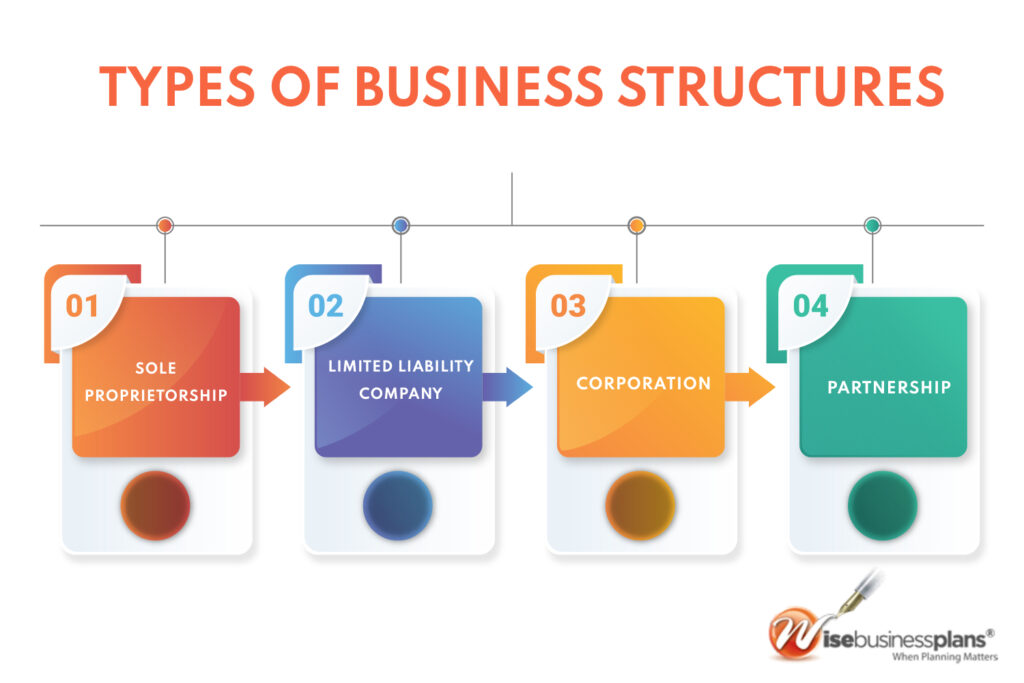

What Are The 4 Types Of Business Structures

Imagine you're at a bustling farmer's market. Tables overflow with colorful produce, artisanal cheeses, and handcrafted jewelry. Each vendor, beaming with pride, represents a unique business, a dream brought to life. But beneath the surface of these vibrant stalls lies a critical decision: how each business is structured. This foundational choice dictates everything from taxation to liability, shaping their entrepreneurial journey.

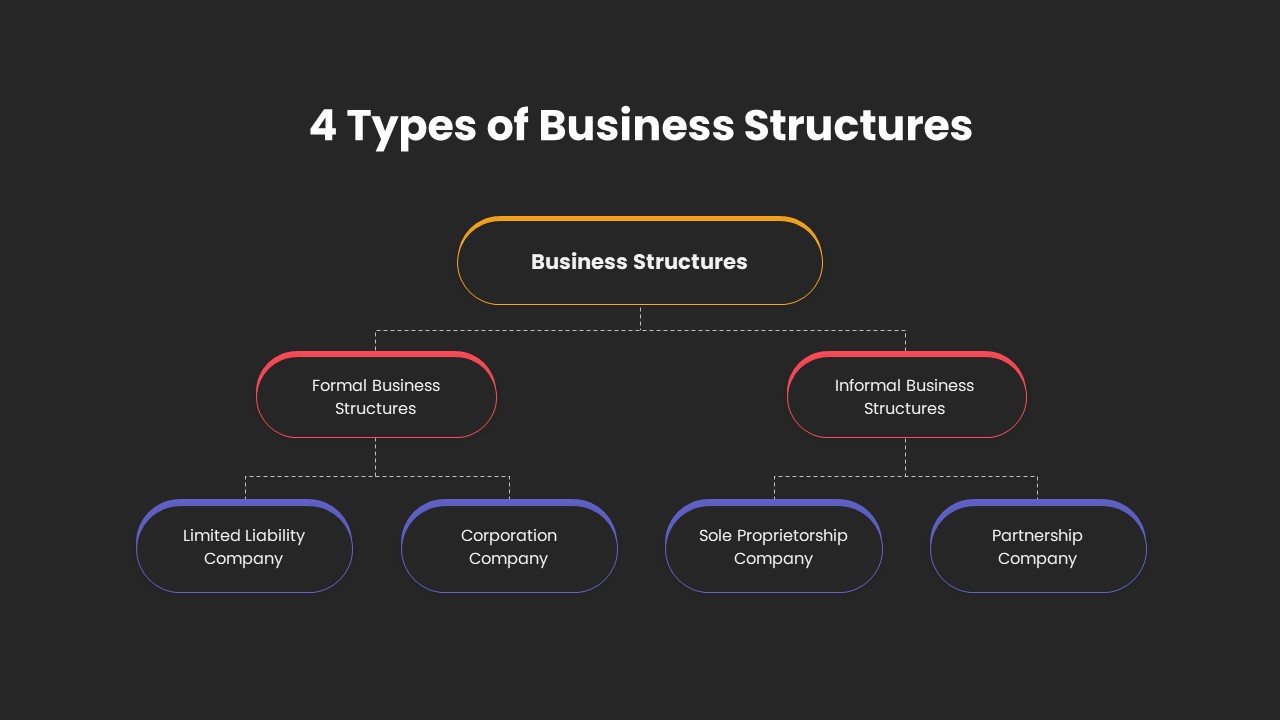

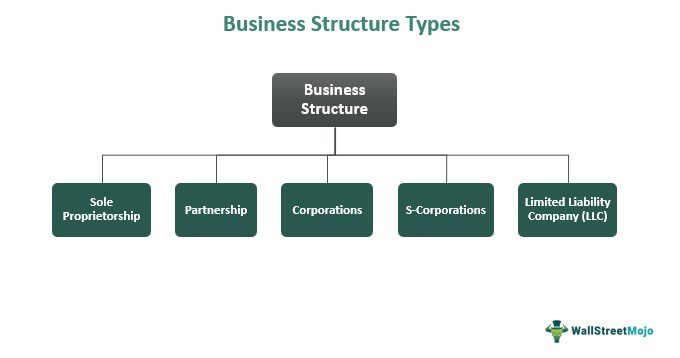

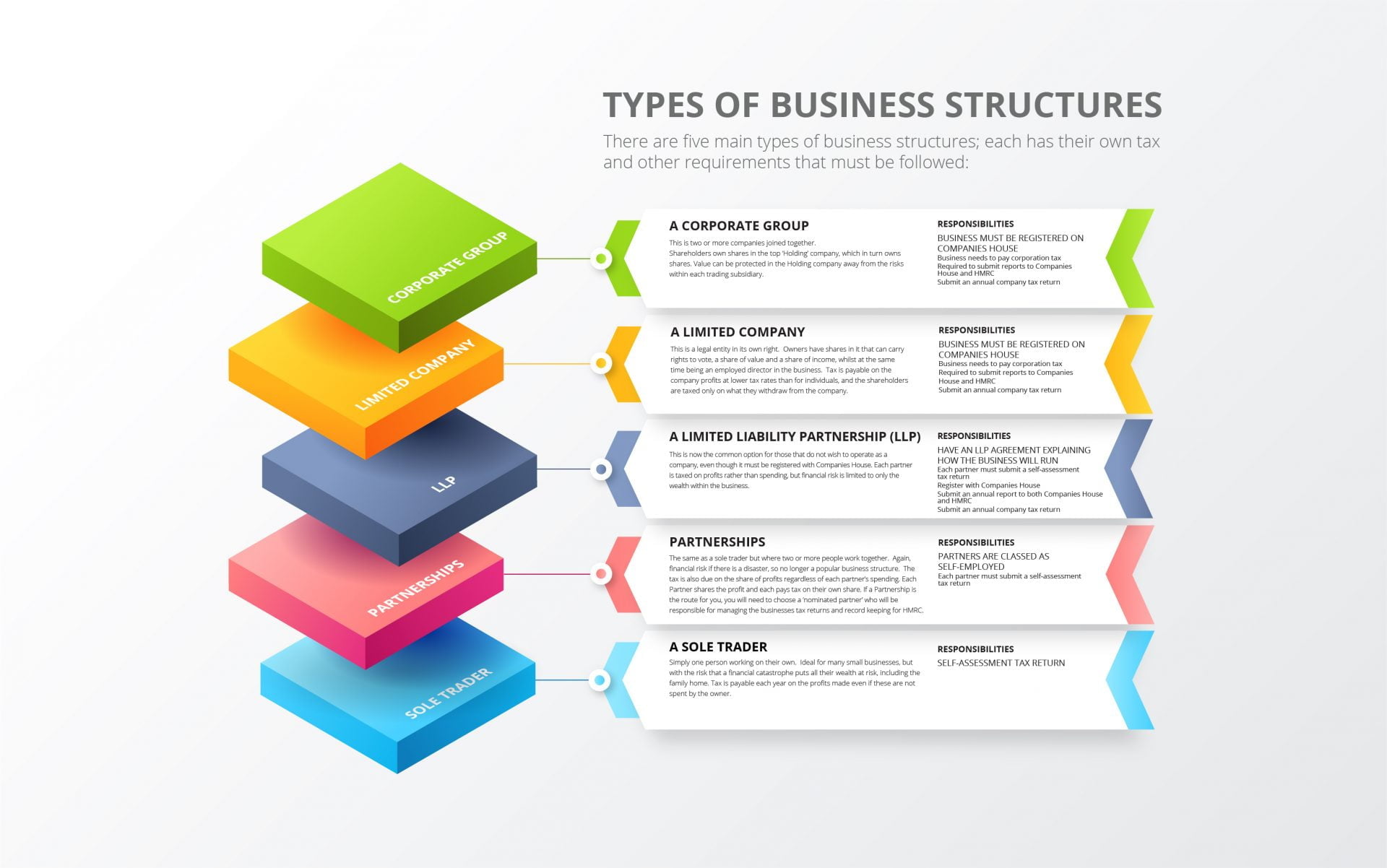

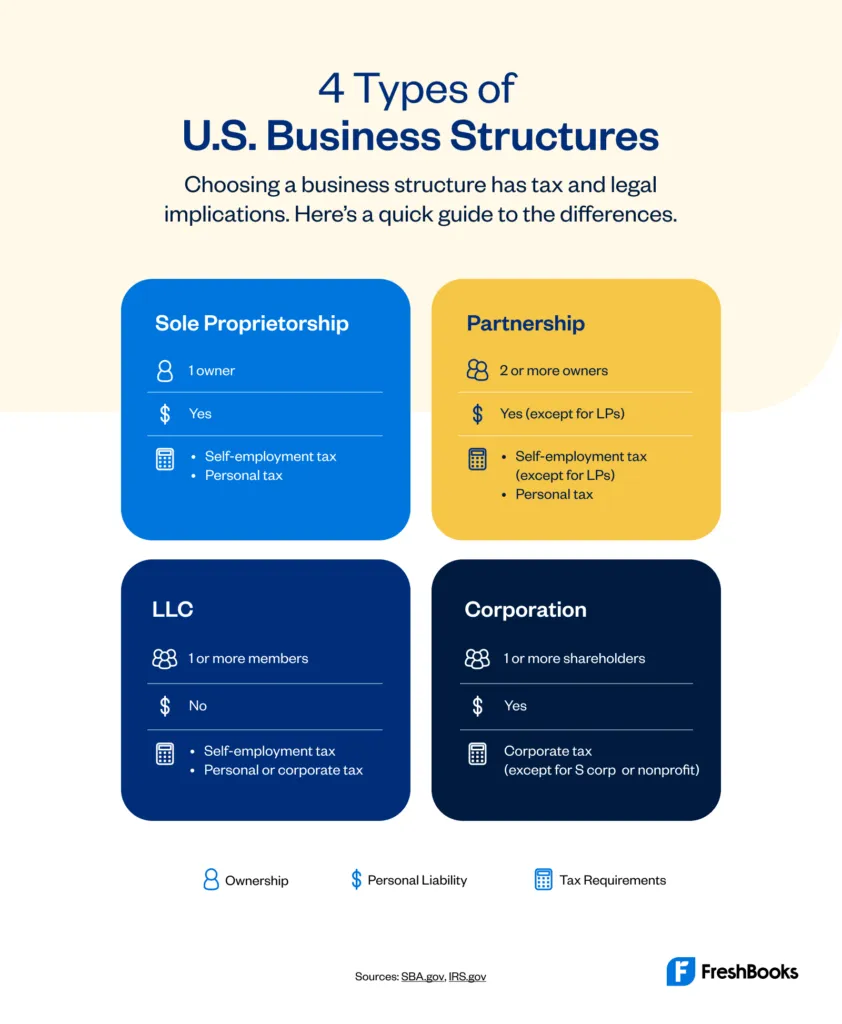

The choice of a business structure is a cornerstone decision for any entrepreneur. It impacts everything from taxation and personal liability to fundraising and overall operational complexity. Understanding the four primary types – sole proprietorship, partnership, limited liability company (LLC), and corporation – is crucial for setting a business up for success.

The Humble Beginnings: Sole Proprietorship

The sole proprietorship is often the simplest and most straightforward business structure. It's essentially an extension of the individual owner. Think of the freelance writer, the independent artist, or the local handyman – they likely operate as sole proprietors.

Setting up a sole proprietorship is relatively easy. It generally requires minimal paperwork. However, the owner is personally liable for all business debts and obligations. This means their personal assets are at risk if the business incurs debt or faces legal action.

Two Heads Are Better Than One: Partnership

When two or more individuals decide to join forces and share in the profits or losses of a business, they form a partnership. Partnerships can be as simple as a handshake agreement. Though, formal partnership agreements are strongly encouraged.

A formal agreement outlines responsibilities, profit sharing ratios, and dispute resolution processes. There are different types of partnerships, including general partnerships. In a general partnership, all partners share in the business's operational management and liability. Limited partnerships also exist. They offer some partners limited liability and operational control.

Striking a Balance: Limited Liability Company (LLC)

The LLC offers a blend of simplicity and liability protection. It combines the pass-through taxation of a sole proprietorship or partnership with the limited liability of a corporation. This is a popular choice for small business owners.

LLCs shield the owner's personal assets from business debts and lawsuits. This makes it a more secure option compared to sole proprietorships or general partnerships. Forming an LLC typically involves filing articles of organization with the state and adhering to ongoing compliance requirements.

The Corporate World: Corporations

The corporation is a more complex business structure. It is recognized as a separate legal entity from its owners (shareholders). This separation provides the strongest liability protection.

Corporations can raise capital more easily through the sale of stock. However, they face more stringent regulatory requirements and potential double taxation (at the corporate level and again when profits are distributed to shareholders). There are different types of corporations. This includes S corporations, which offer pass-through taxation to avoid double taxation.

Delving Deeper: S Corporations vs. C Corporations

Within the corporate structure, the distinction between S corporations and C corporations is vital. C corporations are subject to corporate income tax. Shareholders then pay taxes on dividends they receive.

S corporations, on the other hand, allow profits and losses to be passed through directly to the owners' personal income without being subject to corporate tax rates. This can be a significant advantage for smaller businesses that meet the eligibility requirements.

Making the Right Choice: Key Considerations

Choosing the right business structure is not a one-size-fits-all decision. Several factors should be considered, including the level of liability protection desired, the complexity of the business, tax implications, and future growth plans.

Consulting with a legal professional and a certified public accountant (CPA) is highly recommended. This will ensure that the chosen structure aligns with the business's specific needs and goals. According to the Small Business Administration (SBA), seeking expert advice is a critical step in starting a successful business.

As the sun sets over the bustling farmer's market, casting long shadows across the stalls, one thing becomes clear: the foundation upon which each business is built matters. It defines their path, shapes their future, and ultimately determines their success. Choosing the right business structure is an investment in that very foundation. An investment that paves the way for a thriving entrepreneurial journey.