What Car Can I Get With A 650 Credit Score

Your car's on its last legs and you're staring down the barrel of needing a new one, but your credit score isn't exactly stellar? Don't panic yet. A 650 credit score, while not ideal, isn't a dead end when it comes to financing a car.

This article cuts through the noise and delivers the straight facts: What cars can you realistically get with a 650 credit score, what are your financing options, and what pitfalls should you avoid like the plague? Consider this your rapid response guide to getting back on the road.

Understanding Your Buying Power

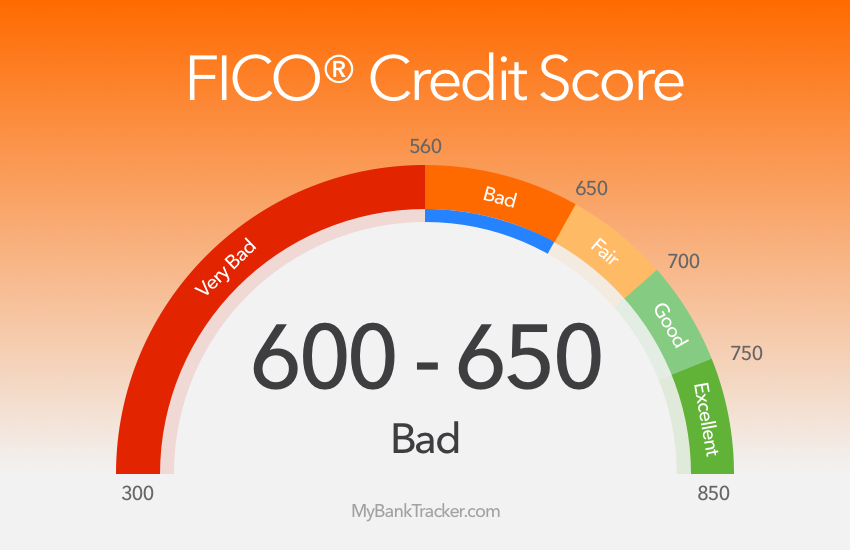

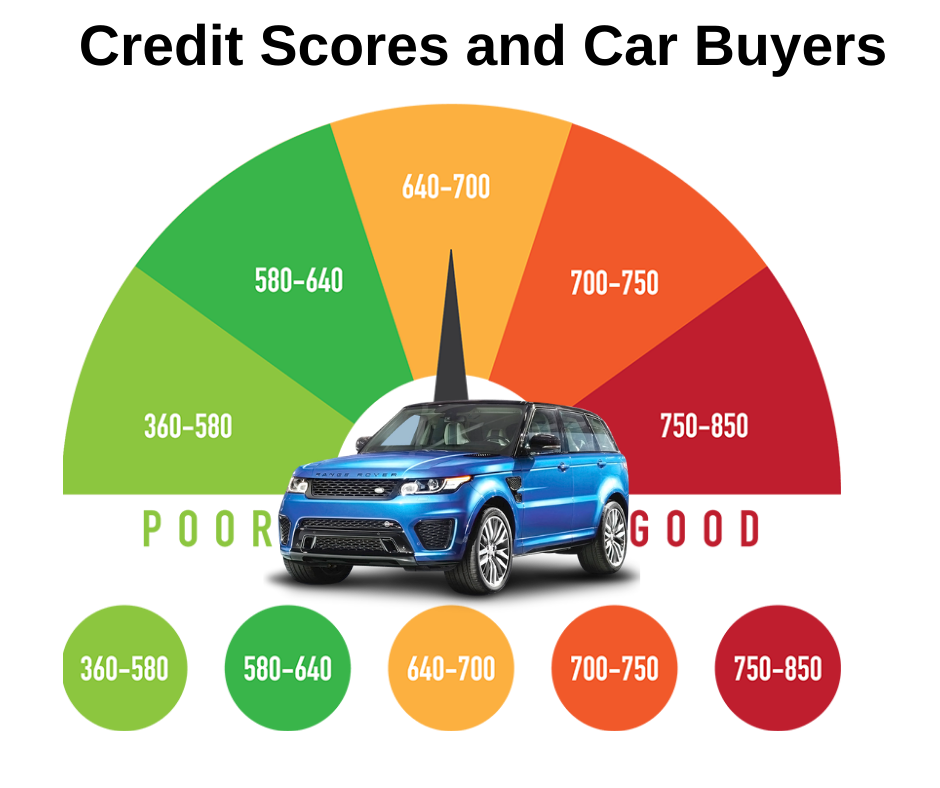

A 650 credit score typically falls into the "fair" or "good" range depending on the credit scoring model used (FICO or VantageScore). Expect interest rates to be higher than someone with an excellent credit score (750+).

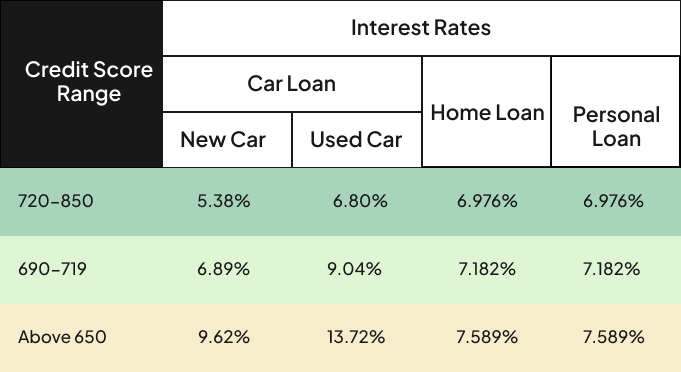

According to recent data from Experian, the average interest rate for someone with a credit score between 601-660 on a new car loan is around 10.27%. For a used car loan, it jumps to approximately 16.67%.

Important: These are averages. Your actual rate will vary based on the lender, the age and type of vehicle, your down payment, and the loan term.

Realistic Car Options

Forget about that brand-new luxury SUV. With a 650 credit score, your best bet is to focus on affordable new or reliable used vehicles. Aim for vehicles with good fuel economy and a proven track record for reliability.

New Cars Under $25,000 (MSRP):

Certain models from brands like Kia (Rio, Forte), Nissan (Versa, Sentra), and Hyundai (Accent, Elantra) often have MSRPs under $25,000.

Keep an eye out for manufacturer incentives and special financing offers, which can sometimes lower the overall cost. However, read the fine print carefully to ensure these offers apply to your credit situation.

Used Cars (3-5 Years Old):

A well-maintained used car offers better value for your money. Focus on models known for reliability such as Toyota (Corolla, Camry), Honda (Civic, Accord), and Mazda (3, 6).

Get a pre-purchase inspection by a trusted mechanic. This can save you thousands of dollars in potential repairs down the road. Do not skip this step!

Financing Options: Where to Look

You have several options for securing financing. Each has its own pros and cons, so do your homework. Don't settle for the first offer you receive.

Credit Unions:

Credit unions often offer better interest rates and more flexible terms than traditional banks, particularly for members with less-than-perfect credit. Membership requirements may apply.

Banks:

Explore financing options from your existing bank. Established relationships can sometimes lead to more favorable terms.

Online Lenders:

Online lenders offer a convenient way to compare rates from multiple lenders without impacting your credit score (until you formally apply). Research reputable online lenders carefully.

Dealership Financing:

Dealerships offer in-house financing, but be cautious. They may mark up interest rates to increase their profit margin. Compare their offer to those you've received from other lenders.

Avoiding the Traps

A 650 credit score makes you vulnerable to predatory lending practices. Stay alert and avoid these common pitfalls:

- High Interest Rates: Don't accept an excessively high interest rate simply because you feel you have no other choice. Shop around aggressively.

- Long Loan Terms: Longer loan terms (e.g., 72 or 84 months) lower your monthly payment but increase the total amount of interest you pay over the life of the loan. Aim for a shorter term (48 or 60 months) if possible.

- Hidden Fees: Scrutinize the loan agreement for hidden fees, such as prepayment penalties or origination fees. Demand full transparency.

- Upselling: Resist pressure to purchase unnecessary add-ons, such as extended warranties or paint protection.

Key Strategies for Success

Here's how to maximize your chances of securing a favorable loan:

Save for a Down Payment: A larger down payment reduces the amount you need to borrow and lowers your monthly payment. It also demonstrates to lenders that you are a responsible borrower.

Improve Your Credit Score (If Possible): Even a small improvement in your credit score can make a difference in your interest rate. Pay down existing debt and correct any errors on your credit report. Check your credit report at AnnualCreditReport.com. Free credit reports are provided weekly until the end of 2026.

Get Pre-Approved: Getting pre-approved for a car loan gives you a better understanding of your budget and strengthens your negotiating position at the dealership. Know what you can afford before you go!

What's Next?

Start by checking your credit report and exploring financing options with credit unions and online lenders. Get pre-approved for a loan and set a realistic budget. Don't rush into a purchase; take your time to find the right car at the right price.

The car market is constantly evolving. Keep an eye on interest rate trends and manufacturer incentives. With careful planning and diligent research, you *can* get back on the road with a 650 credit score.

.png)