What Is A Good Delta For Options

Imagine yourself standing at the edge of a vast, shimmering ocean, the stock market stretching out before you like an endless horizon. The waves represent the fluctuating prices of stocks, and you're holding a surfboard: your options contract. You’re trying to figure out how to ride these waves, but something keeps eluding you – a sense of direction, a reliable compass to guide you through the unpredictable swells. That compass, in the world of options trading, is often the delta.

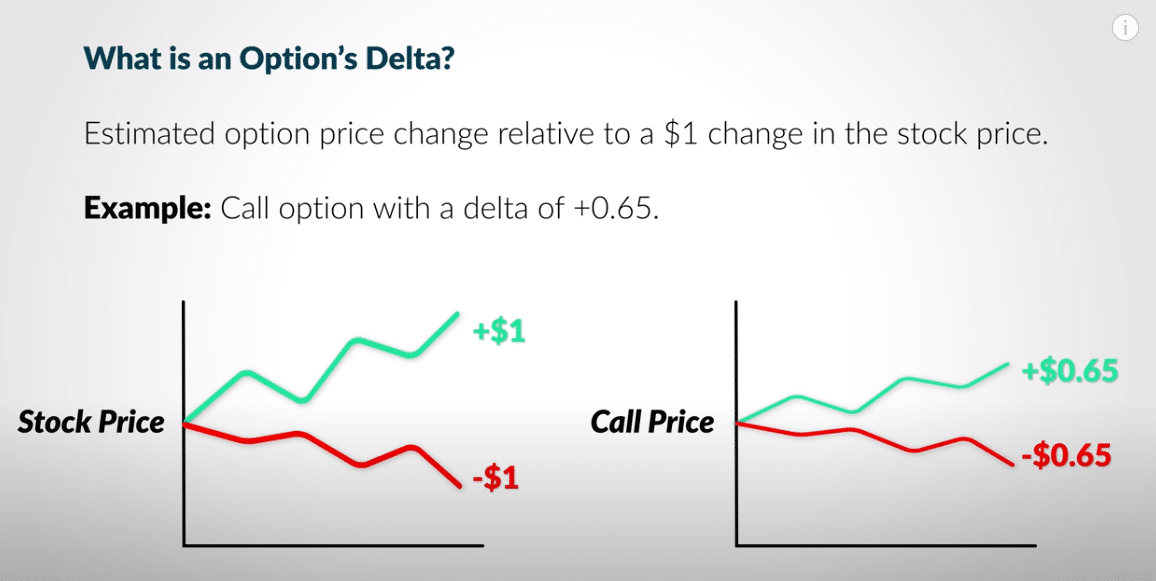

Understanding delta is crucial for anyone navigating the options market. It's not a magic number, but rather a dynamic tool that provides insight into how an option's price is expected to change in relation to a $1 move in the underlying asset. Knowing what constitutes a "good" delta depends entirely on your trading strategy, risk tolerance, and market outlook.

Deciphering Delta: The Basics

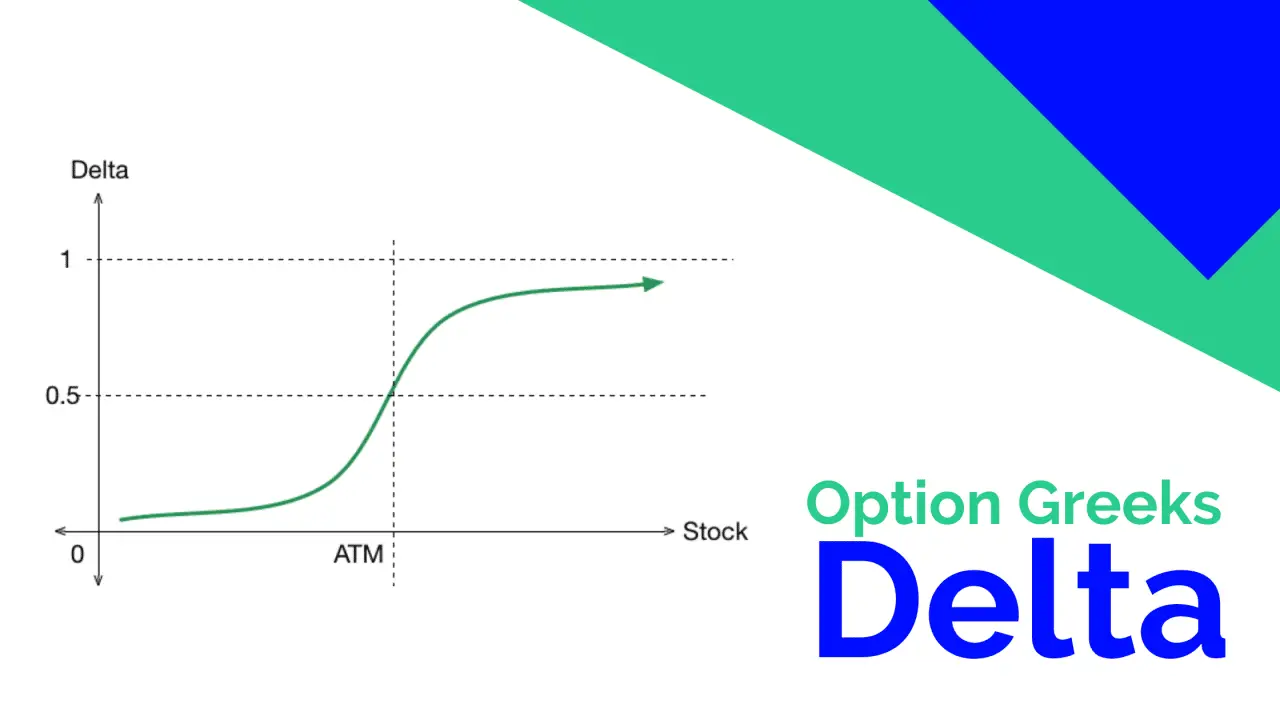

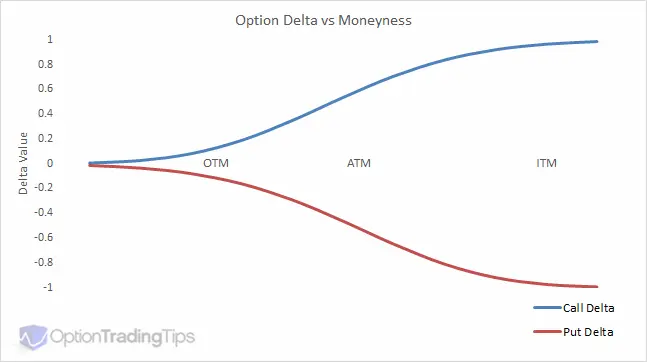

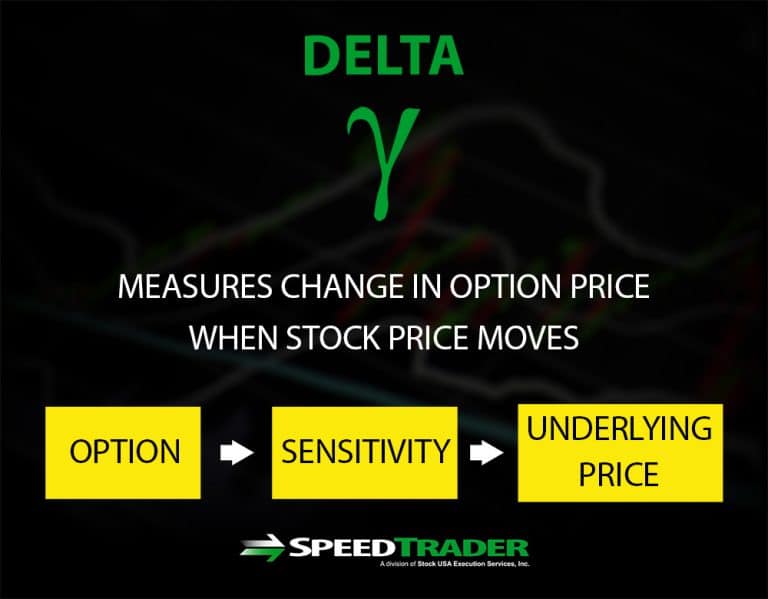

Delta is a Greek letter used in options trading to represent the sensitivity of an option's price to changes in the price of the underlying asset. It's a number between -1 and 1 for options on stocks. Call options have a positive delta (ranging from 0 to 1), meaning their price tends to increase as the underlying stock price rises. Put options have a negative delta (ranging from -1 to 0), so their price tends to increase as the underlying stock price falls.

A delta of 0.50 for a call option suggests that the option's price will theoretically increase by $0.50 for every $1 increase in the underlying stock price, all other factors being constant. Similarly, a delta of -0.50 for a put option suggests that the option's price will increase by $0.50 for every $1 decrease in the underlying stock price. Remember, these are just approximations, and the actual change can vary.

Understanding Delta Values

The closer the delta is to 1 or -1, the more the option's price will move in sync with the underlying asset. These options are considered "deep in the money." Options with delta values closer to 0 are less sensitive to price changes in the underlying asset. These options are typically "out of the money."

An "at-the-money" option, with its strike price closest to the current market price of the underlying asset, usually has a delta around 0.50 for calls and -0.50 for puts. This is a crucial benchmark for understanding the sensitivity of different options contracts.

What Makes a Delta "Good"? It Depends.

There’s no universally "good" delta. The ideal delta value is deeply intertwined with your personal investment goals, risk appetite, and the specific strategy you employ.

For the Directional Trader

If you have a strong directional conviction – meaning you believe a stock will either significantly rise or fall – then you might opt for options with higher delta values, closer to 1 for calls and -1 for puts. These options will offer greater profit potential if your prediction is correct. However, they also carry a higher risk of losing value if the stock moves against your prediction.

Traders who prefer a more conservative approach might choose options with lower delta values. This reduces the potential profit but also limits the downside risk. This strategy might be suitable for those seeking to hedge existing positions or make smaller, more controlled bets on the market.

Delta as a Probability Indicator

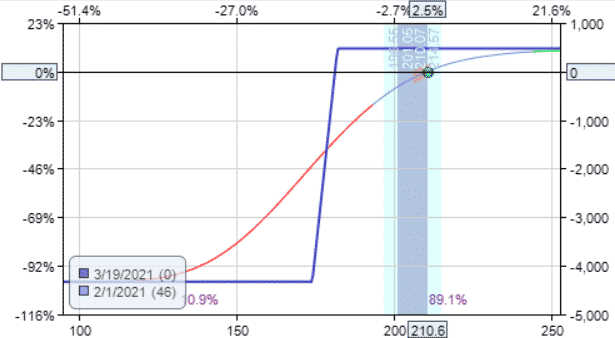

Many traders use delta as a rough estimate of the probability that an option will expire "in the money." For example, a call option with a delta of 0.30 might be interpreted as having roughly a 30% chance of expiring in the money. Keep in mind that this is only an approximation, and other factors influence the actual probability. Volatility, time decay, and the overall market environment all play a role.

Delta and Options Strategies

Different options strategies inherently involve different delta exposures. For instance, a covered call strategy, where you sell call options on stocks you already own, aims to generate income. The delta of the short call option is a key factor in determining the potential income and the risk of having your shares called away.

A straddle, which involves buying both a call and a put option with the same strike price and expiration date, is a volatility play. It profits if the underlying asset makes a significant move in either direction. The combined delta of the call and put options is typically close to zero at the outset, but it will change as the underlying asset's price moves.

Managing Delta: Delta Neutral Strategies

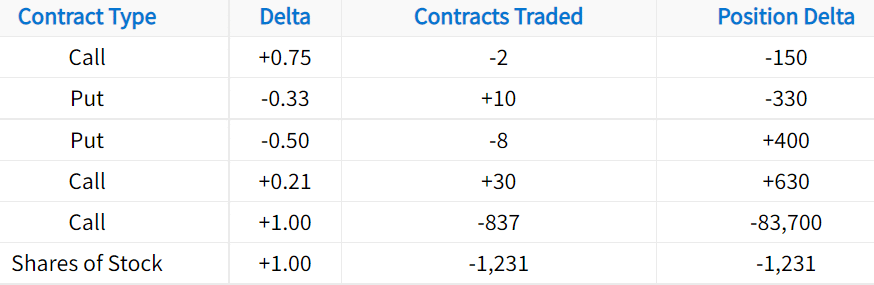

Some advanced traders aim to create delta-neutral portfolios. This involves combining different options and stock positions to achieve a net delta of zero. The goal is to profit from changes in volatility or time decay, rather than relying on directional movements in the underlying asset. This requires constant monitoring and adjustments as delta values change.

Achieving a true delta-neutral position is challenging because delta is dynamic and changes continuously. However, striving for delta neutrality can be a valuable risk management technique.

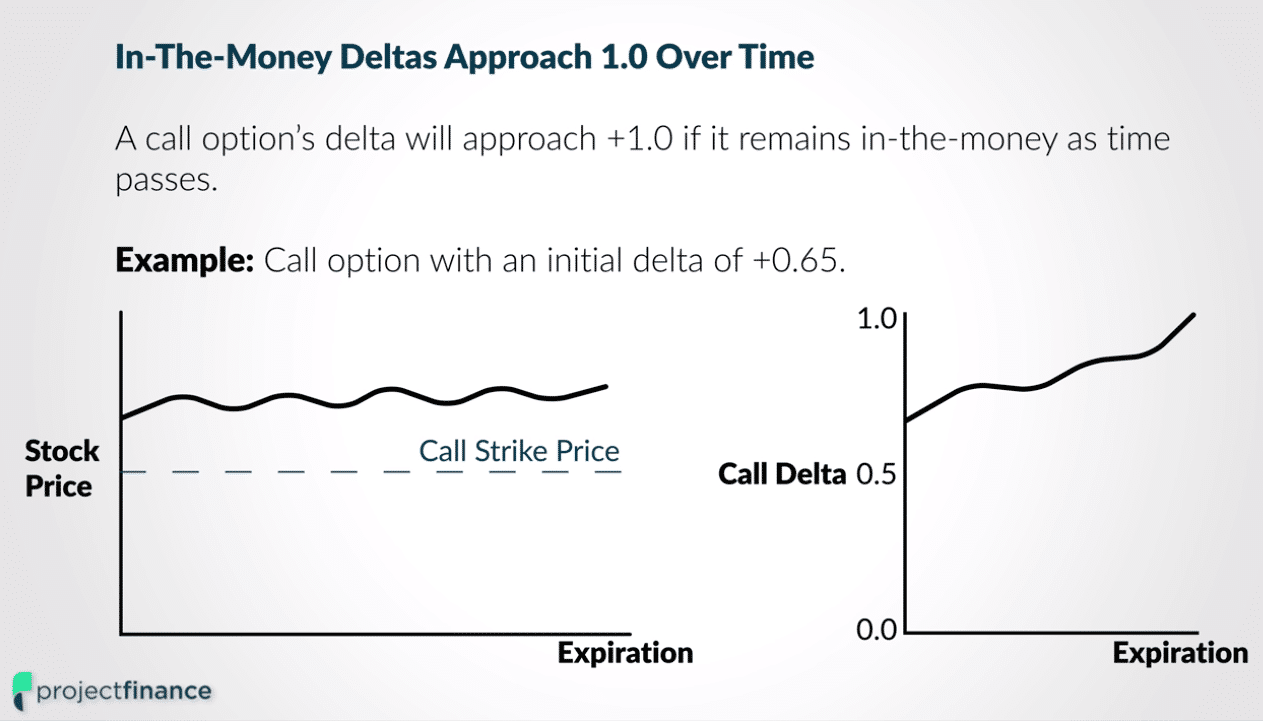

The Importance of Dynamic Delta

It's important to remember that delta is not a static number. It changes as the price of the underlying asset fluctuates, as the expiration date approaches, and as volatility changes. This dynamic nature is why options trading requires constant monitoring and adjustments.

A trader must understand how delta is expected to change under different market conditions. For example, as an option moves deeper in the money, its delta will approach 1 (for calls) or -1 (for puts). This means that the option's price will become increasingly sensitive to changes in the underlying asset's price.

Beyond Delta: A Holistic View

While delta is a crucial factor, it's just one piece of the puzzle. Successful options trading requires a holistic view that considers other Greek letters, such as gamma (the rate of change of delta), theta (time decay), and vega (sensitivity to volatility). It also involves understanding the broader market context, including economic indicators, industry trends, and company-specific news.

Relying solely on delta without considering these other factors can lead to misinformed trading decisions. A well-rounded understanding of options pricing and risk management is essential for long-term success.

Conclusion: Delta as a Guiding Star

Thinking back to that ocean analogy, delta is not the only instrument you need, but it certainly helps you read the waves. There is no "good" delta in isolation; rather, the right delta aligns seamlessly with your strategic objectives, risk tolerance, and your well-researched view of the market. The most valuable skill isn't just understanding what delta is, but how to use it strategically within a broader framework of risk management and market analysis.

As you navigate the options market, remember that continuous learning and adaptation are key. Keep refining your understanding of delta, explore different options strategies, and always manage your risk responsibly. With knowledge and discipline, you can harness the power of options to achieve your financial goals.