What Is Fund Accounting Investopedia

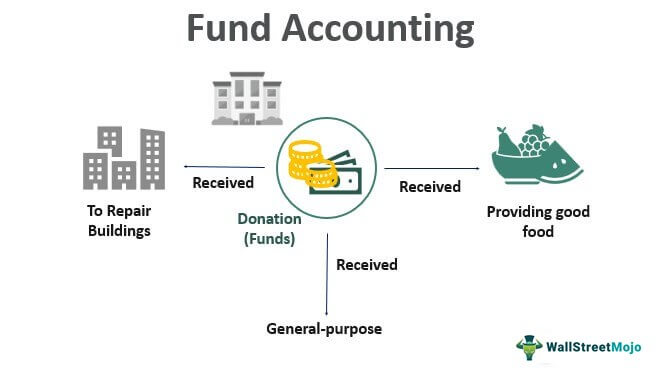

Imagine you're managing a bustling community center, a place of vibrant programs and diverse needs. Funds arrive earmarked for specific purposes – youth sports, senior care, arts initiatives. You need to ensure every dollar is spent exactly where it's intended, creating a transparent and trustworthy environment for your donors and the community you serve. This is the essence of fund accounting – precision and accountability at the heart of non-profit and governmental organizations.

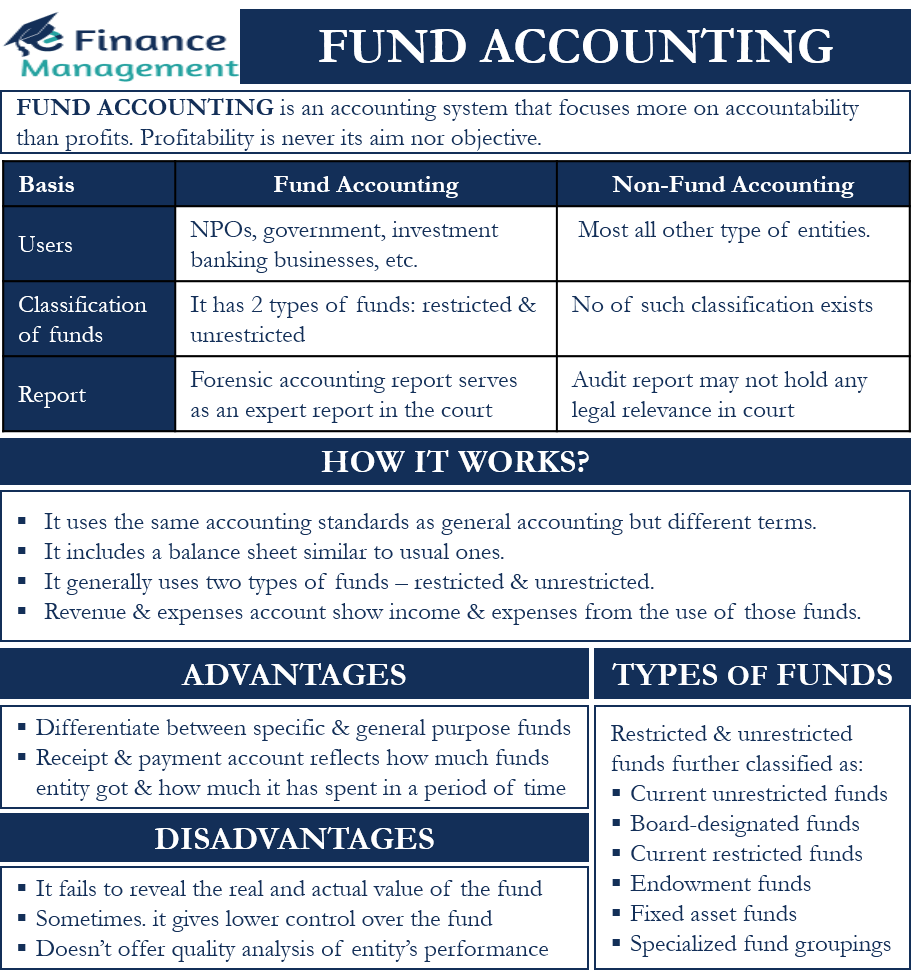

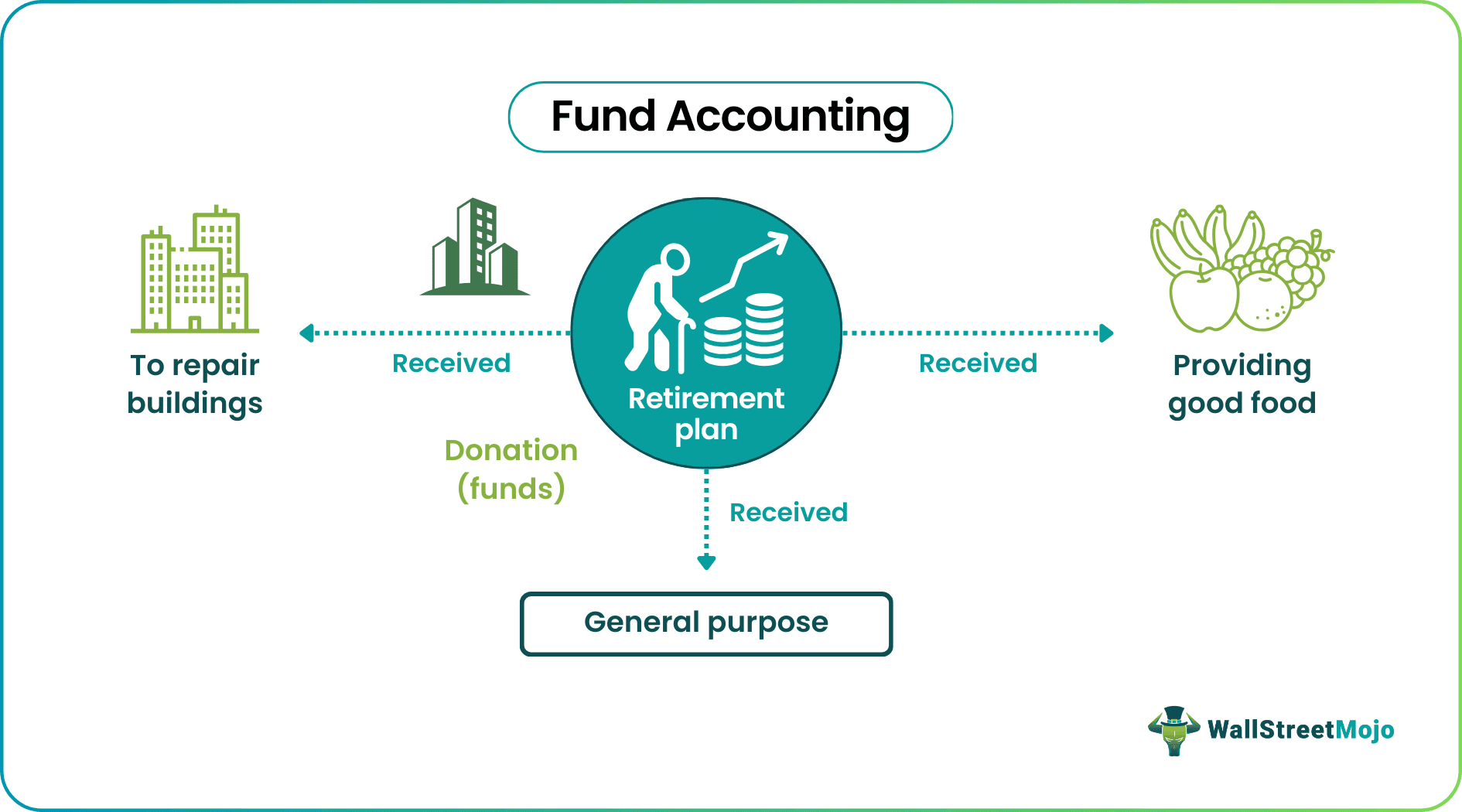

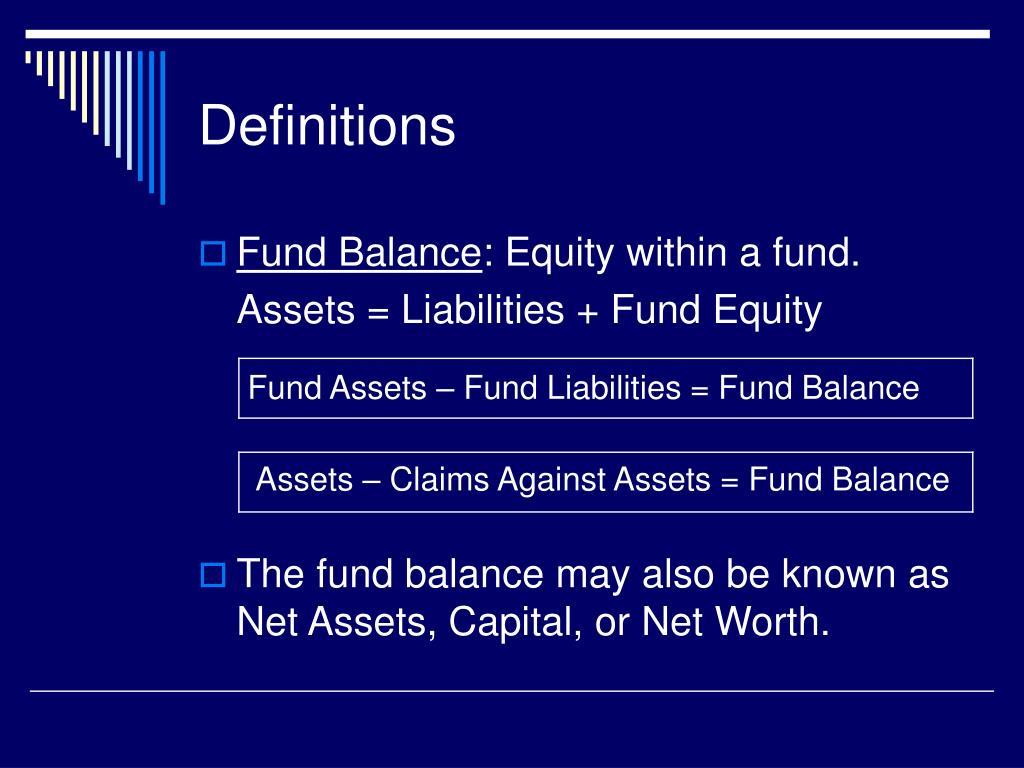

At its core, fund accounting is a specialized accounting system focusing on accountability and stewardship of resources. It ensures money is spent according to donor restrictions and legal requirements. This method separates resources into distinct funds, each with its own balance sheet, to track income and expenses independently.

The Foundation of Fund Accounting

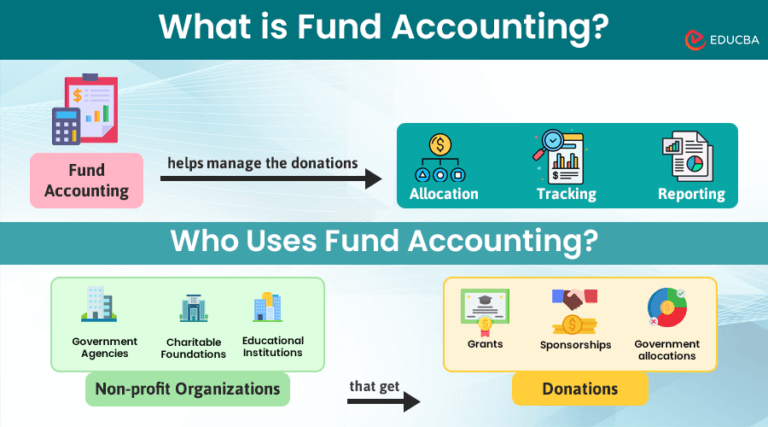

Fund accounting arose from the unique financial needs of non-profit organizations and governmental entities. Unlike for-profit businesses, these entities often receive donations, grants, and tax revenue that come with stipulations. These stipulations dictate how the funds can be used, necessitating a system to track and report on each restricted fund separately.

Historically, the evolution of fund accounting reflects growing demands for transparency and financial responsibility. As the public increasingly scrutinized non-profit spending, the need for a robust accounting framework became paramount. This led to the development of generally accepted accounting principles (GAAP) tailored for non-profit organizations and governmental bodies, ensuring consistency and comparability in financial reporting.

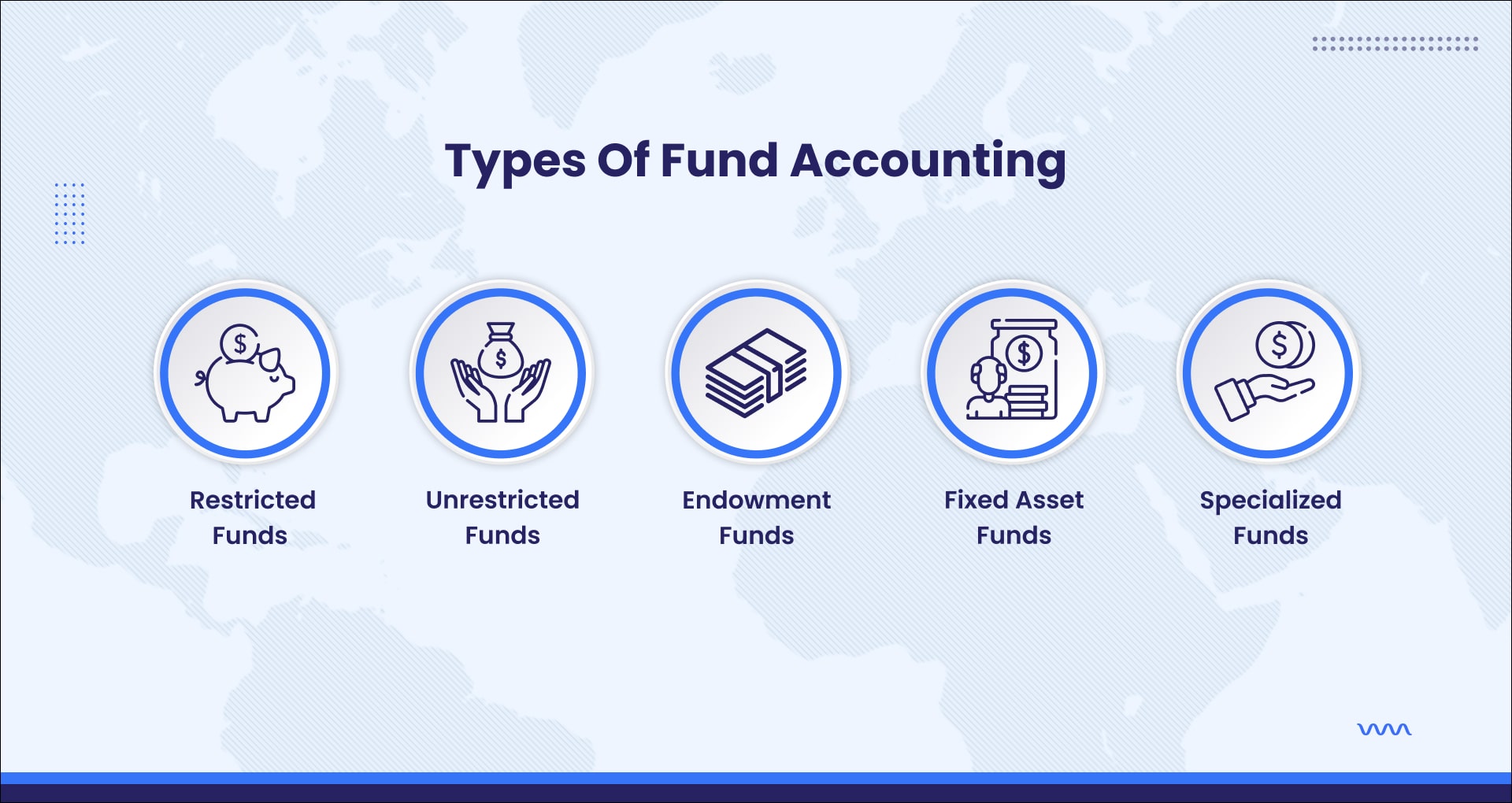

Types of Funds

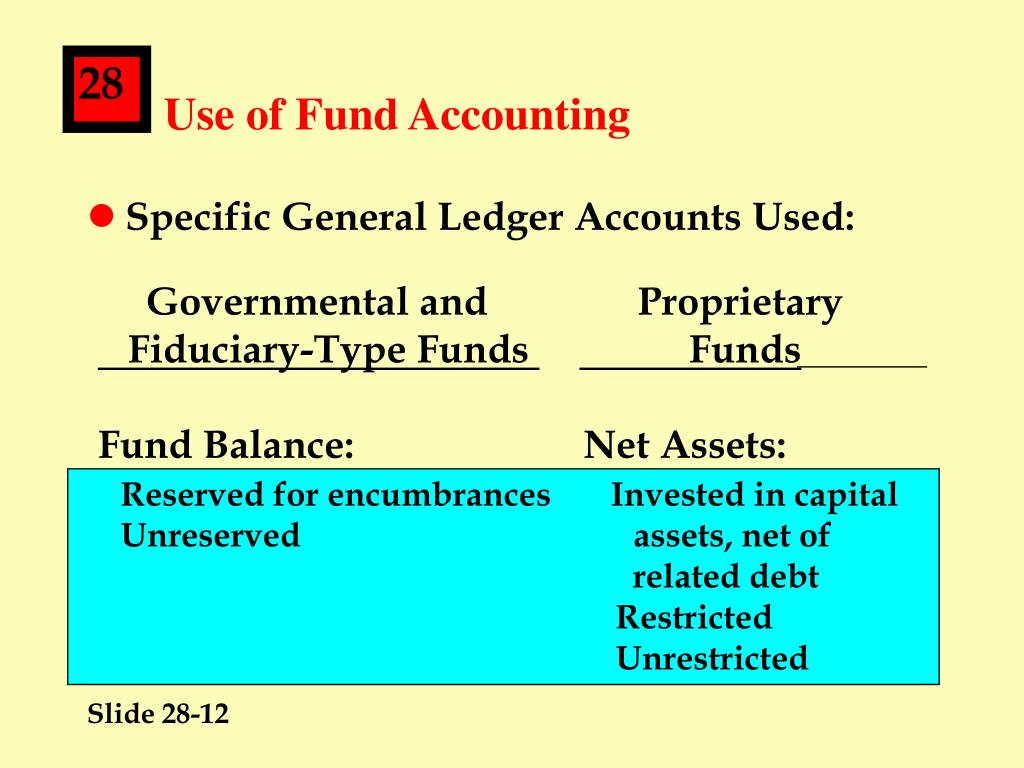

Fund accounting employs different categories of funds, each serving a specific purpose. These categories typically fall into two main classifications: governmental funds and proprietary funds.

Governmental funds account for the core government services, such as general operations, public safety, and infrastructure. These funds are typically financed through taxes and grants.

Proprietary funds, on the other hand, operate more like businesses, providing goods or services to the public for a fee. Examples include utilities, hospitals, or public transportation systems.

Why Fund Accounting Matters

The significance of fund accounting extends beyond mere compliance. It fosters trust among donors, stakeholders, and the public.

By demonstrating meticulous management of resources, organizations can build stronger relationships with their supporters. Proper fund accounting allows organizations to demonstrate they use resources wisely to achieve their mission.

Furthermore, it aids in strategic decision-making, providing insights into the financial health of each program or service. This allows for better resource allocation and improved operational efficiency.

Challenges and Future Trends

While essential, fund accounting presents unique challenges. It can be complex, requiring specialized expertise and software.

Maintaining accurate records and ensuring compliance with regulations can be demanding. The increasing complexity of grant funding and donor restrictions also adds to the burden.

Looking ahead, technology is poised to play a significant role in simplifying fund accounting processes. Cloud-based accounting solutions and automated reporting tools offer greater efficiency and transparency. These innovations will allow organizations to focus less on manual tasks and more on their core mission.

Ultimately, fund accounting is about safeguarding resources and upholding the public trust. It is a powerful tool that enables non-profit and governmental organizations to fulfill their missions effectively and ethically. It is a commitment to accountability, ensuring that every dollar makes a difference in the lives of those they serve.

"Fund accounting ensures resources are used effectively and in accordance with donor intentions,"stated a recent report by the NonProfit Financial Managers Association.

![What Is Fund Accounting Investopedia Fund Accounting: A Comprehensive Guide [With Example]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2023/02/word-image-59332-1-969x1024.png)