What Does Settled Cash Mean Fidelity

The seemingly simple act of buying or selling stocks can be fraught with delays and restrictions, particularly when the concept of "settled cash" comes into play. For Fidelity customers, understanding this term is crucial for navigating investment strategies and avoiding unexpected account limitations. Misunderstandings can lead to missed opportunities or even potential trading violations, making a clear grasp of settled cash essential for successful investing.

At its core, settled cash refers to funds from sales or deposits that are fully available for reinvestment or withdrawal. This article delves into the intricacies of settled cash within Fidelity accounts, explaining its meaning, implications, and how it affects trading decisions. We will explore settlement times, potential restrictions, and strategies for managing your cash flow effectively, ensuring a smooth and profitable investment journey.

Understanding Settled Cash at Fidelity

Settled cash, in simple terms, is the money in your brokerage account that's ready to be used. It represents funds from sales of securities, dividends, or deposits that have fully cleared the financial system. Until funds are settled, they are considered 'unsettled' and subject to certain limitations by Fidelity.

The reason for this delay stems from the process of transferring ownership of securities. The Depository Trust & Clearing Corporation (DTCC) plays a crucial role in settling trades, ensuring accurate and secure transfer of assets.

Settlement Times: The T+2 Rule

The standard settlement time for most securities transactions in the U.S. is T+2, meaning two business days after the trade date. This timeframe is mandated by the Securities and Exchange Commission (SEC). This means if you sell a stock on Monday, the cash from that sale typically won't be settled and available until Wednesday.

Certain types of transactions, such as those involving mutual funds, may have different settlement times. Always check the specific details of the investment for its unique settlement period.

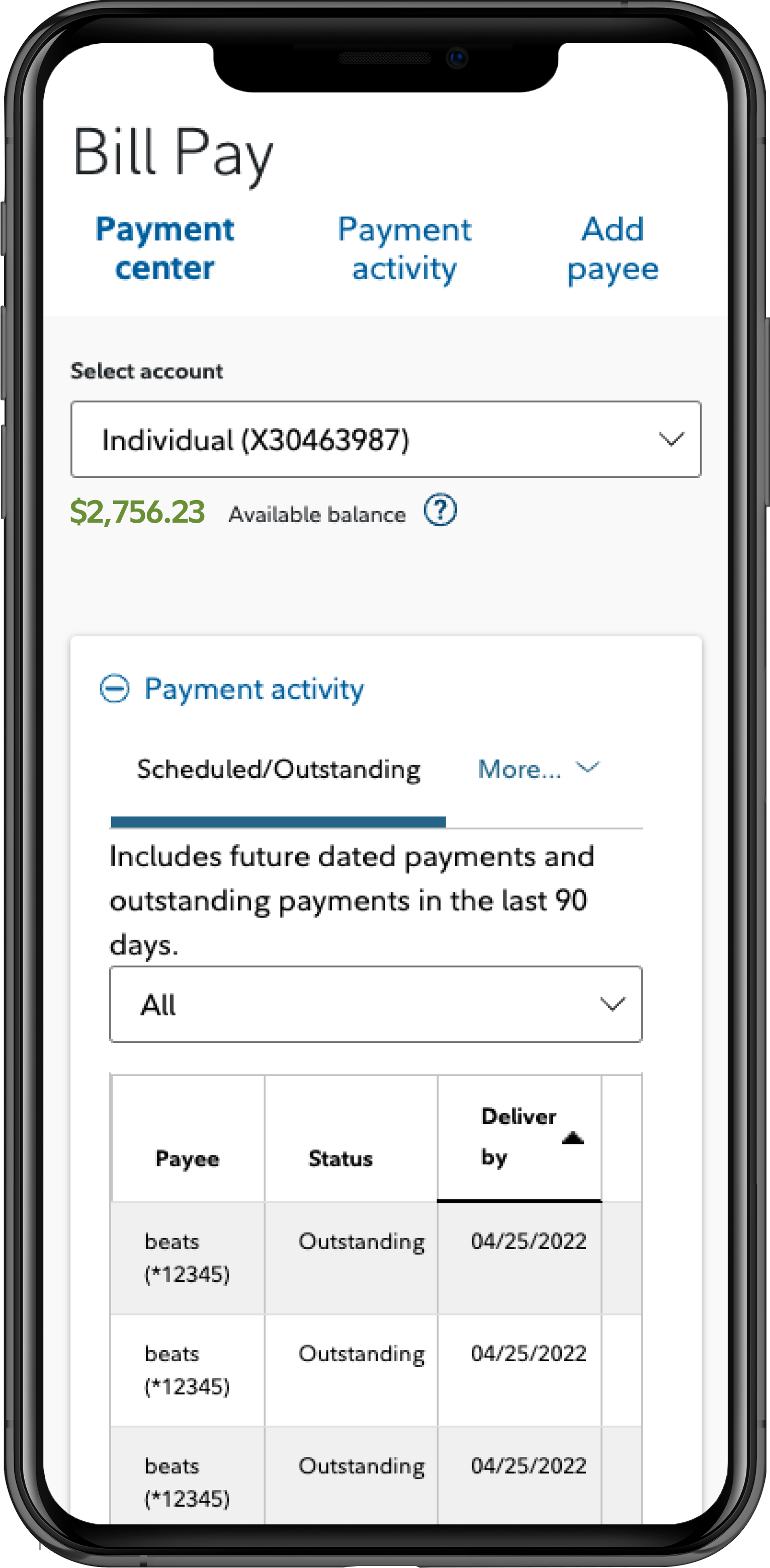

Impact on Trading and Withdrawals

Unsettled cash can significantly impact your ability to trade and withdraw funds. Fidelity, like other brokerages, generally restricts the use of unsettled cash for certain activities. This is primarily to protect both the investor and the brokerage from potential risks, such as trade reversals or insufficient funds.

For example, you might be able to purchase securities with unsettled cash, but you typically cannot withdraw it immediately. Attempting to withdraw unsettled funds can lead to account restrictions or even penalties.

Fidelity's Specific Policies on Settled Cash

Fidelity's policies regarding settled cash are designed to comply with regulatory requirements and manage risk. They provide clear guidelines on when funds become available for different types of transactions. Understanding these policies is essential for avoiding unintentional violations of trading rules.

Fidelity's website and customer service representatives offer detailed information on their specific settled cash policies. Investors are encouraged to consult these resources for the most up-to-date information.

Good Faith Violations

A "good faith violation" occurs when you buy a security with unsettled funds and then sell it before the initial funds have settled. This is a serious issue that can lead to trading restrictions on your account. Fidelity closely monitors trading activity to prevent good faith violations.

Repeated good faith violations can result in your account being restricted to trading only with settled cash. This can severely limit your ability to take advantage of market opportunities.

Strategies for Managing Settled Cash

Several strategies can help you manage your cash flow effectively and avoid issues with settled cash. One simple approach is to plan your trades carefully, considering the T+2 settlement period.

Another strategy is to maintain a cash cushion in your account. Having settled cash readily available allows you to execute trades without relying on unsettled funds.

Consider utilizing Fidelity's margin account feature with caution, as it allows you to borrow funds for trading, but it comes with its own set of risks and costs.

Looking Ahead

The concept of settled cash is likely to remain a key consideration for investors. While technology is constantly evolving, the fundamental need for secure and reliable settlement processes persists. The DTCC and regulatory bodies like the SEC will continue to refine settlement procedures to balance efficiency with risk management.

Investors should stay informed about any changes to settlement times or brokerage policies. Understanding these changes is critical for navigating the complexities of the financial markets and making informed investment decisions.

By understanding and actively managing settled cash, Fidelity customers can optimize their trading strategies and achieve their financial goals. Knowledge is power in the world of investing, and a thorough understanding of settled cash empowers you to navigate the market with confidence.

![What Does Settled Cash Mean Fidelity [Explained 2025] 👩🏫 Fidelity Settled Cash Vs. Cash Available To Trade](https://usefidelity.com/wp-content/uploads/2023/10/fidelity-settled-cash-768x304.png)