Vanguard Rollover Ira Brokerage Account

Imagine yourself nearing retirement, a vision of calm mornings and fulfilling hobbies dancing in your head. The years of diligent saving and strategic investments are finally about to pay off. But amidst the excitement, a daunting question lingers: What to do with that accumulated wealth in your employer-sponsored 401(k)? This is where a Rollover IRA comes into play, offering a pathway to greater control and flexibility over your retirement future.

The Vanguard Rollover IRA Brokerage Account is a popular option for individuals seeking to consolidate and manage their retirement savings after leaving an employer. It provides a simple and cost-effective platform to transfer funds from a 401(k) or other qualified retirement plan, offering a wide array of investment choices beyond those typically available in employer-sponsored plans.

Understanding the Rollover IRA Landscape

A Rollover IRA is essentially an Individual Retirement Account designed specifically to receive funds from other retirement accounts. This is a common strategy for those leaving a job, retiring, or simply seeking greater control over their investments. Unlike leaving your money in your old employer's plan, or taking a taxable distribution, a rollover allows you to defer taxes and continue growing your nest egg within a tax-advantaged environment.

Vanguard, a name synonymous with low-cost investing, has long been a favorite among both novice and seasoned investors. Founded by John C. Bogle, the company pioneered the concept of index fund investing, democratizing access to diversified portfolios and significantly lowering investment expenses for millions.

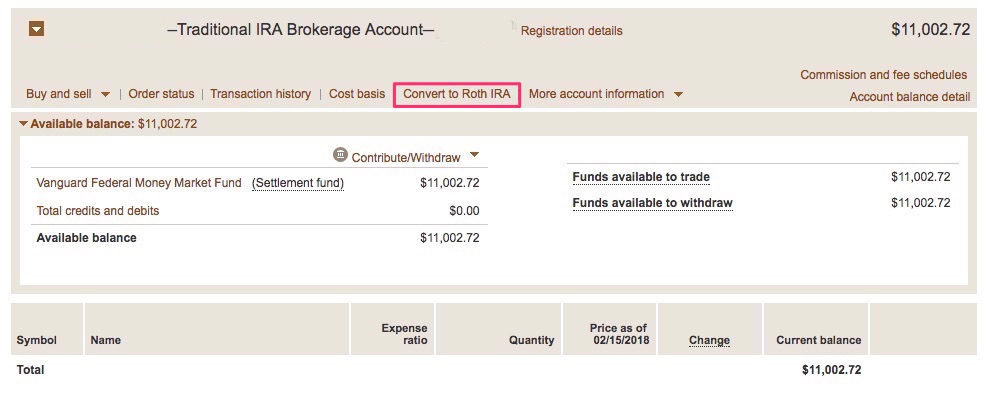

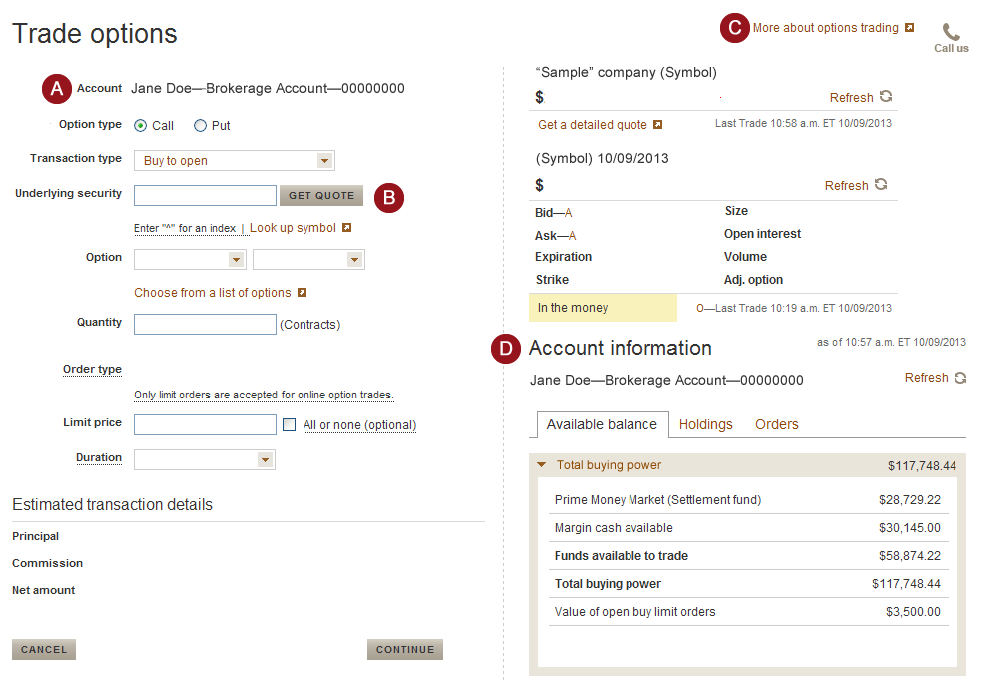

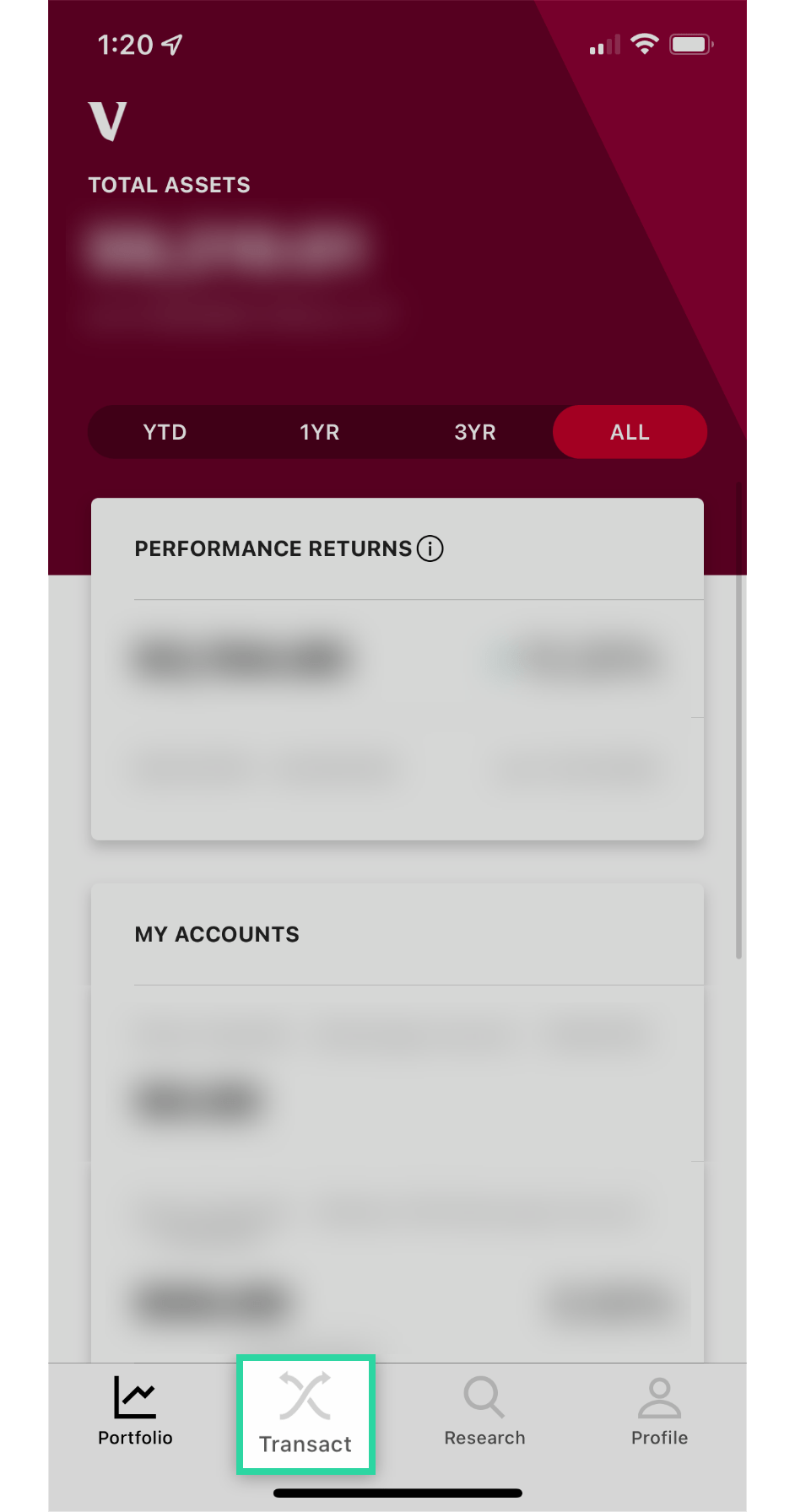

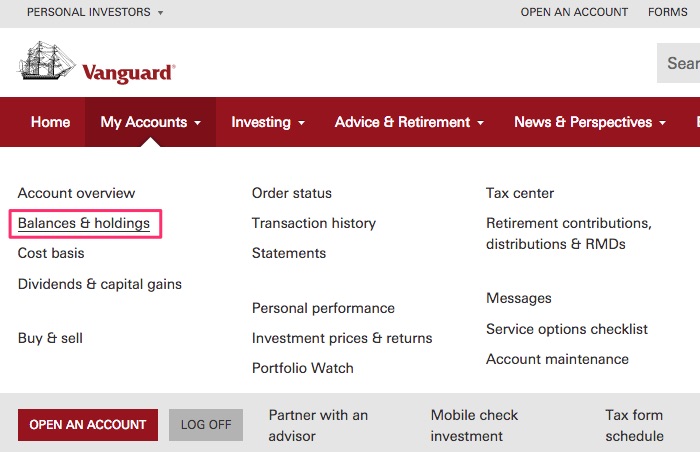

The Vanguard Rollover IRA Brokerage Account builds upon this legacy by offering a streamlined platform to manage your rollover funds. With a brokerage account, you gain access to a vast universe of investments, including stocks, bonds, ETFs (Exchange Traded Funds), and mutual funds, giving you unparalleled control over your asset allocation.

Key Features and Benefits

One of the most compelling reasons to consider a Vanguard Rollover IRA is the company's commitment to low costs. Vanguard is renowned for its rock-bottom expense ratios, meaning you keep more of your investment returns. This can make a significant difference over the long term, especially when compounded over decades.

The platform is user-friendly, making it accessible even to those unfamiliar with brokerage accounts. Vanguard provides a range of educational resources and tools to help you make informed investment decisions, from understanding different asset classes to creating a personalized investment strategy.

“Our mission has always been to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success," - John C. Bogle, Founder of Vanguard.

Another key advantage is the flexibility to invest according to your own risk tolerance and financial goals. Whether you're a conservative investor seeking stability or an aggressive investor pursuing high growth, you can tailor your portfolio to meet your specific needs.

Navigating the Rollover Process

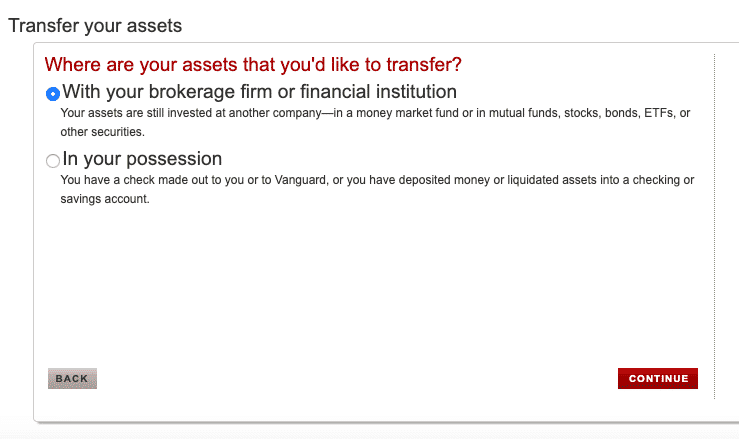

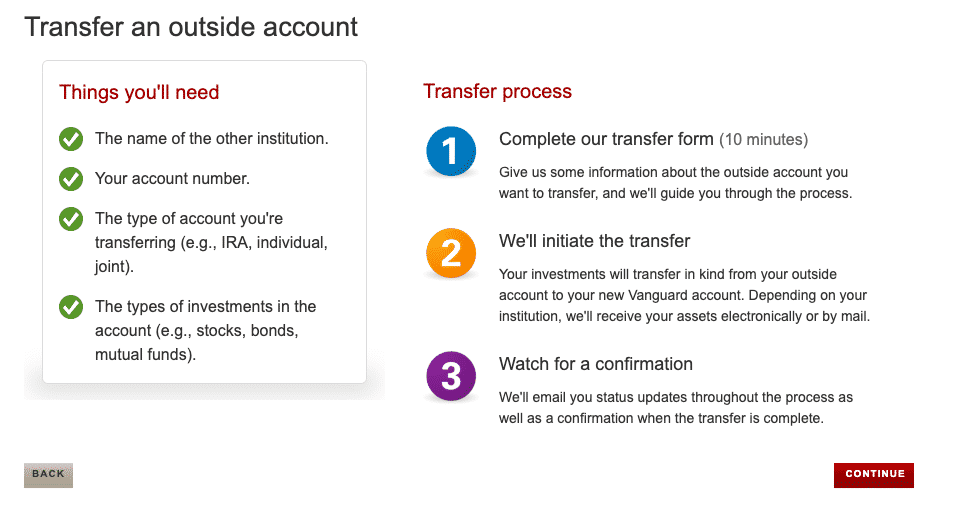

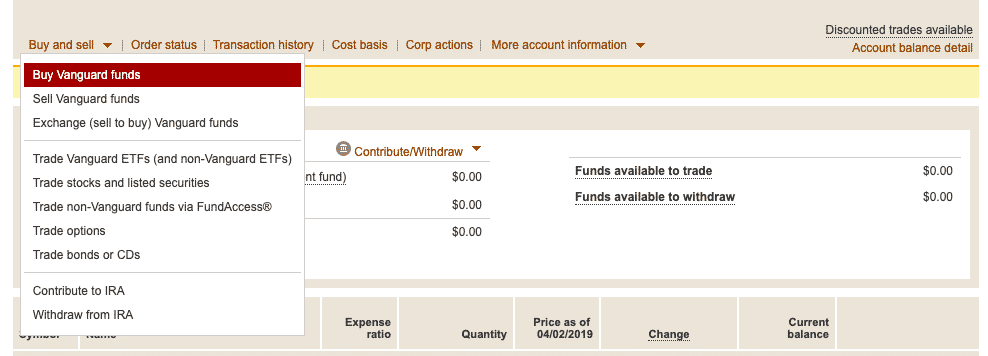

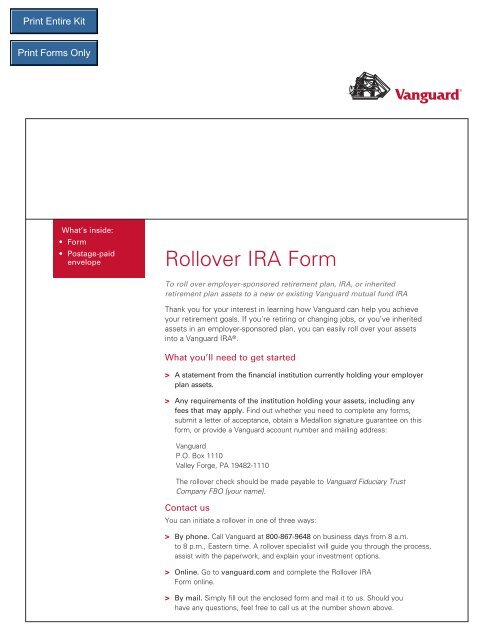

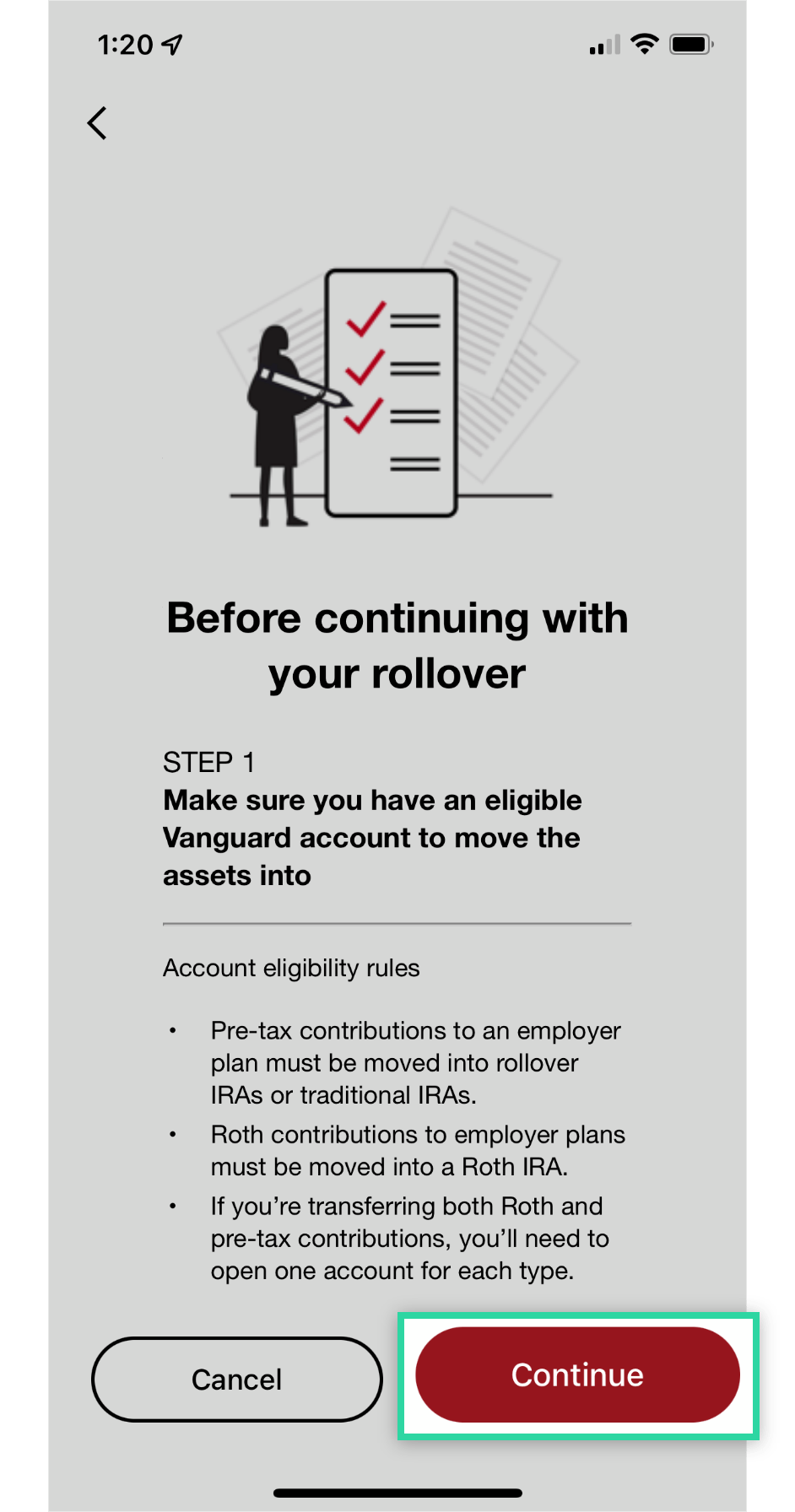

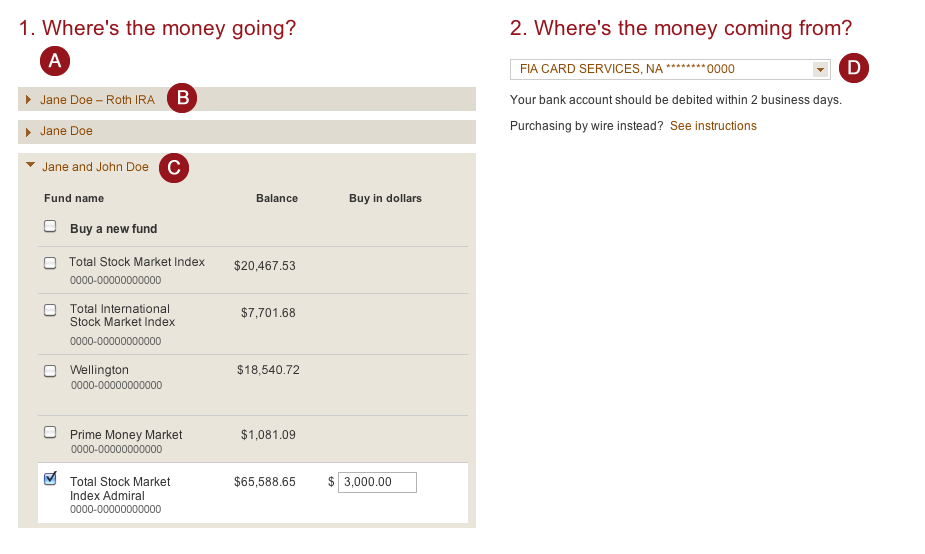

Rolling over funds into a Vanguard Rollover IRA is generally a straightforward process. You'll typically need to complete some paperwork with both your former employer's plan administrator and Vanguard to initiate the transfer.

There are two primary methods for rolling over funds: a direct rollover and an indirect rollover. A direct rollover involves the funds being transferred directly from your old plan to Vanguard, while an indirect rollover involves you receiving a check for the funds, which you then have 60 days to deposit into your Rollover IRA. A direct rollover is generally recommended, as it avoids potential tax implications.

It's always a good idea to consult with a financial advisor before making any major financial decisions, including rolling over retirement funds. A qualified advisor can help you assess your individual circumstances, understand the potential tax implications, and develop a suitable investment strategy.

Potential Considerations

While a Vanguard Rollover IRA Brokerage Account offers numerous advantages, it's important to be aware of potential drawbacks. Managing your own investments requires time and effort, as you'll need to stay informed about market conditions and periodically rebalance your portfolio.

Furthermore, while Vanguard offers a wide range of investment options, it's crucial to conduct your own due diligence and understand the risks associated with each investment. It's important to diversify your portfolio and avoid putting all your eggs in one basket.

The absence of personalized advice within a brokerage account structure might be a challenge for some investors. Investors who prefer guided assistance may consider Vanguard's Personal Advisor Services.

A Stepping Stone to Retirement Security

The Vanguard Rollover IRA Brokerage Account can be a powerful tool for building and managing your retirement savings. By providing a low-cost, flexible, and user-friendly platform, it empowers individuals to take control of their financial future and pursue their retirement dreams with confidence.

Ultimately, the decision of whether or not to roll over your retirement funds into a Vanguard Rollover IRA is a personal one. But for those seeking greater control, lower costs, and a wider range of investment options, it's certainly worth considering.

As you approach retirement, remember that it's not just about accumulating wealth, but also about managing it wisely. A strategic rollover can be a crucial step in ensuring a secure and fulfilling retirement.