Unrealized Gains And Losses On Held To Maturity Securities Are

Banks face renewed scrutiny as unrealized losses on Held-to-Maturity (HTM) securities remain substantial, threatening financial stability. Current accounting practices obscure the true economic health of institutions holding these assets.

This situation, echoing pre-Silicon Valley Bank (SVB) conditions, raises concerns about potential liquidity crises and the need for increased regulatory oversight. The focus centers on the disconnect between book value and market value of HTM portfolios across the banking sector.

The Problem: Hidden Risks in HTM Portfolios

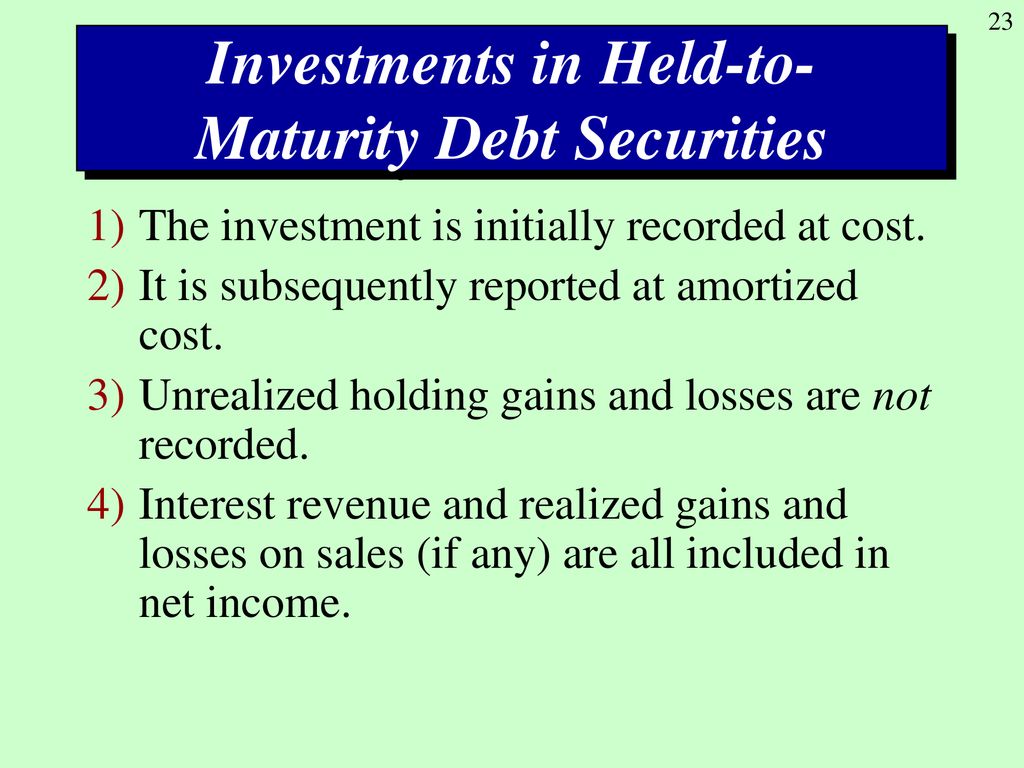

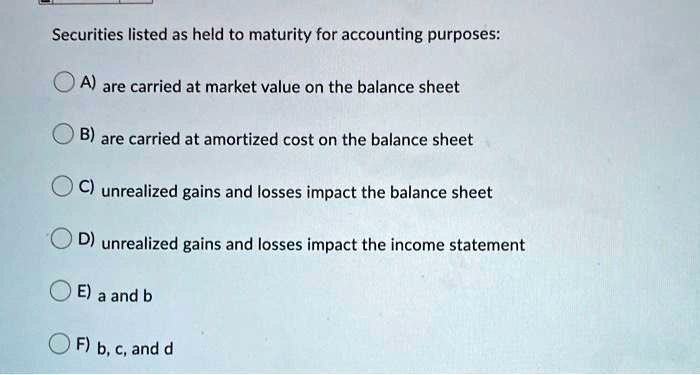

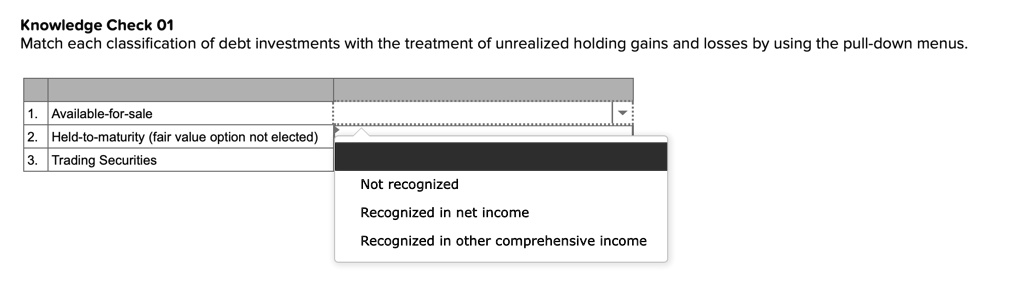

The crux of the issue lies in how Held-to-Maturity (HTM) securities are accounted for. Under current Generally Accepted Accounting Principles (GAAP), banks are not required to mark HTM securities to market.

This means unrealized losses, reflecting the difference between the purchase price and current market value, are not immediately recognized on the income statement. Instead, they are often relegated to accumulated other comprehensive income (AOCI) on the balance sheet, potentially masking the true extent of a bank's financial vulnerabilities.

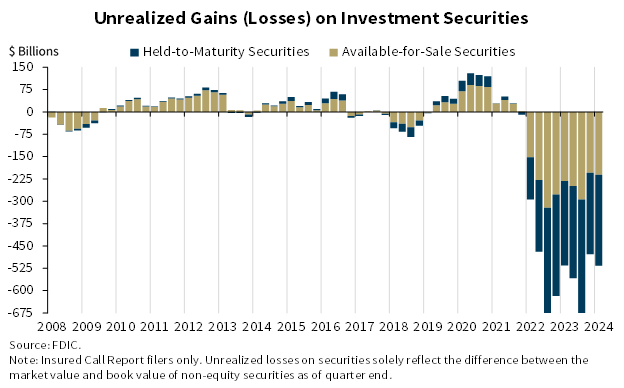

Data from the Federal Reserve and individual bank filings reveal the magnitude of these unrealized losses. As of Q3 2024, aggregate unrealized losses on HTM securities held by U.S. banks were estimated to be in the hundreds of billions of dollars.

These losses stem primarily from rising interest rates, which inversely affect the value of fixed-income securities like U.S. Treasury bonds and agency mortgage-backed securities that comprise a significant portion of HTM portfolios.

Echoes of SVB: A Warning Sign?

The current scenario draws uncomfortable parallels to the events leading to the collapse of Silicon Valley Bank (SVB) in March 2023. SVB held a large portfolio of HTM securities that significantly declined in value as interest rates rose.

When depositors, primarily venture capital-backed companies, began withdrawing funds, SVB was forced to sell these securities at a loss to meet liquidity needs. This triggered a bank run and ultimately led to its failure.

The underlying problem – the disconnect between the book value of HTM securities and their true market value – remains a concern across the banking sector. While regulations have been updated, the fundamental accounting treatment persists.

Who is Affected?

The impact of unrealized losses on HTM securities varies across institutions. Regional and community banks with a higher proportion of HTM holdings relative to their capital are particularly vulnerable.

Larger, systemically important banks are generally better positioned to absorb these losses due to their greater capital buffers and more diversified asset bases. However, even these institutions are not immune to the potential contagion effects of widespread bank failures.

Depositors, shareholders, and the broader economy are all exposed to the risks associated with hidden losses in HTM portfolios. Loss of confidence in the banking system can lead to decreased lending and investment, hindering economic growth.

Calls for Increased Transparency

Experts and analysts are increasingly calling for greater transparency in the accounting treatment of HTM securities. Some advocate for requiring banks to mark all HTM securities to market, providing a more accurate picture of their financial health.

This would involve recording unrealized gains and losses on the income statement, reflecting the true economic value of these assets. While this approach could increase volatility in reported earnings, it would also provide a more realistic assessment of a bank's solvency.

Others propose alternative solutions, such as enhanced disclosure requirements and stress testing scenarios that explicitly account for potential losses on HTM portfolios. These measures would aim to provide regulators and investors with a more comprehensive understanding of the risks faced by banks.

The Role of Regulators

Regulatory agencies, including the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC), are actively monitoring the situation. They are conducting stress tests and analyzing bank balance sheets to assess potential vulnerabilities.

Following the SVB collapse, regulators implemented stricter supervisory measures, including increased scrutiny of liquidity risk management practices. However, further action may be necessary to address the underlying accounting issues and prevent future crises.

Potential regulatory responses include increasing capital requirements, limiting the amount of HTM securities that banks can hold, or mandating more frequent and detailed reporting of unrealized losses.

Next Steps and Ongoing Developments

The Financial Accounting Standards Board (FASB) is currently reviewing accounting standards related to HTM securities. Any changes to these standards could have a significant impact on the banking industry.

Congress may also consider legislation to address the issue. Some lawmakers have already expressed concerns about the potential risks posed by unrealized losses on HTM portfolios and are exploring potential legislative remedies.

The situation remains fluid, and continued monitoring is crucial. The stability of the financial system depends on addressing the hidden risks associated with unrealized losses on Held-to-Maturity securities. The long-term impact on the economy is still uncertain, and further action is needed to ensure confidence in the banking system.

![Unrealized Gains And Losses On Held To Maturity Securities Are Unrealized gains (losses) on investment securities.[10] | Download](https://www.researchgate.net/publication/376131429/figure/fig2/AS:11431281209086216@1701633286787/Unrealized-gains-losses-on-investment-securities10_Q640.jpg)

.jpg)

![Unrealized Gains And Losses On Held To Maturity Securities Are Unrealized gains (losses) on investment securities.[10] | Download](https://www.researchgate.net/publication/376131429/figure/fig2/AS:11431281209086216@1701633286787/Unrealized-gains-losses-on-investment-securities10.png)