What Credit Score Is Needed For Discover

Imagine you're browsing online, a sleek Discover card catches your eye with its promises of rewards and cashback. You envision yourself using it for everyday purchases, building credit, and enjoying the perks. But a question lingers: "Do I even qualify?" The world of credit scores can feel like a maze, especially when trying to decipher what different lenders require.

The credit score needed for a Discover card typically falls within the good to excellent range, generally a FICO score of 670 or higher. This requirement varies depending on the specific card and individual financial profile.

Understanding Discover's Credit Score Landscape

Discover, known for its customer-friendly approach and introductory offers, provides a range of credit card options. These options cater to different credit profiles.

From secured cards designed for those with limited or no credit history to travel cards targeting seasoned spenders with stellar credit, Discover aims to be inclusive.

The Significance of Credit Scores

A credit score is a three-digit number that represents your creditworthiness.

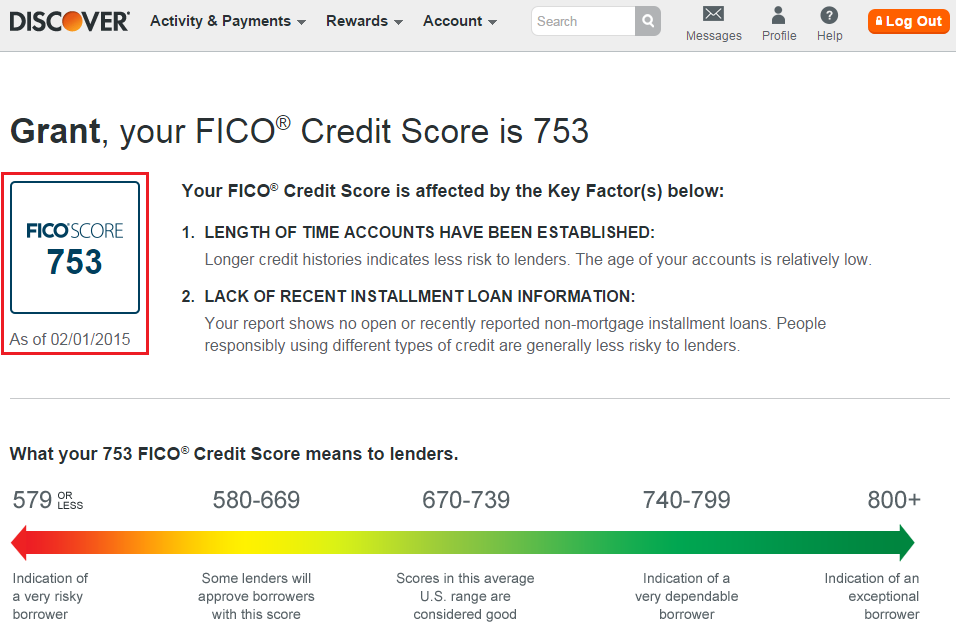

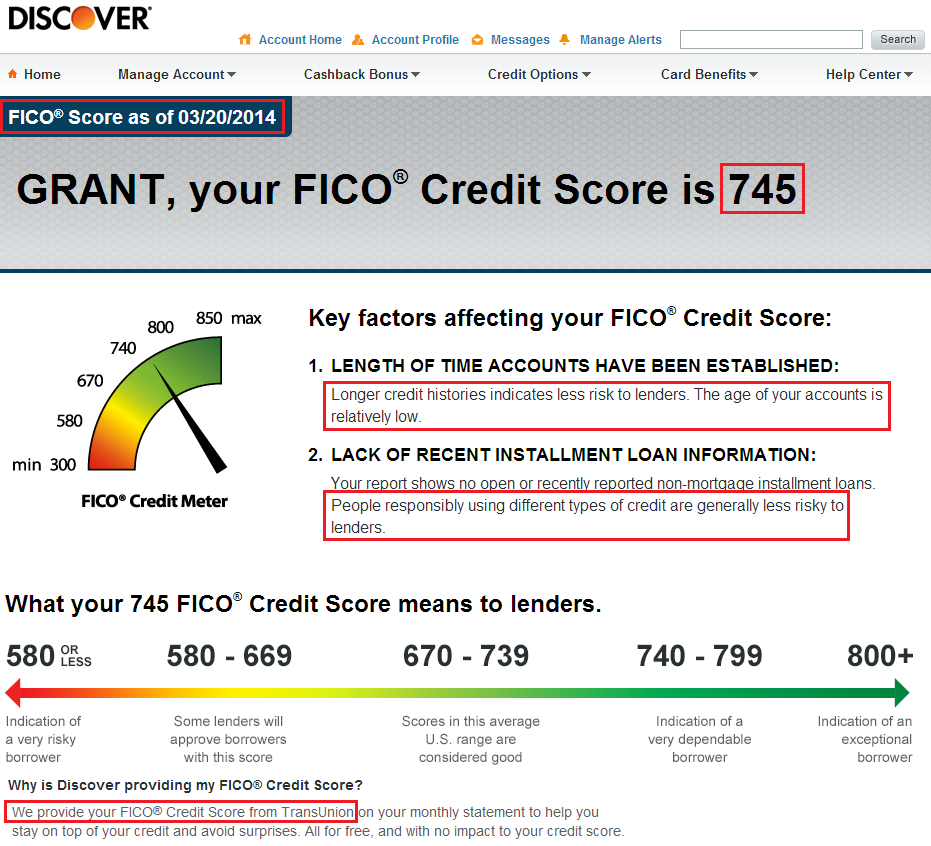

Lenders use this score, along with other factors, to assess the risk of lending you money. Higher scores indicate a lower risk, making you more likely to be approved for credit cards, loans, and other financial products.

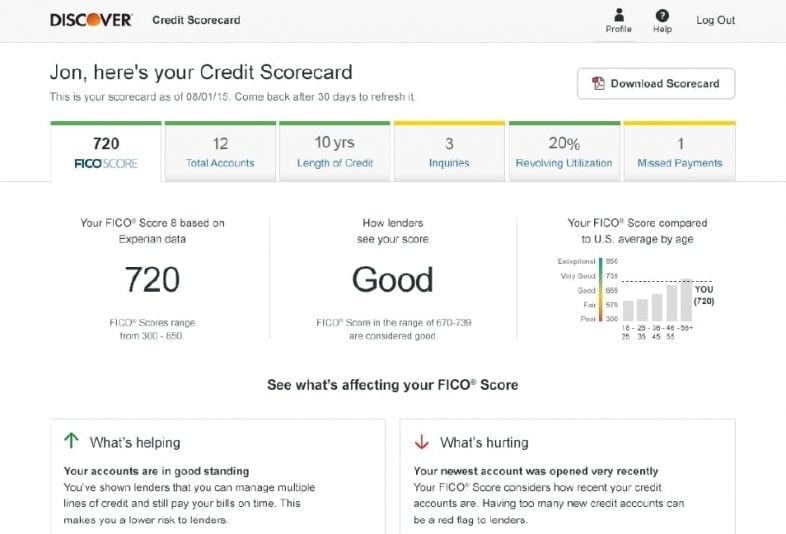

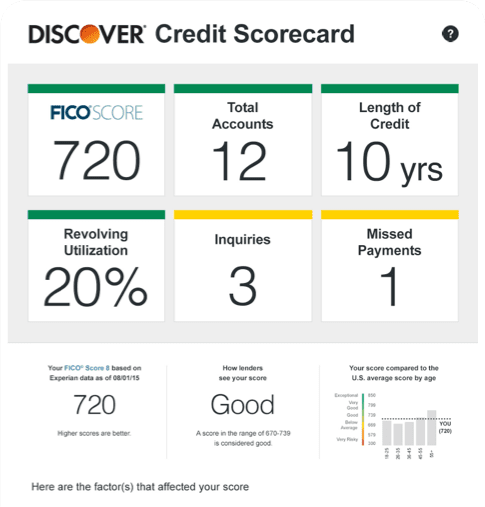

According to Experian, one of the major credit bureaus, a good credit score ranges from 670 to 739.

Discover's Card Portfolio: A Spectrum of Options

Discover offers several cards, including the Discover it® Secured Credit Card, designed for individuals with limited or no credit history.

Secured cards typically require a security deposit that acts as your credit limit. Responsible use can help build or rebuild credit.

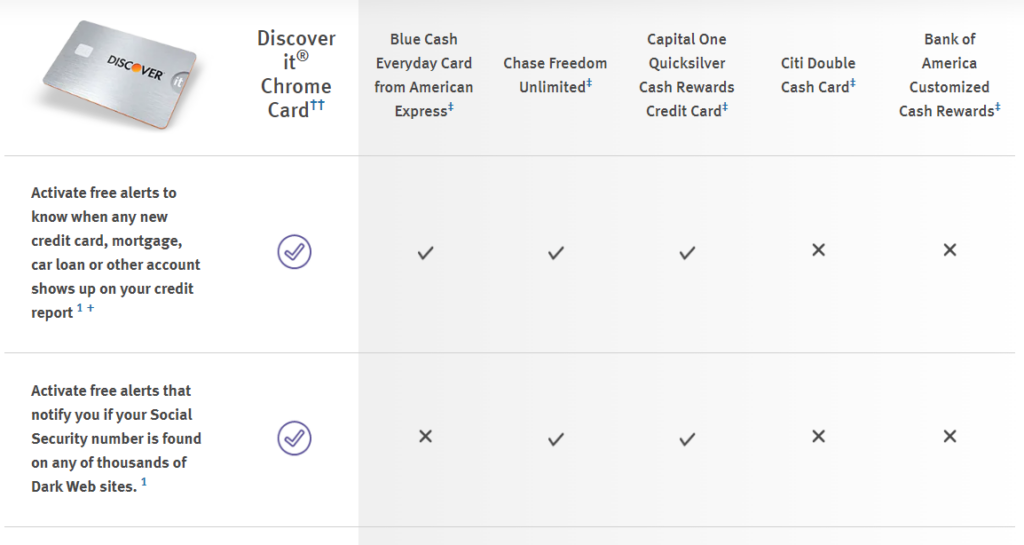

The Discover it® Cash Back and Discover it® Chrome cards, are usually targeted at individuals with good to excellent credit.

Factors Beyond the Score

While a good credit score is crucial, Discover also considers other factors when evaluating applications.

These include your income, employment history, debt-to-income ratio, and overall credit history.

A stable income and low debt can compensate for a slightly lower credit score in some cases.

Tips for Improving Your Credit Score

If your credit score isn't quite where it needs to be, don't despair.

There are several steps you can take to improve it, such as paying your bills on time, keeping your credit utilization low, and avoiding opening too many accounts at once.

Regularly checking your credit report for errors and disputing any inaccuracies can also make a difference.

A Word From Discover

"At Discover, we're committed to providing accessible credit options and empowering individuals to achieve their financial goals,"states a representative from Discover.

"We encourage applicants to review their credit reports and understand the factors that influence their creditworthiness."

Conclusion

While aiming for a credit score of 670 or higher is a good starting point, remember that Discover considers the whole picture. Building a strong credit profile involves responsible financial habits and a commitment to improving your financial health. With the right approach, that Discover card – and all the benefits it offers – can be within your reach.