What Do I Need To Open An Account With Citibank

Opening a new bank account is a significant financial decision, and understanding the requirements is crucial for a smooth process. Citibank, a multinational financial services corporation, offers a variety of account options to cater to diverse needs.

This article outlines the necessary documentation and criteria to open an account with Citibank. Knowing these requirements beforehand can save time and prevent potential complications. It also empowers individuals to make informed choices regarding their banking needs.

General Requirements for Opening a Citibank Account

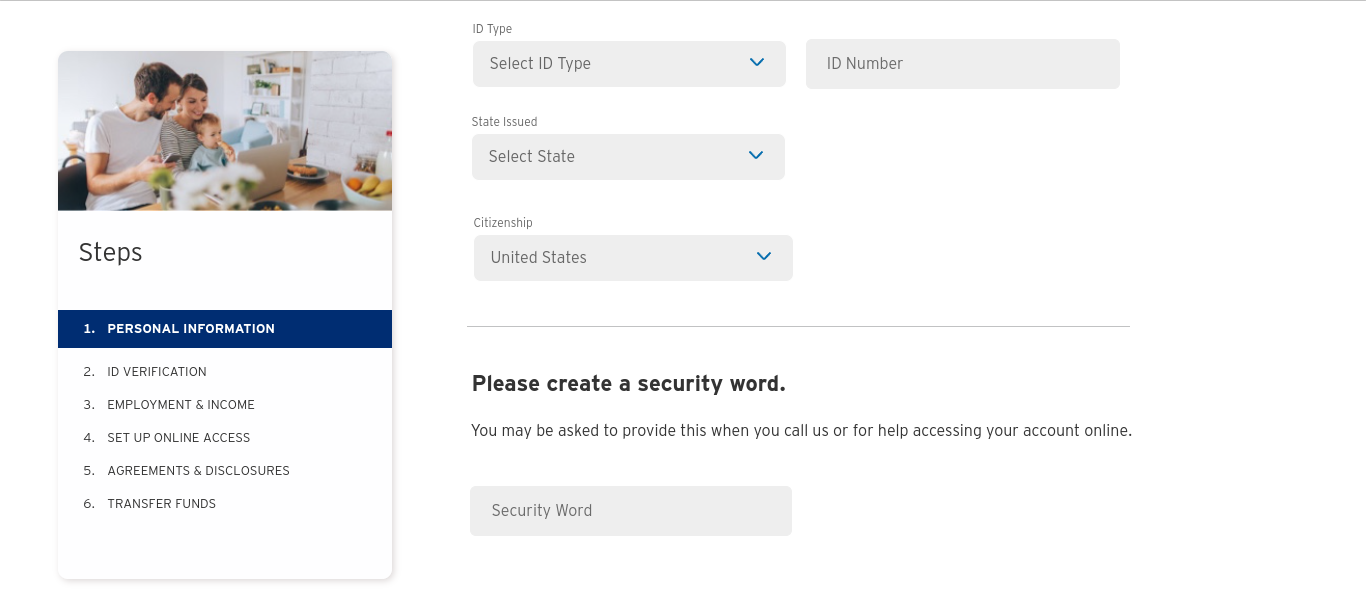

Regardless of the specific account type, Citibank generally requires certain standard documentation and information from all applicants. These typically include proof of identity, proof of address, and basic personal information.

Proof of Identity

A government-issued photo ID is essential. Acceptable forms of identification usually include a driver's license, a passport, or a state-issued identification card. This document verifies the applicant's identity and helps prevent fraud.

Proof of Address

Citibank also requires documentation to verify the applicant's current residential address. Acceptable documents may include a recent utility bill (such as a gas, electric, or water bill), a bank statement from another financial institution, or a lease agreement.

Personal Information

Applicants will need to provide their Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN). This information is necessary for tax reporting purposes.

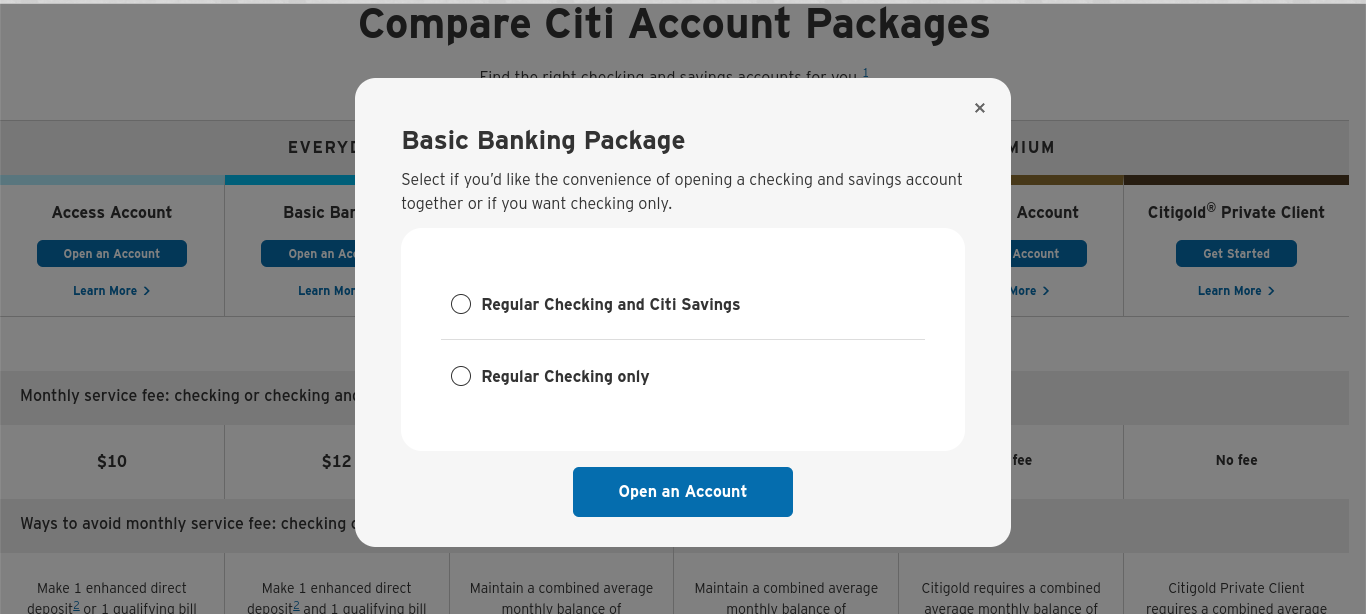

Specific Requirements Based on Account Type

While the general requirements remain consistent, specific account types may have additional prerequisites. These could include minimum deposit amounts or specific eligibility criteria.

For example, some premium accounts may require a higher minimum balance to avoid monthly fees. Students or young adults might have access to specialized accounts with tailored features and requirements.

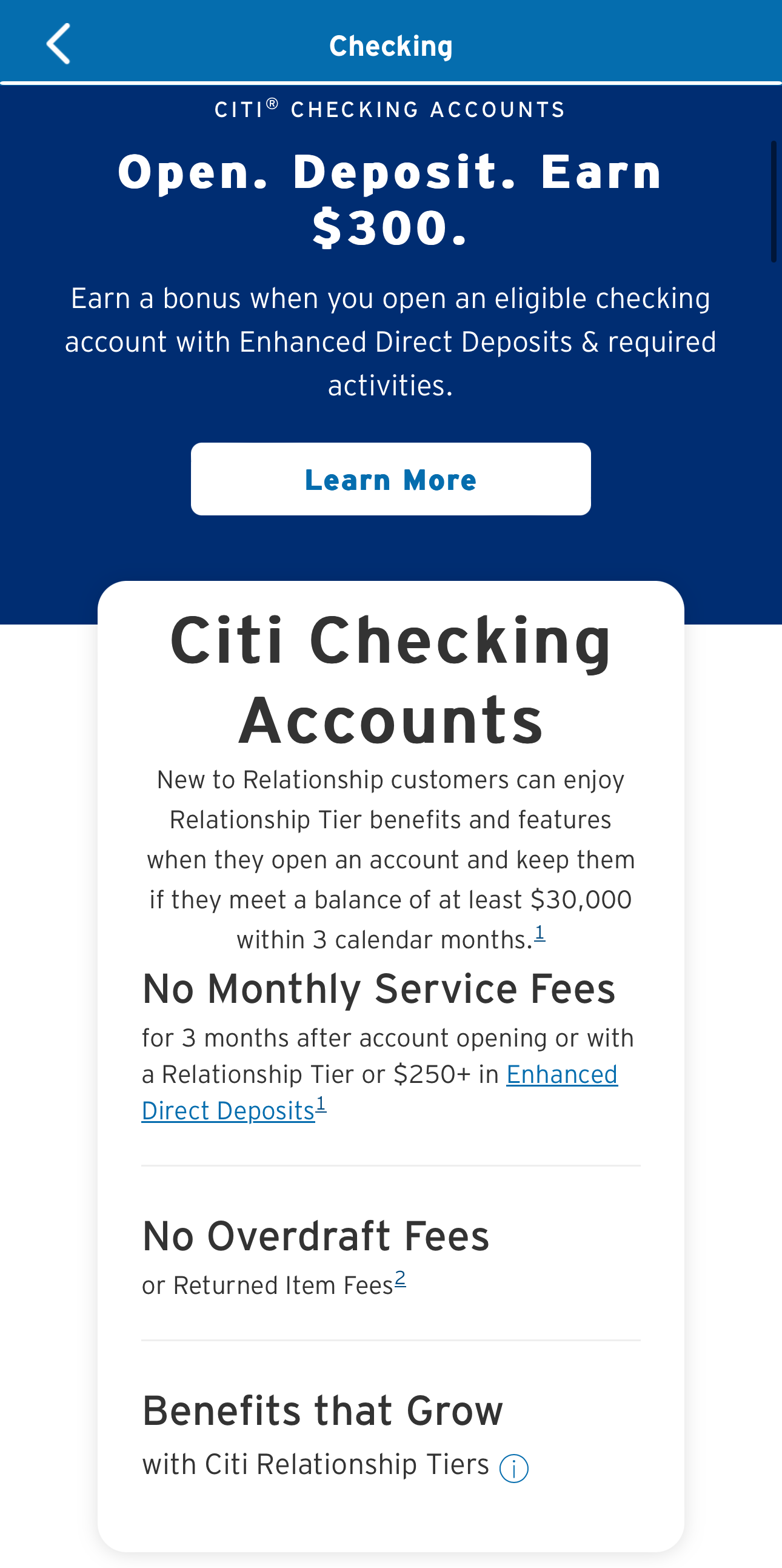

Opening an Account Online

Citibank, like many modern banks, offers the option to open an account online. The online application process usually mirrors the in-person process, requiring scanned copies or digital uploads of the necessary documents.

However, certain restrictions might apply to online account openings. Applicants may be required to visit a branch in person for verification purposes, especially for certain account types or in cases where additional documentation is needed.

Opening an Account for a Business

Opening a business account with Citibank necessitates providing additional documentation related to the business entity. This typically includes the business's Employer Identification Number (EIN), articles of incorporation, and operating agreement.

Furthermore, Citibank may require information about the business's owners and authorized signatories. They will need to provide their personal information and identification as well.

Tips for a Smooth Account Opening Process

Before visiting a Citibank branch or starting the online application, gather all required documents. Double-checking the documents ensures that the information is accurate and up-to-date.

Contact Citibank's customer service or visit their website for a comprehensive list of acceptable documents. This ensures that all the necessary information is at hand.

Understanding the specific requirements for the desired account type is essential. This helps avoid unnecessary delays or complications during the application process.

Conclusion

Opening an account with Citibank involves fulfilling specific documentation and information requirements. Being prepared with the necessary paperwork and understanding the specific account requirements can streamline the process. This will enable individuals to efficiently access Citibank's financial services.