What Happened To E F Hutton

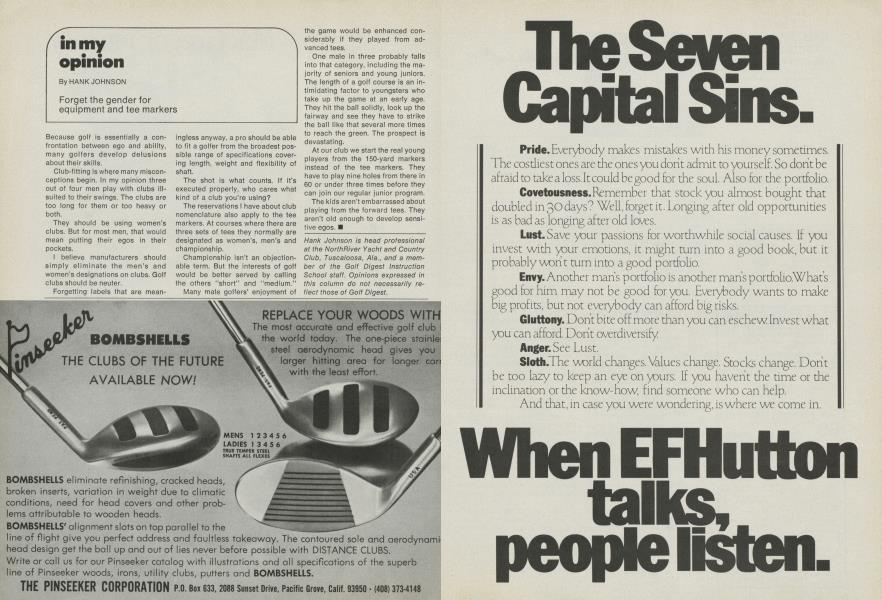

The name E.F. Hutton once resonated with unparalleled prestige on Wall Street, an icon synonymous with financial power and savvy investment. Its commercials, ending with the now-legendary tagline "When E.F. Hutton talks, people listen," cemented its place in popular culture. Yet, this titan of finance vanished from the landscape, leaving behind a legacy tarnished by scandal and mismanagement.

This article delves into the downfall of E.F. Hutton, exploring the series of events that led to its ignominious end. We will examine the cash management practices that triggered a federal investigation, the ensuing reputational damage, and the ultimate acquisition by Shearson Lehman Brothers. Finally, we will consider the broader lessons learned from Hutton's demise, highlighting the fragility of even the most established institutions in the face of ethical lapses and poor leadership.

The Rise of a Wall Street Giant

Established in 1904, E.F. Hutton & Co. grew steadily throughout the 20th century. It expanded from a regional brokerage into a national powerhouse.

By the 1980s, it was one of the largest and most respected investment firms in the United States. E.F. Hutton boasted hundreds of offices nationwide and a vast network of brokers.

The firm’s success was fueled, in part, by its aggressive marketing and its focus on retail investors. Its famous advertising campaign proved extraordinarily effective.

The Cash Management Scheme

The scandal that ultimately brought down E.F. Hutton centered around a systematic overdrafting scheme. This involved the firm drawing on bank accounts before funds had actually cleared.

Essentially, Hutton was using the float – the time between when a check is deposited and when the funds are available – to its advantage. This practice, while not inherently illegal, became fraudulent in its scale and intent.

By kiting checks and manipulating bank accounts, Hutton effectively obtained interest-free loans. These amounted to hundreds of millions of dollars.

According to The New York Times, the scheme involved over 400 banks and lasted for several years. The scale of the fraud was staggering.

Federal Investigation and Guilty Plea

The U.S. Justice Department launched a full-scale investigation into Hutton's cash management practices. This was prompted by growing concerns among banking regulators and internal whistleblowers.

In 1985, E.F. Hutton pleaded guilty to 2,000 counts of mail and wire fraud. The firm was fined $2 million and ordered to repay $750,000 in restitution.

While the monetary penalties were significant, the reputational damage proved far more devastating. The scandal shattered the firm's image of integrity.

The Fallout and Loss of Trust

The guilty plea triggered a crisis of confidence in E.F. Hutton. Investors and clients began to question the firm's ethics and financial stability.

Brokers, the lifeblood of any brokerage firm, began to leave in droves. They took their clients and assets with them.

The firm's stock price plummeted, reflecting the market's dim view of its future prospects. The once-proud name was now associated with scandal and deceit.

Internally, morale suffered as employees grappled with the shame and uncertainty surrounding their employer. The atmosphere became toxic.

Attempts at Recovery Fail

E.F. Hutton attempted to rehabilitate its image. These efforts, however, proved largely unsuccessful.

The firm hired a new CEO and implemented stricter internal controls. These were intended to prevent future misconduct.

Despite these measures, the damage was irreparable. The trust that had taken decades to build had been destroyed in a matter of months.

The Acquisition by Shearson Lehman

Facing mounting losses and a dwindling client base, E.F. Hutton was forced to seek a buyer. The firm's independent existence was no longer viable.

In December 1987, Shearson Lehman Brothers, then a subsidiary of American Express, acquired E.F. Hutton. The deal marked the end of an era.

The once-dominant E.F. Hutton name disappeared from Wall Street, absorbed into a larger entity. The acquisition was a stark reminder of the consequences of ethical failure.

According to a Bloomberg report at the time, the acquisition was valued at approximately $960 million. This was a fraction of what Hutton had been worth just a few years earlier.

Lessons Learned and Legacy

The demise of E.F. Hutton serves as a cautionary tale for the financial industry. It underscores the importance of ethical conduct and responsible corporate governance.

The scandal highlighted the potential for abuse within complex financial systems. It also demonstrated the devastating impact of reputational damage.

More broadly, the E.F. Hutton saga illustrates the fragility of even the most established institutions. No company, no matter how successful, is immune to the consequences of unethical behavior.

The "When E.F. Hutton talks, people listen" tagline, once a symbol of the firm's power, became an ironic reminder of its fall from grace. It serves as a permanent reminder of the importance of integrity in the world of finance.

While the name E.F. Hutton is no longer present on Wall Street, the lessons learned from its demise continue to resonate. They remind us of the enduring importance of trust, transparency, and ethical leadership.