What Does As Of Date Mean On Tax Transcript

Taxpayers nationwide are reporting confusion and anxiety over the "As of" date displayed on their IRS tax transcripts. This seemingly innocuous date can trigger alarm, but understanding its true meaning is crucial to avoiding unnecessary panic.

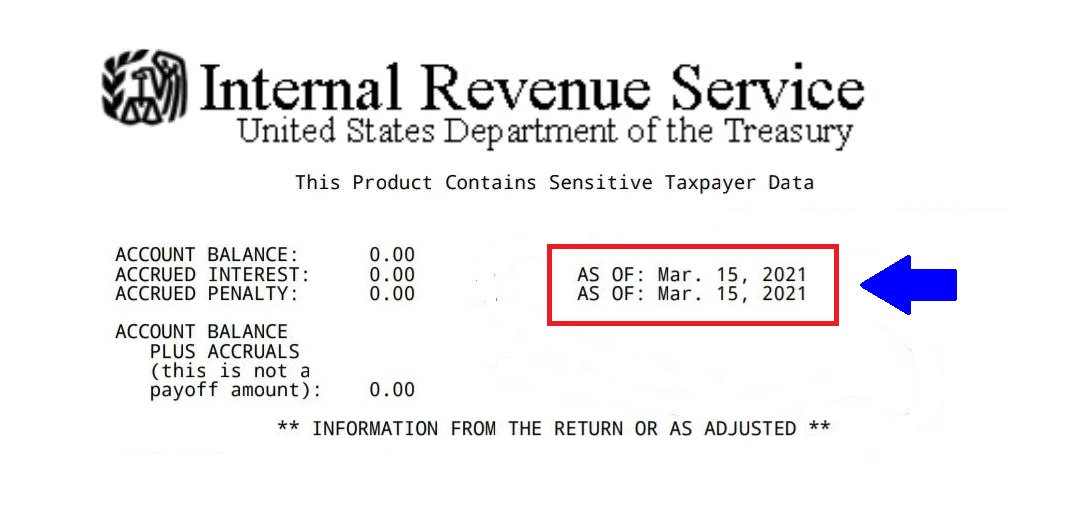

The "As of" date on an IRS tax transcript represents the date the IRS last assessed all activity on your account. It does not necessarily indicate a deadline for action or a problem with your return. This article breaks down the meaning of the "As of" date and what it means for you.

Decoding the "As Of" Date

The "As of" date is essentially a snapshot in time. Think of it as the IRS’s internal accounting of your tax account up to a specific point.

This date is used internally by the IRS for processing and tracking. It's not usually indicative of any immediate action required from the taxpayer.

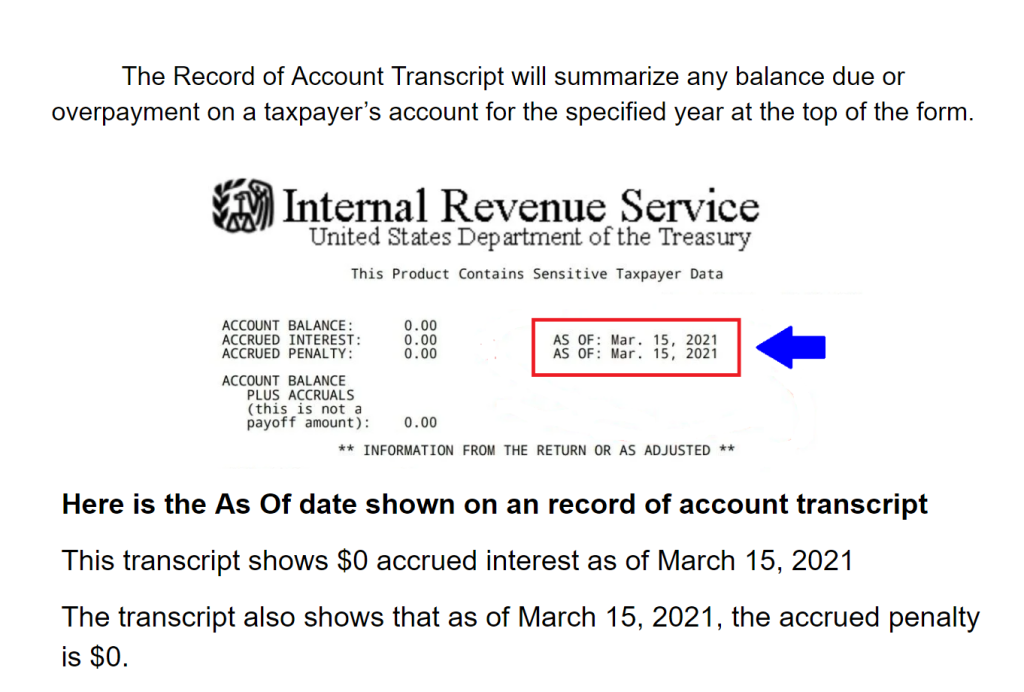

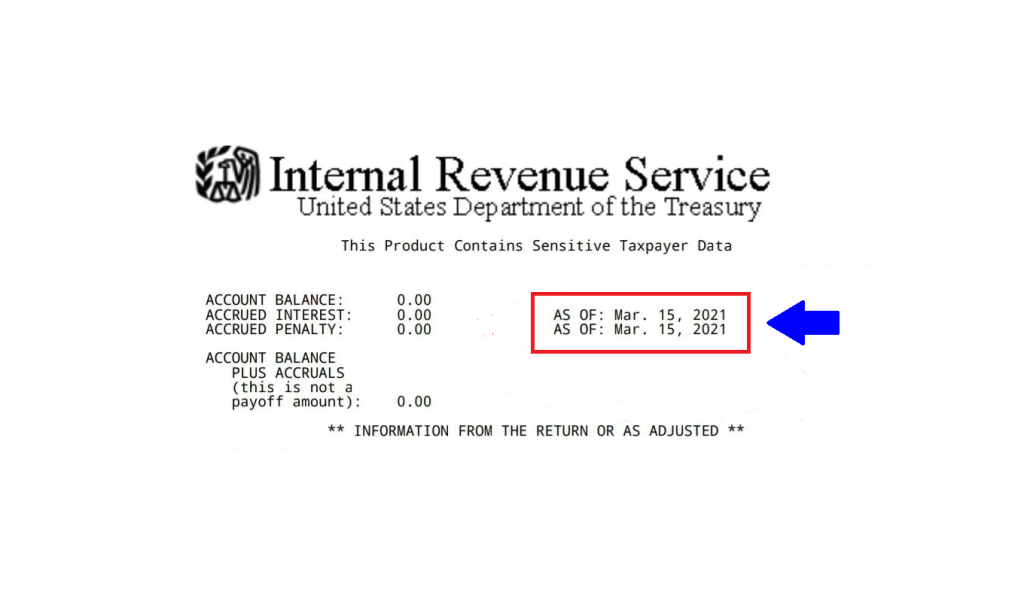

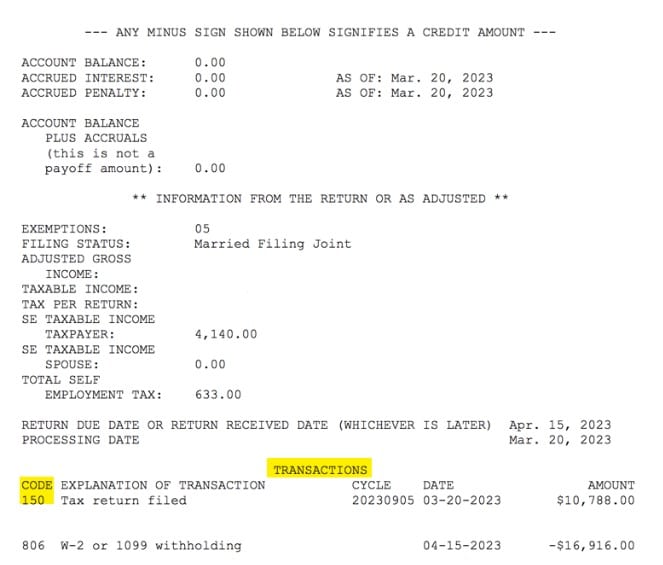

According to the IRS website, the "As of" date reflects the last date they assessed penalties, interest, and account balances.

What the "As Of" Date Doesn't Mean

Many taxpayers mistakenly believe the "As of" date is a deadline. This is a common misconception.

It's not an indication that you owe taxes immediately by that date, nor does it mean your refund is scheduled to be issued on that date.

It also doesn't automatically mean your tax return is under review or that there are errors requiring your immediate attention.

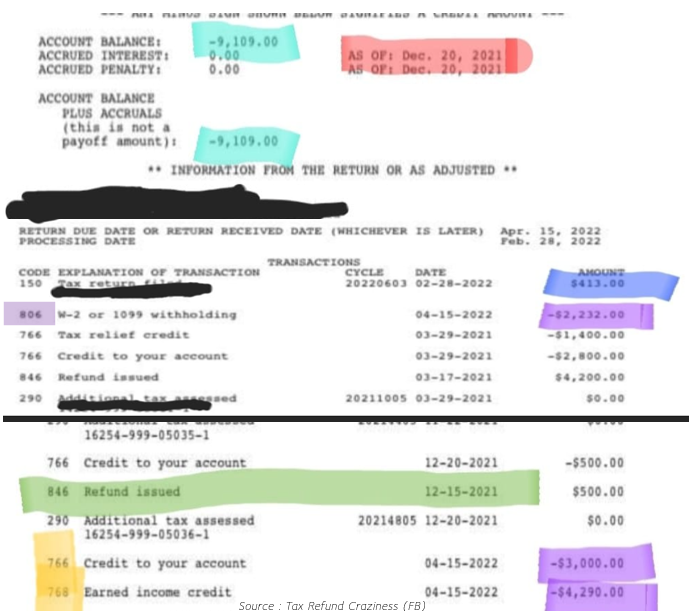

Common Scenarios and Interpretations

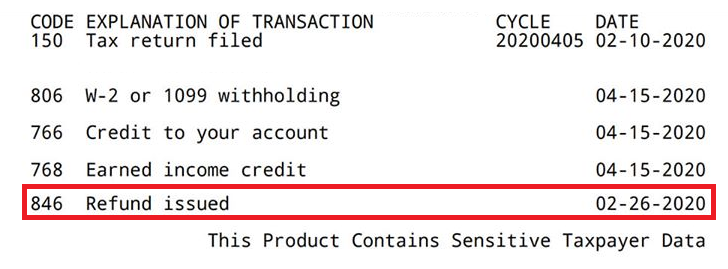

If you recently filed your tax return, the "As of" date might be relatively recent. This simply means the IRS has processed your return up to that point.

If you made a payment, the "As of" date might reflect the date the payment was processed and applied to your account.

However, a future "As of" date can sometimes appear. This often happens when the IRS has scheduled a future action on your account, such as a payment application or a refund issuance.

Where to Find Your "As Of" Date

You can access your tax transcript online through the IRS website using the "Get Transcript" tool. You'll need to create an account and verify your identity.

Alternatively, you can request a transcript by mail or by phone. However, online access is generally the quickest method.

The "As of" date is typically located near the top of your tax transcript.

When to Be Concerned

While the "As of" date is usually not a cause for alarm, there are situations where further investigation might be warranted. For example, if the date is significantly in the past and you are expecting a refund that hasn't arrived, or if you see unfamiliar transactions on your transcript.

If you notice discrepancies or unusual activity on your transcript, it's advisable to contact the IRS directly or consult with a qualified tax professional.

Also, if you receive a notice from the IRS referencing a specific transaction date, compare it to the details on your transcript to ensure accuracy.

Contacting the IRS

If you need to contact the IRS, be prepared for potentially long wait times. The IRS phone lines are often busy, particularly during peak tax season.

Have your Social Security number, tax return information, and a copy of your transcript readily available when you call. This will help expedite the process.

You can find contact information and resources on the IRS website, including frequently asked questions and online tools.

Next Steps and Ongoing Developments

The IRS continues to update its systems and processes, so the interpretation of the "As of" date may evolve. Stay informed by checking the IRS website for the latest guidance.

If you are unsure about the meaning of the "As of" date on your transcript, seeking professional tax advice is always a prudent step.

Monitor your tax account regularly and keep accurate records to avoid potential issues and ensure compliance.