Umass Amherst Accounting Requirements

The path to becoming a certified public accountant (CPA) often begins within the hallowed halls of academia, and for aspiring CPAs in Massachusetts, the University of Massachusetts Amherst's accounting program holds significant weight. However, navigating the program's specific requirements and the subsequent pathway to CPA licensure can be a complex undertaking, filled with nuanced regulations and evolving standards.

This article delves into the intricate details of the UMass Amherst accounting requirements, highlighting the academic prerequisites, course expectations, and the vital connection to the broader CPA licensure framework in Massachusetts. Understanding these details is crucial for students, alumni, and prospective employers alike, as it shapes career trajectories and ensures the competence of future accounting professionals.

Academic Foundation at UMass Amherst

The UMass Amherst Isenberg School of Management offers a comprehensive accounting program designed to provide students with a strong foundation in financial accounting, managerial accounting, auditing, and taxation. Students can pursue a Bachelor of Business Administration (BBA) with a concentration in accounting, which typically involves completing core business courses alongside specialized accounting electives. This BBA degree serves as the initial step toward CPA licensure.

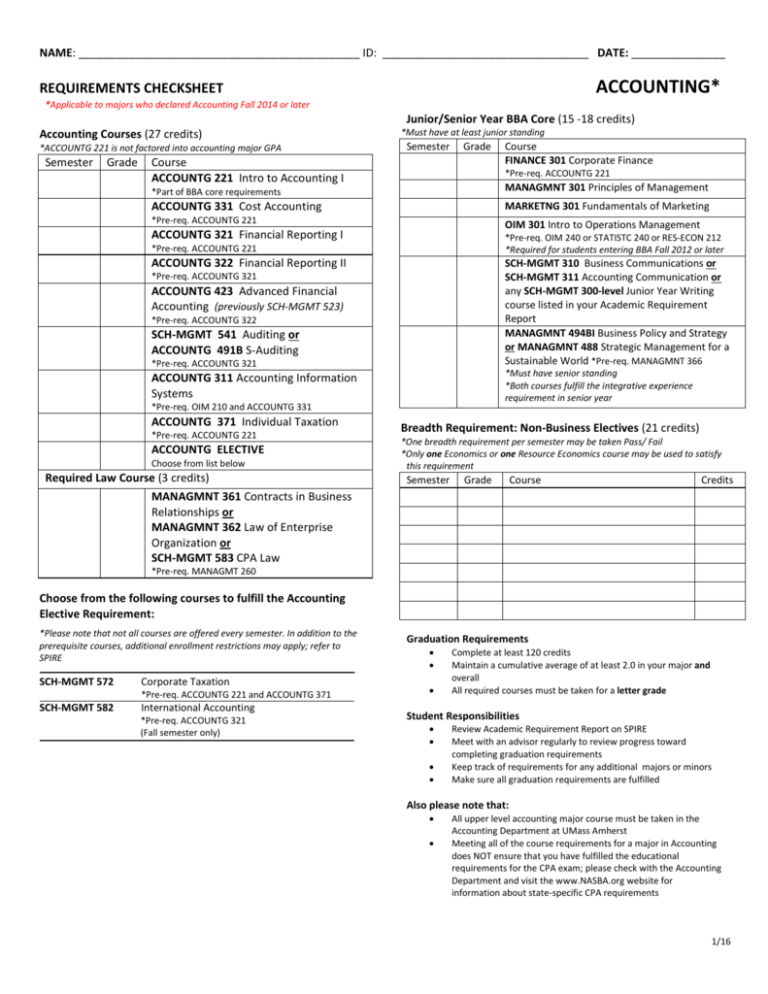

Core accounting courses include introductory and intermediate accounting, cost accounting, auditing, taxation, and accounting information systems. In addition to these foundational courses, students must also satisfy general education requirements and business school core requirements, creating a well-rounded academic experience.

Specific Course Requirements and GPA

Specific course requirements may vary slightly depending on the year of matriculation and any program updates. However, key courses such as Financial Accounting, Managerial Accounting, and Auditing are consistently required. Maintaining a competitive GPA, especially in accounting-specific courses, is essential for both graduation and future career prospects.

Many employers, particularly larger accounting firms, use GPA as a primary screening criterion. Furthermore, a strong GPA can be crucial for admission to graduate programs in accounting, such as the Master of Science in Accounting (MSA), which can further enhance career opportunities.

Connecting to CPA Licensure in Massachusetts

While the UMass Amherst accounting program provides the academic foundation, fulfilling the requirements for CPA licensure in Massachusetts involves a separate process overseen by the Massachusetts Board of Public Accountancy. This process includes meeting specific educational, examination, and experience requirements.

Massachusetts requires candidates to complete 150 semester hours of education, which is significantly more than the typical 120 credit hours required for a bachelor's degree. This additional coursework can be obtained through a master's degree, additional undergraduate courses, or a combination of both.

The 150-Hour Rule and Examination

The 150-hour rule is a cornerstone of CPA licensure requirements across many states, including Massachusetts. This requirement aims to ensure that candidates possess a broad and deep understanding of accounting principles and related business subjects. The UMass Amherst accounting program is designed to help students understand these requirements and plan their academic trajectory accordingly.

In addition to the education requirement, candidates must pass the Uniform CPA Examination, a rigorous exam administered by the American Institute of Certified Public Accountants (AICPA). The exam covers four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Passing all four sections is a major milestone toward licensure.

Experience Requirements and Ethics

Beyond education and examination, candidates must also gain relevant work experience under the supervision of a licensed CPA. The specific experience requirements vary, but typically involve at least one year of full-time employment in accounting-related roles.

Furthermore, candidates must pass an ethics examination to demonstrate their understanding of professional ethics and responsibilities. This ethics requirement is crucial for maintaining the integrity of the accounting profession.

Perspectives and Challenges

The stringent requirements for CPA licensure can present challenges for aspiring accountants. The 150-hour rule, in particular, often necessitates pursuing a graduate degree or additional coursework, adding to the cost and time investment required. This can be a significant barrier for some students, particularly those from disadvantaged backgrounds.

Some argue that the 150-hour rule is overly burdensome and does not necessarily translate into improved competence. Others contend that it is essential for ensuring the quality and credibility of the accounting profession. Debates surrounding the balance between accessibility and rigor continue within the accounting community.

Looking Ahead: The Future of Accounting Education

The accounting profession is constantly evolving, driven by technological advancements, regulatory changes, and globalization. Accounting programs like the one at UMass Amherst must adapt to these changes by incorporating new technologies, data analytics, and emerging accounting standards into the curriculum.

Furthermore, fostering critical thinking, communication skills, and ethical awareness is crucial for preparing future accounting professionals to navigate the complex challenges of the modern business world. Ultimately, the goal is to produce well-rounded graduates who are not only technically proficient but also possess the leadership and problem-solving skills needed to succeed in their careers. The requirements from AICPA are constantly updating, educators and students should be aware.