What Impact If Any Have Recent Regulatory Changes Had On

The landscape of financial regulation has undergone significant shifts in recent months, prompting widespread debate about the real-world effects of these changes. From amendments to banking oversight to adjustments in securities trading rules, stakeholders are keenly observing how these regulatory modifications are shaping the economy and impacting businesses and consumers alike.

This article examines the tangible impact, if any, of these recent regulatory changes. It analyzes data from reputable organizations, official statements, and expert perspectives to provide a balanced and objective assessment of the current situation, focusing on the implications for various sectors and the broader public.

Banking Sector Adjusts to Basel III Endgame

One of the most notable recent regulatory shifts is the ongoing implementation of the Basel III Endgame, a set of international banking regulations designed to enhance bank capital requirements and risk management.

These rules, finalized by regulatory bodies like the Federal Reserve and the European Banking Authority, aim to prevent a repeat of the 2008 financial crisis by making banks more resilient to economic shocks.

However, the changes haven't been without controversy.

"Some argue that the increased capital requirements will constrain bank lending and stifle economic growth,"notes a recent report from the Institute of International Finance.

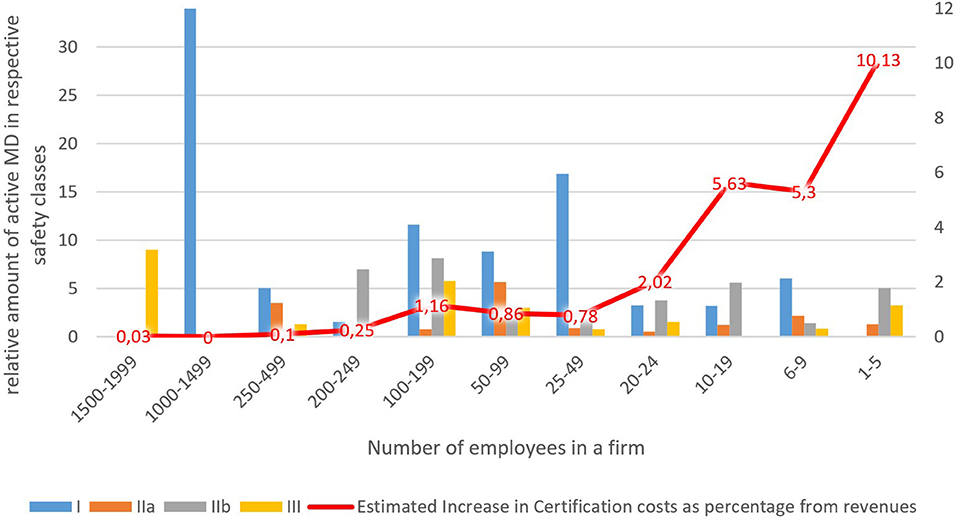

Specifically, smaller and regional banks have voiced concerns about the compliance costs, potentially hindering their ability to compete with larger institutions. These adjustments have the potential to raise the cost of loans for consumers and businesses.

Securities Trading Faces New Scrutiny

Regulatory bodies have also increased their scrutiny of securities trading practices, particularly concerning high-frequency trading and market manipulation.

The Securities and Exchange Commission (SEC) in the United States has introduced new rules aimed at increasing transparency and preventing unfair advantages in the market. These rules attempt to level the playing field for all investors.

For example, Reg NMS II is intended to promote competition in order handling and execution services. It is meant to address conflicts of interest when broker-dealers route orders.

According to a statement released by the SEC, the agency is focused on ensuring that markets are fair, orderly, and efficient. These measures are designed to foster investor confidence and prevent market abuses.

However, some argue that these regulations could add complexity and cost to trading, potentially reducing liquidity in certain markets. The impact remains subject to ongoing assessment.

FinTech Innovation and Regulatory Sandboxes

The rapid growth of FinTech has also prompted regulatory responses, with many jurisdictions experimenting with regulatory sandboxes.

A regulatory sandbox provides a controlled environment for FinTech companies to test innovative products and services without immediately being subject to the full weight of existing regulations.

The UK's Financial Conduct Authority (FCA) has been a pioneer in this area, with other countries following suit. "The goal is to encourage innovation while ensuring consumer protection and financial stability," said Andrew Bailey, former Governor of the Bank of England, in a recent speech.

These initiatives can facilitate the development of new financial products and services, potentially benefiting consumers through increased competition and choice. The challenge lies in balancing innovation with responsible risk management.

Impact on Consumers and Businesses

The combined impact of these regulatory changes on consumers and businesses is multifaceted.

On one hand, stricter banking regulations and increased securities trading oversight could enhance financial stability and protect investors from fraud and market manipulation. This may result in reduced risks in the long run.

On the other hand, higher compliance costs for banks and financial institutions could translate into increased fees and borrowing costs for consumers and businesses. Some have voiced that this will impact the speed of innovation.

The success of regulatory sandboxes in fostering FinTech innovation could lead to new products and services that benefit consumers, but it's crucial to carefully manage potential risks. Balancing the benefits and drawbacks requires ongoing monitoring and assessment.

Looking Ahead

The ultimate impact of these recent regulatory changes will depend on how effectively they are implemented and enforced.

Regular assessments and adjustments will be necessary to ensure that regulations achieve their intended goals without unduly hindering economic growth or stifling innovation.

Stakeholder engagement and transparent communication are crucial for building trust and ensuring that regulations are fit for purpose in a rapidly evolving financial landscape. The future of financial regulation hinges on adaptability and collaboration.

.png)