Ubs Private Banking Minimum Requirements

UBS, a global leader in wealth management, maintains specific eligibility criteria for its private banking services. Understanding these requirements is crucial for individuals seeking to access the exclusive offerings and tailored financial solutions provided by the institution.

This article aims to provide a clear and concise overview of UBS's private banking minimum requirements, shedding light on the qualifications prospective clients must meet. It will examine the assets under management (AUM) threshold and other potential factors influencing eligibility.

Minimum Asset Requirements for UBS Private Banking

The primary determinant for accessing UBS Private Banking is typically the amount of investable assets an individual possesses. While specific figures can vary depending on the region and the type of services sought, a general benchmark exists.

Generally, UBS requires clients to have at least $2 million in investable assets to qualify for their private banking services, according to various industry reports and financial news outlets. This figure represents the minimum threshold for accessing personalized wealth management solutions.

Regional Variations and Other Factors

It's important to note that the $2 million AUM requirement isn't universally fixed and may fluctuate based on geographical location. Some regions with higher costs of living or stronger demand might impose stricter requirements.

Furthermore, the relationship a prospective client has with UBS can also influence eligibility. Existing clients with other UBS accounts may find it easier to transition into private banking, even if they don't initially meet the standard AUM requirement.

Beyond assets, UBS may also consider other factors such as income, net worth, and the complexity of an individual's financial situation. These elements are assessed to determine the suitability of private banking services for the client's specific needs.

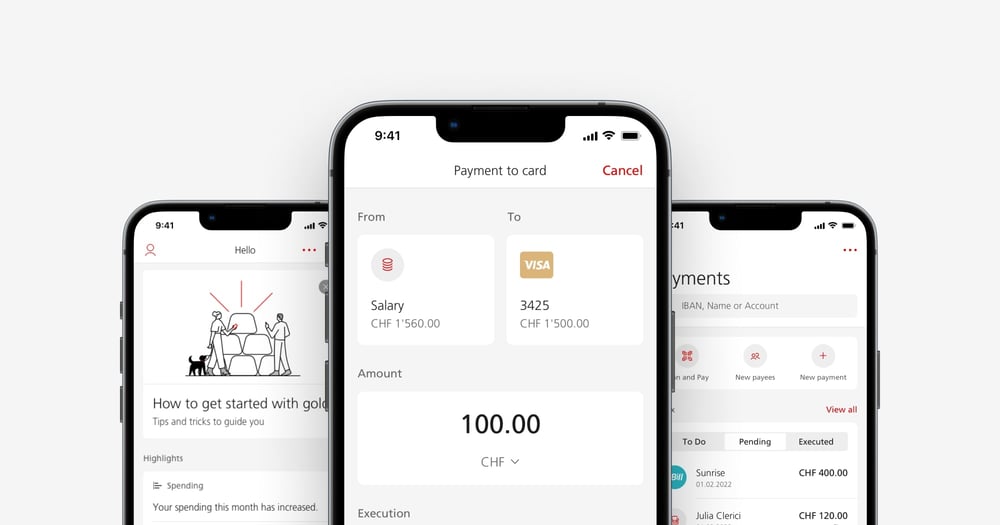

Benefits and Services of UBS Private Banking

Meeting the minimum requirements for UBS Private Banking unlocks access to a comprehensive suite of services designed to manage and grow wealth. These offerings extend beyond traditional investment management.

Clients benefit from personalized financial advice, estate planning, tax optimization strategies, and access to exclusive investment opportunities. UBS's private banking clients also often receive access to concierge services and bespoke financial solutions catered to their unique lifestyles.

The personalized approach is a hallmark of private banking at UBS. Dedicated relationship managers work closely with clients to develop and implement tailored financial plans.

Impact on High-Net-Worth Individuals

The stringent eligibility criteria for UBS Private Banking underscores the exclusivity of these services, catering primarily to high-net-worth individuals and families. This focused approach allows UBS to dedicate significant resources to each client relationship.

For those who qualify, the benefits can be substantial, offering a level of financial expertise and personalized attention often unavailable through standard retail banking channels. However, this also means that a significant portion of the population is excluded from accessing these specialized services.

The existence of such high minimum requirements raises questions about financial accessibility and the potential for wealth concentration. While private banking serves a specific segment of the population, it highlights the disparities in access to financial services based on wealth.

Conclusion

UBS Private Banking maintains a significant barrier to entry through its minimum asset requirements, typically around $2 million in investable assets. While this ensures a high level of personalized service for its clientele, it also limits access to a select group of wealthy individuals.

Understanding these requirements is essential for individuals considering UBS Private Banking and for those interested in the broader landscape of wealth management services. Regional variations and other contributing factors may further influence individual eligibility.

Ultimately, the decision to pursue private banking depends on individual financial circumstances and goals. Thorough research and consultation with financial advisors are crucial steps in determining the suitability of such services.

/i.s3.glbimg.com/v1/AUTH_63b422c2caee4269b8b34177e8876b93/internal_photos/bs/2023/8/x/3X6dPGRvKx6TPLh7l8gA/ap23078531093634.jpg)