What Credit Card Can You Get With A 530 Score

For individuals with a credit score of 530, securing a credit card might seem like an uphill battle. Many traditional credit card issuers typically require a score in the "good" to "excellent" range, leaving those with lower scores searching for alternatives. Understanding the options available and their implications is crucial for anyone looking to rebuild their credit.

This article explores the types of credit cards accessible to individuals with a 530 credit score, delving into the details of each option and highlighting the potential benefits and drawbacks. Knowing your options is the first step to improving your financial future.

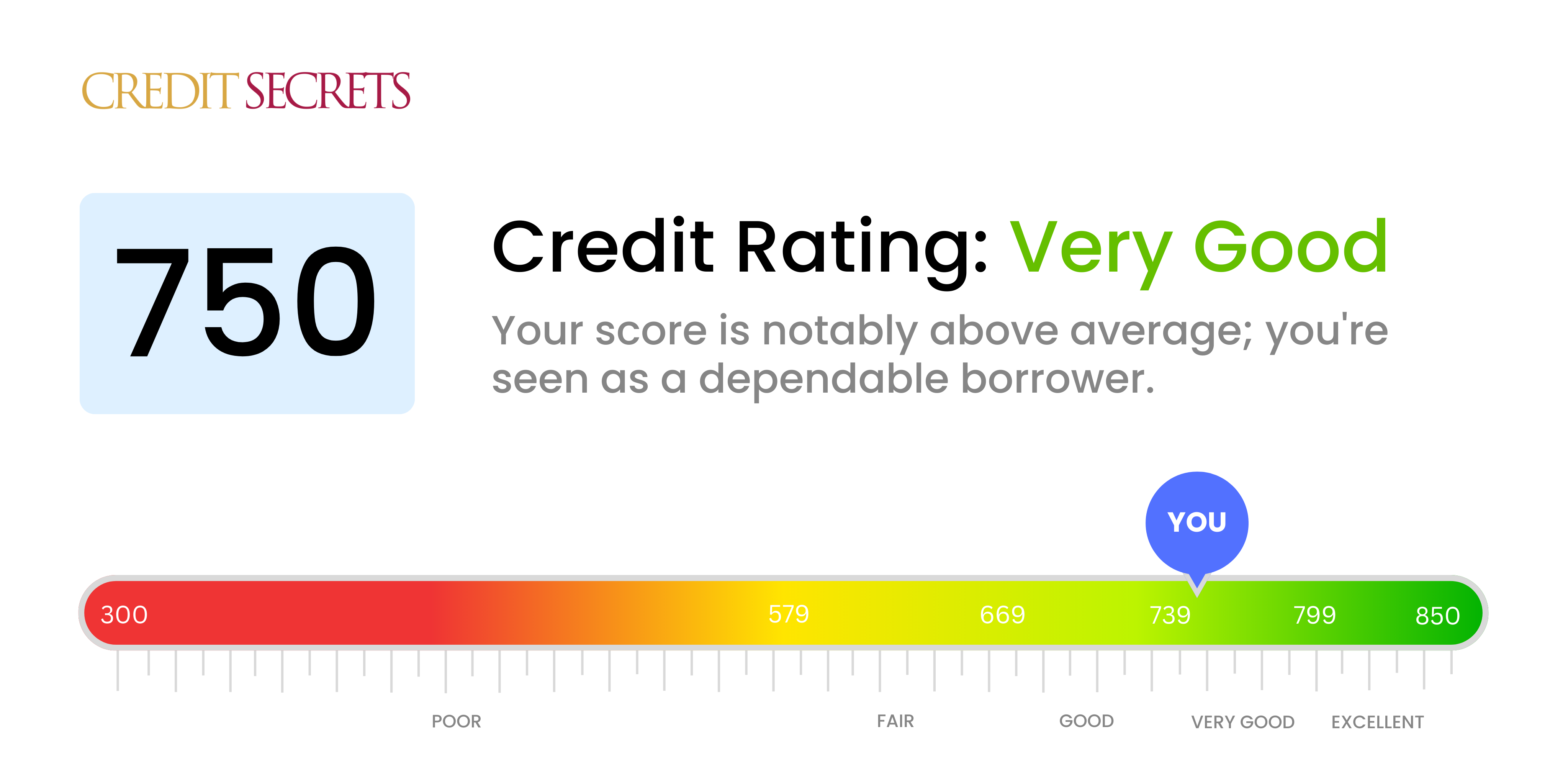

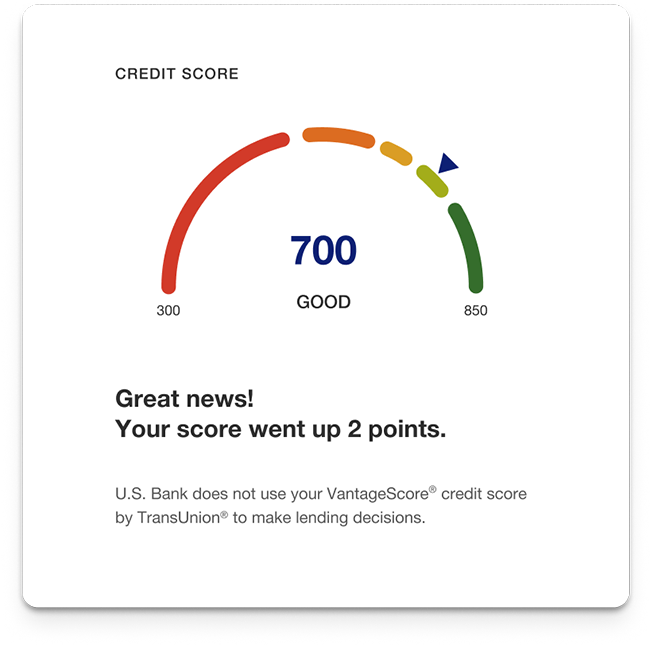

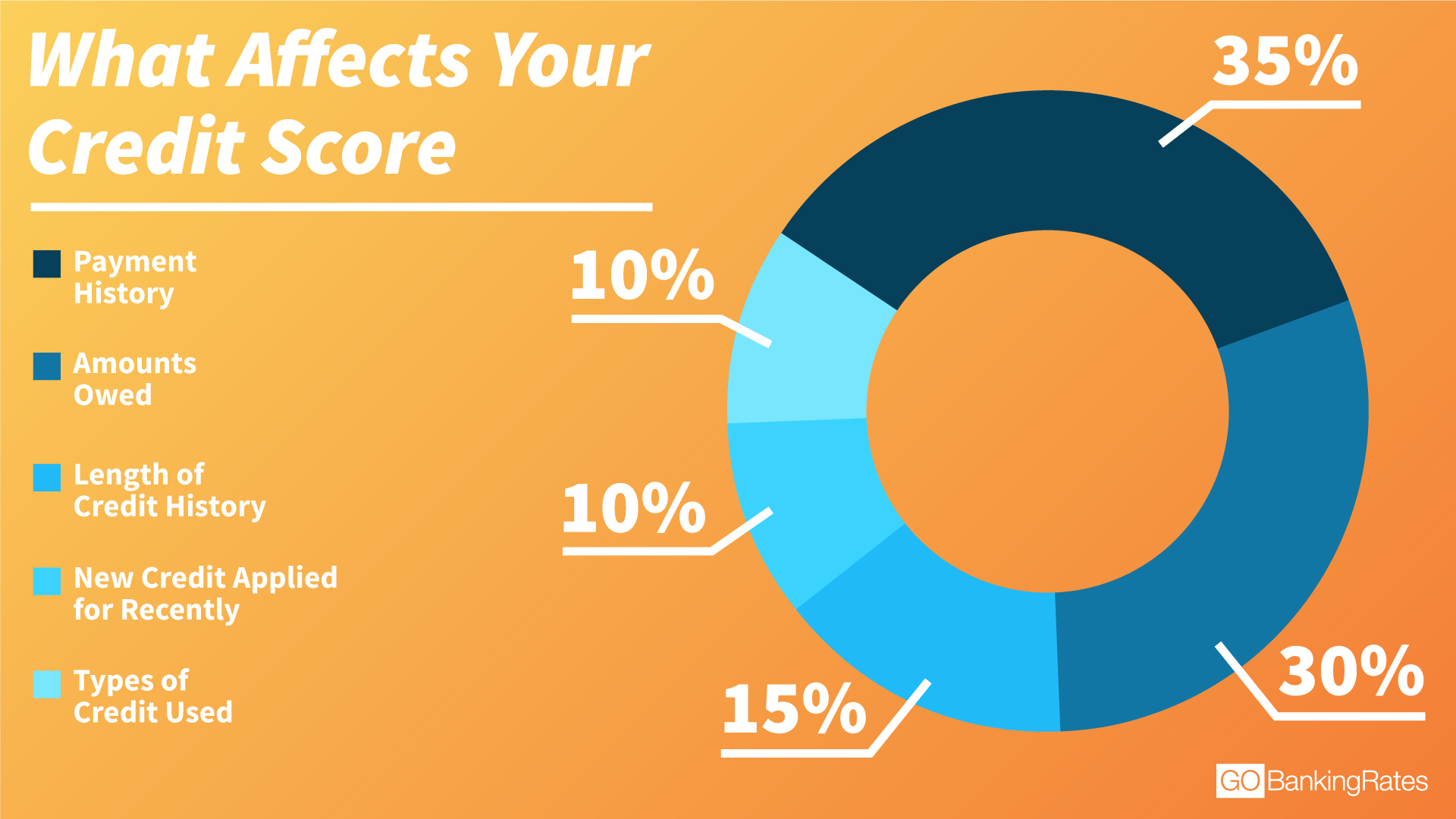

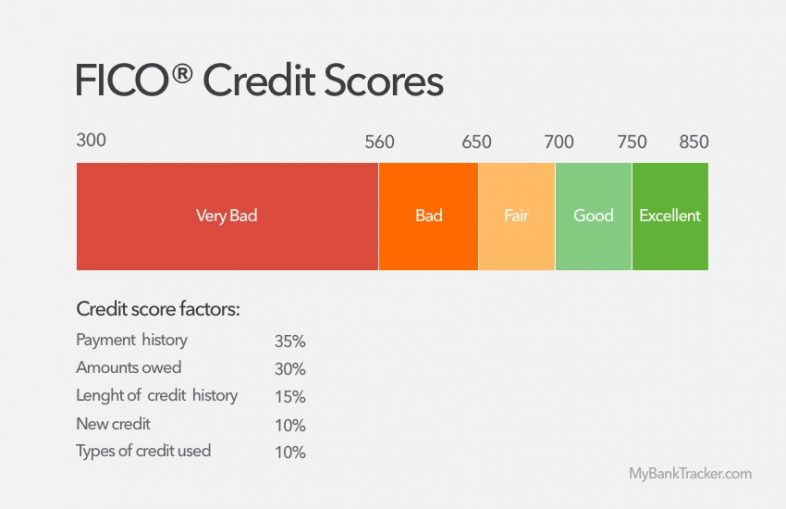

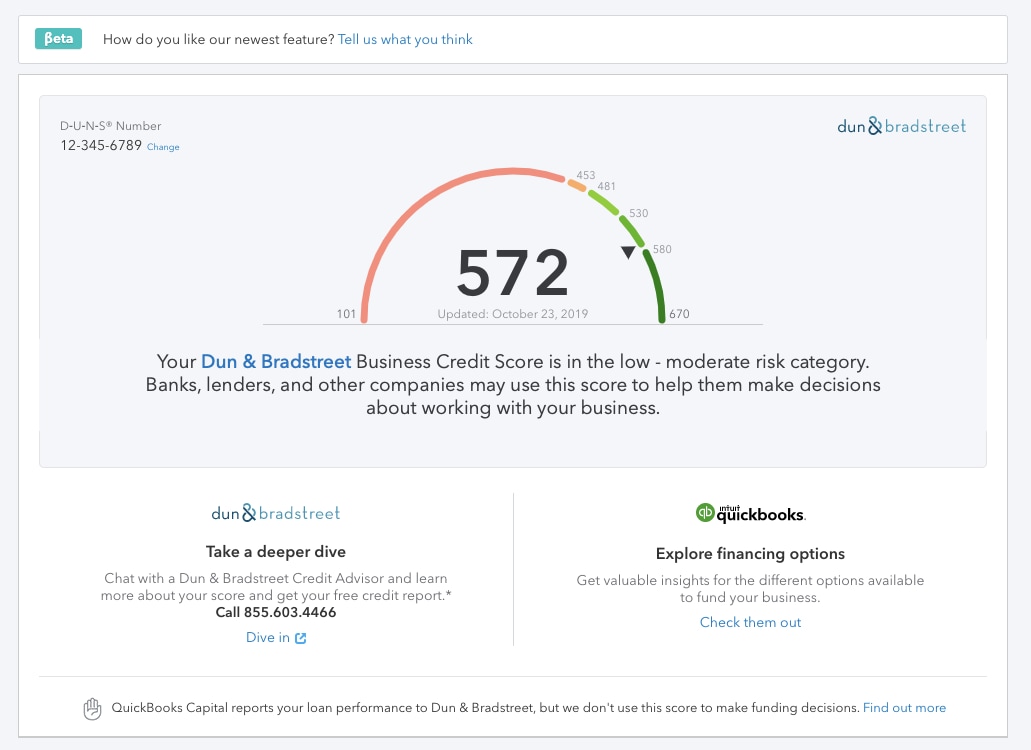

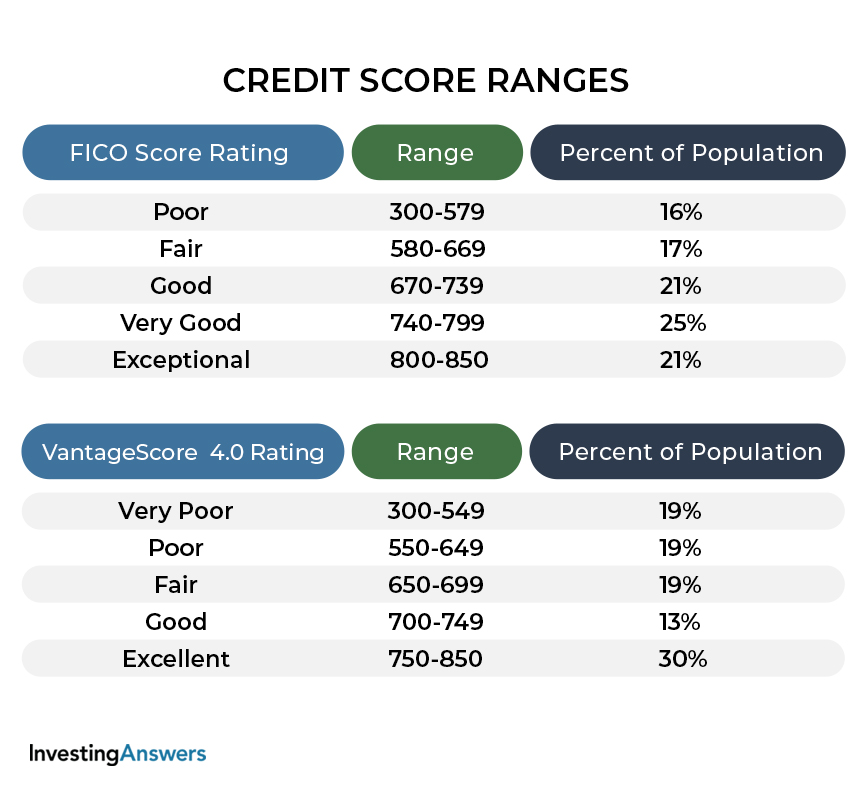

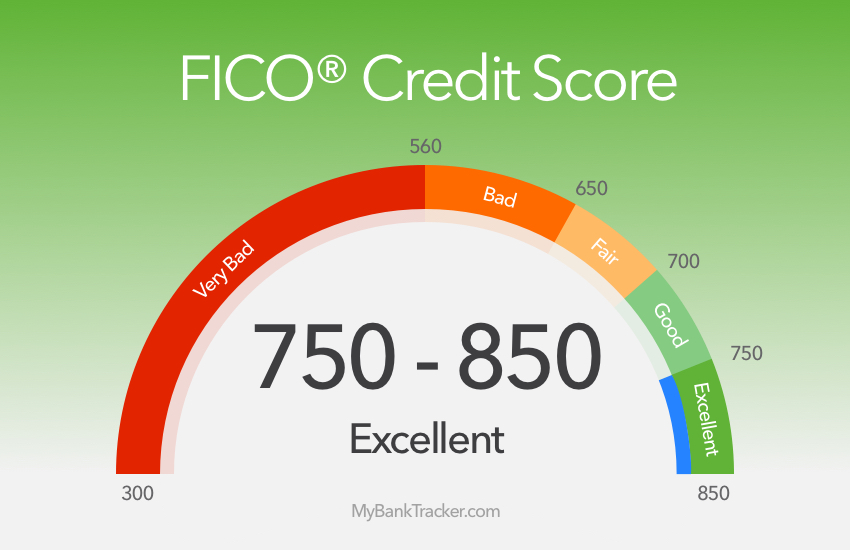

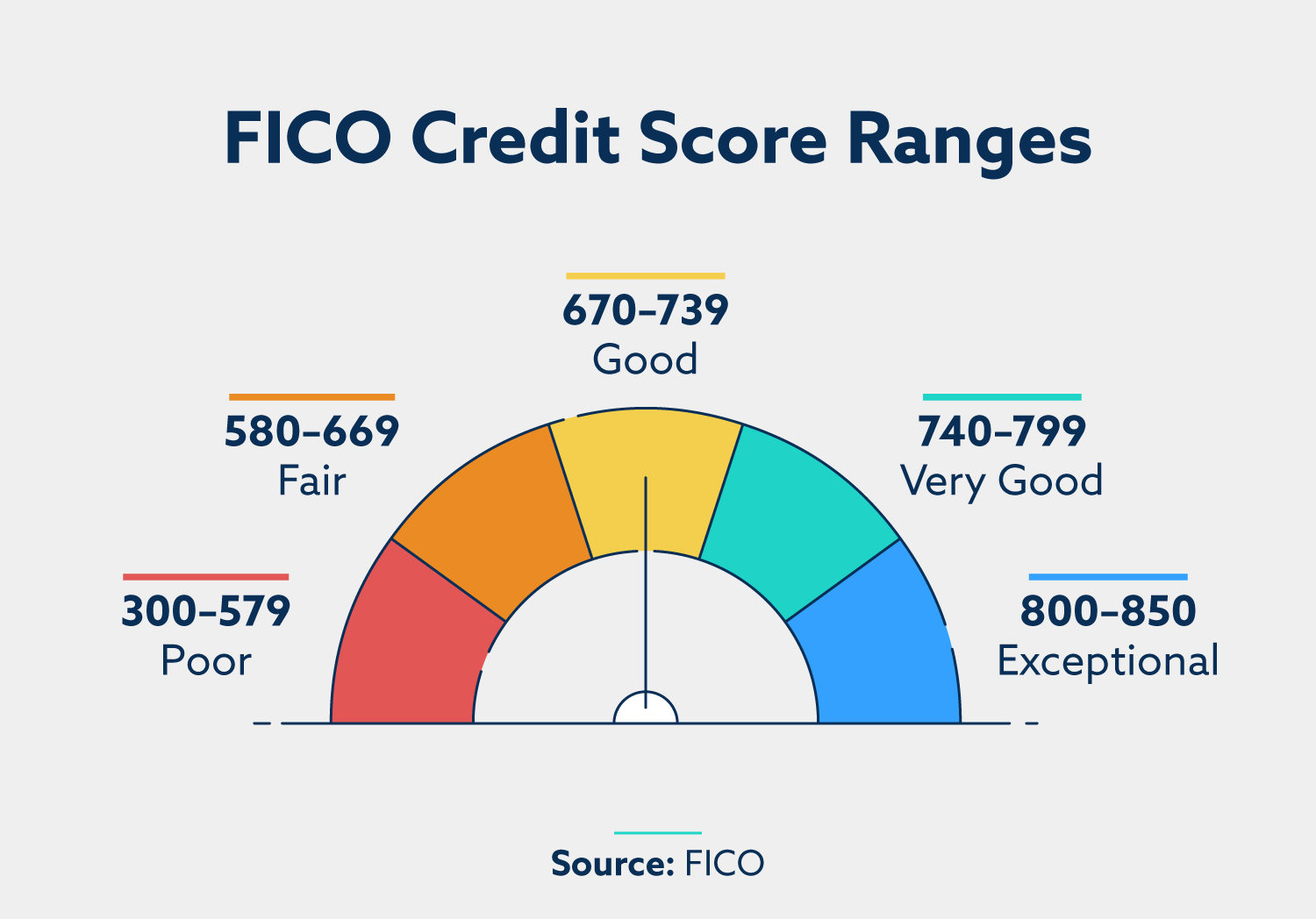

Understanding Credit Score Ranges

Before delving into specific credit card options, it's important to understand what a 530 credit score signifies. Credit scores, often based on the FICO model, typically range from 300 to 850. A score of 530 generally falls within the "poor" or "bad" credit range.

This indicates a higher risk to lenders, as individuals in this range have historically demonstrated a greater likelihood of defaulting on payments. As such, access to credit products is often limited, and the terms are typically less favorable.

Secured Credit Cards: A Common Option

One of the most common and accessible credit card options for individuals with a 530 credit score is a secured credit card. These cards require a security deposit, which typically serves as the credit limit. The deposit acts as collateral for the lender.

If the cardholder fails to make payments, the lender can use the deposit to cover the outstanding balance. Secured cards function similarly to unsecured credit cards, allowing users to make purchases and build credit history through responsible use.

Major issuers like Capital One and Discover offer secured credit cards designed for individuals with less-than-perfect credit. The security deposit requirements usually range from $200 to $500, although some cards may offer higher credit limits based on the deposit amount. Regular, on-time payments are essential for improving one's credit score.

Unsecured Credit Cards for Bad Credit

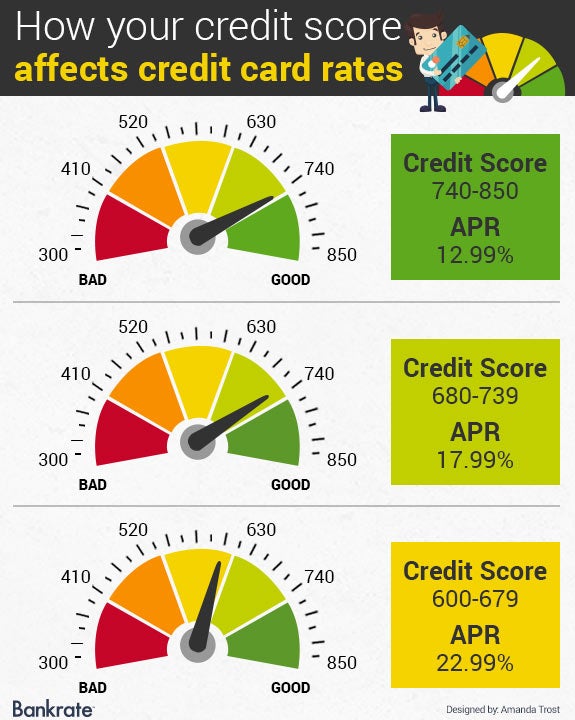

While less common, some unsecured credit cards are specifically designed for individuals with poor credit. These cards typically come with higher interest rates and fees compared to secured cards or cards for those with good credit.

They are often offered by smaller financial institutions or specialized credit card companies. These cards may be a good option for those who cannot afford a security deposit, but careful consideration of the terms and conditions is crucial.

Examples include cards from issuers like Credit One Bank or Avant. However, be cautious of excessive fees and predatory lending practices associated with some subprime credit cards.

Retail or Store Credit Cards

Another option to consider is retail or store credit cards. These cards are often easier to obtain than general-purpose credit cards because they can only be used at specific retail locations.

While they might not be ideal for building a versatile credit history, they can be a stepping stone for establishing credit. Responsible use of a retail credit card can demonstrate creditworthiness to other lenders.

Stores like Amazon, Target, and Macy's may offer store credit cards with more lenient approval criteria.

Impact and Significance

The availability of credit cards for individuals with a 530 credit score is significant for several reasons. It provides an opportunity to build or rebuild credit, which is crucial for accessing loans, renting an apartment, and even securing certain jobs.

By making timely payments and managing credit responsibly, individuals can gradually improve their credit score over time. However, it's equally important to be aware of the potential risks, such as high interest rates and fees, and to use credit cards wisely.

Ultimately, obtaining a credit card with a 530 score is just the first step. Responsible financial behavior and diligent credit management are essential for long-term financial health.

![What Credit Card Can You Get With A 530 Score What Is the Highest Credit Score Possible? [+ How To Score 850!]](https://upgradedpoints.com/wp-content/uploads/2021/09/Credit-Score-Ranges-635x500.png)