Uninterrupted Compound Interest Whole Life Insurance

A lesser-known type of whole life insurance, leveraging uninterrupted compound interest, is gaining traction among financial planners seeking long-term wealth accumulation for their clients. Unlike traditional whole life policies, these plans emphasize maximizing cash value growth through a specific design aimed at minimizing fees and front-loading premiums. This approach, while potentially complex, promises a significantly different trajectory for policyholders.

The core question surrounding this type of insurance revolves around its suitability for various financial situations. Is it a viable alternative to conventional investment strategies? Does it truly deliver the promised benefits? This article delves into the specifics of uninterrupted compound interest whole life insurance, exploring its mechanisms, benefits, and drawbacks, to provide a balanced perspective.

Understanding Uninterrupted Compound Interest Whole Life Insurance

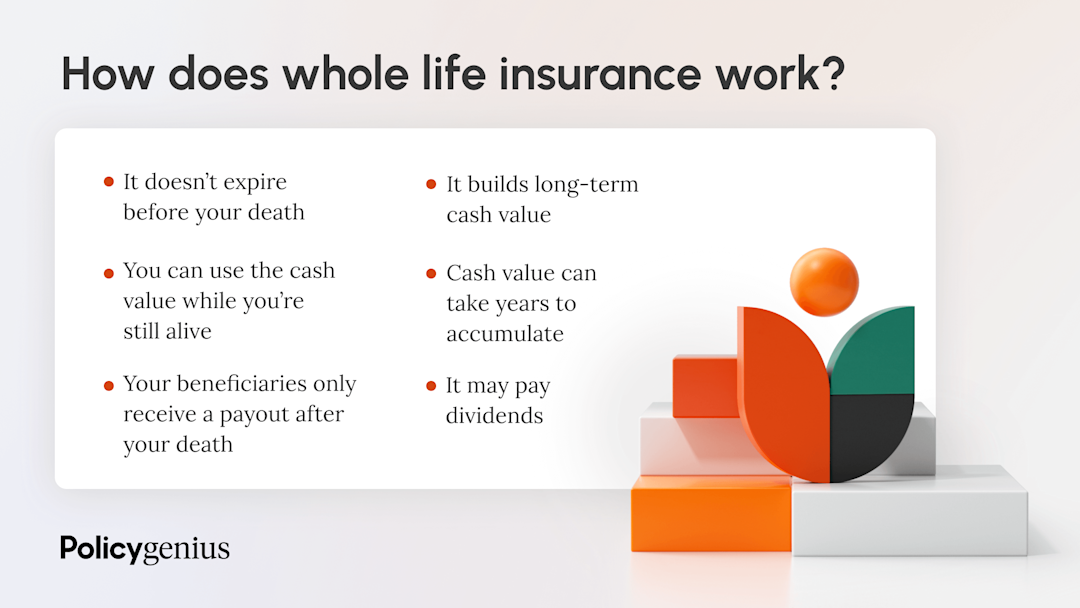

Uninterrupted compound interest whole life insurance is a variation of traditional whole life insurance. The key differentiator lies in its policy design and funding structure. It is designed to build cash value more efficiently than standard policies.

Conventional whole life policies typically allocate a substantial portion of initial premiums towards commissions and administrative fees. This leaves less capital for generating cash value in the early years. Uninterrupted compound interest strategies aim to mitigate this by strategically designing the policy to minimize these upfront expenses.

This is often achieved by increasing the initial death benefit while keeping the premium payments relatively low in comparison to the death benefit. A larger percentage of each premium payment goes toward funding the cash value account, enabling more significant compound growth over time.

The Mechanics: How It Works

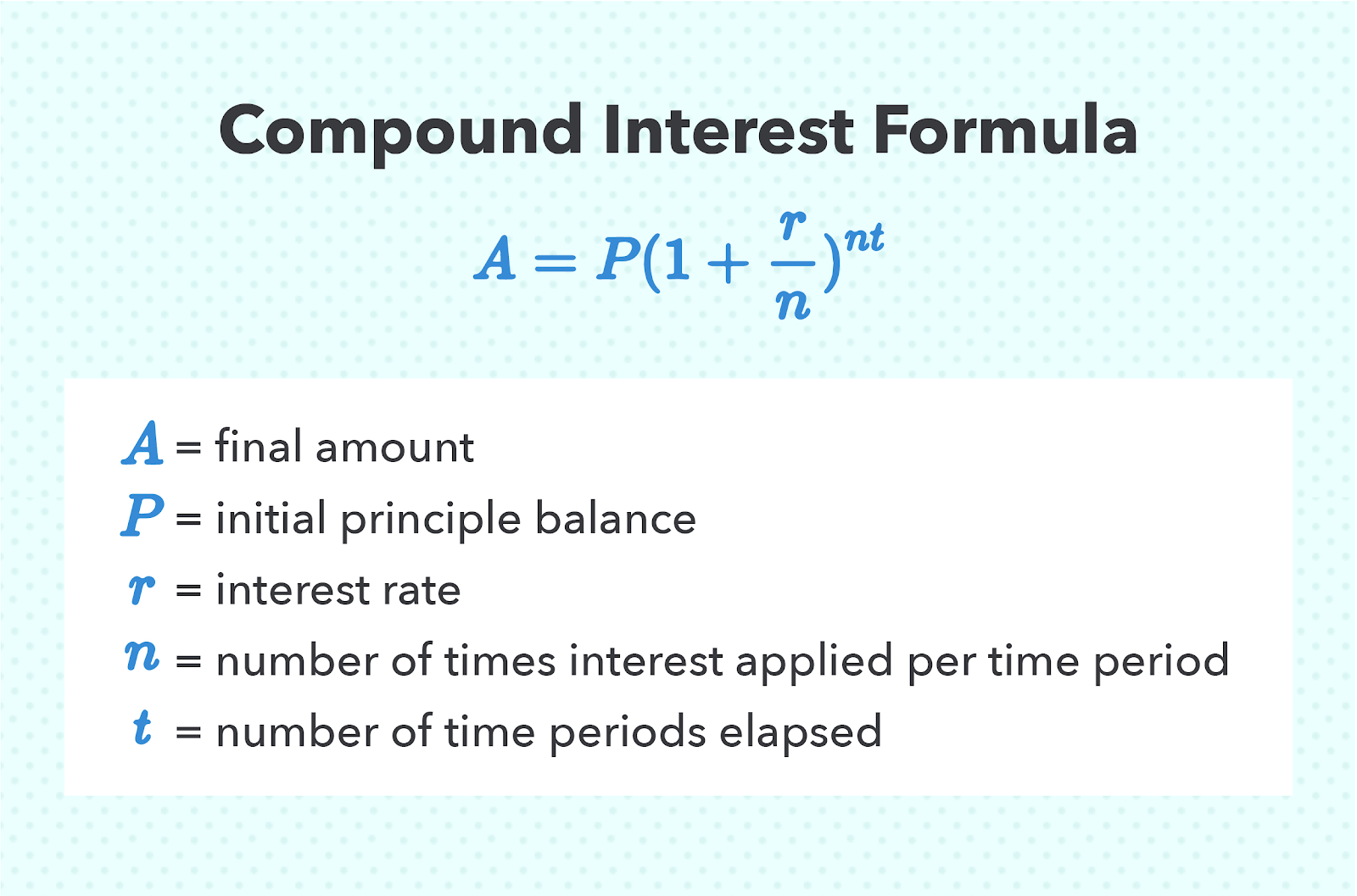

The fundamental principle behind uninterrupted compound interest centers on maximizing the impact of compound interest. Compound interest is the interest earned not only on the principal but also on the accumulated interest from previous periods.

The "uninterrupted" aspect refers to the goal of minimizing withdrawals or loans against the policy, as these actions can reduce the principal and therefore, the potential for future compound growth. The policyholder allows the cash value to grow untouched for as long as possible.

Policies that incorporate this strategy often use a combination of a guaranteed interest rate. The guaranteed rate is the base rate the insurance company guarantees. This rate is supplemented by dividend payments. The insurance company declares dividends based on its financial performance and profitability.

Dividends are not guaranteed, but mutual insurance companies, which are owned by their policyholders, have a history of paying dividends consistently over long periods. These dividends further accelerate the cash value growth within the policy.

Potential Benefits

One of the primary benefits is the potential for tax-advantaged growth. The cash value grows tax-deferred, meaning that policyholders do not pay taxes on the accumulated earnings until they are withdrawn.

Another advantage is tax-free access to the cash value through policy loans. Policy loans are not considered taxable events. These are borrowed against the cash value of the policy and repaid with interest.

This provides policyholders with a source of capital that can be used for various purposes. These purposes includes funding retirement expenses, purchasing real estate, or investing in other opportunities, without incurring immediate tax liabilities.

Whole life insurance also offers a guaranteed death benefit, providing financial security for beneficiaries. The death benefit provides financial protection for loved ones in the event of the policyholder's death.

Policies with uninterrupted compound interest designs also allow for a steady increase in the death benefit as the cash value grows. This provides an additional layer of financial protection over time.

Potential Drawbacks and Considerations

Despite the potential benefits, this type of insurance comes with important considerations. One of the main challenges is the complexity of the policy design and funding strategy. It requires a thorough understanding of the policy mechanics and a careful evaluation of the insurance company's financial strength and dividend history.

Another important aspect to consider is the long-term commitment required. These policies are designed for long-term wealth accumulation, and early surrender can result in significant losses due to surrender charges and other fees.

It is also crucial to recognize that the dividend payments are not guaranteed. While many mutual insurance companies have a strong track record of paying dividends, past performance is not indicative of future results. Changes in economic conditions or the insurance company's financial performance could impact dividend payouts.

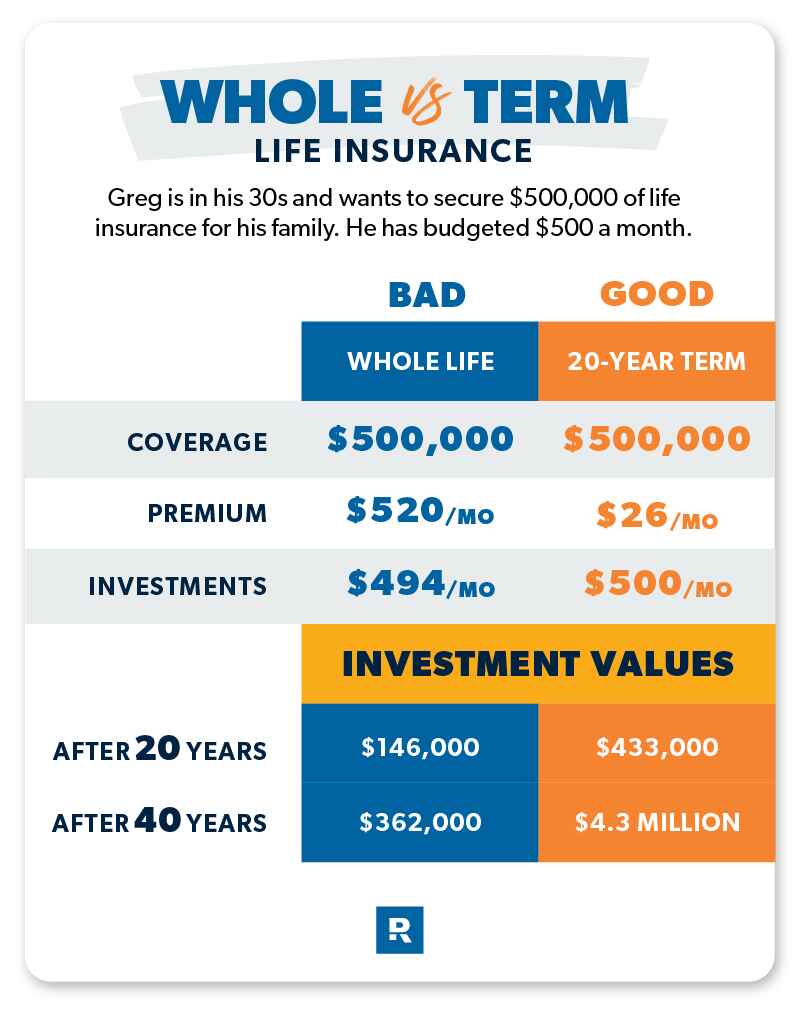

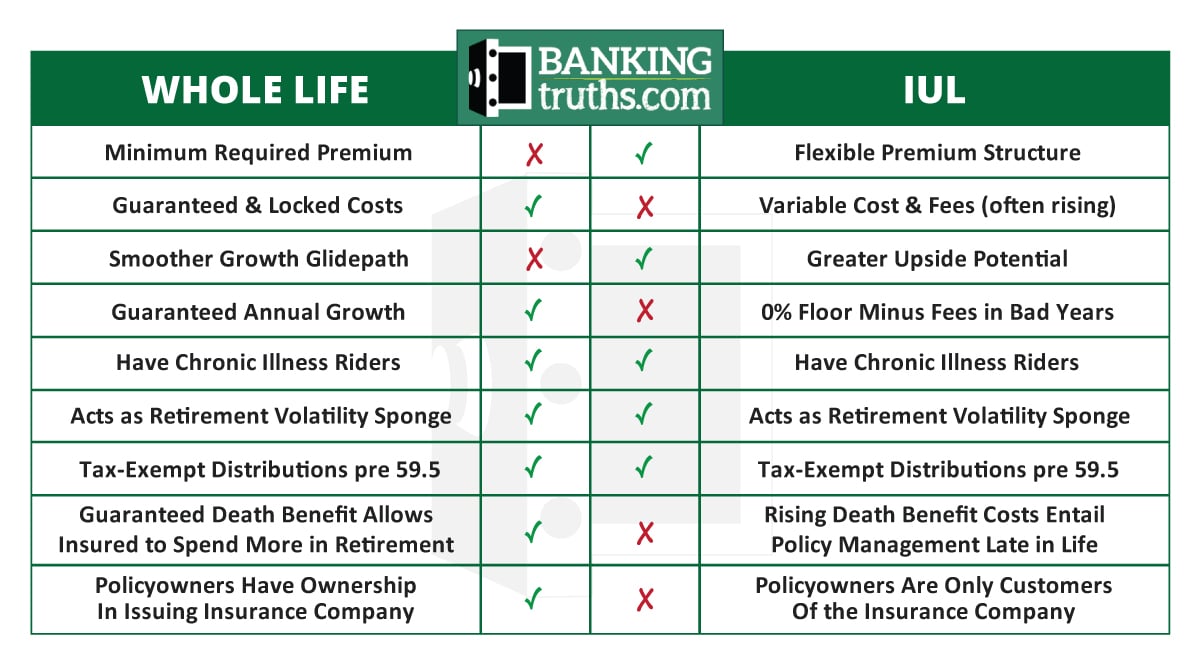

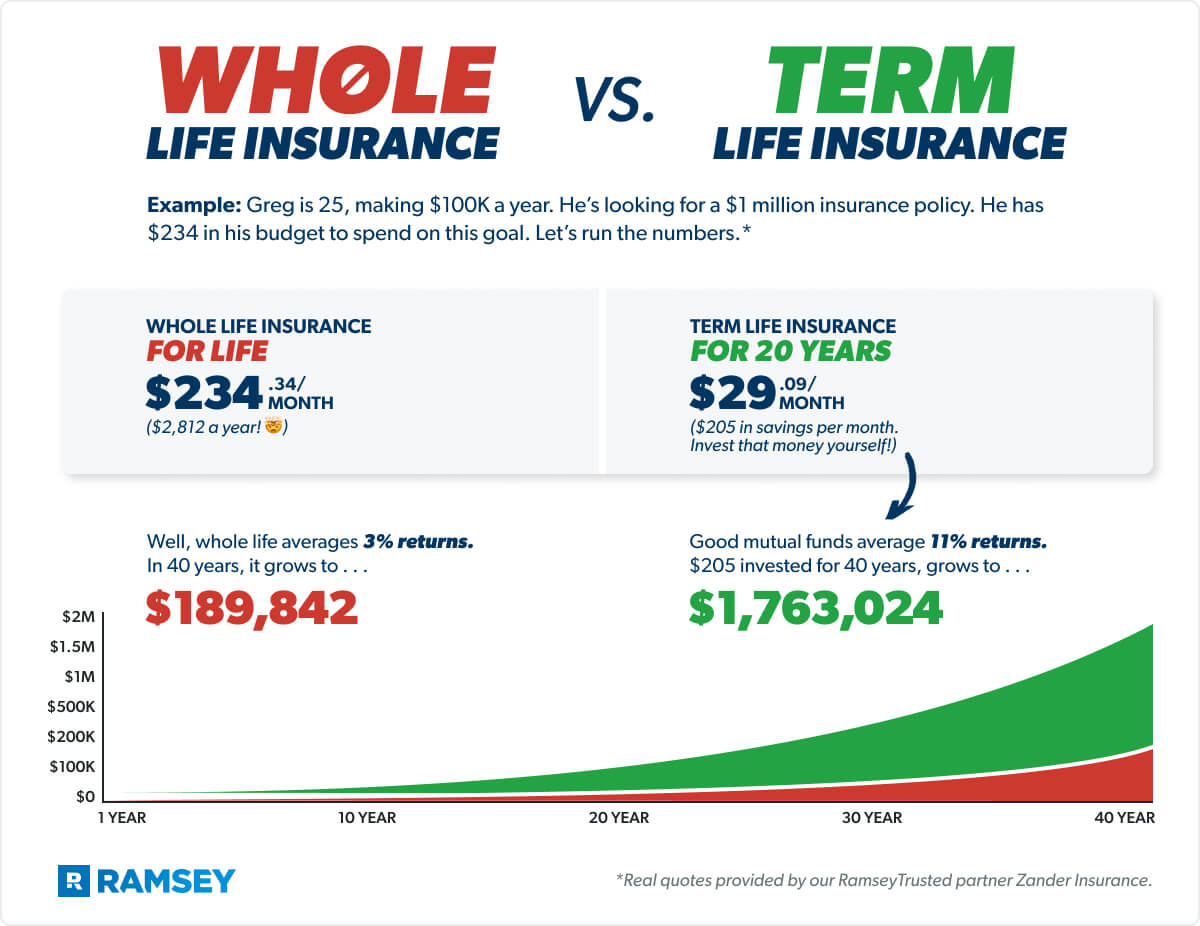

Moreover, the returns generated by these policies may not always outperform other investment options, especially in the short term. Comparing the potential returns of uninterrupted compound interest whole life insurance with other investment alternatives is essential. This includes stocks, bonds, and real estate, before making a decision.

The Role of the Financial Advisor

Given the complexity and long-term nature of uninterrupted compound interest whole life insurance, the role of a qualified financial advisor is paramount. An advisor can help individuals assess their financial goals. They can analyze their risk tolerance, and determine whether this type of policy aligns with their overall financial plan.

A financial advisor can also provide guidance on selecting an appropriate insurance company. They can choose a company with a strong financial standing and a history of paying dividends. Furthermore, they can help navigate the intricacies of policy design. They can ensure that the policy is structured to maximize cash value growth and minimize fees.

"It's crucial for consumers to do their homework," says Jane Doe, a certified financial planner at ABC Financial Planning. "Understand the fees, the guarantees, and the projections. Compare it with other investment vehicles. Seek independent advice."

Conclusion

Uninterrupted compound interest whole life insurance offers a unique approach to wealth accumulation. It leverages tax advantages, and a guaranteed death benefit. However, it requires careful consideration and a long-term perspective.

The potential benefits of this type of insurance can be substantial. But individuals must weigh these advantages against the complexities, long-term commitment, and the possibility of lower returns compared to other investment options.

Ultimately, the decision to invest in uninterrupted compound interest whole life insurance should be based on a thorough understanding of the policy mechanics. It should also be based on an evaluation of individual financial circumstances, and guidance from a qualified financial advisor.