What Does Pnl Mean In Crypto

Crypto traders face constant market volatility. Understanding PnL is crucial for navigating this complex landscape and making informed decisions.

Decoding PnL: Your Crypto Compass

PnL, or Profit and Loss, is the financial barometer of your crypto trading activities. It measures the difference between the purchase price and the sale price of your assets, indicating whether you've gained or lost money on a trade.

This article will dissect the components of PnL, explain how it's calculated, and highlight its importance for successful crypto investing.

What Exactly Does PnL Represent?

PnL encapsulates the overall profitability of your trading strategies. It can be calculated for individual trades or across your entire portfolio over a specified period.

It's not just about making money; it's about understanding the efficiency of your strategies and identifying areas for improvement.

Calculating Your Crypto PnL: The Essentials

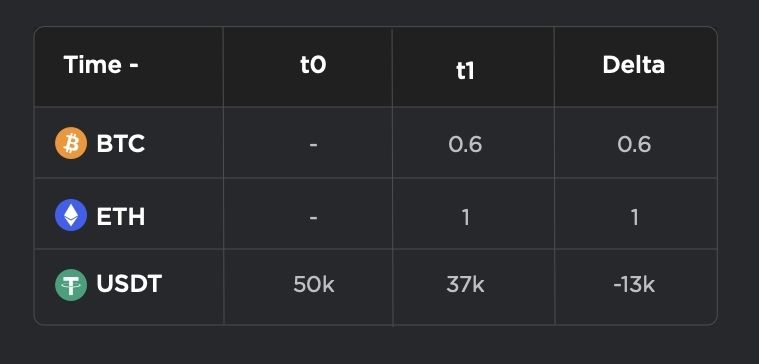

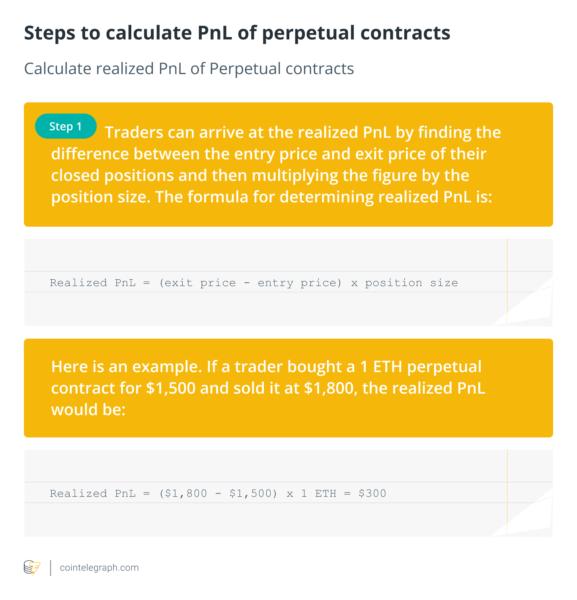

The basic formula for PnL is: PnL = (Sale Price - Purchase Price) - Trading Fees.

For example, if you bought Bitcoin for $30,000 and sold it for $35,000, and paid $50 in trading fees, your PnL would be $4,950.

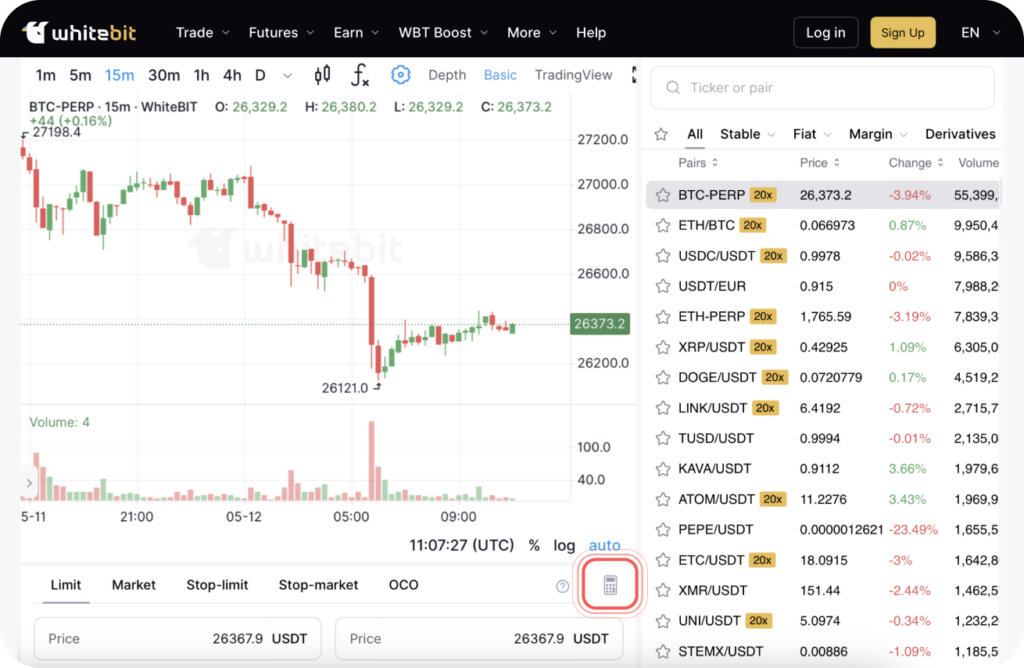

Many crypto exchanges automatically calculate and display your PnL for each trade and across your account.

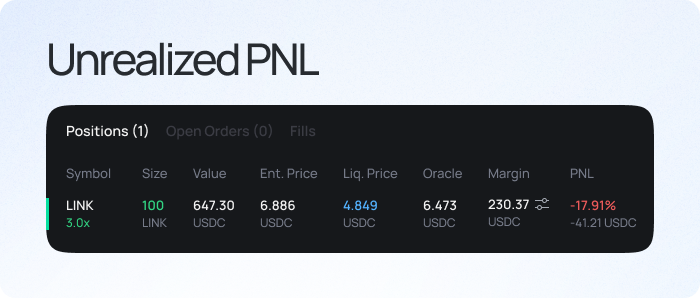

Realized vs. Unrealized PnL: A Critical Distinction

Realized PnL refers to profits or losses from closed positions, meaning you've already sold the asset.

Unrealized PnL, also known as open PnL, reflects the current profit or loss on positions you still hold.

Unrealized PnL fluctuates with market prices and only becomes realized when you sell the asset.

The Significance of PnL in Crypto Trading

Monitoring your PnL helps you assess the effectiveness of your trading strategies. Are you consistently making profitable trades?

It also aids in risk management, allowing you to identify potentially losing positions and adjust your strategy accordingly. Furthermore, understanding PnL is crucial for tax reporting, as you'll need to report your realized gains and losses.

Factors Influencing Your Crypto PnL

Market volatility is a major driver of PnL in the crypto market. Sudden price swings can dramatically impact your profits and losses.

Trading fees charged by exchanges can eat into your profits, especially if you're a frequent trader. Your trading strategy, including entry and exit points, risk tolerance, and position sizing, also heavily influences your PnL.

Tools and Resources for PnL Tracking

Most cryptocurrency exchanges offer built-in tools for tracking your PnL. These tools often provide detailed reports on your trading history, including realized and unrealized gains/losses, trading fees, and portfolio performance.

Third-party portfolio trackers like CoinTracking and Accointing can aggregate data from multiple exchanges and wallets, providing a comprehensive view of your PnL.

Spreadsheet software like Microsoft Excel or Google Sheets can be used to manually track and calculate your PnL.

Common Mistakes to Avoid When Calculating PnL

Failing to account for all trading fees is a common mistake. These fees can significantly reduce your overall profitability.

Ignoring the impact of taxes on your gains can lead to unexpected financial burdens. Improperly tracking transaction history leads to inaccurate accounting.

Analyzing Your PnL: Key Metrics to Watch

Pay attention to your win rate, which is the percentage of your trades that are profitable. A high win rate indicates a successful trading strategy.

Also, consider your average profit per trade and your average loss per trade. These metrics provide insights into your risk-reward ratio. Finally, look at your portfolio's overall PnL over time to assess your long-term investment performance.

The Future of PnL Tracking in Crypto

Expect to see more sophisticated PnL tracking tools emerge as the crypto market matures. These tools will likely incorporate advanced analytics and AI-powered insights.

Furthermore, tax reporting for crypto is becoming increasingly complex, so expect to see more solutions that automate the PnL calculation and reporting process.

Taking Control of Your Crypto Finances

Understanding PnL is not just about knowing whether you're making money. It's about gaining control over your financial future in the volatile world of cryptocurrency. Continue refining your strategies and staying informed about market trends.

Consistently monitor your PnL, analyze your trading performance, and adapt your strategies accordingly. Stay informed, be vigilant, and trade wisely.