Wall Street Prep Vs Breaking Into Wall Street

The world of investment banking is notoriously competitive, and securing a coveted position often hinges on rigorous preparation. Two prominent names dominate the landscape of finance training programs: Wall Street Prep (WSP) and Breaking Into Wall Street (BIWS). Both platforms promise to equip aspiring bankers with the technical skills and industry knowledge necessary to succeed, but their approaches, content, and target audiences differ significantly, sparking ongoing debate among students and professionals alike.

This article delves into a comprehensive comparison of Wall Street Prep and Breaking Into Wall Street, dissecting their strengths and weaknesses to help aspiring finance professionals make informed decisions about their training investments. It explores the curriculum, teaching methodologies, pricing structures, and career support offered by each platform, drawing upon publicly available information and industry insights. Ultimately, it aims to provide a balanced perspective on which program might be a better fit for different career goals and learning styles.

Curriculum and Content Depth

Wall Street Prep is often lauded for its breadth of coverage, offering a wide range of courses covering accounting, financial modeling, valuation, and corporate finance. The platform is structured around instructor-led courses, online modules, and practice exams, providing a well-rounded learning experience. The content is typically considered more accessible to individuals with limited prior finance knowledge.

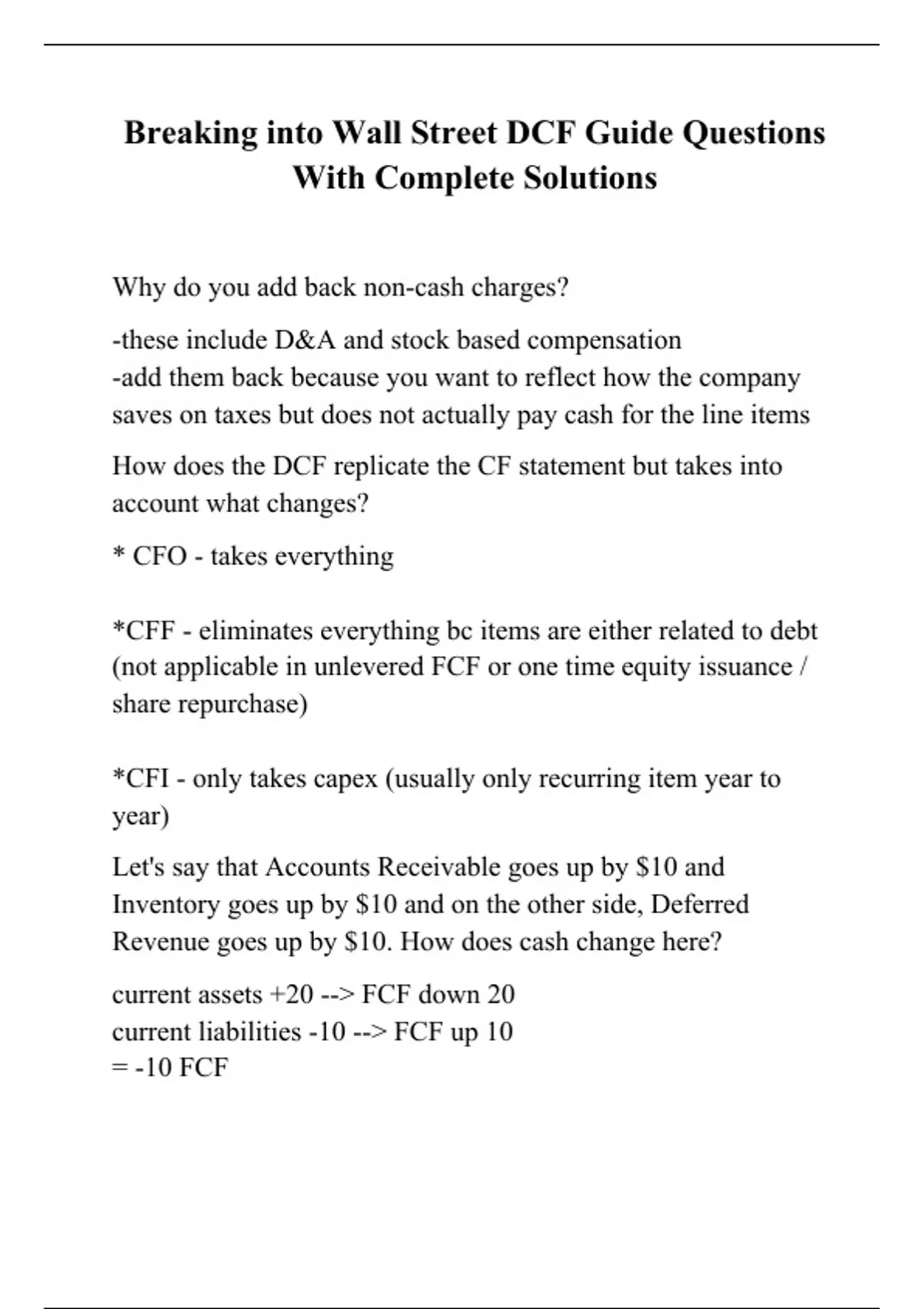

BIWS, founded by Brian DeChesare, focuses on providing intensive, hands-on training in financial modeling and valuation. BIWS emphasizes practical application, featuring real-world case studies and in-depth modeling exercises. The program’s depth can be challenging for newcomers, but it's highly valued by those seeking advanced technical proficiency.

Teaching Methodology

WSP's approach incorporates a mix of live instruction, self-paced learning, and interactive exercises. Their instructor-led courses provide real-time guidance and feedback, while their online modules offer flexibility and convenience. This blended learning model caters to diverse learning preferences.

BIWS leans heavily towards self-directed learning, offering comprehensive video tutorials and detailed written guides. The platform's focus is on independent problem-solving and mastery of complex financial models. While some may prefer a more structured environment, BIWS cultivates strong self-sufficiency.

Pricing and Accessibility

Wall Street Prep typically offers a range of pricing options, from individual courses to comprehensive packages, allowing students to tailor their investment to specific needs. Their tiered pricing structure makes some content more accessible to students with budget constraints.

Breaking Into Wall Street generally has a higher upfront cost compared to WSP. The price reflects the program’s intensive nature and the depth of the training. However, BIWS offers various payment plans and often provides discounts, making the program accessible to a wider audience.

Career Support and Resources

WSP provides resources to aid job searching, including resume reviews, interview preparation, and networking guidance. While career services are available, their primary focus remains on technical training.

BIWS offers more extensive career support, including detailed interview guides, networking strategies, and case study analysis. BIWS fosters a strong community of alumni, facilitating mentorship and job opportunities. Their career services are more personalized and intensive than WSP.

Which Platform to Choose?

Choosing between Wall Street Prep and Breaking Into Wall Street depends on individual needs and goals. Those seeking a broad introduction to finance and a structured learning environment may prefer WSP. Its accessibility and wide range of courses make it a solid foundation.

Individuals aiming for advanced financial modeling skills and dedicated career support will likely find BIWS to be more valuable. Its intensive focus and strong community can provide a significant edge in the competitive investment banking landscape.

Ultimately, the best choice hinges on a self-assessment of skill level, learning style, and career aspirations. Consider exploring free trials or introductory materials offered by both platforms to determine the best fit.

The Future of Finance Training

As the finance industry continues to evolve, the demand for specialized training programs like Wall Street Prep and Breaking Into Wall Street will likely persist. These platforms will likely adapt by incorporating new technologies, expanding their course offerings, and refining their career support services.

The rise of online learning and remote work will further fuel the need for accessible and effective finance training programs. Both WSP and BIWS are poised to play a crucial role in shaping the next generation of finance professionals.