What Does Bundled Mean In Crypto

The term "bundled" is increasingly popping up in cryptocurrency conversations, often causing confusion for newcomers and even seasoned investors. It refers to a variety of strategies where different crypto assets, services, or functionalities are packaged together and offered as a single unit. Understanding the nuances of bundling is critical for navigating the crypto landscape effectively.

This article aims to demystify what "bundled" means in the context of cryptocurrency. It will explore the different forms bundling can take, analyze the motivations behind it, and discuss the potential benefits and risks for users.

Decoding Bundled Crypto: A Multifaceted Approach

Bundling in crypto isn't a one-size-fits-all concept. Instead, it encompasses several distinct approaches. These approaches are designed to enhance user experience, streamline investment processes, or create new business models.

Bundled Assets: Simplifying Investment

One common form involves bundling crypto assets. This often takes the form of exchange-traded products (ETPs) like Exchange Traded Funds (ETFs) or baskets of tokens representing a specific sector. These bundles offer investors diversified exposure to a particular niche within the crypto market.

For example, an ETF might track the performance of the top 10 decentralized finance (DeFi) tokens. Similarly, a bundle could include a mix of metaverse-related cryptocurrencies. These baskets reduce the need for individual asset selection and management.

Bundled Services: All-in-One Crypto Platforms

Another facet of bundling involves combining different crypto-related services. Crypto platforms may bundle staking rewards with lending services. Also, bundled services includes a bundled package of brokerage accounts with educational resources.

This approach seeks to create a more convenient and comprehensive experience for users. It can make it easier to manage different aspects of their crypto portfolio within a single ecosystem. This ease of use is particularly appealing to beginners.

Bundled Functionality: Enhanced User Experience

Bundling also extends to combining different functionalities within a single protocol or application. A decentralized exchange (DEX), for example, might bundle trading with yield farming opportunities. This allows users to seamlessly transition between different activities.

Such bundled functionality is frequently seen in DeFi protocols. These protocols aim to create a more capital-efficient and user-friendly environment.

The "Why" Behind Bundling: Benefits and Motivations

The rise of bundling in the crypto space is driven by several factors. These factors are primarily aimed at attracting new users and increasing adoption.

One key driver is simplification. Bundling simplifies complex processes and reduces the barriers to entry for new users. By offering a curated selection of assets or a combination of services, platforms can make crypto investing less intimidating.

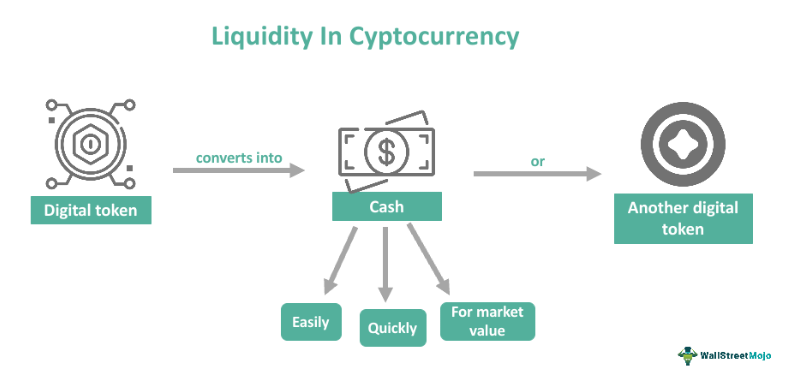

Diversification is another major benefit. Bundled assets allow investors to diversify their portfolios more easily. This reduces the risk associated with investing in individual cryptocurrencies. This is especially beneficial in a volatile market.

Efficiency is also a major consideration. Bundling services can save users time and effort. Instead of juggling multiple platforms, users can manage their assets and activities within a single ecosystem. This streamlining can improve the overall experience.

Potential Pitfalls: Risks and Considerations

While bundling offers numerous advantages, it's essential to be aware of the potential drawbacks. One common concern is the lack of transparency associated with some bundled products. Investors need to understand the underlying assets or services included in the bundle and the fees associated with them.

Complexity can also be a challenge. Some bundles may be complex. Understanding the intricacies of each component can be difficult, even for experienced investors. This can lead to unintended consequences or poor investment decisions.

Hidden fees represent another potential pitfall. Some bundled products may have hidden fees or charges that erode returns. Thoroughly researching the terms and conditions before investing is crucial.

Impact and the Future of Bundling

The trend toward bundling is likely to continue as the crypto market matures. Platforms will seek new ways to attract users and offer more comprehensive solutions.

The impact of bundling on the broader crypto ecosystem could be significant. It could lead to increased adoption, greater institutional investment, and the development of more innovative products and services.

However, it's crucial for regulators to monitor the development of bundled crypto products. This monitoring prevents potential consumer harm and ensures market integrity. Increased regulatory scrutiny and consumer education is necessary.

Ultimately, understanding what "bundled" means in crypto is crucial for navigating the evolving landscape. By weighing the benefits and risks, investors can make informed decisions and participate in the growth of the crypto market effectively.