What Do I Need To Open A Bank Account Citibank

Opening a bank account is a crucial step in managing personal finances, providing a safe and convenient place to store and access funds. For those considering Citibank, understanding the specific requirements and processes involved is essential. This article outlines the necessary documentation, eligibility criteria, and steps required to open a bank account with Citibank.

The process of opening a Citibank account is relatively straightforward, though it's important to gather the necessary documents beforehand. These requirements ensure compliance with federal regulations and help prevent identity theft and money laundering.

Key Requirements for Opening a Citibank Account

Identification is a cornerstone of the account opening process. You'll generally need two forms of identification, one primary and one secondary.

A primary ID can be a driver's license, a state-issued ID card, a passport, or a permanent resident card (Green Card). The primary ID must be current and valid.

Acceptable secondary IDs may include a credit card, a social security card, a birth certificate, or a recent utility bill in your name showing your current address. Citibank might have specific preferences, so it's best to confirm with them directly.

Proof of Address

Beyond identification, proof of address is crucial. Citibank needs to verify your physical address to comply with Know Your Customer (KYC) regulations and ensure they can contact you regarding your account.

Acceptable documents typically include a recent utility bill (water, gas, electricity), a lease agreement, or a bank statement from another financial institution. These documents should be dated within the last few months.

Minimum Deposit

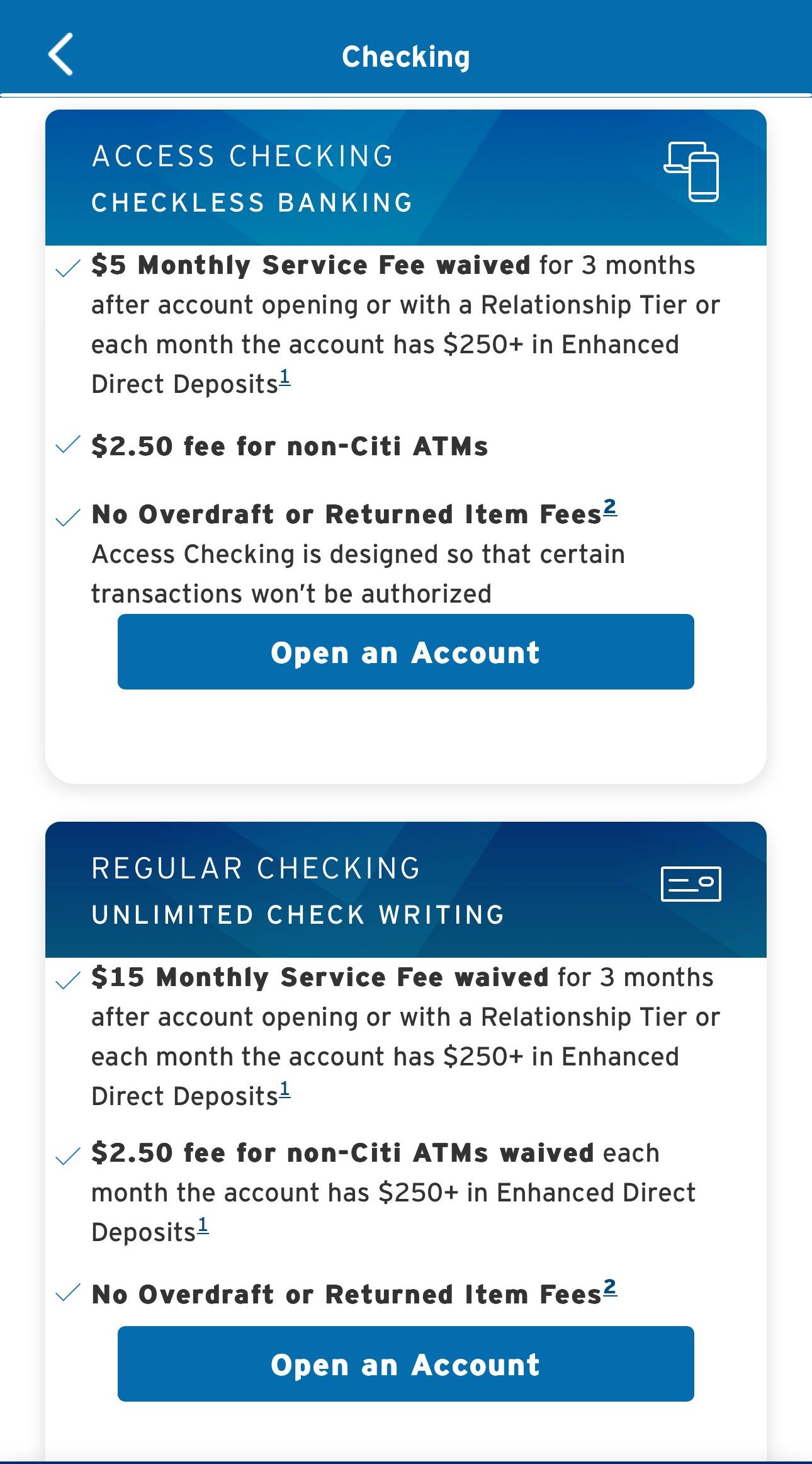

Many Citibank accounts require an initial minimum deposit to activate the account. The amount varies depending on the specific account type.

Some basic checking accounts might have a low or even zero minimum deposit requirement, while premium accounts often require a more substantial initial deposit. Checking Citibank's current account offerings is crucial to ensure one meets the financial thresholds.

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

A Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is typically required for tax reporting purposes. This information allows Citibank to report any interest earned on your account to the IRS.

For non-US citizens or residents, an ITIN may be necessary. You may need to present your visa or other relevant immigration documents.

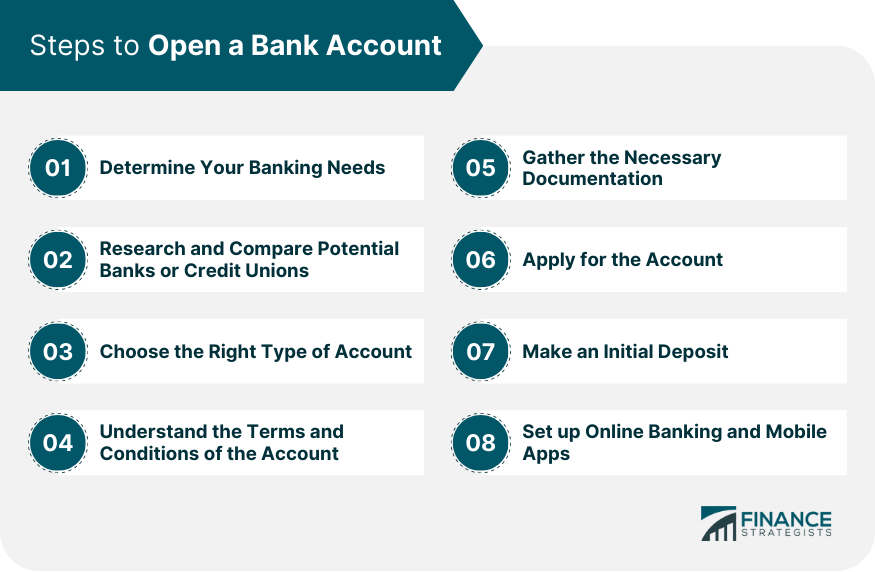

The Account Opening Process

You can open a Citibank account either online or in person at a local branch. The online process usually involves completing an application form and uploading scanned copies of the required documents.

Opening an account in person allows you to speak directly with a Citibank representative who can answer your questions and guide you through the process. Before visiting a branch, check their website for hours of operation.

Regardless of the method you choose, be prepared to provide accurate and complete information. Providing false or misleading information could lead to delays or even denial of your application.

Potential Impact and Considerations

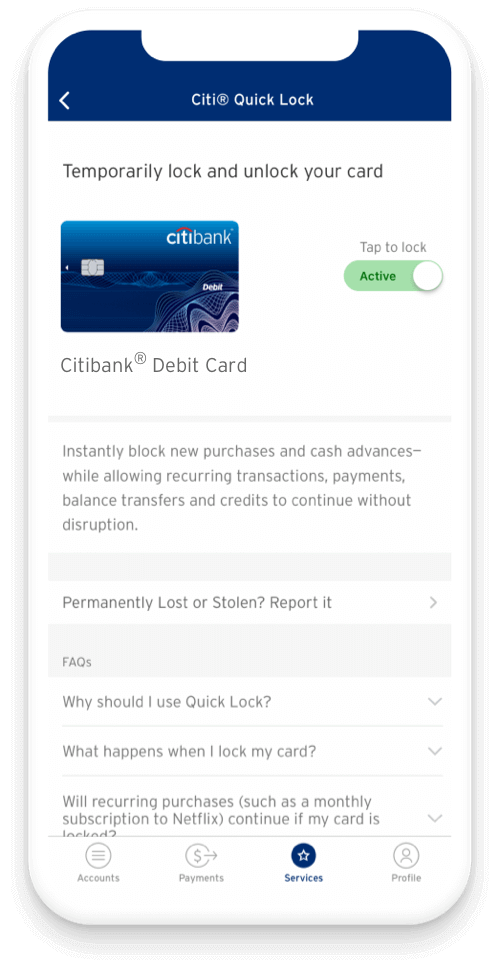

Opening a Citibank account offers numerous benefits, including access to a wide range of financial products and services, online and mobile banking, and a network of ATMs. Citibank also offers various perks and rewards programs.

It's essential to compare Citibank's account offerings with those of other banks to determine which one best suits your financial needs and goals. Consider factors such as fees, interest rates, and account features before making a decision.

Ultimately, opening a bank account with Citibank is a significant step towards financial stability and security. By understanding the requirements and taking the necessary steps, individuals can easily access the benefits offered by this large financial institution.

Before you proceed, it's always a good idea to visit Citibank's official website or contact a representative directly to confirm the most up-to-date requirements and account options.