Wells Fargo Wealth Management Salary

Wells Fargo Wealth Management salaries are under scrutiny as new data reveals potential disparities and competitive pressures. Junior advisors are particularly impacted, facing concerns over base pay and bonus structures.

This article breaks down the latest information on Wells Fargo Wealth Management compensation, highlighting key salary ranges, bonus expectations, and the overall impact on employee morale and retention within the division.

Wealth Management Salary Overview

Recent reports indicate that entry-level wealth management positions at Wells Fargo may offer a base salary ranging from $60,000 to $80,000. This figure can vary based on location, experience, and specific team assignments.

However, many sources suggest that bonuses make up a significant portion of total compensation, often tied to performance metrics and client acquisition.

Experienced financial advisors with established books of business can earn significantly more, potentially exceeding $200,000 or higher depending on assets under management (AUM) and revenue generation.

Compensation Structures

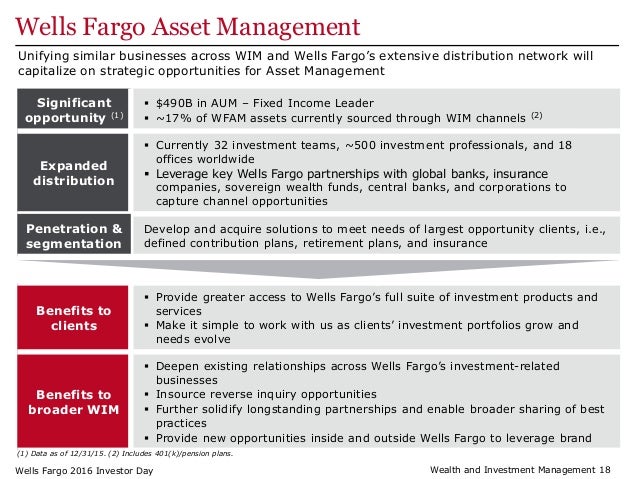

Wells Fargo employs a tiered compensation structure that rewards advisors for bringing in new clients and growing their existing AUM.

The firm reportedly uses a grid-based system, where commission rates increase as advisors reach higher tiers of assets managed.

This system is designed to incentivize high performance, but also places pressure on advisors to consistently meet targets. The structure differs amongst regions and experience level.

Competitive Landscape

Other major wealth management firms, such as Morgan Stanley and Merrill Lynch, are actively recruiting talent with competitive compensation packages.

This competitive pressure is forcing Wells Fargo to re-evaluate its salary structure to retain top-performing advisors and attract new talent.

The rising cost of living in major metropolitan areas further exacerbates concerns about base pay, especially for junior advisors in high-cost locations.

Impact on Employee Morale

Reports from current and former Wells Fargo employees suggest that concerns over compensation are impacting morale.

The emphasis on sales and client acquisition can create a stressful work environment. Many junior advisors have spoken out about this.

Some advisors have expressed frustration with the transparency and predictability of bonus payouts, leading to uncertainty about their total earnings.

High turnover has been a recurring issue.

Key Takeaways

Wells Fargo Wealth Management salaries are highly variable, with a strong emphasis on performance-based bonuses.

Entry-level positions may offer a base salary that is competitive with other firms, but bonuses are a crucial component of total compensation.

The competitive landscape for wealth management talent is intensifying, potentially requiring Wells Fargo to make adjustments to its compensation strategy to retain and attract top advisors.

Next Steps

Industry analysts are closely monitoring Wells Fargo's compensation strategy to assess its impact on employee retention and overall performance.

Further updates are expected as Wells Fargo responds to competitive pressures and employee feedback.

Stay tuned for ongoing coverage of developments in wealth management compensation and its implications for the financial services industry.