Two Categories Of Expenses For Merchandising Companies Are

Imagine walking into a bustling marketplace, the air thick with the scent of spices, the vibrant colors of textiles catching your eye. Each vendor, a small business owner, has carefully curated their wares, hoping to entice customers with their unique offerings. But behind the enticing displays and engaging sales pitches lies a complex web of expenses that every merchandising company, big or small, must navigate to stay afloat.

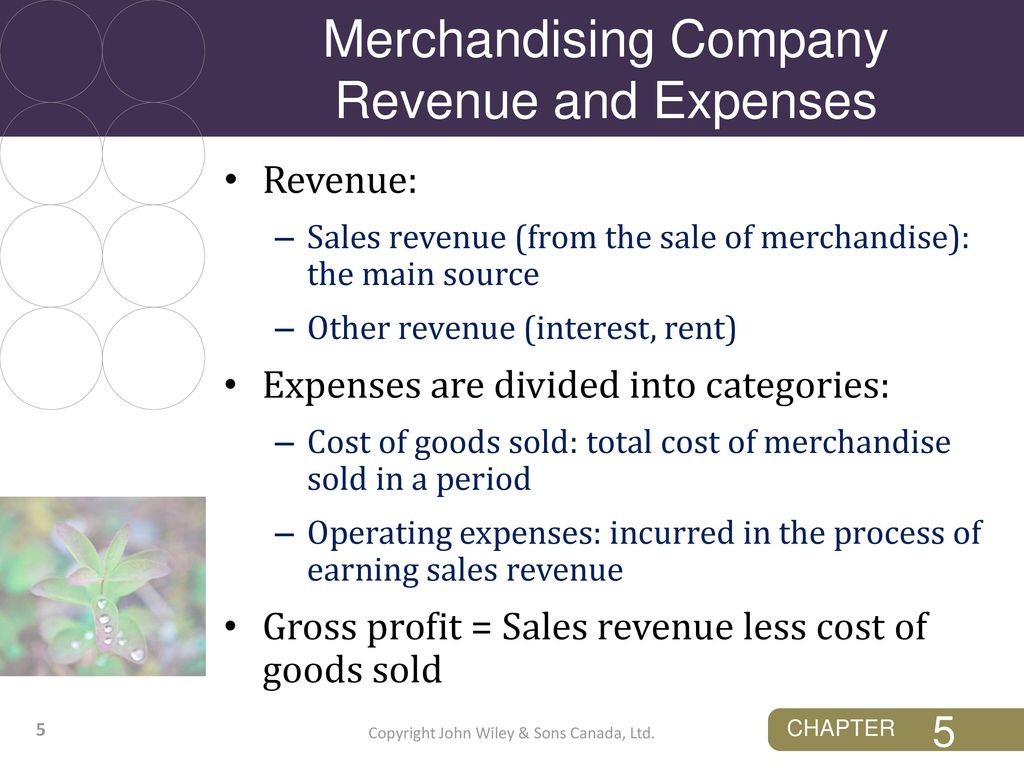

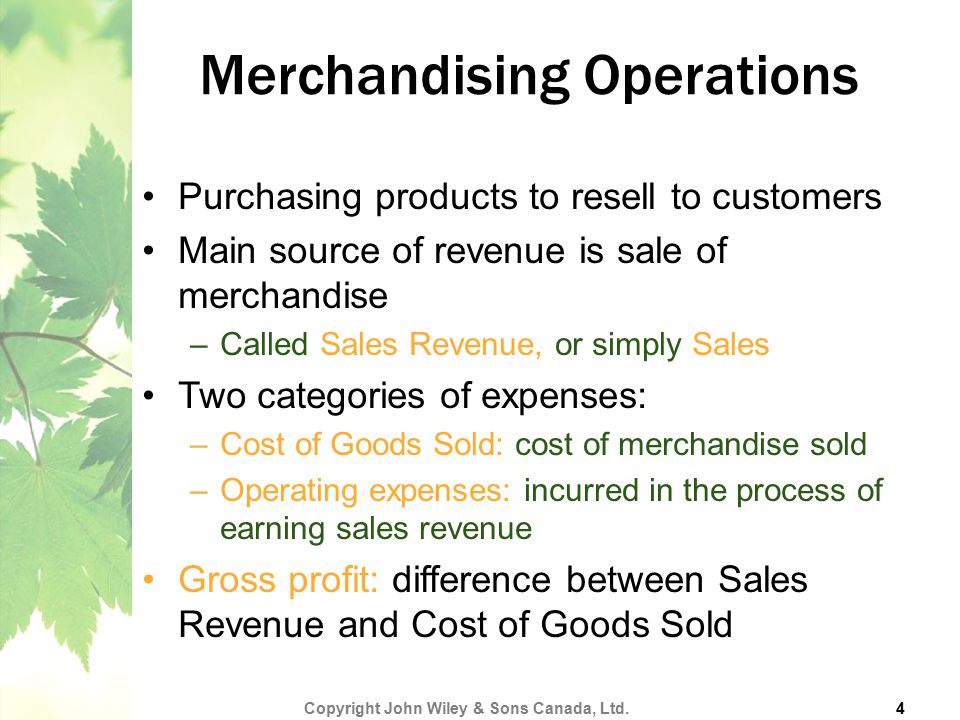

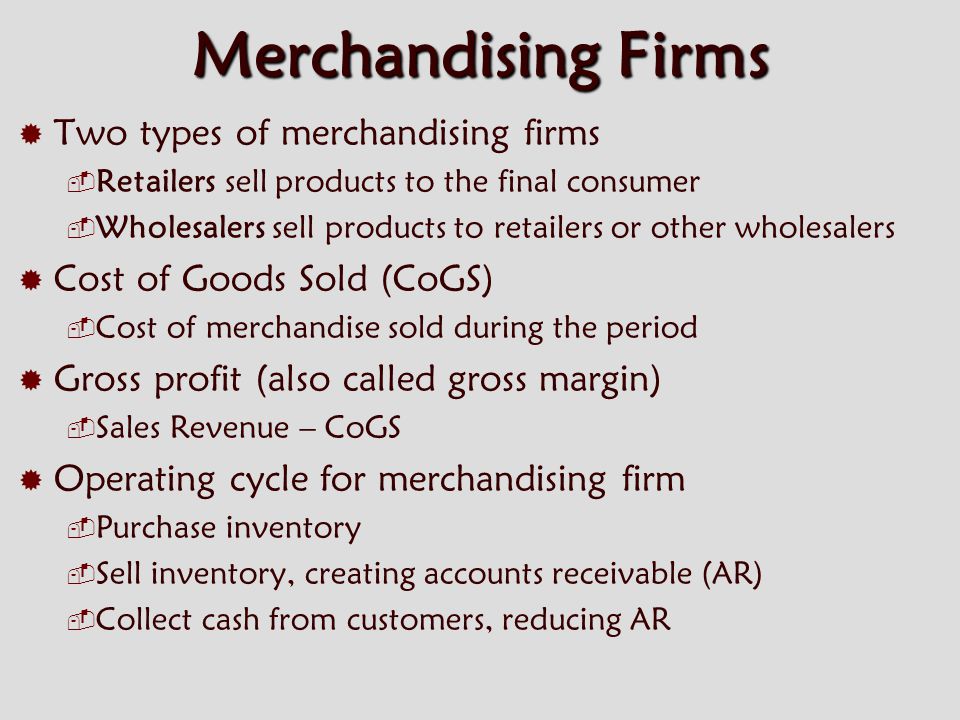

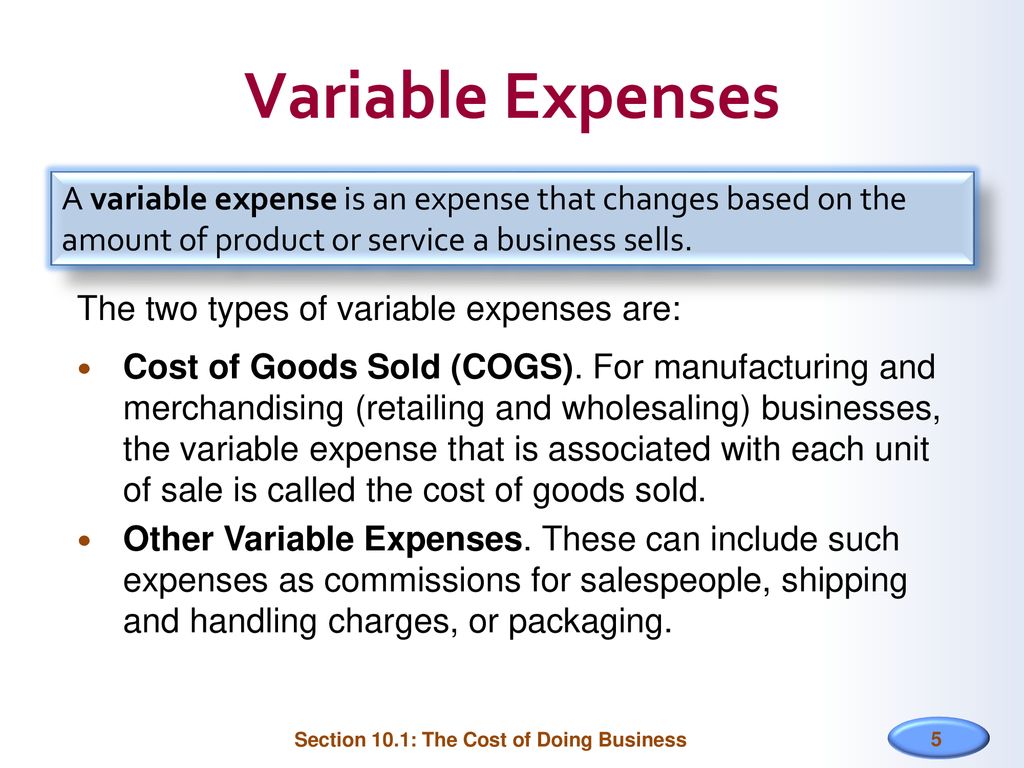

This article aims to shed light on the two primary categories of expenses that merchandising companies face: Cost of Goods Sold (COGS) and Operating Expenses. Understanding these categories is crucial for anyone involved in the business of buying and selling goods, from the local artisan to the multinational corporation. We'll explore the intricacies of each, providing a clear picture of how they impact profitability and overall business strategy.

Cost of Goods Sold (COGS): The Foundation of Profitability

COGS represents the direct costs associated with producing or acquiring the goods a company sells. It's the most significant expense for merchandising businesses, as it directly impacts the gross profit margin.

What's Included in COGS?

The most obvious component of COGS is the purchase price of the merchandise. If a boutique buys dresses wholesale for $30 each, that $30 is a direct cost.

Transportation costs to get the goods to the business are also part of COGS. This includes shipping fees, freight charges, and even insurance during transit.

Direct labor costs, if applicable, are included when the merchandising company adds value to the product. Consider a bakery that buys flour and bakes bread; the wages for the bakers directly involved in production are part of COGS.

Finally, any raw materials or components used to create the finished product are included in COGS. For example, the cost of fabric, buttons, and zippers for a clothing manufacturer.

It's important to note that COGS only includes direct costs. Indirect costs, like rent or utilities for the manufacturing facility, fall under operating expenses.

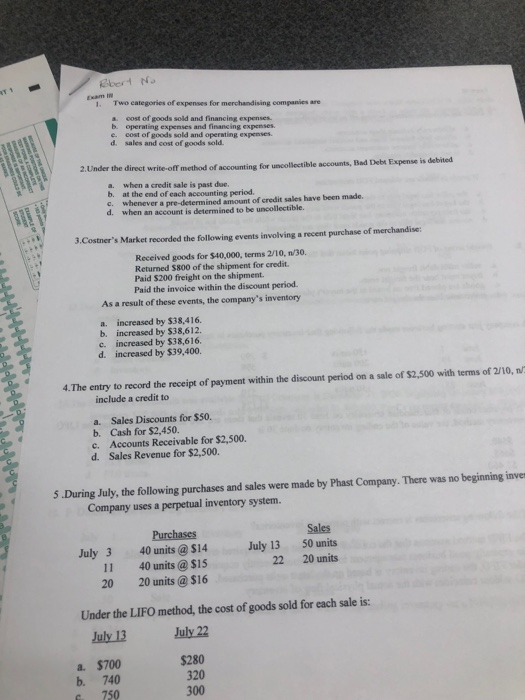

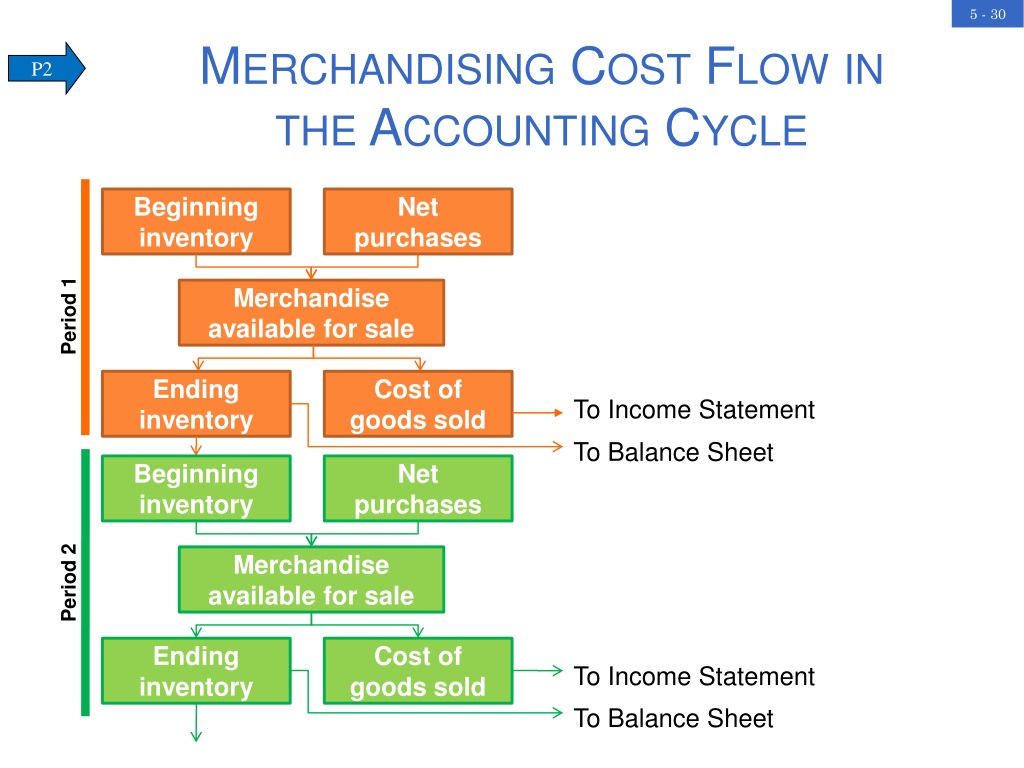

Calculating COGS: A Key to Understanding Profitability

Calculating COGS is a vital step in determining a company's gross profit. The formula is straightforward: Beginning Inventory + Purchases - Ending Inventory = COGS.

For instance, if a bookstore starts the month with $5,000 worth of books, purchases $2,000 worth of new books, and ends the month with $4,000 worth of books, their COGS is $3,000 ($5,000 + $2,000 - $4,000 = $3,000). This number is then subtracted from revenue to calculate the gross profit.

Efficient inventory management is key to controlling COGS. Techniques like Just-in-Time (JIT) inventory help minimize holding costs and reduce the risk of obsolescence.

Negotiating favorable terms with suppliers is another effective strategy. Securing discounts or extended payment terms can significantly impact the bottom line.

Operating Expenses: Keeping the Business Running

Operating expenses are the costs a company incurs to run its business, outside of the direct costs of producing or acquiring the goods they sell. They are essential for supporting the business's day-to-day activities.

Categories of Operating Expenses

Selling expenses are directly related to marketing and selling the product. This includes advertising, sales commissions, and promotional materials.

Administrative expenses are the costs associated with managing the business. These include salaries for administrative staff, rent for office space, utilities, and insurance.

Depreciation is a non-cash expense that represents the decline in value of assets over time. For example, the depreciation of a delivery truck or office equipment is an operating expense.

Controlling Operating Expenses: Maximizing Efficiency

Managing operating expenses effectively is critical for maximizing profitability. Businesses can explore various strategies to reduce these costs.

Negotiating better rates with suppliers for services like insurance or utilities can lead to significant savings. Consider switching to more energy-efficient lighting or equipment.

Investing in technology can automate tasks and improve efficiency. Customer relationship management (CRM) systems can streamline sales and marketing efforts, for example.

Outsourcing non-core functions, such as payroll or IT support, can often be more cost-effective than hiring in-house staff. Careful analysis is needed to determine what functions are best handled internally versus externally.

According to a report by the Small Business Administration (SBA), businesses that carefully manage their operating expenses are more likely to survive and thrive in competitive markets. Regular review and adjustment of spending habits are crucial.

The Interplay Between COGS and Operating Expenses

While COGS and operating expenses are distinct categories, they are interconnected. Decisions made in one area can impact the other.

For example, investing in a more efficient delivery system might increase operating expenses initially, but it could also reduce transportation costs within COGS in the long run. Understanding the overall impact is crucial.

A strategic approach involves analyzing both COGS and operating expenses together to identify opportunities for optimization. This requires a holistic view of the business and a willingness to adapt to changing market conditions.

Ultimately, a healthy merchandising business is one that effectively manages both COGS and operating expenses. A strong gross profit margin combined with controlled operating costs leads to a healthy bottom line.

Looking Ahead: The Future of Expense Management

The landscape of expense management is constantly evolving, driven by technological advancements and changing consumer behavior. Businesses must stay informed and adapt to new challenges and opportunities.

Data analytics is playing an increasingly important role in expense management. Companies can use data to identify trends, predict future costs, and make more informed decisions.

Sustainability is also becoming a more significant factor. Consumers are increasingly demanding environmentally friendly products, which can impact both COGS (through the cost of sustainable materials) and operating expenses (through investments in green technologies).

In conclusion, understanding the two primary categories of expenses, COGS and operating expenses, is fundamental for any merchandising company seeking to achieve profitability and long-term success. By carefully managing these expenses and embracing new strategies, businesses can navigate the complexities of the marketplace and thrive in an ever-changing world. As the marketplace continues to evolve, so too must the strategies for managing these critical expenses, ensuring that businesses remain competitive and resilient.

+Period+Costs+(Current+Expenses).jpg)