What Documents We Need To Open A Bank Account

Imagine stepping into a bank, sunlight streaming through the large windows, the scent of polished wood and hushed conversations filling the air. You're ready to take a leap towards financial security, eager to open your very first bank account. But before you can start envisioning a future of savings and smart investments, there's a little hurdle to clear: gathering the right documents.

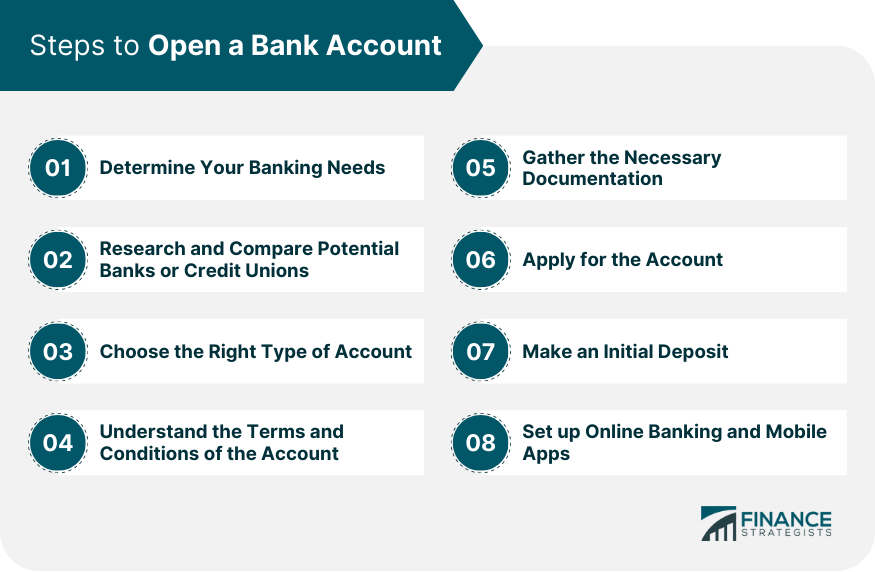

Opening a bank account might seem daunting at first, but it's a straightforward process once you understand the required paperwork. This article will guide you through the essential documents you’ll need, ensuring a smooth and successful start to your banking journey.

Why Banks Need Documentation

Banks request specific documents to comply with regulations like the USA PATRIOT Act, designed to prevent money laundering and other financial crimes. This is part of their commitment to maintaining a safe and secure financial environment for everyone.

These regulations help banks verify your identity and confirm your address, which protects both you and the bank from fraud. It’s all about building trust and maintaining the integrity of the financial system.

Essential Identification Documents

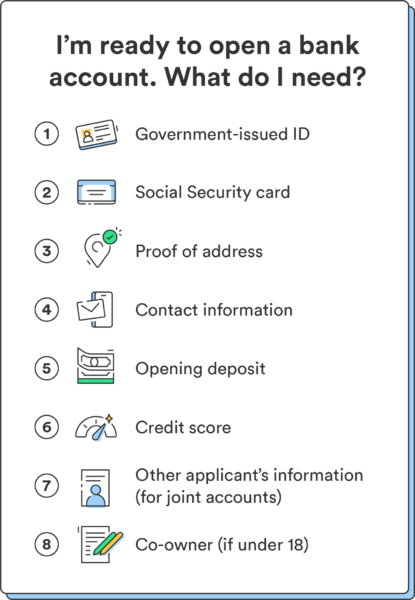

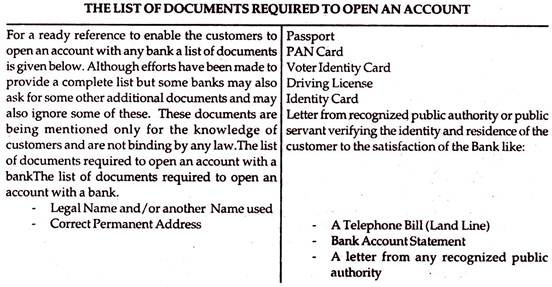

The most crucial document you’ll need is a valid photo identification. This typically includes a driver's license, a state-issued ID card, or a passport.

According to the Consumer Financial Protection Bureau (CFPB), banks generally require government-issued photo IDs to confirm your identity. These documents must be current and unexpired.

For non-US citizens, a permanent resident card (Green Card) or a valid visa is usually required. Banks need to verify your legal status and right to reside in the United States.

Proof of Address

In addition to verifying your identity, banks need to confirm your current address. This is usually done with documents like a utility bill (water, electricity, or gas), a lease agreement, or a recent bank statement from another financial institution.

The document must display your name and the address you’re using to open the account. A piece of mail from a government agency, such as the IRS or your local DMV, is also usually accepted.

If you've recently moved and haven't updated your address on your ID, these address verification documents become even more critical.

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Banks require your Social Security Number (SSN) or, if you're a non-resident alien, your Individual Taxpayer Identification Number (ITIN), for tax reporting purposes. This is mandatory for U.S. residents and those required to pay U.S. taxes.

The IRS requires banks to report any interest earned on your account, which necessitates the collection of your SSN or ITIN.

Be prepared to provide this information accurately during the application process.

Additional Documents (Depending on the Account Type)

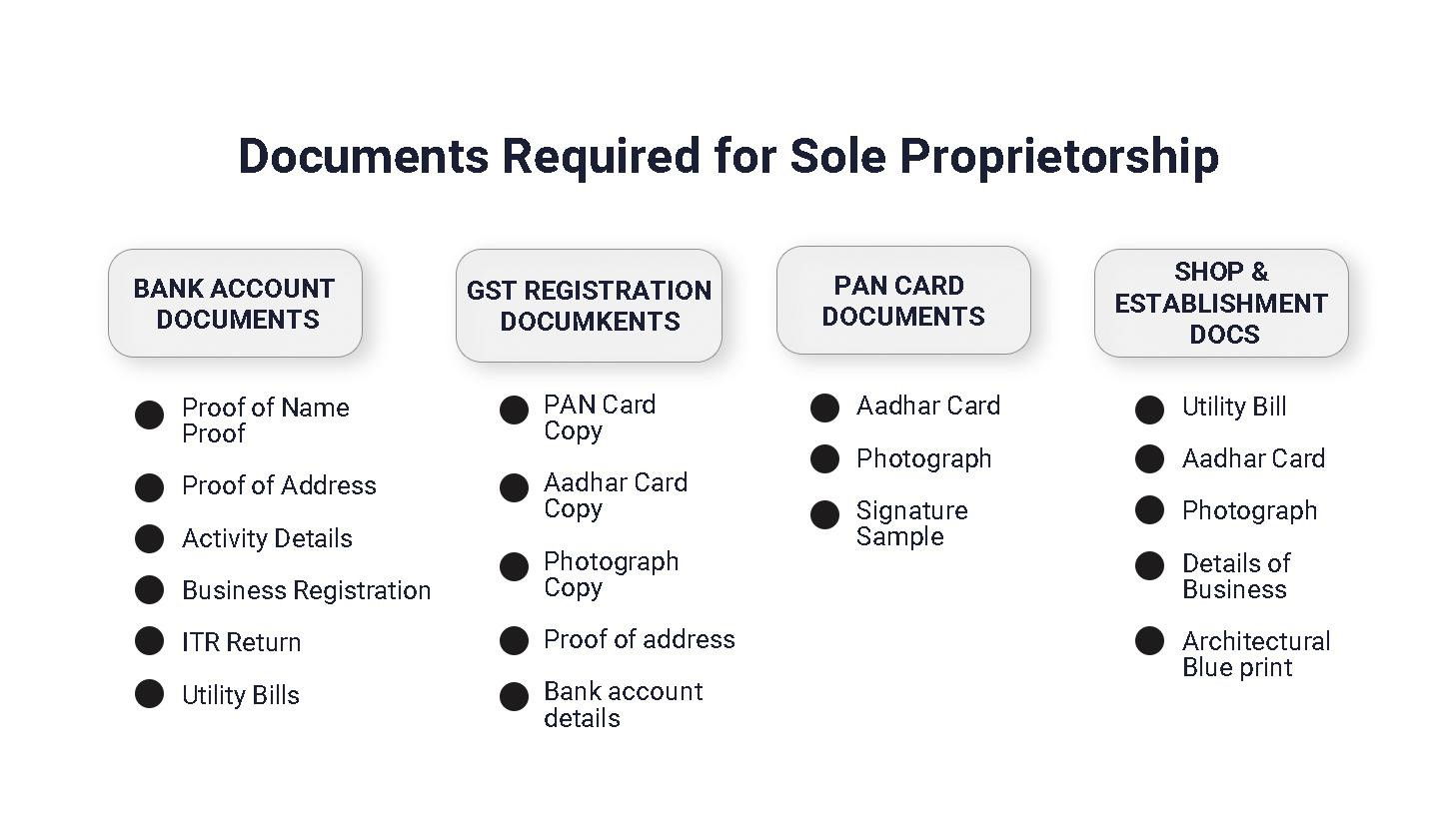

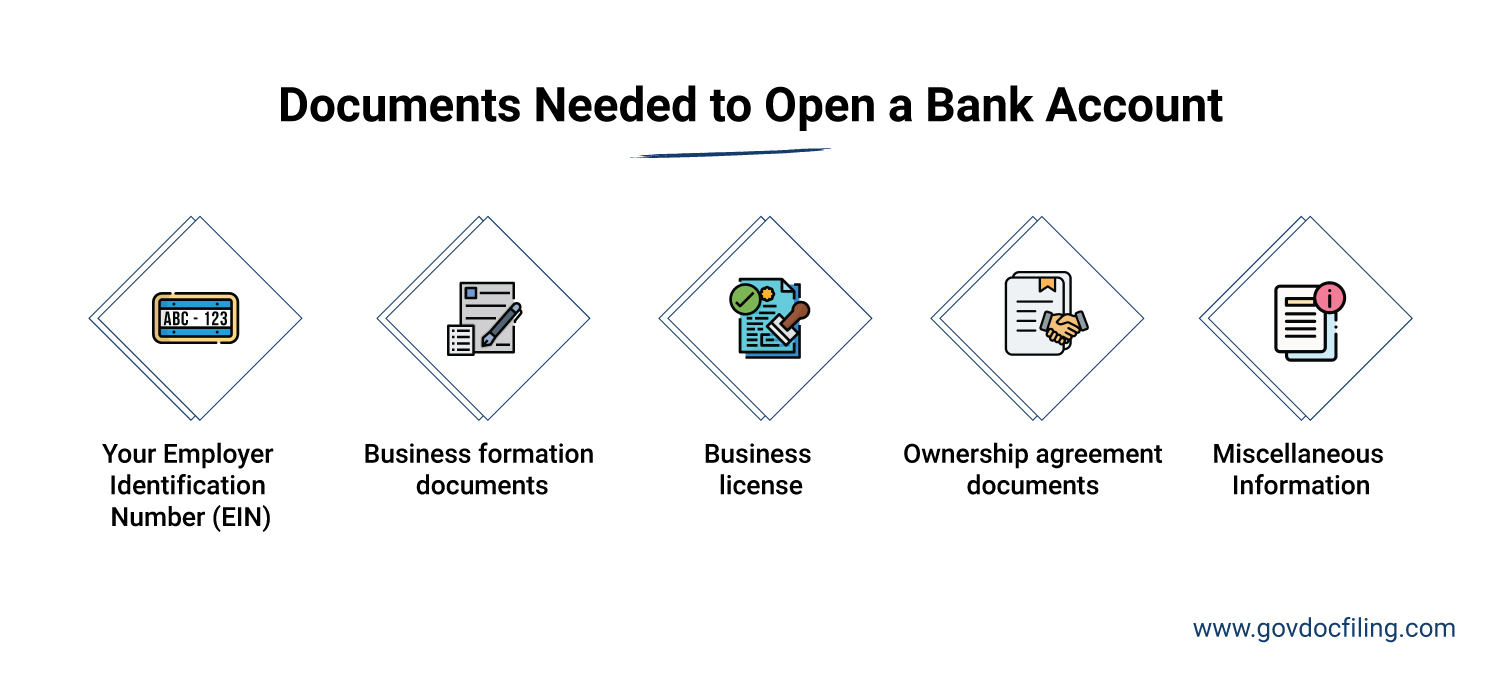

Depending on the type of account you're opening, you might need additional documentation. For example, if you're opening a business account, you'll need to provide your business's legal documents, such as articles of incorporation or a business license.

For student accounts, some banks may require proof of enrollment, such as a student ID or transcript. Minors opening accounts may need a parent or guardian to co-sign and provide their own identification.

Always check with the specific bank about any specific requirements related to the type of account you’re opening.

Tips for a Smooth Account Opening

Before heading to the bank, call ahead or check their website for a list of accepted documents. This will save you time and ensure you have everything you need.

Make sure all your documents are current and valid. Expired IDs or outdated bills can cause delays.

Consider bringing photocopies of your documents in case the bank needs to keep them on file.

Opening a bank account is a significant step towards managing your finances effectively. By understanding the required documents and preparing in advance, you can make the process a breeze. Remember, it’s all about ensuring security and compliance, and with the right preparation, you'll be on your way to financial empowerment in no time. As Benjamin Franklin said, "An investment in knowledge pays the best interest."

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)