Variable Costing Income Statements Are Based Upon A

Imagine a small bakery, the aroma of freshly baked bread swirling in the air, the gentle hum of the oven a constant backdrop. But behind the scenes, beyond the delightful sensory experience, lies a complex web of numbers. Knowing how to decipher these numbers is essential, because that decides whether the bakery is truly thriving or just breaking even.

At the heart of understanding a business's financial health often lies the income statement. For businesses adopting a particular method, the key to understanding their profitability is recognizing that Variable Costing Income Statements are based upon the principle of separating costs into variable and fixed components, which then dictates the structure and interpretation of the reported financial results.

Delving into Variable Costing

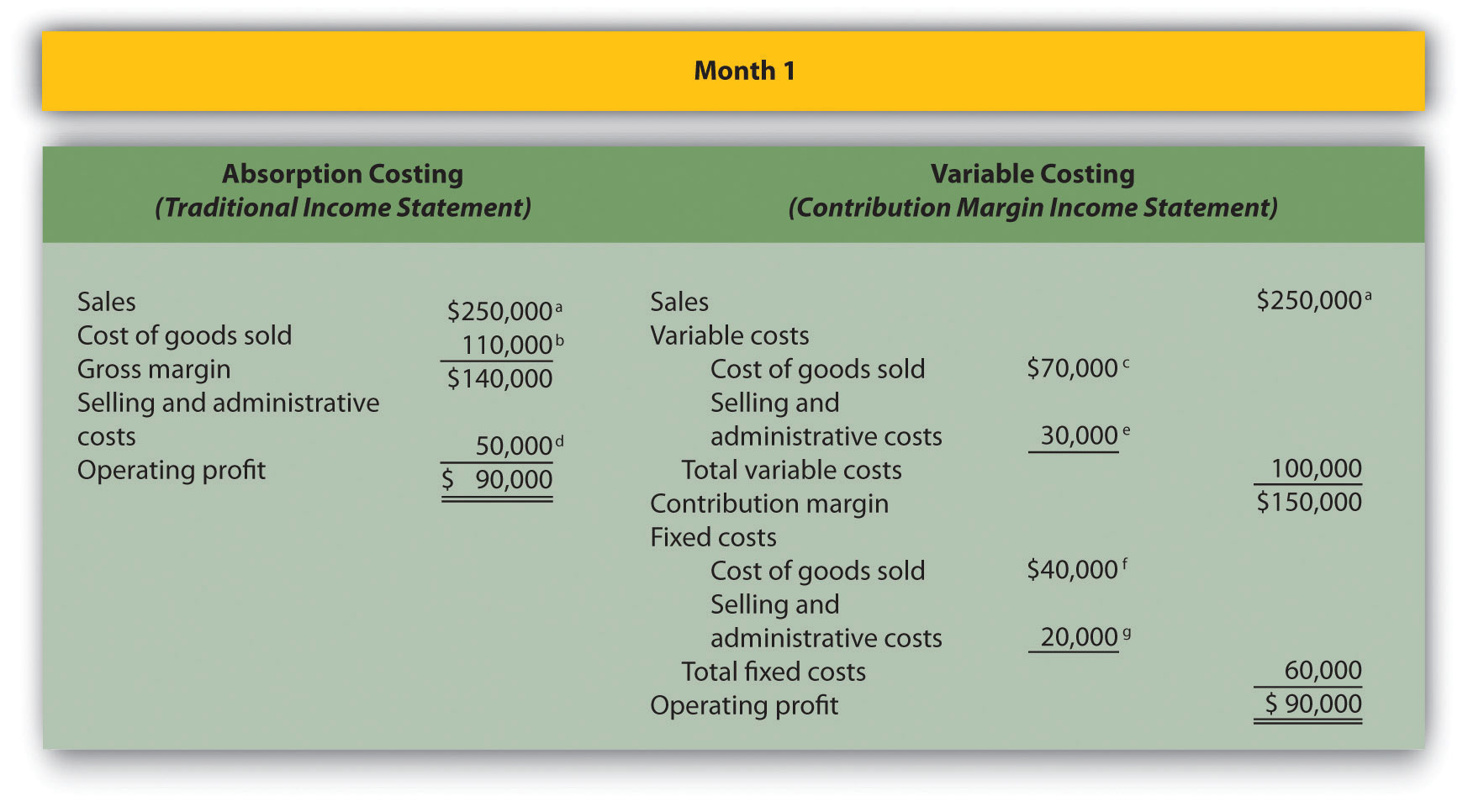

Variable costing, also known as direct costing, stands as a distinct approach to cost accounting. It differs significantly from absorption costing, the more traditional method often used for external reporting.

With variable costing, only those costs that fluctuate directly with production volume are considered product costs. These typically encompass direct materials, direct labor, and variable manufacturing overhead.

Think of our bakery again. Flour, sugar, and the wages of the bakers directly involved in making the bread would all be classified as variable costs.

The Anatomy of a Variable Costing Income Statement

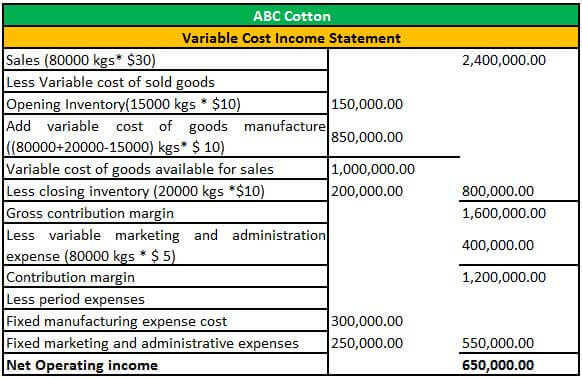

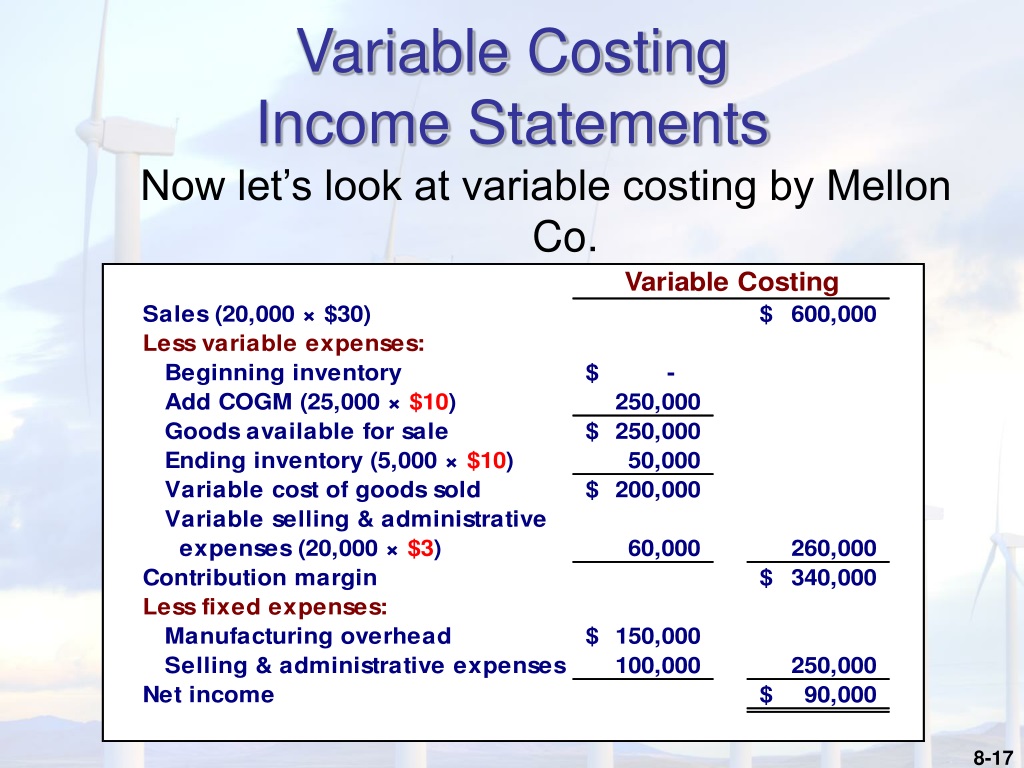

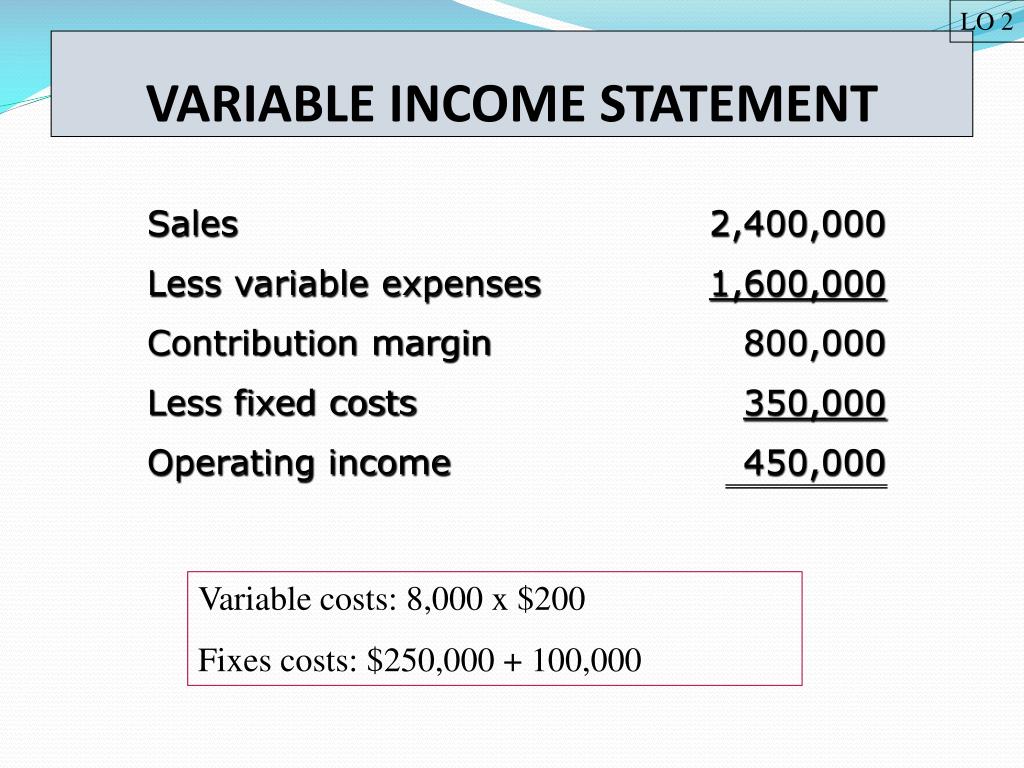

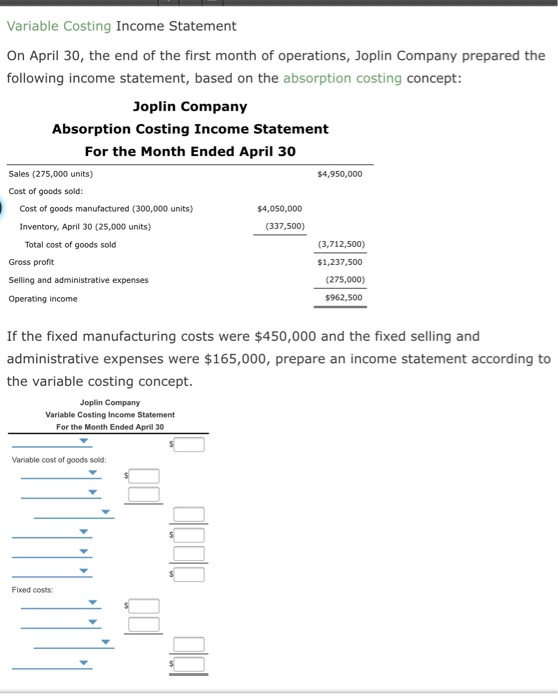

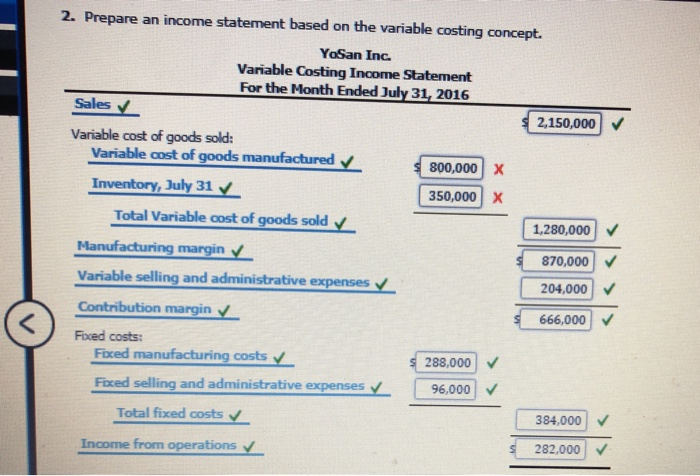

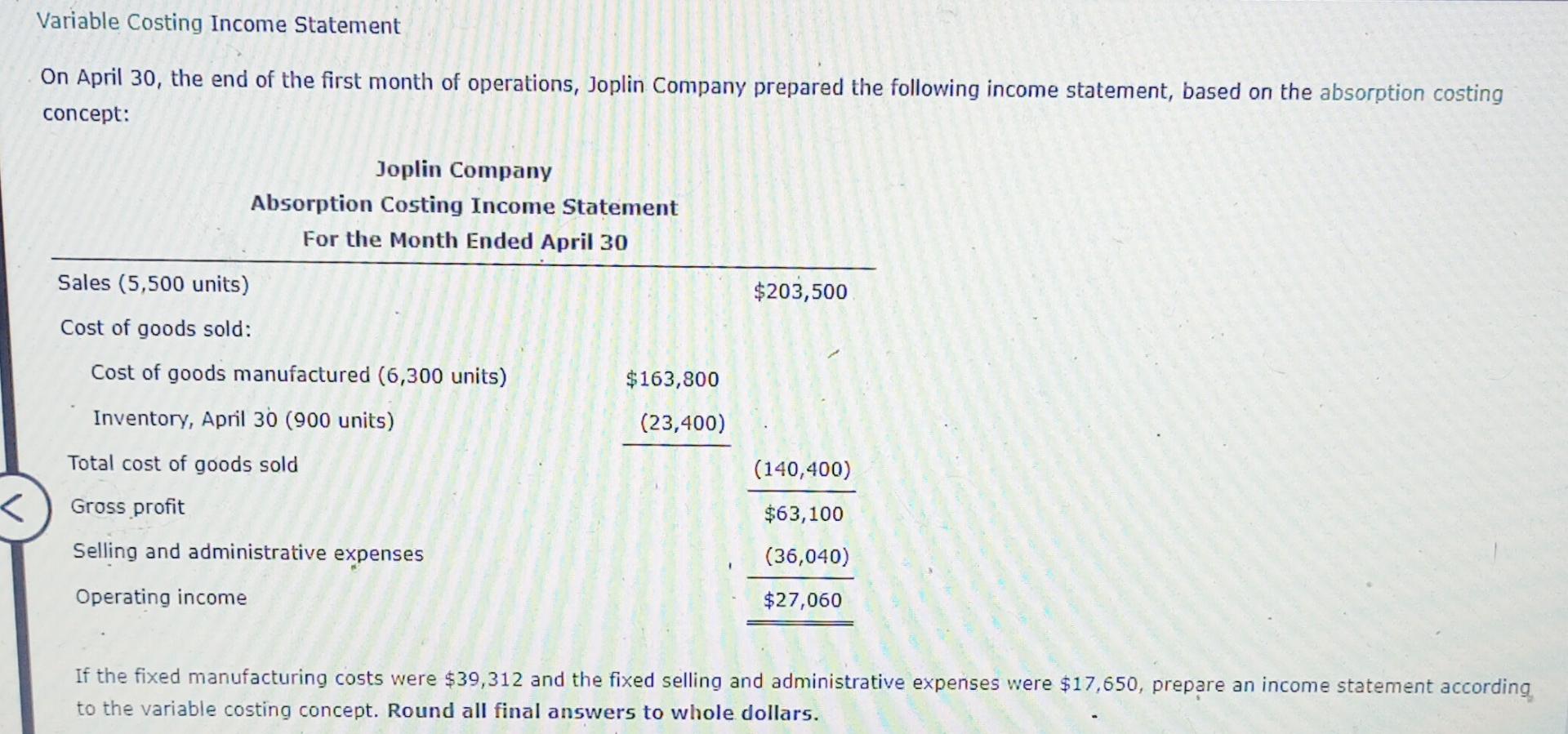

A variable costing income statement presents a different picture of profitability compared to its absorption costing counterpart. Instead of calculating gross profit by deducting all manufacturing costs from revenue, it focuses on the contribution margin.

The contribution margin represents the revenue remaining after deducting all variable costs. This provides a clear view of how much each unit sold contributes towards covering fixed costs and generating profit.

The basic format flows as follows: Revenue less Variable Costs (both manufacturing and selling & administrative) equals Contribution Margin. Then, Fixed Costs (both manufacturing and selling & administrative) are deducted to arrive at Net Operating Income.

This format shines a light on the cost-volume-profit relationship. In essence, it allows managers to quickly assess how changes in sales volume impact profitability.

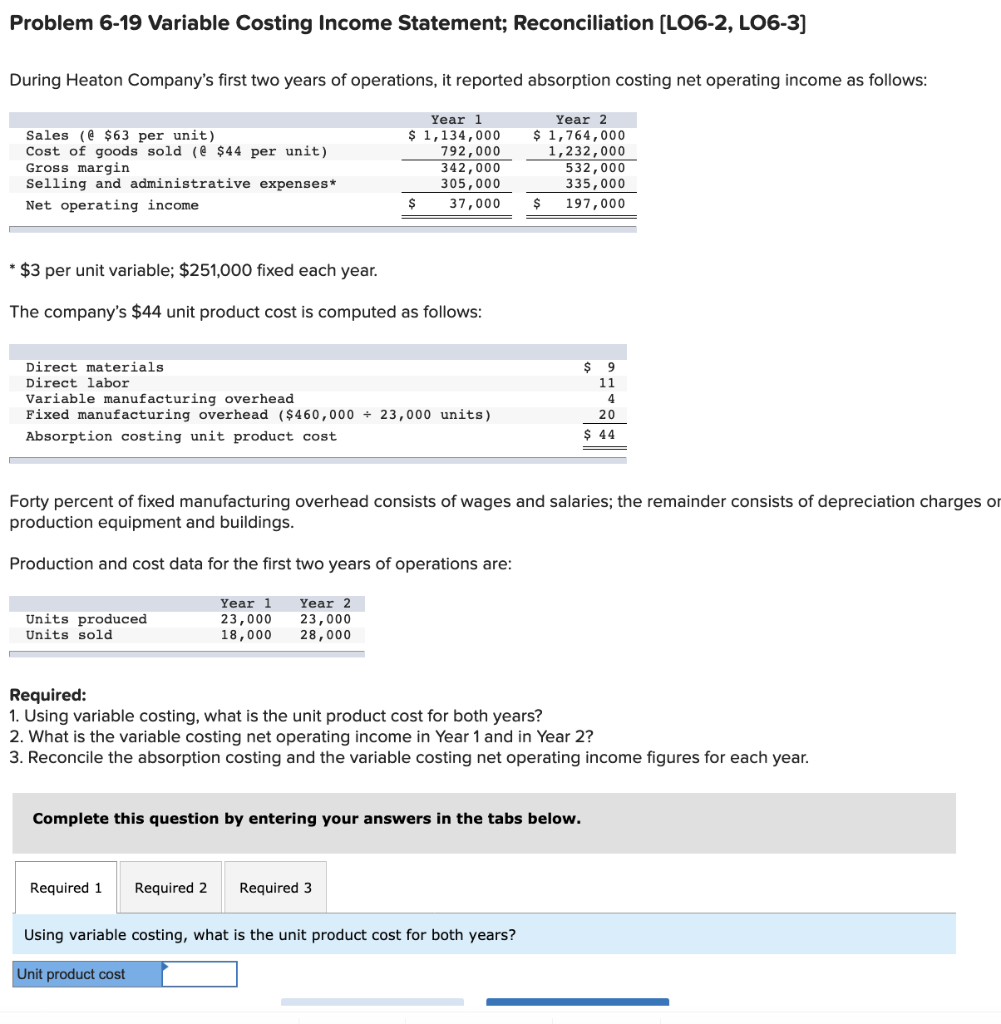

Variable vs. Absorption: A Key Distinction

The crucial difference between variable and absorption costing lies in the treatment of fixed manufacturing overhead. Under absorption costing, fixed manufacturing overhead is treated as a product cost.

This means it is allocated to each unit produced and expensed only when the product is sold. Under variable costing, fixed manufacturing overhead is treated as a period cost, expensed in full during the period it is incurred.

Imagine our bakery has rent for its building. Under absorption costing, a portion of that rent would be allocated to each loaf of bread produced. Under variable costing, the entire rent expense would be recognized in the month it is paid, regardless of how many loaves were baked.

Why Use Variable Costing?

Variable costing offers several advantages for internal management decision-making. Its focus on the contribution margin provides a clearer picture of the true profitability of products and services.

This transparency allows managers to make more informed decisions about pricing, product mix, and whether to accept or reject special orders. It sidesteps the situation where production impacts profitability, as can happen with absorption costing.

Because fixed manufacturing overhead is treated as a period cost, net operating income under variable costing is directly tied to sales volume. This prevents the potential for artificially inflating profits by simply increasing production, even if those products remain unsold.

This can be particularly beneficial for performance evaluation. According to the Chartered Institute of Management Accountants (CIMA), using variable costing prevents managers from manipulating profits by overproducing, aligning their incentives with the company's overall goals.

Limitations to Consider

While variable costing is valuable for internal decision-making, it is not generally accepted for external financial reporting. Most generally accepted accounting principles (GAAP) require the use of absorption costing for external reporting purposes.

This is because absorption costing provides a more comprehensive picture of the total cost of goods sold, including both variable and fixed manufacturing overhead. This is considered necessary for accurately matching revenues and expenses in financial statements used by investors and creditors.

Another potential drawback is that the separation of costs into fixed and variable components can be challenging in practice. Some costs may exhibit characteristics of both, requiring careful analysis and judgment to classify them appropriately.

The Significance in the Modern Business Landscape

In today's dynamic and competitive business environment, understanding cost behavior is more critical than ever. Variable costing empowers managers with the insights needed to make informed decisions about pricing, production, and resource allocation.

Its emphasis on the contribution margin provides a clear understanding of the profitability of individual products and services, enabling businesses to optimize their product mix and focus on the most profitable areas.

Moreover, its simplicity and ease of understanding make it a valuable tool for communication and collaboration across different departments within an organization. By promoting a shared understanding of cost-volume-profit relationships, variable costing can foster a more data-driven and profitable culture.

Real-World Applications

Consider a manufacturing company deciding whether to accept a special order at a discounted price. Using variable costing, the company can quickly determine the incremental costs associated with the order and calculate the contribution margin.

If the contribution margin is positive, even if the order doesn't cover all fixed costs, accepting the order may still be beneficial as it contributes to covering overall fixed costs and increasing profitability.

Similarly, a service company can use variable costing to analyze the profitability of different service offerings. By identifying the variable costs associated with each service, the company can determine which services are the most profitable and allocate resources accordingly.

"Variable costing provides a powerful lens through which managers can view their business," explains Dr. Anya Sharma, a professor of accounting at the University of California, Berkeley. "It strips away the complexities of fixed cost allocation and reveals the true profitability drivers."

The Path Forward

While not a replacement for traditional absorption costing for external reporting, variable costing serves as a critical internal management tool. Its ability to provide a clear, concise view of cost-volume-profit relationships is invaluable in today's competitive landscape.

Businesses that embrace variable costing principles are better equipped to make informed decisions, optimize their operations, and achieve sustainable profitability. They can navigate market complexities with greater agility and confidence.

Ultimately, the decision of whether to utilize variable costing comes down to the specific needs and priorities of the organization. However, its value as a strategic decision-making tool is undeniable, making it an important concept for all business professionals to understand. Understanding the intricacies of cost accounting allows business leaders to navigate financial complexities and turn that understanding into real world action and tangible results.

![Variable Costing Income Statements Are Based Upon A [SOLVED] On October 31, the end of the first month of operations](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/images/question_images/1670/5/6/2/9066392c45a63e171670562906266.jpg)