Upon Policy Delivery Which Of The Following

The moment a life insurance policy is delivered marks a critical juncture, triggering several important considerations for the policyholder. Understanding these post-delivery aspects is crucial to ensuring that the policy aligns with their needs and provides the intended financial security. This article explores the key elements that policyholders should be aware of upon receiving their life insurance policy.

The period immediately following policy delivery often includes a "free look" period, providing an opportunity to review and potentially cancel the policy without penalty.

The "Free Look" Period: A Chance for Reassessment

Virtually all life insurance policies come with a "free look" period, which typically lasts between 10 and 30 days, depending on the state and the insurance company. This period allows the policyholder to examine the policy documents thoroughly. During this time, the insured can cancel the policy for a full refund of any premiums paid.

This is a vital opportunity to reassess whether the policy meets the individual's needs and expectations.

Key Actions During the Free Look Period

During the free look period, policyholders should take the following steps: review the policy details carefully, confirm accuracy of personal information, and compare the policy with other options.

These activities ensure that the selected policy suits the person's unique circumstances.

Reviewing Policy Details: Policyholders should carefully examine the policy document to verify that all the information, including the insured's name, date of birth, beneficiary designations, and coverage amount, is accurate. Any discrepancies should be immediately reported to the insurance company for correction.

Confirming Accuracy of Personal Information: Ensure all personal details are correct. Errors could lead to claim complications in the future.

Comparing the Policy with Other Options: Even after purchasing a policy, it's wise to compare its features and premiums with other available options. This can help confirm that the policyholder has secured the best possible coverage at a competitive price.

If the policy doesn't align with expectations, the free look period offers a no-risk chance to cancel. A refund is guaranteed in most situations.

Beneficiary Designations: Ensuring Your Wishes Are Honored

Beneficiary designations are an integral part of any life insurance policy. Upon policy delivery, it's crucial to carefully review and confirm that the designated beneficiaries are correct and up-to-date.

Beneficiaries are the individuals or entities who will receive the death benefit upon the insured's passing.

Importance of Accurate Beneficiary Designations

Inaccurate or outdated beneficiary designations can lead to significant complications and unintended consequences. For instance, if a primary beneficiary has passed away, the death benefit may be paid to a contingent beneficiary or, in the absence of a designated contingent beneficiary, to the insured's estate, which can be subject to probate.

This can cause delays in receiving the funds and potentially reduce the amount available to loved ones.

It is advisable to review beneficiary designations regularly, particularly after major life events such as marriage, divorce, birth of a child, or death of a beneficiary. Life insurance companies typically provide forms for updating beneficiary information.

Keeping these designations up to date prevents unintended outcomes.

Understanding Policy Provisions and Riders

Life insurance policies often include various provisions, riders, and exclusions that can significantly impact the coverage and benefits. Upon policy delivery, policyholders should take the time to thoroughly understand these elements.

Policy provisions outline the terms and conditions of the contract.

Key Policy Elements to Review

Important provisions to understand include the suicide clause, contestability period, and reinstatement provisions. Riders, which are optional add-ons, can provide additional benefits, such as accelerated death benefits for critical illness or disability income protection.

Exclusions outline situations where the policy won't pay a benefit.

Suicide Clause: This clause typically states that if the insured dies by suicide within a specified period (usually two years) from the policy's inception, the death benefit will not be paid.

Contestability Period: During this period (usually two years), the insurance company has the right to contest the policy if it discovers any material misrepresentations or omissions in the application.

Reinstatement Provisions: If a policy lapses due to non-payment of premiums, reinstatement provisions outline the conditions under which the policy can be reinstated, typically requiring payment of back premiums and proof of insurability.

By understanding these key elements, policyholders can ensure they are fully aware of the scope and limitations of their coverage.

Premium Payment Options and Schedules

Understanding the premium payment options and schedules is crucial for maintaining the policy in good standing. Upon policy delivery, policyholders should review the payment frequency, due dates, and available payment methods.

Policies can typically be paid monthly, quarterly, semi-annually, or annually.

Setting Up Payment Options

Setting up automated payments can help prevent unintentional lapses due to missed payments. Policyholders should also understand the grace period, which is the period after a premium due date during which the policy remains in force even if the premium is not paid. If a premium is not paid by the end of the grace period, the policy may lapse.

Lapsing means that the coverage is terminated.

It is important to keep the insurance company informed of any changes in contact information to ensure timely delivery of premium notices. Regular communication with the insurance company is vital.

Contact updates are essential.

Seeking Professional Advice

Navigating the complexities of life insurance policies can be challenging. Policyholders should not hesitate to seek professional advice from a qualified insurance advisor or financial planner. An advisor can help clarify policy provisions, assess whether the coverage continues to meet the individual's evolving needs, and provide guidance on making any necessary adjustments.

Professional advice offers invaluable support.

Understanding the policy upon delivery empowers policyholders to make informed decisions and take necessary actions to ensure the policy provides the intended benefits and financial protection. It is advisable to take advantage of the free look period, review beneficiary designations, understand policy provisions, and maintain regular communication with the insurance company.

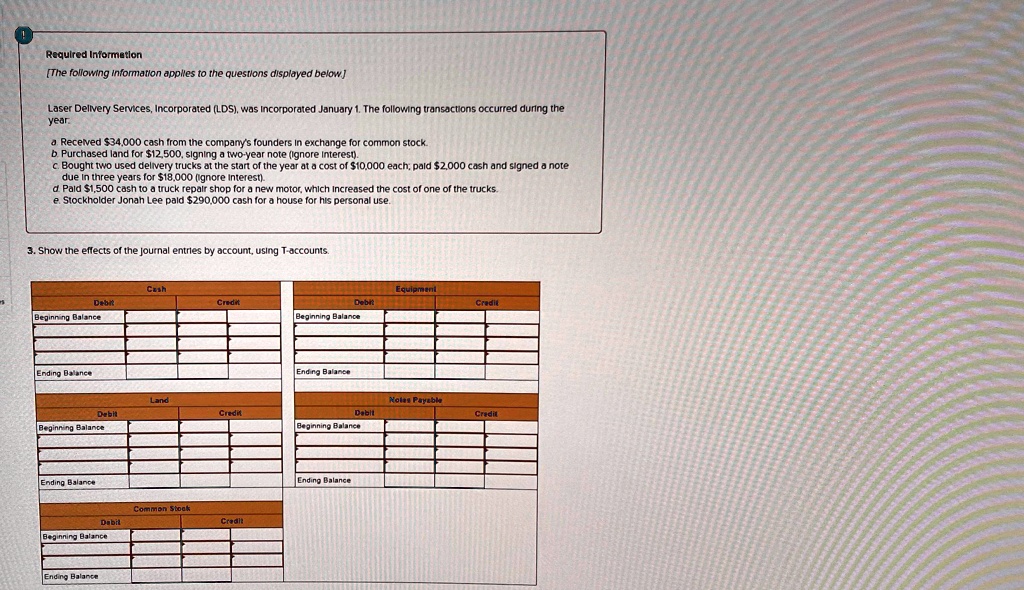

![Upon Policy Delivery Which Of The Following [Solved] Murphy Delivery Service completed the fol | SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1676/9/6/6/57263f47aac2c1011676966571475.jpg)