What Are The Results Of Unanticipated Inflation

Consumers are reeling as unanticipated inflation continues to erode purchasing power, forcing rapid adjustments across all sectors. The sudden surge is disrupting financial stability and reshaping economic landscapes globally.

This article breaks down the tangible consequences of unforeseen inflationary pressures, examining the immediate impacts on individuals, businesses, and the overall economy based on recent data and reports. Understanding these effects is crucial for navigating the current economic uncertainty.

Erosion of Purchasing Power

The most immediate and visible effect of unanticipated inflation is the decline in purchasing power. Consumers find that their existing income buys fewer goods and services than before.

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) rose significantly in the past year, indicating a substantial increase in the cost of living. For instance, a family earning $50,000 annually effectively experiences a pay cut as the real value of their income diminishes.

This disproportionately affects low-income households, who allocate a larger percentage of their income to necessities like food and energy. Data from the Center on Budget and Policy Priorities reveals that these households struggle to afford basic needs amidst rising prices.

Impact on Savings and Investments

Unanticipated inflation dramatically impacts savings and investment strategies. Fixed-income investments, such as bonds, lose value as their returns fail to keep pace with rising prices.

Individuals relying on these investments for retirement income face reduced financial security. Real estate and certain commodities, traditionally considered inflation hedges, may become overpriced and vulnerable to market corrections.

The Federal Reserve's data shows a marked shift in investment patterns, with investors seeking alternative assets to protect their wealth, often contributing to market volatility.

Business Disruptions and Price Volatility

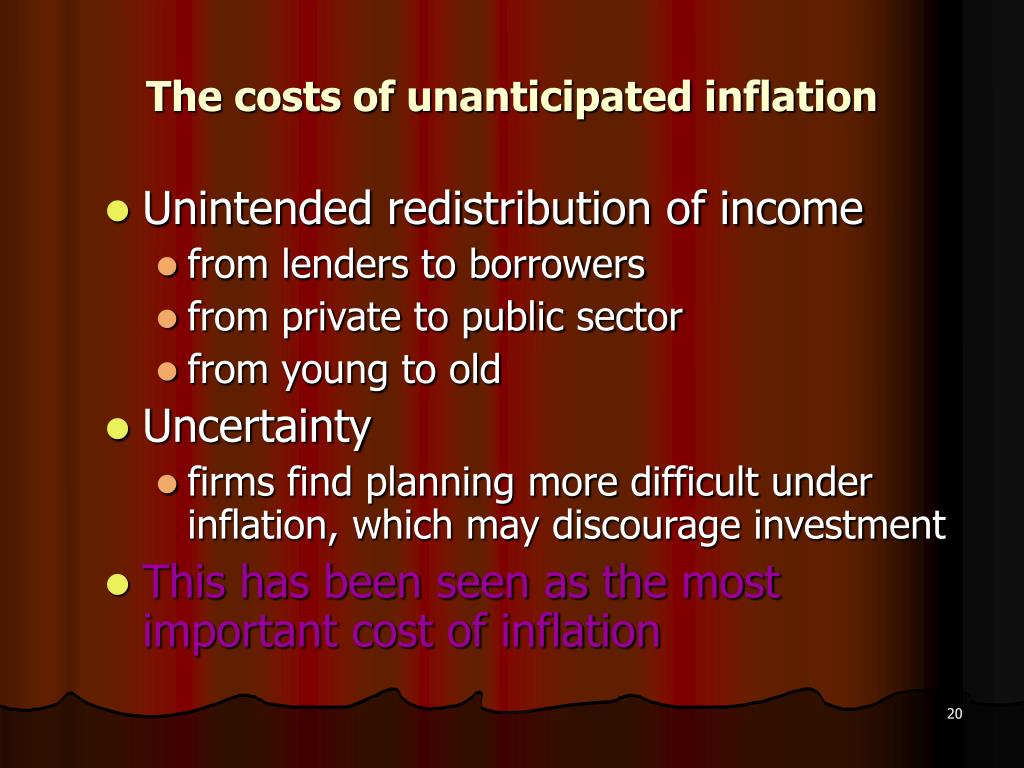

Businesses face numerous challenges amid unanticipated inflation, including increased input costs and unpredictable demand. Raw materials, labor, and transportation expenses rise, squeezing profit margins.

Companies struggle to set prices accurately, leading to either reduced sales or diminished profitability. Supply chain disruptions, exacerbated by inflationary pressures, further complicate business operations.

A recent survey by the National Federation of Independent Business (NFIB) found that a significant percentage of small business owners cite inflation as their top concern, impacting their ability to hire and expand.

Debt and Borrowing

While borrowers with fixed-rate debt may initially benefit from inflation, the overall impact on debt and borrowing is complex. The real value of outstanding debt decreases, making it easier to repay in nominal terms.

However, rising interest rates, implemented to combat inflation, increase the cost of new borrowing. This can stifle economic growth and reduce investment opportunities.

Furthermore, variable-rate loans become more expensive, increasing the financial burden on existing borrowers. The Mortgage Bankers Association reported a decline in mortgage applications as rates climbed.

Labor Market Effects

Unanticipated inflation can trigger wage-price spirals, where rising prices lead to demands for higher wages, which in turn push prices even higher. While workers may initially benefit from wage increases, these gains are often offset by the escalating cost of goods and services.

Businesses may respond to higher labor costs by reducing their workforce or postponing hiring, potentially leading to increased unemployment. The Labor Department's data indicates a tightening labor market, but concerns persist regarding potential job losses in vulnerable sectors.

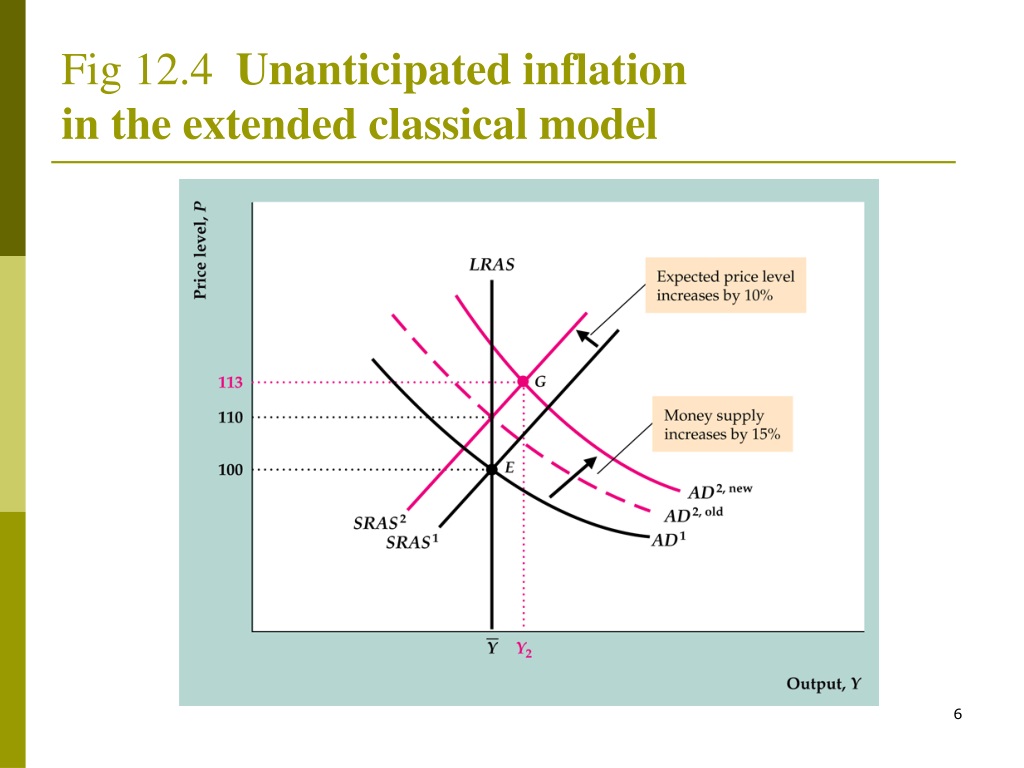

Government Response and Policy Implications

Governments and central banks respond to unanticipated inflation through various policy measures, primarily monetary policy adjustments. Raising interest rates is a common tool to curb inflation, but it can also slow economic growth.

Fiscal policies, such as reducing government spending or increasing taxes, can also be implemented to moderate demand. The effectiveness of these measures depends on the underlying causes of inflation and the credibility of the policymakers.

The Federal Reserve has signaled its commitment to controlling inflation, but the timing and magnitude of future rate hikes remain uncertain, adding to market anxiety.

Global Repercussions

Unanticipated inflation is not confined to individual countries; it has significant global repercussions. International trade and investment flows are disrupted by fluctuating exchange rates and increased uncertainty.

Countries heavily reliant on imports are particularly vulnerable to inflationary pressures. The World Bank has warned of increased poverty and food insecurity in developing nations due to rising global prices.

Coordinated international efforts are needed to address global inflationary challenges, but geopolitical tensions complicate cooperation.

Conclusion: Navigating the Uncertainty

The consequences of unanticipated inflation are far-reaching and multifaceted. Individuals, businesses, and governments must adapt to the changing economic landscape to mitigate the adverse effects.

Monitoring economic indicators, adjusting investment strategies, and implementing prudent fiscal policies are essential steps. The Federal Reserve's upcoming policy decisions will be closely watched for further guidance on managing inflation and supporting economic stability.

Continued vigilance and adaptability are crucial for navigating the ongoing economic uncertainty.

+or+unanticipated+(unexpected).jpg)

.jpg)

.jpg)