

Analysts are closely watching Tower's ability to navigate the current downturn. The focus is on the company's strategic initiatives and cost management efforts.

Some analysts express concern about the decline in gross margin. They are looking for signs of improvement in operational efficiency.

Investment firms are re-evaluating their ratings on Tower Semiconductor. The company's long-term growth prospects remain a key consideration.

Next Steps and Ongoing Developments

Tower Semiconductor will continue to execute its strategic plan, focusing on key growth areas. The company remains committed to delivering value to its shareholders.

Management will host an earnings call to provide further details on the results and outlook. This call will offer an opportunity for investors to ask questions.

The company is actively pursuing new business opportunities and partnerships. Efforts are underway to strengthen its market position and drive long-term growth.

Tower Semiconductor is navigating a complex and evolving semiconductor landscape. The company's ability to adapt and innovate will be critical to its future success.