What Does A Bond's Rating Reflect

Imagine standing at the edge of a vast ocean, ready to set sail. You've got your vessel, your crew, and a map promising treasure, but how confident are you in the journey? Is the ship seaworthy? Are the winds in your favor? In the world of finance, bonds are much like these ships, and bond ratings are the assessment of their seaworthiness, guiding investors through the sometimes turbulent waters of the market.

At its core, a bond rating is an independent assessment of a bond issuer's creditworthiness, indicating the likelihood that they will repay their debt (both principal and interest) on time and in full. Think of it as a credit score for companies and governments that issue bonds. These ratings aren't just arbitrary numbers; they are crucial indicators helping investors gauge the risk associated with investing in a particular bond.

Understanding the Basics of Bond Ratings

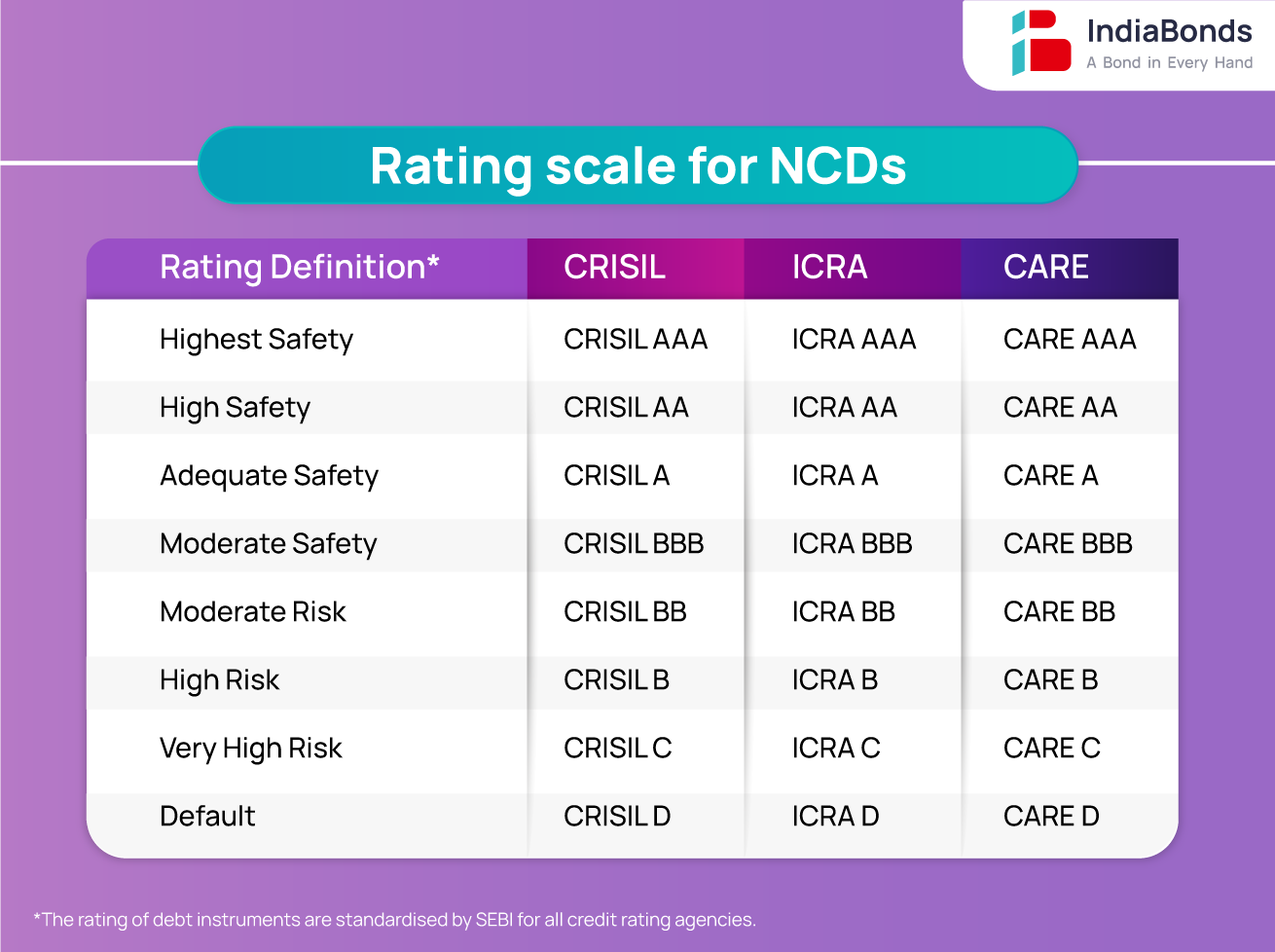

To truly grasp the significance of a bond rating, it's helpful to understand the context in which these ratings are developed. Bond ratings are assigned by credit rating agencies, most notably Standard & Poor's (S&P), Moody's, and Fitch Ratings. These agencies meticulously evaluate the financial health and stability of bond issuers before assigning a rating.

The process is thorough, involving a deep dive into the issuer's financial statements, market position, management quality, and the overall economic environment. They analyze everything from cash flow and debt levels to industry trends and regulatory risks. This comprehensive analysis allows them to arrive at an informed opinion about the issuer's ability to meet its debt obligations.

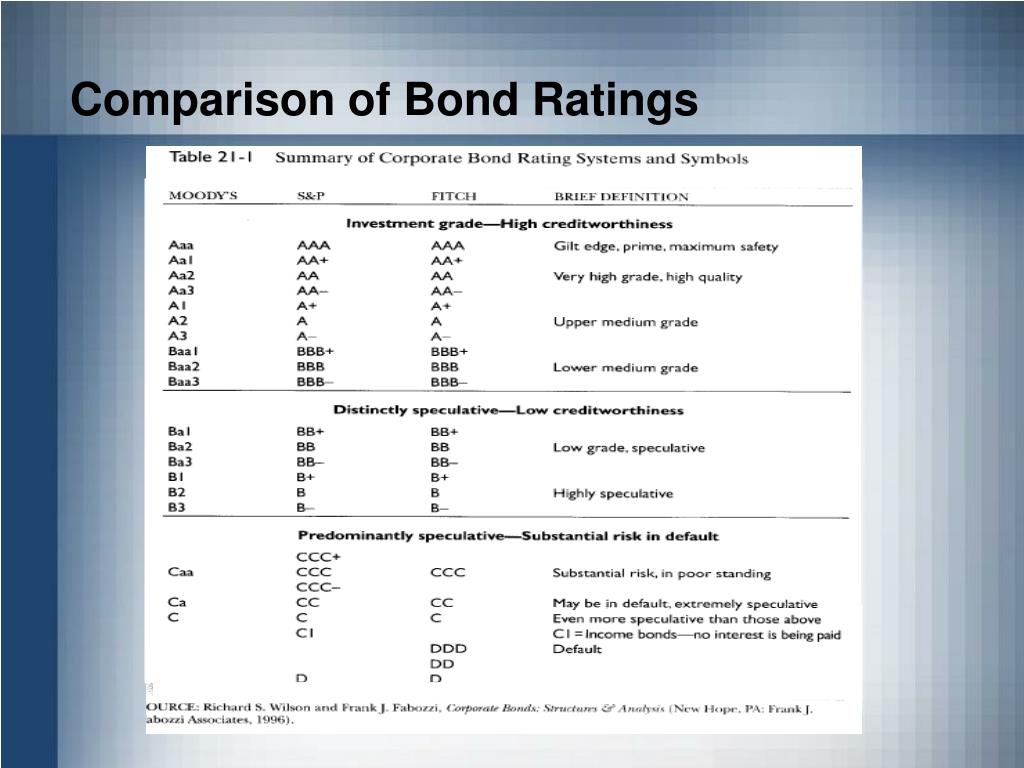

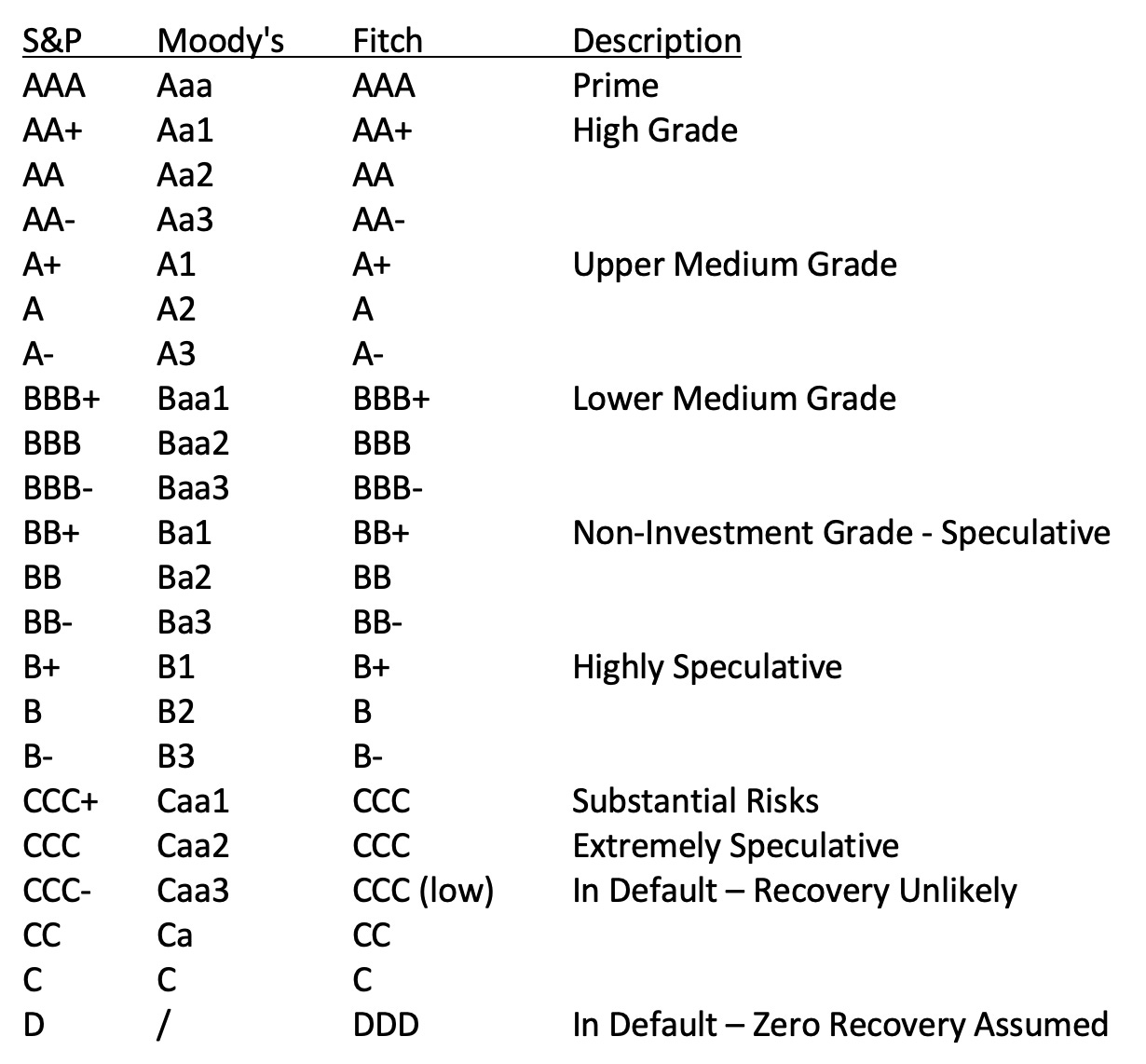

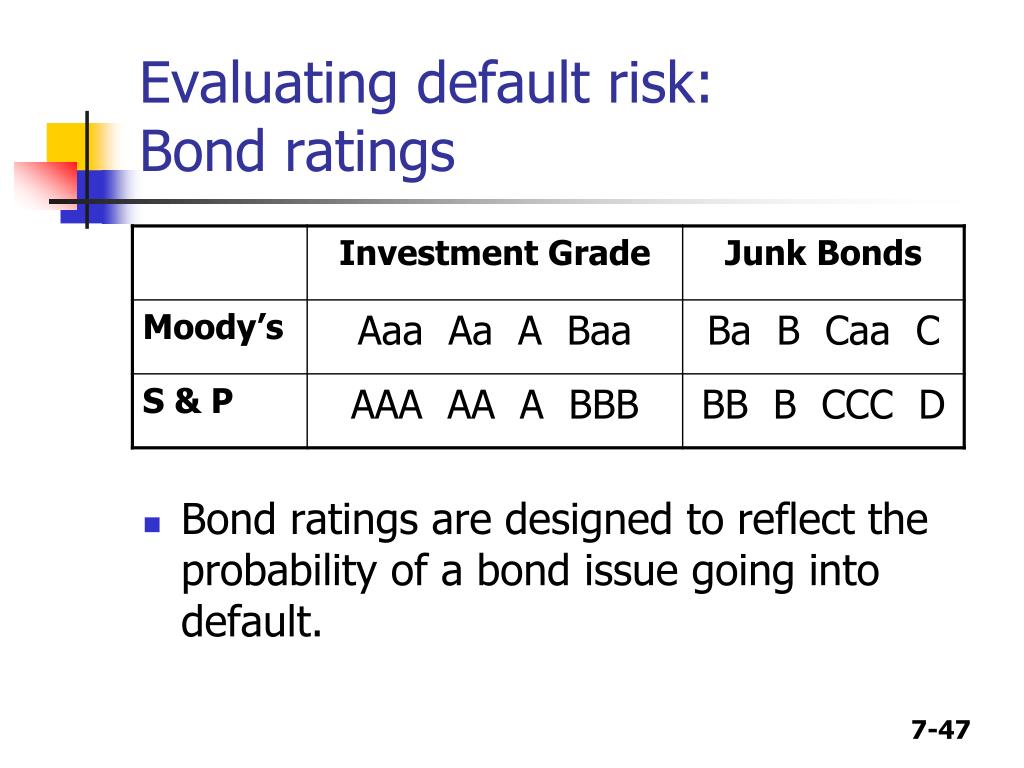

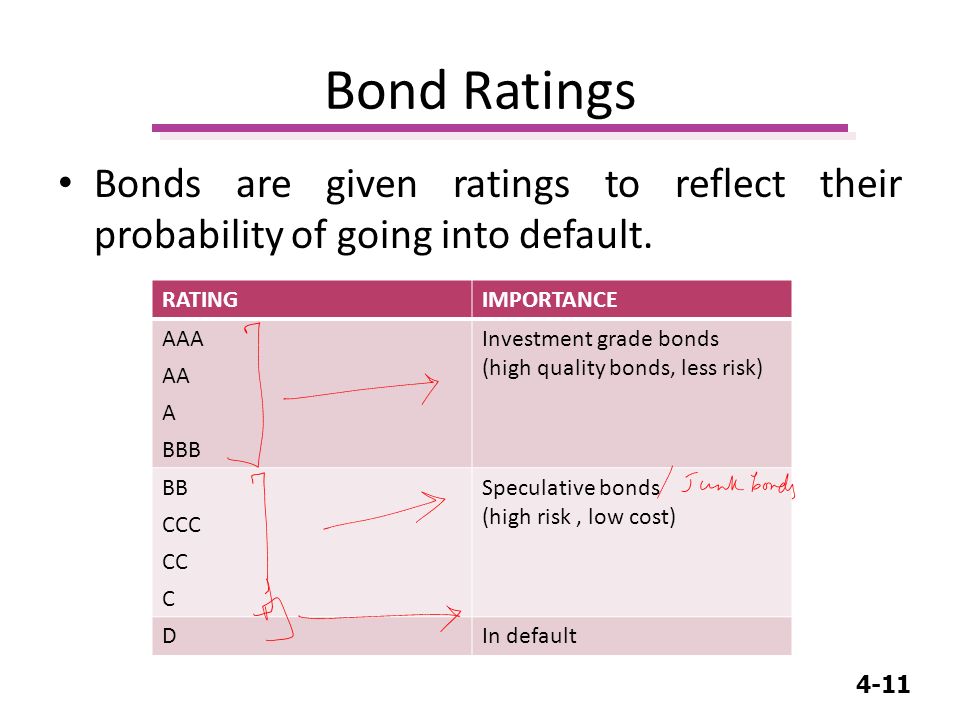

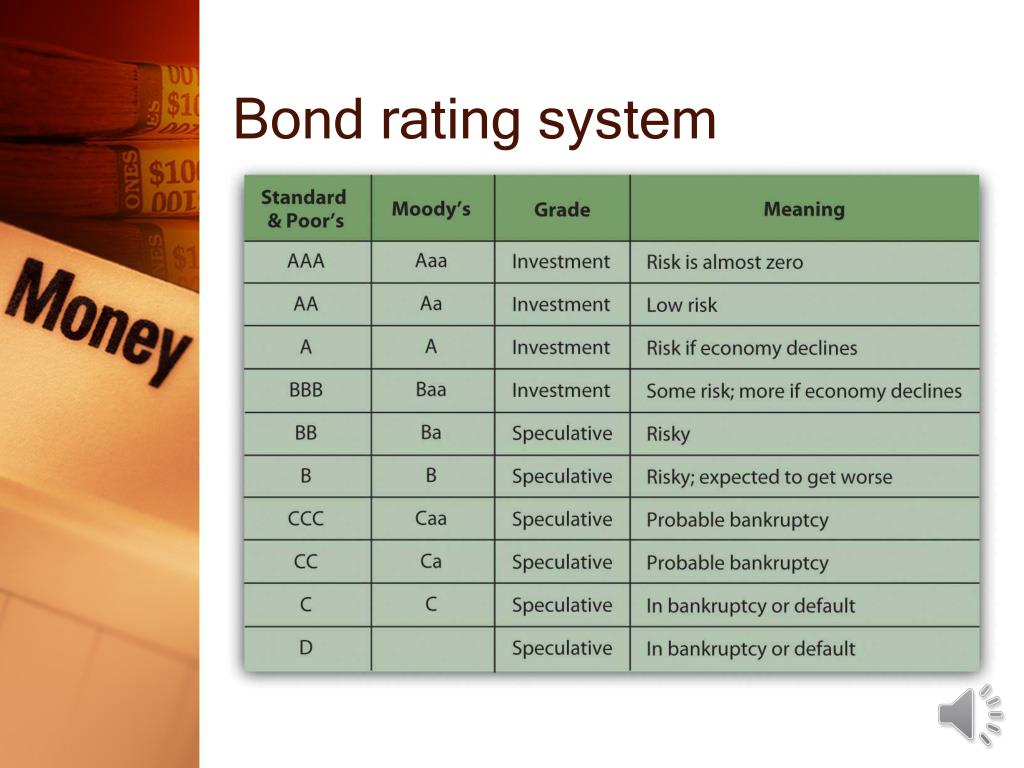

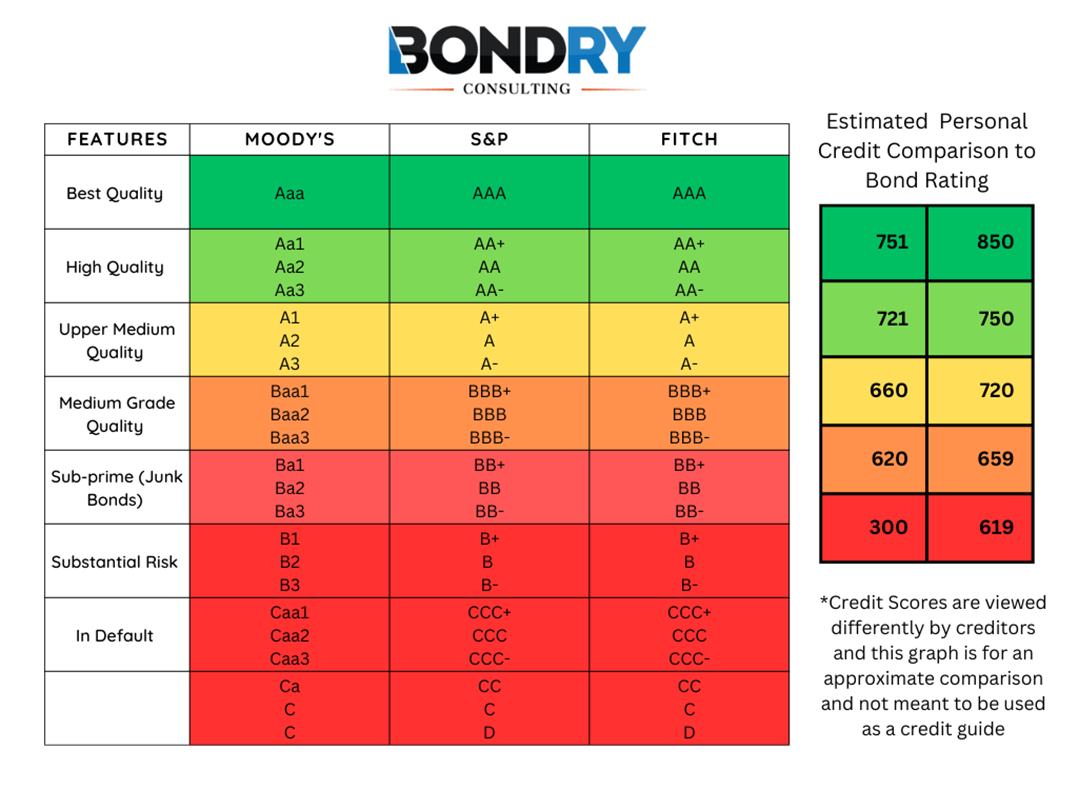

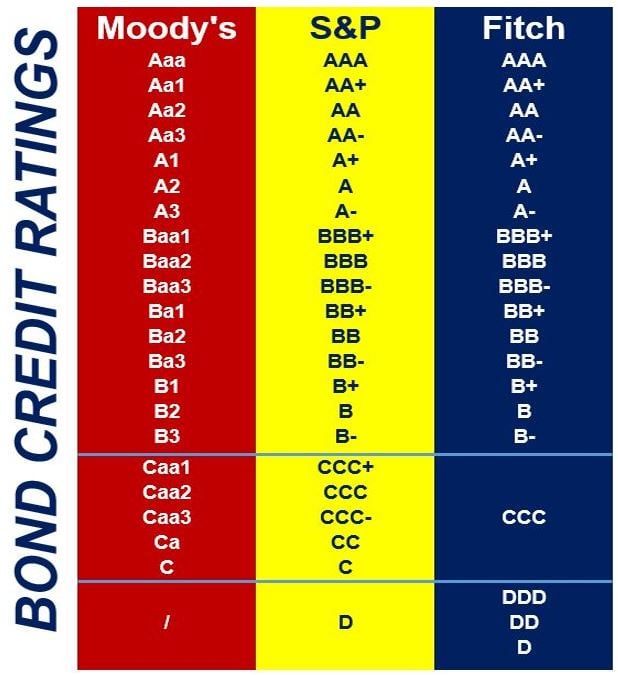

Bond ratings are typically expressed using a letter-grade system. S&P and Fitch use a scale that ranges from AAA (highest quality) to D (default). Moody's uses a similar system, ranging from Aaa to C. Within these major categories, "+" and "-" signs (S&P and Fitch) or numerical modifiers (Moody's) are used to indicate relative standing within each rating grade.

Bonds rated AAA (or Aaa) are considered the safest investments, with a very low risk of default. Bonds rated BBB (or Baa) or higher are considered investment grade, suitable for institutional investors and risk-averse individuals. Bonds rated below BBB (or Baa) are considered non-investment grade, often referred to as "junk bonds" or "high-yield bonds," carrying a higher risk of default but potentially offering higher returns.

Factors Influencing a Bond's Rating

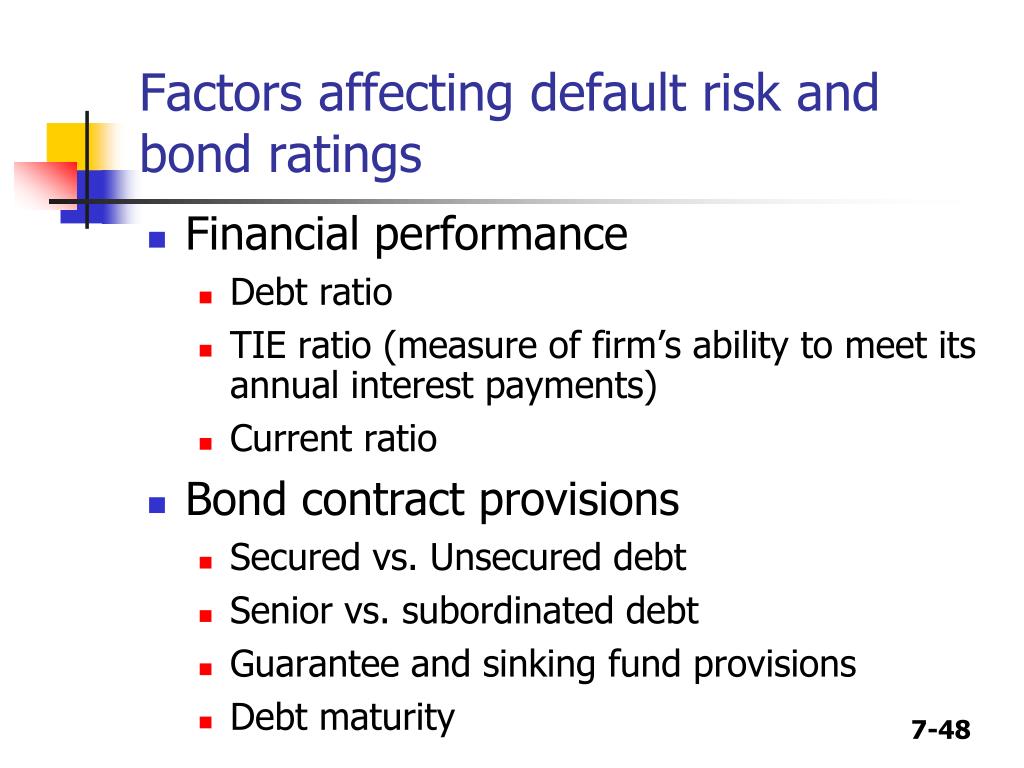

Several key factors contribute to a bond's ultimate rating. The issuer's financial health, as mentioned earlier, is paramount. Rating agencies scrutinize financial statements, looking at profitability, cash flow, and leverage ratios.

The strength of the issuer's industry also plays a crucial role. Is the industry stable and growing, or is it facing significant challenges? Companies in industries with favorable outlooks are more likely to receive higher ratings. Management quality is another critical consideration.

Effective management teams are better equipped to navigate economic headwinds and maintain financial stability. The overall economic environment, including interest rates, inflation, and economic growth, can also affect a bond's rating. A strong economy generally supports stronger creditworthiness.

Furthermore, the specific terms of the bond itself can influence its rating. Factors such as the seniority of the debt (i.e., its priority in the event of bankruptcy), the presence of collateral, and any covenants or restrictions placed on the issuer can all impact the perceived risk.

The Significance of Bond Ratings for Investors

Bond ratings serve as a valuable tool for investors of all types, from individual savers to large institutional money managers. They provide a standardized way to assess the credit risk associated with different bonds, allowing investors to make more informed decisions. By understanding a bond's rating, investors can better align their investments with their risk tolerance and financial goals.

For risk-averse investors, sticking to investment-grade bonds may be a prudent strategy. These bonds offer a relatively safe haven, with a lower risk of default. Investors seeking higher returns may be willing to venture into the realm of high-yield bonds, but they must be prepared to accept a greater degree of risk.

Bond ratings also play a crucial role in the broader financial markets. They influence the pricing of bonds, with higher-rated bonds typically offering lower yields and lower-rated bonds offering higher yields to compensate investors for the increased risk. Bond ratings can affect an issuer's ability to access capital markets.

A downgrade in a bond rating can make it more expensive for a company or government to borrow money, while an upgrade can make borrowing more affordable. Institutional investors, such as pension funds and insurance companies, often have strict guidelines that limit their investments to bonds with specific ratings. This can create significant demand for highly rated bonds and limit demand for lower-rated bonds.

Limitations and Criticisms of Bond Ratings

Despite their importance, bond ratings are not without their limitations. One major criticism is that rating agencies can be slow to react to changing circumstances. This can lead to situations where a bond's rating does not accurately reflect its current level of risk.

The role of rating agencies in the 2008 financial crisis also came under intense scrutiny. Critics argued that the agencies had assigned overly optimistic ratings to complex securities, contributing to the crisis. There is inherent conflict of interest within the rating agency business model.

Agencies are typically paid by the issuers whose bonds they rate, which can create an incentive to assign higher ratings. While regulations have been put in place to address these issues, the potential for bias remains a concern. Investors should not rely solely on bond ratings when making investment decisions.

It's crucial to conduct independent research and consider a variety of factors, including the issuer's financial statements, industry trends, and the overall economic outlook. Diversification is key to managing risk in any investment portfolio.

A Final Thought

As you navigate the world of bonds, remember that a bond rating is just one piece of the puzzle. It's a valuable indicator of creditworthiness, but it should be used in conjunction with other sources of information and a healthy dose of skepticism. By understanding what a bond rating reflects and recognizing its limitations, you can make more informed investment decisions and chart a course toward your financial goals.

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)