What Is Atm In Stock Market

In the high-stakes arena of the stock market, where fortunes can be made and lost in the blink of an eye, a new term has been gaining traction: ATM. It's not the familiar cash dispenser, but rather a complex trading strategy involving the use of options. This strategy has sparked both excitement and concern, with some analysts hailing it as a sophisticated tool for generating income, while others warn of its potential to amplify market volatility.

The ATM strategy, short for "At-The-Money" option selling, involves selling both call and put options that have strike prices closest to the current market price of the underlying asset. This article delves into the intricacies of this strategy, exploring its mechanics, risks, potential rewards, and the ongoing debate surrounding its impact on market stability.

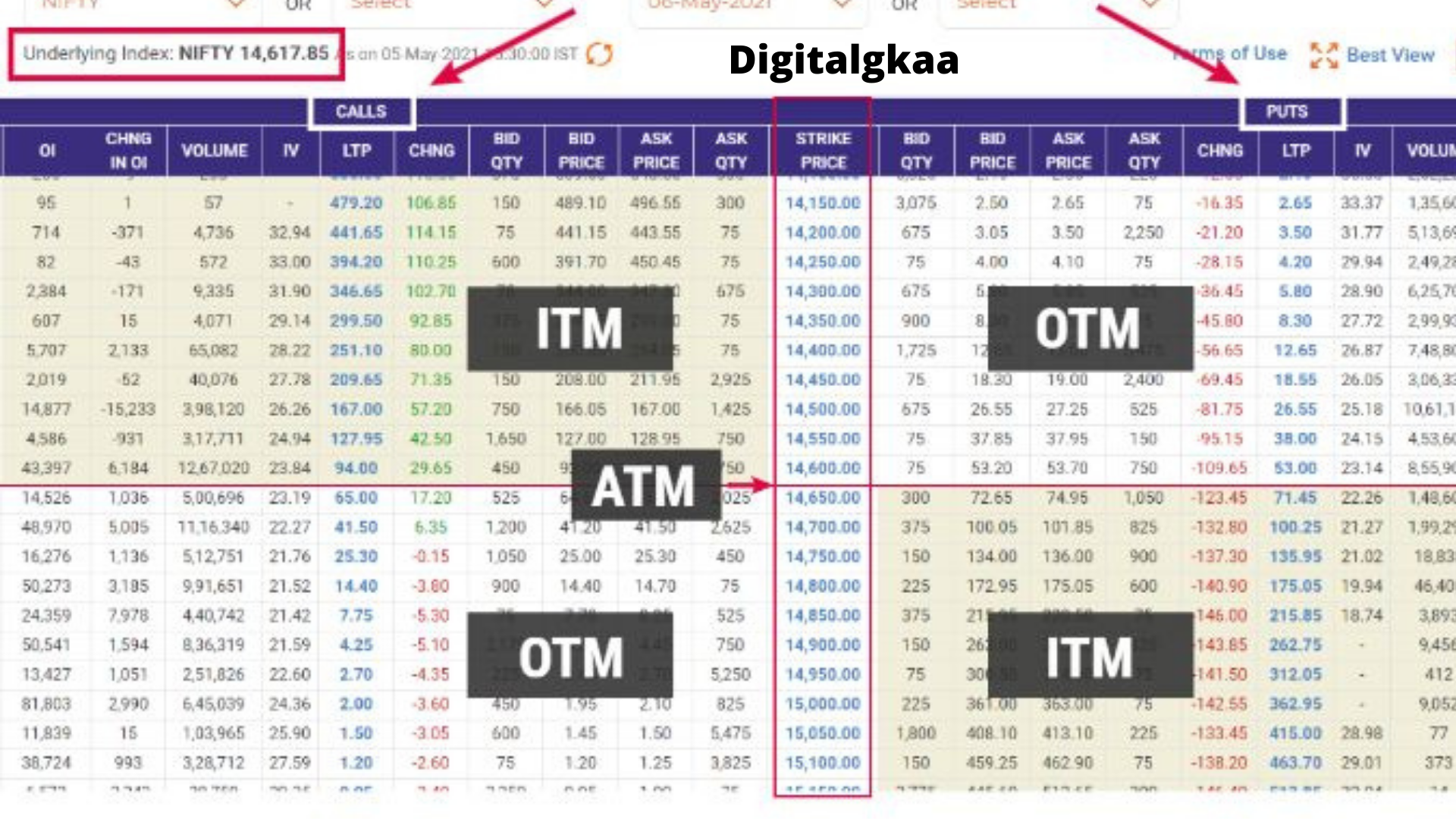

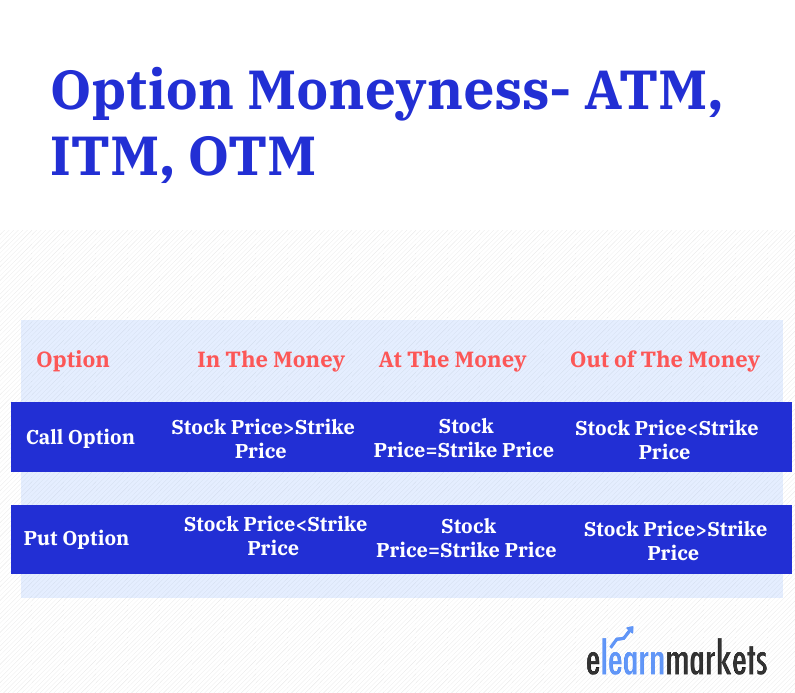

Understanding At-The-Money Options

An "At-The-Money" (ATM) option is a contract whose strike price is closest to the current market price of the underlying asset. For example, if a stock is trading at $100, the $100 call option and the $100 put option would both be considered ATM.

Options give the buyer the right, but not the obligation, to buy (in the case of a call) or sell (in the case of a put) the underlying asset at the strike price on or before the expiration date. The seller of the option, on the other hand, is obligated to fulfill the contract if the buyer exercises it.

How the ATM Strategy Works

The ATM strategy typically involves selling both an ATM call option and an ATM put option on the same underlying asset with the same expiration date. This is known as a short straddle or a short strangle.

The seller collects a premium from both the call and put options. The maximum profit is the total premium received, which is achieved if the stock price remains at or very near the strike price at expiration.

The risk, however, is substantial. If the stock price moves significantly in either direction (up or down), the seller could face unlimited losses on the call option if the price rises or potentially large losses on the put option if the price plummets.

The Appeal and the Risks

The primary appeal of the ATM strategy lies in its potential to generate consistent income. Because options decay in value as they approach expiration, the seller benefits from this time decay.

Many traders utilize this strategy when they anticipate relatively low volatility in the underlying asset. The idea is that the stock price will remain within a narrow range, allowing the options to expire worthless and the seller to keep the premium.

However, the risks are considerable. Unexpected news, earnings announcements, or macroeconomic events can cause the stock price to swing dramatically, leading to significant losses for the option seller. Furthermore, because the potential losses are theoretically unlimited (especially on the short call), prudent risk management is essential.

Risk Management Techniques

Traders employing the ATM strategy often use various risk management techniques to mitigate potential losses. These include setting stop-loss orders, hedging with other options or assets, and carefully monitoring the underlying asset's volatility.

Another common technique is to roll the options to a later expiration date if the stock price moves against the seller. This involves buying back the existing options (potentially at a loss) and selling new options with a later expiration date and possibly different strike prices.

The use of sophisticated algorithms and automated trading systems has also become prevalent in managing ATM option positions, allowing traders to react quickly to changing market conditions.

The Debate on Market Impact

The growing popularity of ATM option selling has raised concerns among some market analysts. They argue that it can contribute to increased market volatility and potentially destabilize prices.

The argument is that large-scale selling of ATM options can create a "gamma squeeze" effect. Gamma is a measure of how much an option's delta (its sensitivity to changes in the underlying asset's price) changes as the price of the underlying asset moves.

As the stock price moves away from the strike price of the ATM options, option dealers who have sold the options may need to hedge their positions by buying or selling the underlying asset, further amplifying the price movement and potentially creating a feedback loop.

Counterarguments and Alternative Perspectives

However, proponents of the ATM strategy argue that it provides liquidity to the options market and helps to stabilize prices by providing a counterparty to buyers. They also point out that the impact of ATM selling on overall market volatility is likely to be limited unless it reaches an extremely large scale.

Others argue that market volatility is driven by a multitude of factors, including macroeconomic conditions, investor sentiment, and news events, and that attributing it solely to ATM option selling is an oversimplification.

Moreover, regulations and risk management practices among institutional investors help to limit the potential for excessive risk-taking and mitigate the systemic impact of ATM strategies.

The Future of ATM Strategies

The ATM option selling strategy is likely to remain a popular tool for sophisticated traders seeking to generate income in a relatively low-volatility environment. However, it is crucial for traders to understand the risks involved and to implement robust risk management techniques.

Regulatory oversight of the options market is also likely to continue to evolve, with a focus on ensuring market stability and preventing excessive risk-taking. Increased transparency and reporting requirements may also be implemented to provide greater visibility into the activities of large option sellers.

Ultimately, the impact of ATM strategies on the stock market will depend on a complex interplay of factors, including market conditions, regulatory policies, and the risk management practices of individual traders and institutions.

_121721.png)