What Does Home Buying Power Mean On Credit Karma

For prospective homebuyers navigating the complex real estate market, understanding their financial standing is paramount. Credit Karma, a popular personal finance company, offers a feature called "Home Buying Power" designed to help users estimate how much they can afford. But what exactly does this tool provide, and how should potential buyers interpret its results?

Credit Karma's Home Buying Power is an estimate of the home price a user might be able to afford, based on their credit profile, income, debt, and down payment savings. It leverages self-reported data and information from the user’s credit report to generate this figure. While it can be a useful starting point, experts emphasize that it's not a pre-approval or a guarantee of a specific loan amount.

Understanding the Components

The Home Buying Power estimate is influenced by several key factors. These include credit score, income, existing debt (such as credit card balances, student loans, and car payments), and the anticipated down payment.

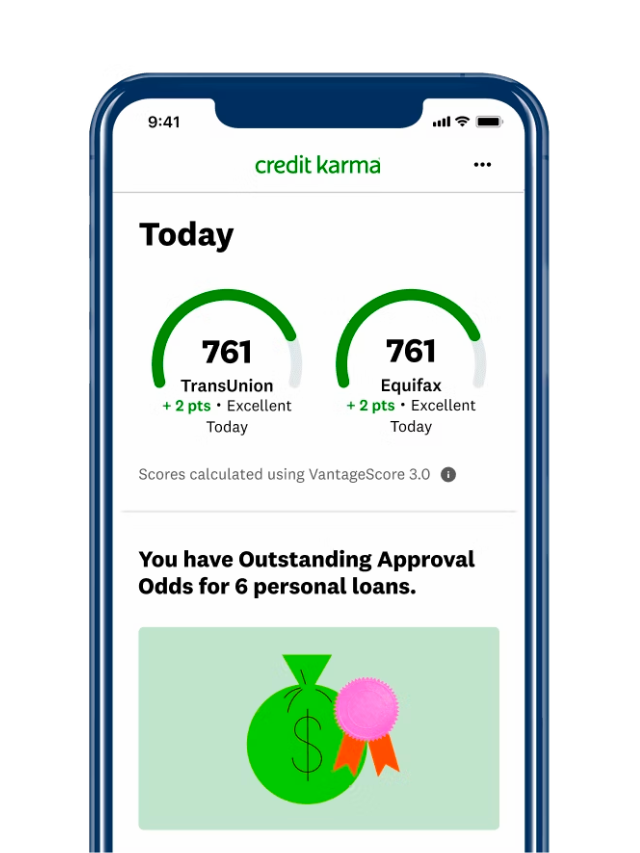

A higher credit score generally translates to better interest rates, increasing affordability. Similarly, a higher income allows for larger mortgage payments. Lowering debt-to-income ratio (DTI), calculated by dividing monthly debt payments by monthly gross income, can improve the home buying power.

How Credit Karma Calculates Home Buying Power: The algorithm Credit Karma employs remains proprietary. However, it reportedly uses standard mortgage industry calculations to project potential loan amounts and monthly payments. This involves factoring in prevailing interest rates, property taxes, and homeowners insurance.

Limitations and Considerations

While the Home Buying Power tool can be a helpful initial assessment, it has inherent limitations. It relies heavily on self-reported data, which may not always be entirely accurate or up-to-date. It also doesn't account for all potential expenses associated with homeownership.

Unexpected repairs, maintenance costs, and potential increases in property taxes are often overlooked. Moreover, Credit Karma's estimate doesn't reflect the nuances of individual lenders' underwriting criteria. This means that one lender might approve a borrower for a different amount than another, even with the same credit profile.

Expert Advice: Financial advisors consistently recommend getting pre-approved by a mortgage lender before seriously beginning the home search. "A pre-approval provides a more accurate assessment of your borrowing capacity and strengthens your offer when you find a property you like," explains John Miller, a certified financial planner at ABC Financial.

Beyond the Estimate: Additional Factors

Beyond the core components of the Home Buying Power calculation, potential homebuyers should also consider the long-term financial implications of owning a home. This includes factoring in closing costs, moving expenses, and the potential for unforeseen financial emergencies.

It's also crucial to assess personal financial goals and priorities. Just because you *can* afford a certain mortgage payment doesn't necessarily mean you *should*. It's important to balance housing costs with other financial needs, such as retirement savings, education expenses, and personal investments.

Furthermore, prospective buyers should research local market conditions. Property values, interest rates, and property taxes can vary significantly from one location to another. Understanding these regional differences is critical for making informed decisions.

The Impact on Potential Homebuyers

Credit Karma’s Home Buying Power feature offers a convenient way for individuals to gauge their potential affordability. It encourages users to proactively manage their credit and finances, ultimately leading to more informed decisions. This early insight can save time and prevent disappointment down the line.

However, it's crucial to remember that this tool is just one piece of the puzzle. It shouldn't be the sole basis for making such a significant financial commitment. Combining the estimate with professional advice and thorough research is the key to a successful home buying experience.

In conclusion, Credit Karma's Home Buying Power is a useful tool for understanding general affordability. Potential buyers should treat it as a starting point and supplement it with pre-approval from a lender and professional financial planning.