Union Bank Of India Swot Analysis

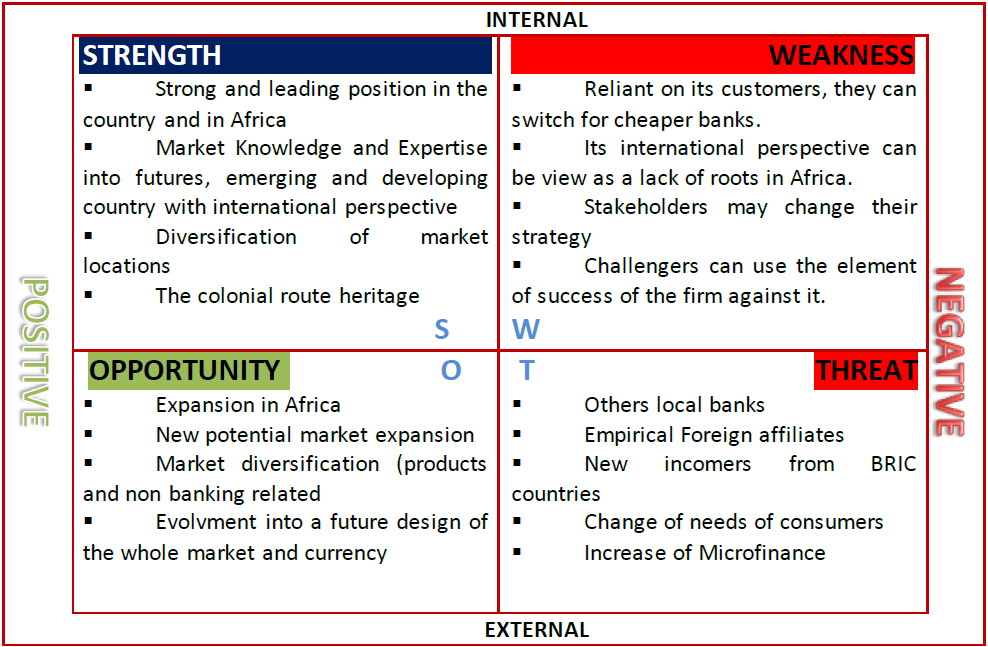

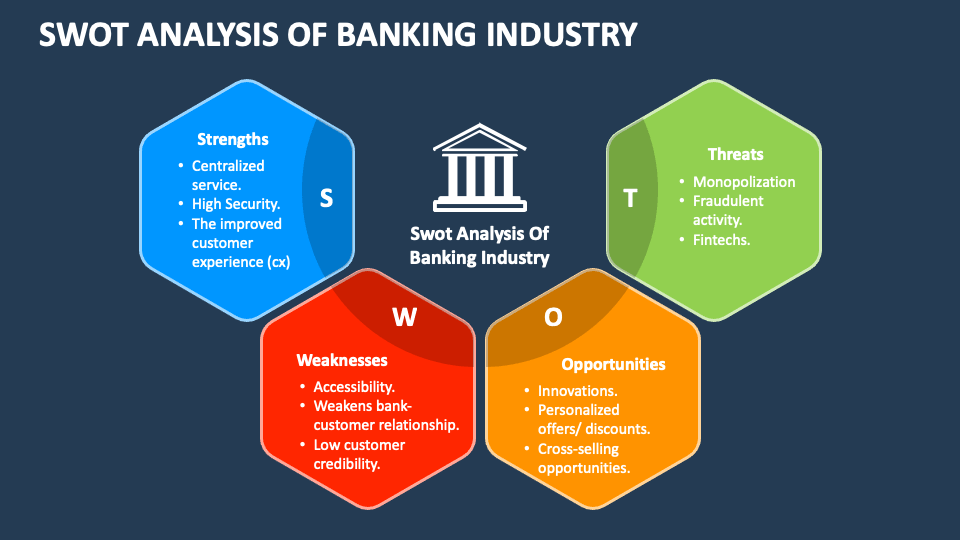

Union Bank of India, a major public sector bank in India, stands at a critical juncture as it navigates a dynamic and competitive financial landscape. Understanding its internal strengths and weaknesses, alongside external opportunities and threats, is crucial for charting a successful course for the future.

A SWOT analysis provides a structured framework for evaluating these factors, offering insights into the bank's strategic position and informing decision-making processes. This analysis will explore Union Bank's current standing, drawing upon publicly available information and reports.

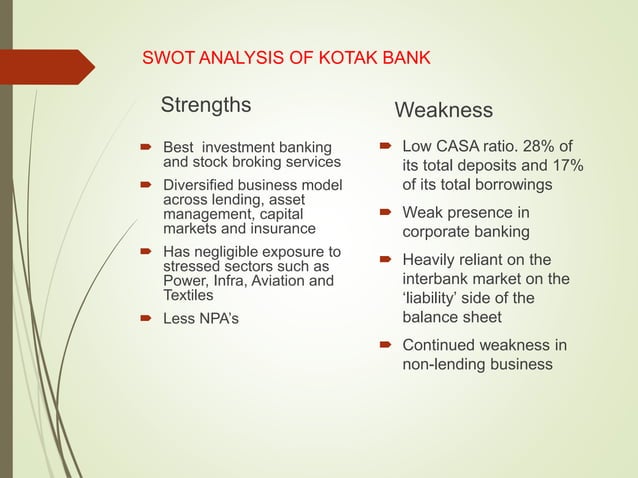

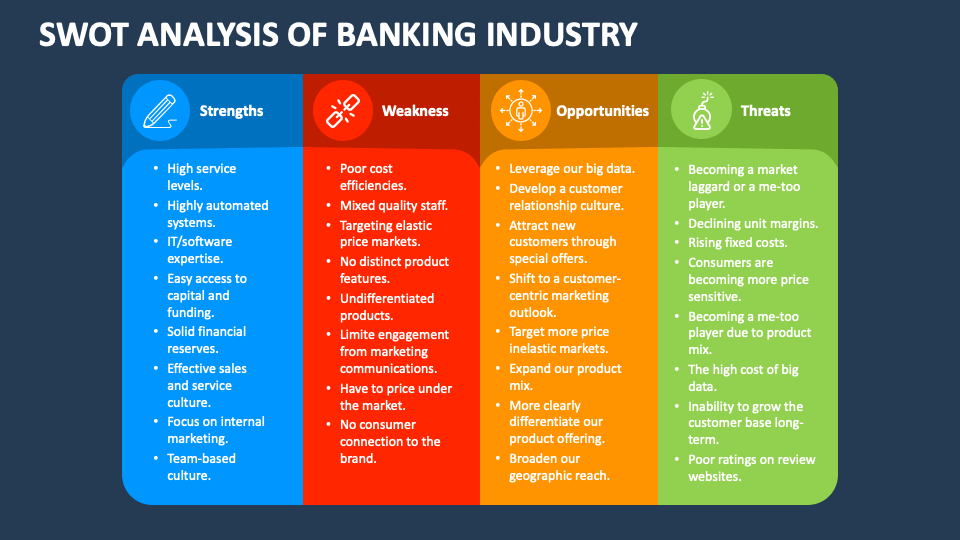

Strengths

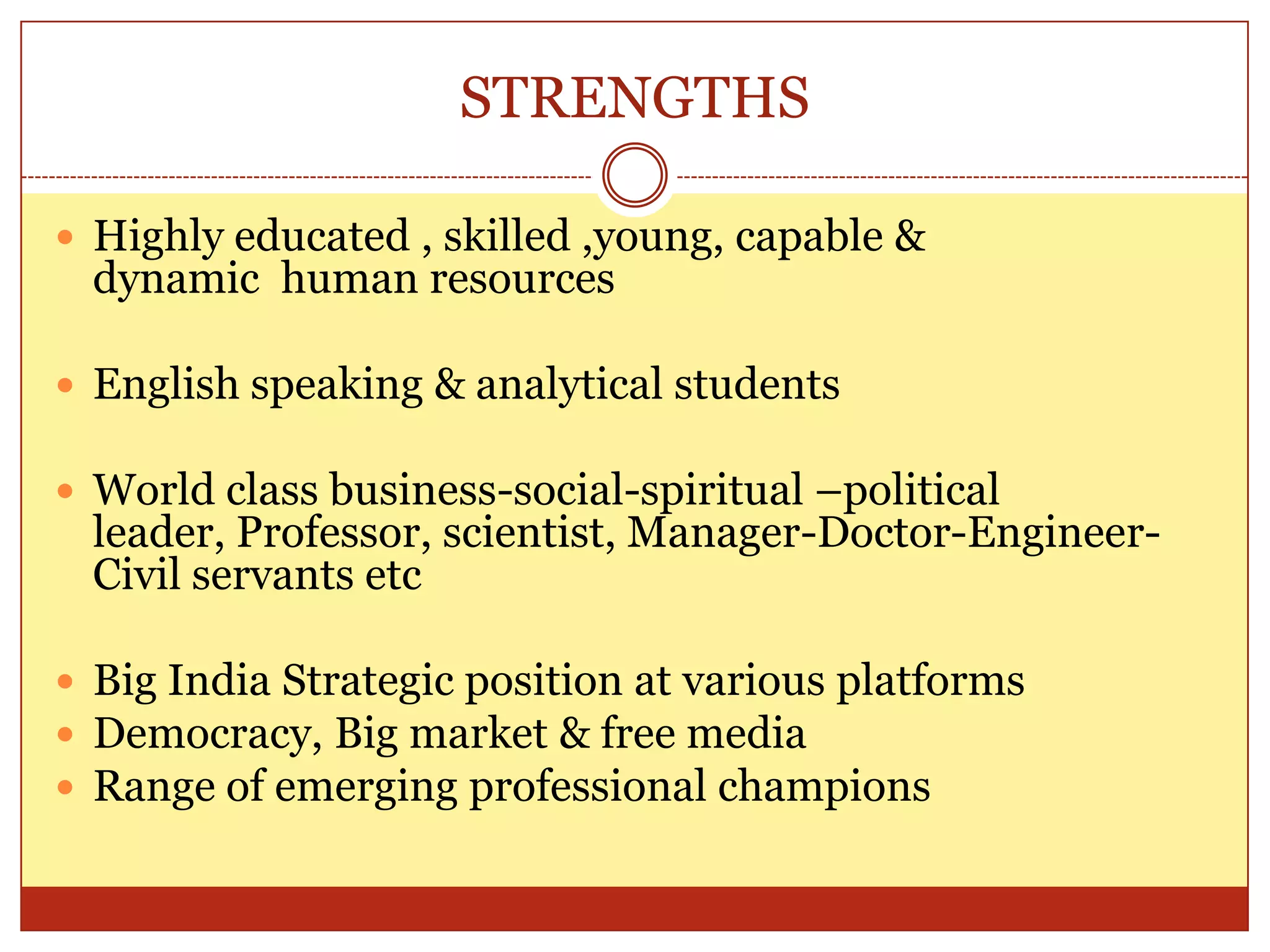

One of Union Bank's key strengths lies in its extensive branch network, particularly in rural and semi-urban areas. This widespread presence allows it to reach a diverse customer base and penetrate markets that may be underserved by private sector banks.

The bank also benefits from its strong brand reputation and the trust associated with being a public sector institution. This trust is particularly important in attracting depositors and maintaining customer loyalty.

Furthermore, Union Bank has been actively investing in technology to improve its operational efficiency and enhance customer experience. This includes the development of mobile banking applications and the implementation of digital payment solutions.

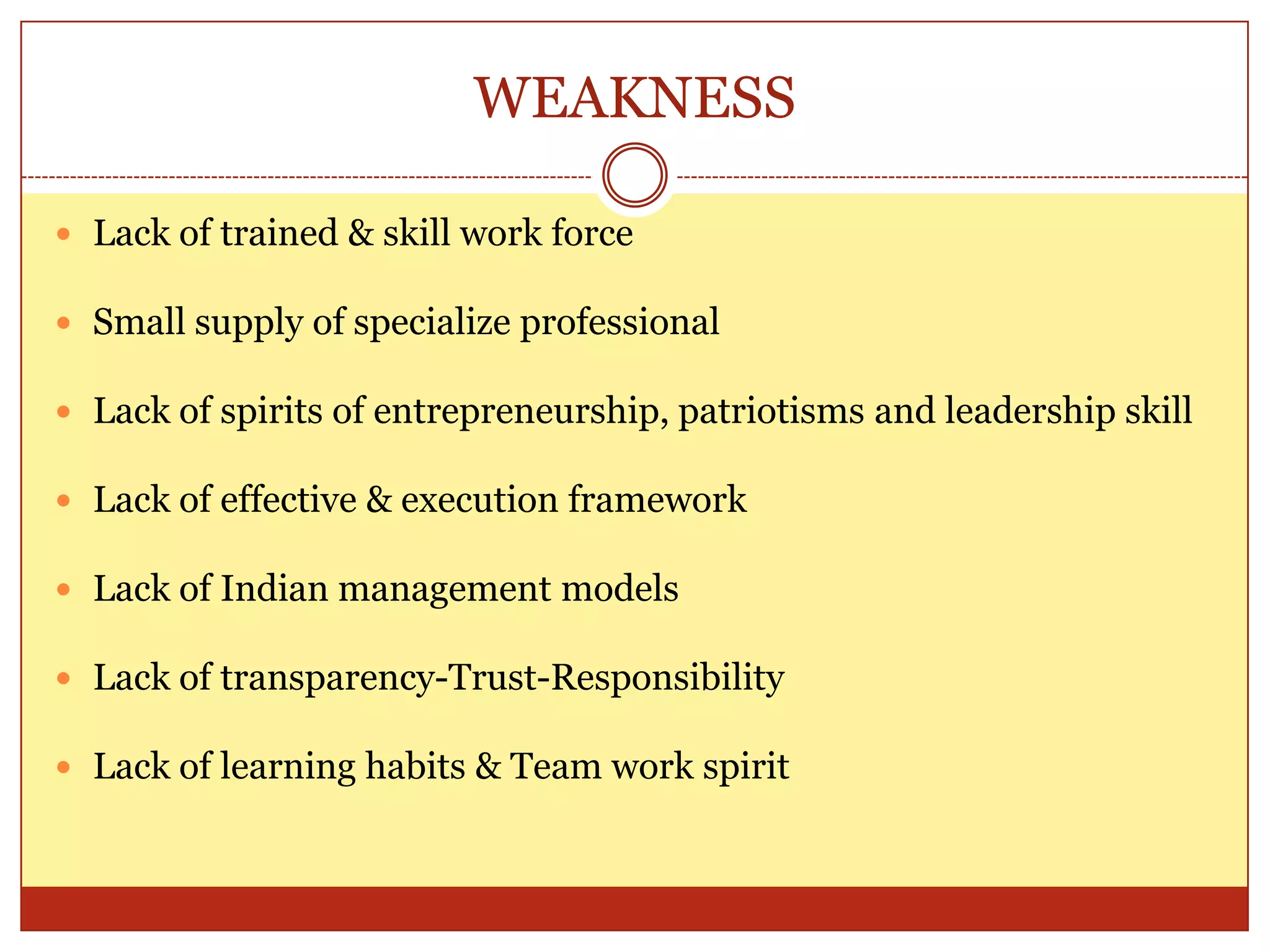

Weaknesses

Despite its strengths, Union Bank faces several weaknesses. A significant challenge is the relatively high level of non-performing assets (NPAs), which can erode profitability and strain capital adequacy.

Like many public sector banks, Union Bank is also often perceived as having slower decision-making processes and a more bureaucratic organizational structure compared to its private sector counterparts. This can hinder its ability to respond quickly to market changes.

Attracting and retaining skilled talent can also be a challenge, as the bank often competes with private sector institutions that may offer more attractive compensation packages and career opportunities. The talent gap could be an obstacle to successful digital transformations.

Opportunities

The rapidly growing Indian economy presents numerous opportunities for Union Bank. Increasing urbanization, rising disposable incomes, and expanding financial inclusion initiatives are driving demand for banking services across various segments.

The government's focus on infrastructure development also creates opportunities for Union Bank to provide financing for large-scale projects. This can lead to significant revenue generation and contribute to economic growth.

Furthermore, the increasing adoption of digital technologies offers opportunities for Union Bank to expand its reach and improve its service delivery. This includes leveraging data analytics to personalize customer offerings and enhance risk management.

Threats

The banking sector is becoming increasingly competitive, with the entry of new players such as fintech companies and private sector banks. These competitors often have more agile business models and are better equipped to adapt to changing customer preferences.

Stringent regulatory requirements and compliance costs also pose a threat to Union Bank's profitability. Meeting these requirements can be resource-intensive and divert attention from core business activities.

Economic downturns and global financial crises can also negatively impact the bank's performance. These events can lead to increased loan defaults and reduced demand for banking services.

The Human Angle

For employees of Union Bank, the ongoing transformation represents both a challenge and an opportunity. Many are eager to embrace new technologies and contribute to the bank's growth, but some are also concerned about job security and the need for reskilling.

One branch manager, speaking anonymously, expressed optimism about the bank's future but emphasized the importance of investing in employee training and development. "We need to equip our staff with the skills they need to thrive in the digital age," he said.

For customers, the bank's transformation promises improved services and greater convenience. However, some customers, particularly those in rural areas, may be hesitant to adopt digital banking solutions. This requires patience and efforts to educate customers on the benefits of these technologies.

The bank is taking initiative in educating these individuals. They have launched several training programs in rural areas to bring awareness to the benefits of using such technologies.

Conclusion

Union Bank of India's SWOT analysis reveals a complex picture of its current position. While the bank benefits from its extensive branch network and strong brand reputation, it also faces challenges related to NPAs and bureaucratic processes.

The opportunities presented by the growing Indian economy and the increasing adoption of digital technologies are significant, but the bank must also address the threats posed by increasing competition and stringent regulatory requirements. By leveraging its strengths, addressing its weaknesses, capitalizing on opportunities, and mitigating threats, Union Bank of India can successfully navigate the challenges and achieve its strategic objectives.

Ultimately, Union Bank's success will depend on its ability to adapt to the changing landscape, embrace innovation, and prioritize customer satisfaction. The decisions it makes in the coming years will determine its future role in the Indian financial sector.