What Is A Dp3 Homeowners Policy

Imagine a crisp autumn evening. The scent of woodsmoke drifts through the air, mingling with the aroma of freshly baked apple pie emanating from your kitchen window. But suddenly, a rogue branch, weakened by age and the relentless wind, crashes down, piercing your roof. The storm intensifies, and rain begins to seep into your attic. What now? This is where understanding your homeowners insurance policy becomes absolutely critical.

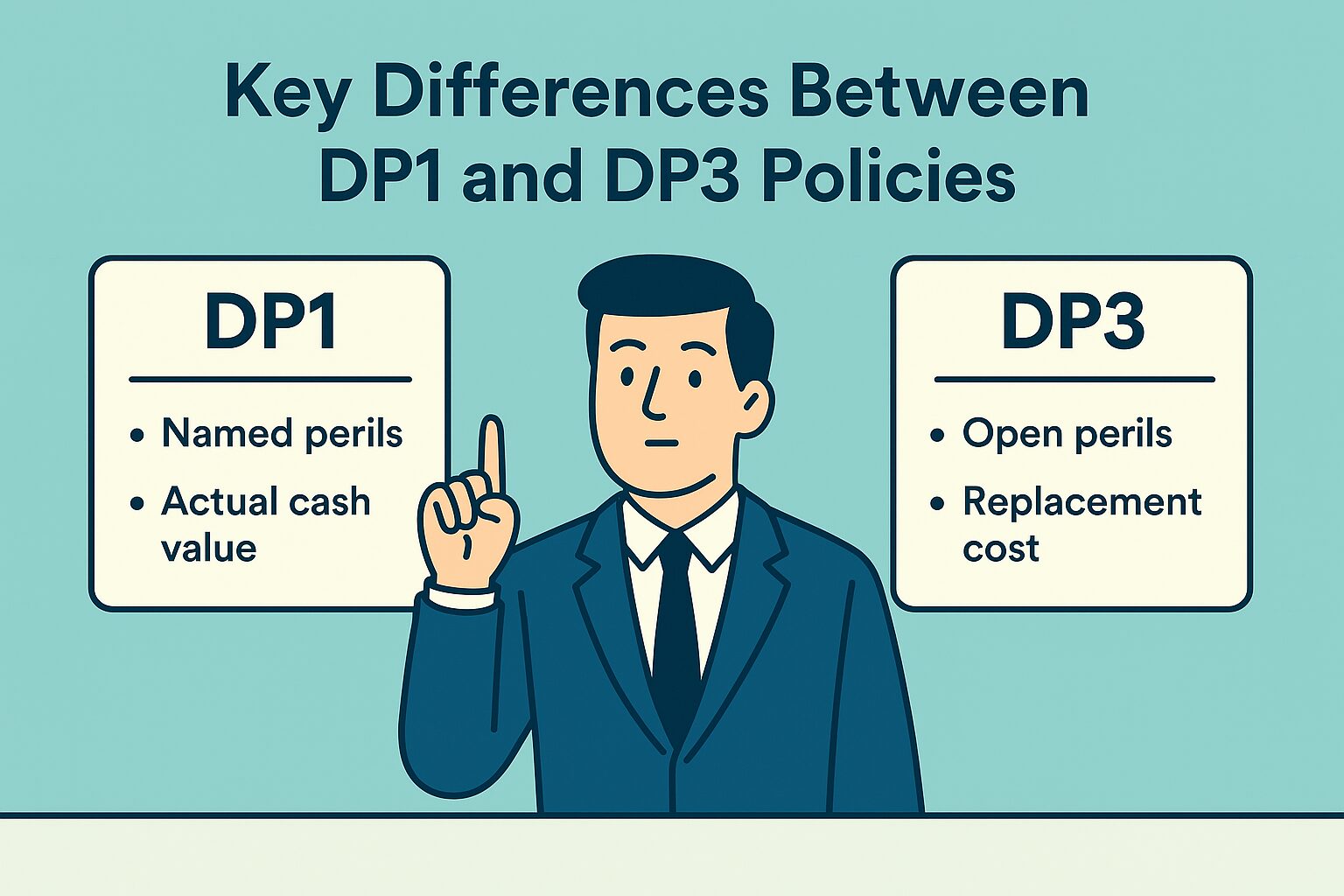

At its core, a DP3 homeowners policy, also known as a Dwelling Fire Policy 3, is a type of insurance specifically designed to protect your dwelling from a range of perils. Unlike standard homeowners policies that cover both the structure and your personal belongings, the DP3 focuses primarily on the physical building itself, offering broader coverage than the more basic DP1 and DP2 policies. It's a crucial tool for homeowners, landlords, and anyone looking to safeguard their property investment.

Delving Deeper into the DP3: What Makes It Special?

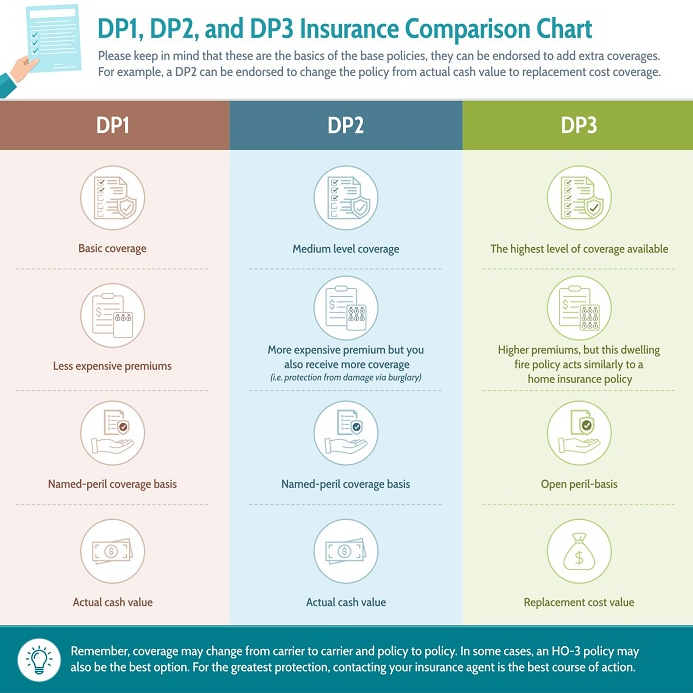

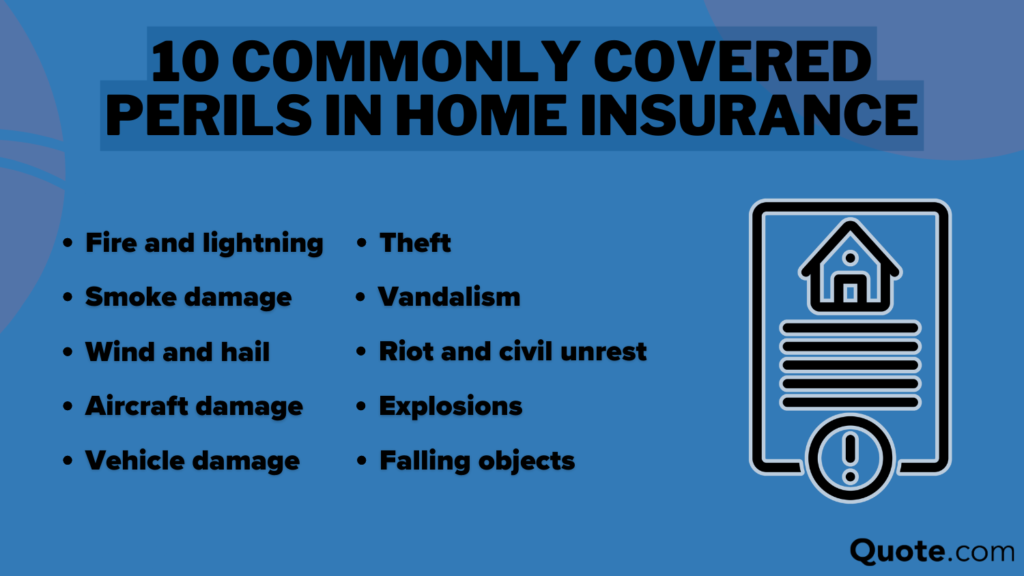

The DP3 policy stands out because of its "all-risk" or "open perils" coverage for the dwelling itself. This means that instead of listing specifically what *is* covered, the policy covers *everything* unless it's explicitly excluded. This provides a wider safety net compared to named-peril policies like DP1 and DP2, which only cover the perils specifically listed in the policy documents.

Think of it this way: with a named-peril policy, if something happens that isn't on the list, you're on your own. With a DP3, the burden of proof shifts to the insurance company to demonstrate why a particular event *isn't* covered. This can make a significant difference when dealing with unexpected damage.

It is important to remember that the 'all-risk' moniker isn't entirely accurate. DP3 policies do have exclusions. Common exclusions typically include events like earthquakes, floods (requiring separate flood insurance), wear and tear, and damage caused by pests or rodents. Understanding these exclusions is just as important as understanding the covered perils.

Who Benefits from a DP3 Policy?

While anyone owning a dwelling can benefit from a DP3 policy, it's particularly well-suited for certain situations. Landlords, for example, often find DP3 policies to be an excellent choice for protecting their rental properties. Since landlords typically aren't responsible for the tenants' personal belongings, focusing coverage on the dwelling itself makes financial sense.

Homeowners who rent out their property on a short-term basis, such as through Airbnb or VRBO, may also find a DP3 policy more appropriate than a standard homeowners policy. Many standard policies have exclusions or limitations on coverage for short-term rentals, so a DP3 policy can provide the necessary protection.

Additionally, individuals who own vacant or unoccupied homes may choose a DP3 policy. These properties often present a higher risk of damage due to lack of maintenance or vandalism. A DP3 can offer peace of mind in these scenarios, ensuring that the structure is protected.

DP3 Coverage Components: A Closer Look

A typical DP3 policy encompasses several key coverage areas. Let's break them down:

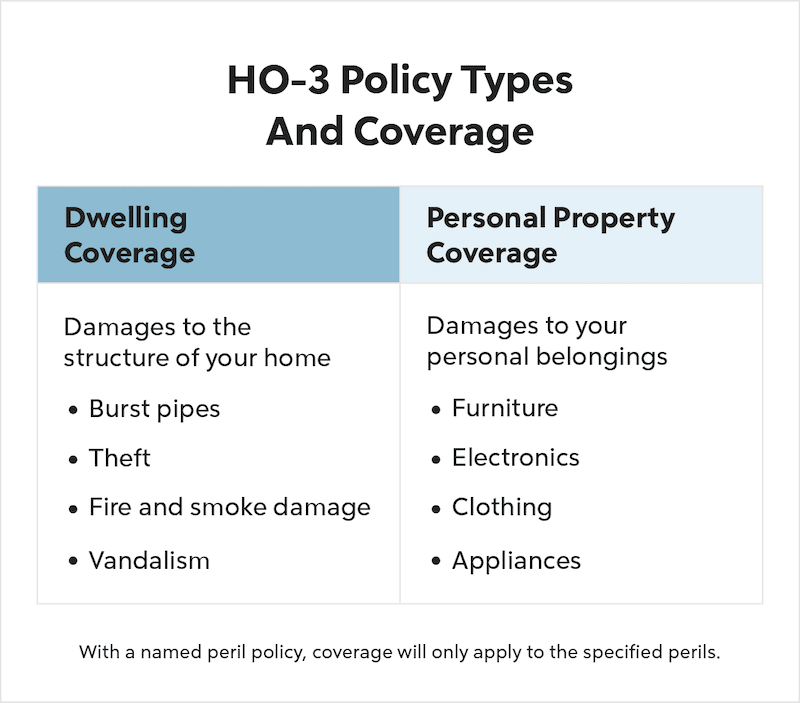

Dwelling Coverage:

This is the primary component, covering the physical structure of the house, including attached structures like garages or decks. It protects against covered perils such as fire, wind, hail, and vandalism. The coverage limit should be sufficient to rebuild the home if it were completely destroyed.

Other Structures Coverage:

This covers structures on the property that are detached from the main dwelling, such as sheds, fences, or detached garages. Typically, the coverage limit for other structures is a percentage of the dwelling coverage limit, often around 10%.

Fair Rental Value Coverage:

This coverage is particularly important for landlords. If a covered peril renders the rental property uninhabitable, this coverage reimburses the landlord for lost rental income until the property is repaired or rebuilt. This ensures a steady stream of income even during challenging times.

Additional Living Expenses (ALE):

While not always included, some DP3 policies offer ALE coverage. This helps cover the cost of temporary housing, meals, and other expenses if the homeowner needs to live elsewhere while the dwelling is being repaired due to a covered peril. This is most relevant for owner-occupied properties.

DP3 vs. Standard Homeowners Insurance: Key Differences

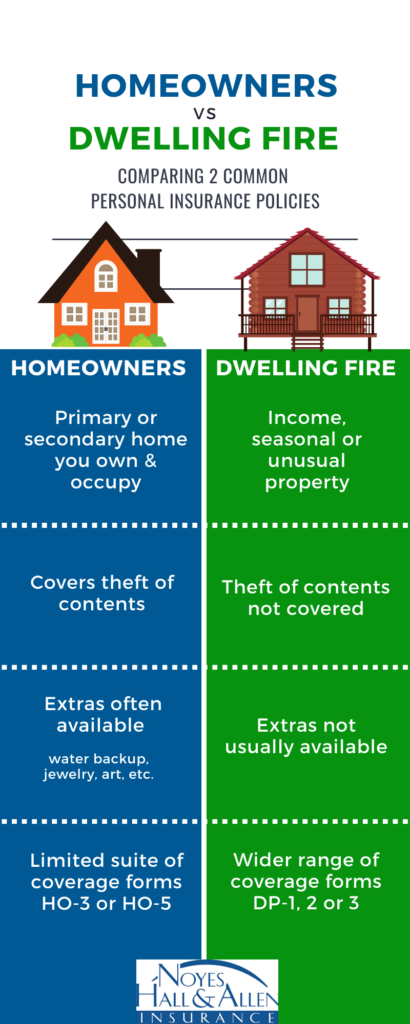

Understanding the distinctions between a DP3 policy and a standard homeowners insurance policy is critical for making informed decisions. The most significant difference lies in the scope of coverage. Standard homeowners policies typically cover both the dwelling and the homeowner's personal belongings, as well as liability protection.

DP3 policies, on the other hand, primarily focus on the dwelling itself. While some DP3 policies may offer limited personal property coverage, it's usually significantly less than what's provided in a standard homeowners policy. Liability coverage is also typically not included in a DP3 policy and would need to be purchased separately.

Another key difference lies in the eligibility requirements. Standard homeowners policies often require the property to be owner-occupied. DP3 policies, in contrast, are frequently used for non-owner-occupied properties, making them a popular choice for landlords and those with vacant homes.

Decoding the Fine Print: Important Considerations

Before purchasing a DP3 policy, it's essential to carefully review the policy documents and understand the terms and conditions. Pay close attention to the exclusions, coverage limits, and deductible amounts. Understanding these details will help you avoid unexpected surprises down the road.

It's also crucial to accurately assess the replacement cost of your dwelling. This is the amount it would cost to rebuild the home from scratch using current materials and labor costs. Ensuring that your dwelling coverage limit is sufficient to cover the full replacement cost is vital for protecting your investment.

Consulting with an experienced insurance agent is highly recommended. An agent can help you assess your specific needs, compare different DP3 policies, and ensure that you have the right coverage for your situation. They can also explain any complex policy language and answer any questions you may have.

The Cost Factor: What to Expect

The cost of a DP3 policy varies depending on several factors, including the location of the property, the dwelling coverage limit, the deductible amount, and the insurance company. Generally, DP3 policies are less expensive than standard homeowners policies due to the narrower scope of coverage.

However, it's important to remember that the cheapest policy isn't always the best. Consider the coverage limits, exclusions, and the insurance company's reputation for claims handling. Balancing cost with adequate coverage is key to making a smart decision.

Obtaining quotes from multiple insurance companies is always a good idea. This allows you to compare prices and coverage options and find the policy that best fits your needs and budget. Don't be afraid to negotiate with insurance companies to get the best possible rate.

Navigating Claims: What to Do When Disaster Strikes

Even with the best insurance policy in place, dealing with property damage can be stressful. Knowing what to do when disaster strikes can make the claims process smoother and more efficient. The first step is to ensure everyone's safety and prevent further damage to the property.

Next, contact your insurance company as soon as possible to report the claim. Provide them with all the necessary information, including the date of the incident, a description of the damage, and any relevant documentation, such as photos or videos.

Cooperate fully with the insurance adjuster who will be assigned to your claim. They will inspect the damage, assess the loss, and determine the amount of coverage available. Keep detailed records of all communication with the insurance company and any expenses you incur as a result of the damage. By being prepared and proactive, you can navigate the claims process with confidence.

The Future of DP3 Policies: Adapting to a Changing World

As the world changes, so too do the risks facing homeowners and property owners. Climate change, increasing urbanization, and evolving technology are all factors that are shaping the future of the insurance industry. DP3 policies are likely to adapt to these changes by incorporating new coverage options and addressing emerging risks.

For example, some insurance companies are now offering endorsements to DP3 policies that provide coverage for flood damage or earthquake damage. Others are incorporating smart home technology into their policies, offering discounts to homeowners who install devices that can detect leaks, prevent fires, or deter burglars.

Staying informed about these developments and adapting your insurance coverage accordingly is crucial for protecting your property and ensuring your financial security. The DP3 policy, with its adaptability and focus on dwelling protection, will likely remain a valuable tool for homeowners and landlords alike in the years to come.

The rhythmic tapping of rain against the windowpane, once a soothing sound, can turn ominous when you're unsure if your home is truly protected. A DP3 policy, while not a magical shield against all misfortune, offers a significant layer of security, especially for those who rent out their properties or own vacant dwellings. It's a reminder that being informed and prepared is the best way to weather any storm, both literally and figuratively. Taking the time to understand the nuances of this type of insurance can be the difference between a minor inconvenience and a major financial setback. And that, ultimately, is peace of mind worth pursuing.

.png)