What Is Included In The Post Closing Trial Balance

The post-closing trial balance, a critical document in the accounting cycle, provides a snapshot of a company's financial standing after all closing entries have been posted. It ensures that all debits and credits are equal, forming the basis for preparing accurate financial statements. Understanding its components is essential for accountants, auditors, and anyone involved in financial reporting.

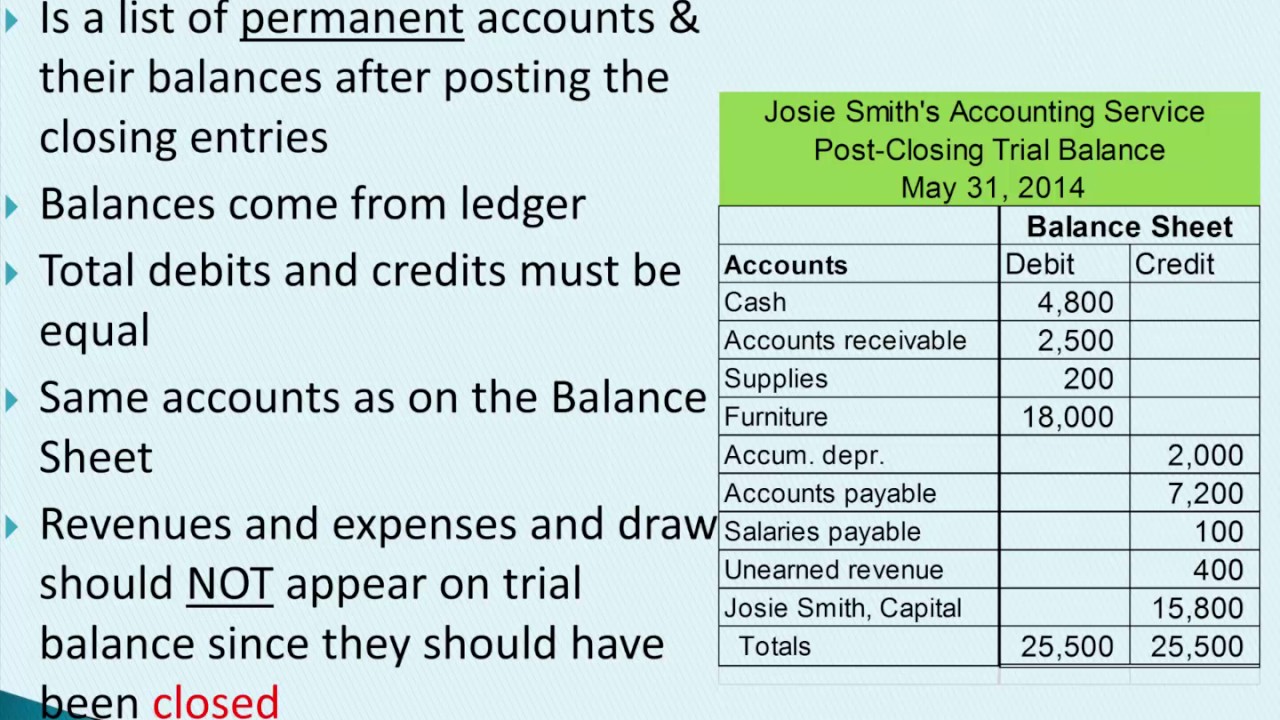

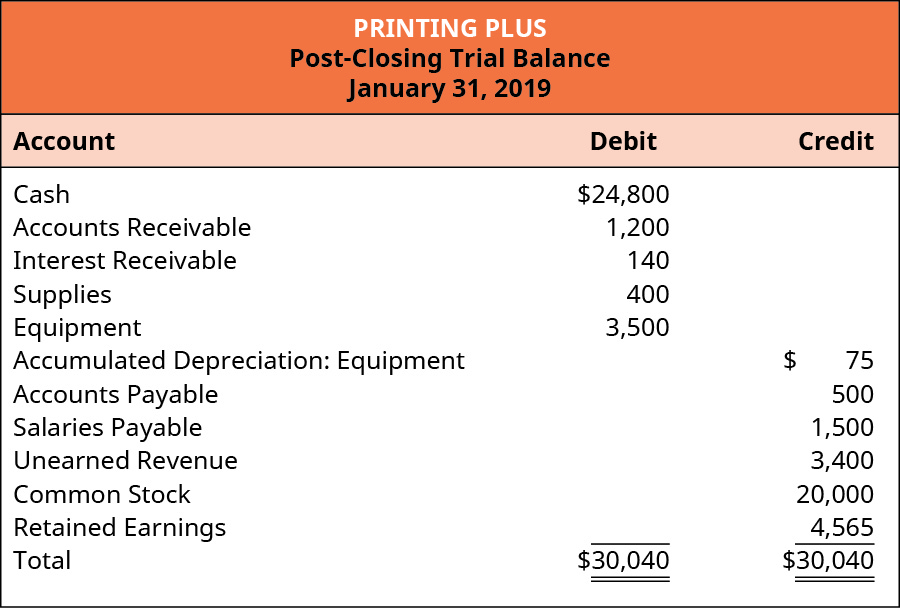

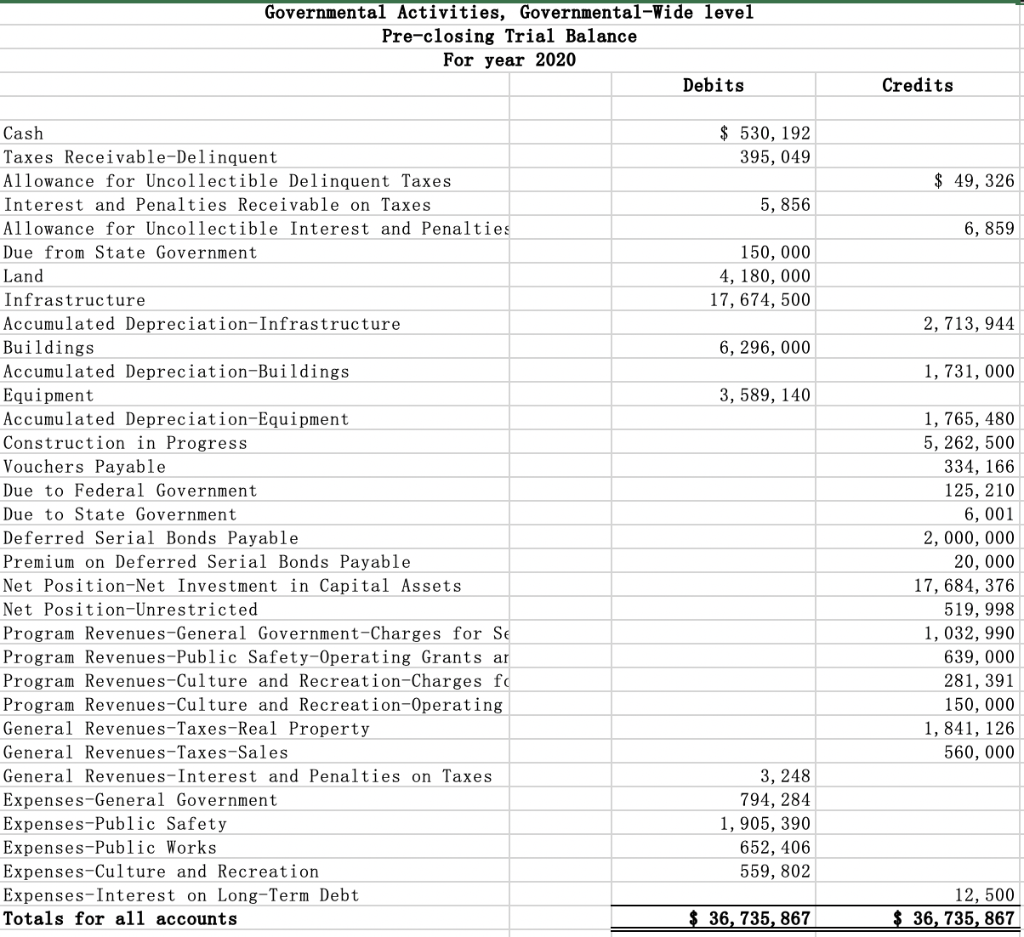

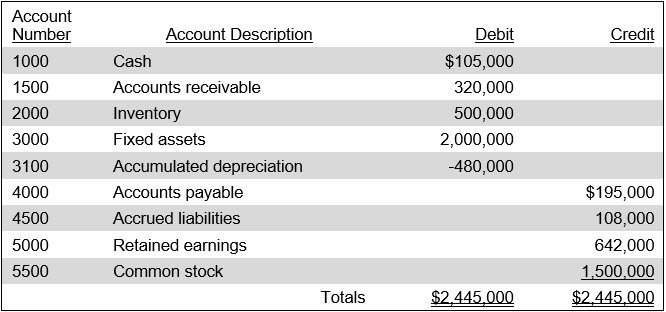

At its core, the post-closing trial balance is a list of all permanent accounts – assets, liabilities, and equity – that have non-zero balances after the closing process. This document serves as a crucial verification step, confirming the arithmetical accuracy of the general ledger following the end-of-period closing activities. This is what ensures the accounting equation (Assets = Liabilities + Equity) remains balanced.

Key Components of the Post-Closing Trial Balance

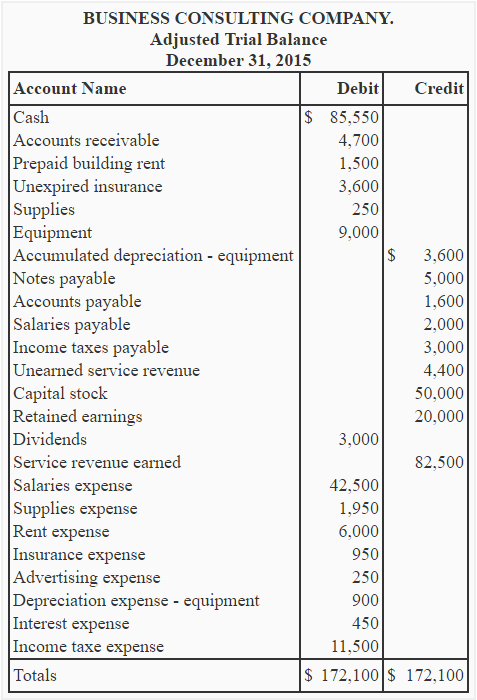

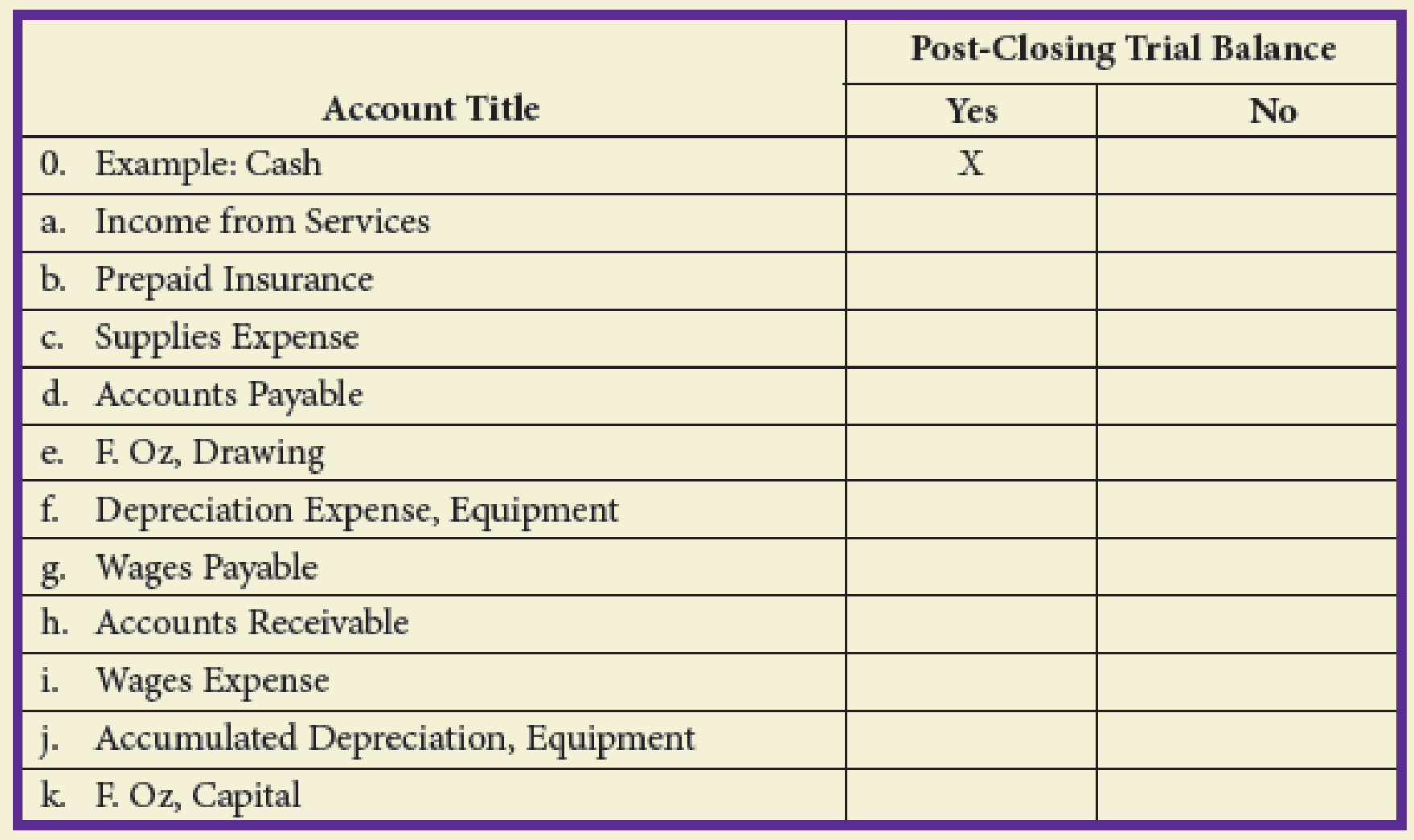

The post-closing trial balance exclusively features permanent accounts, also known as real accounts. These accounts carry their balances forward from one accounting period to the next. Temporary accounts, or nominal accounts, are closed out.

Asset Accounts

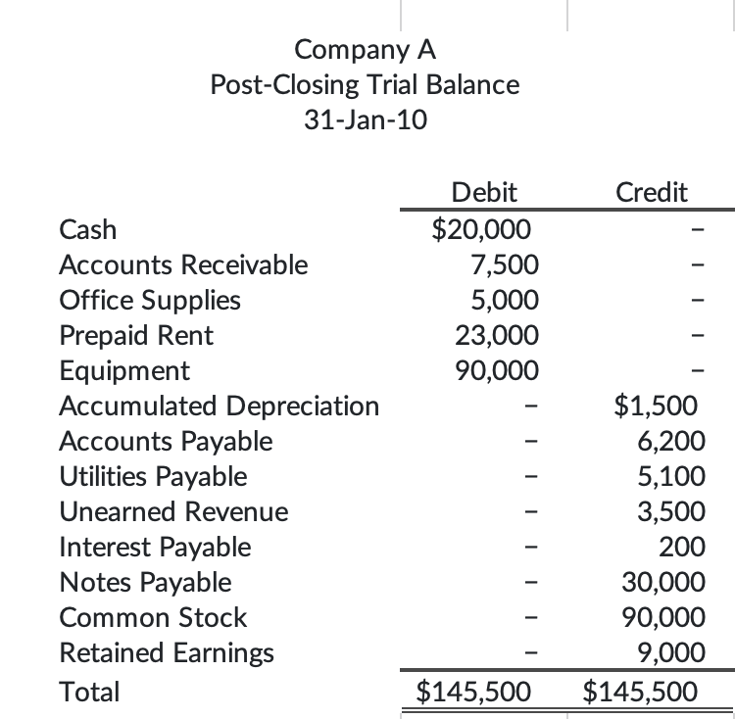

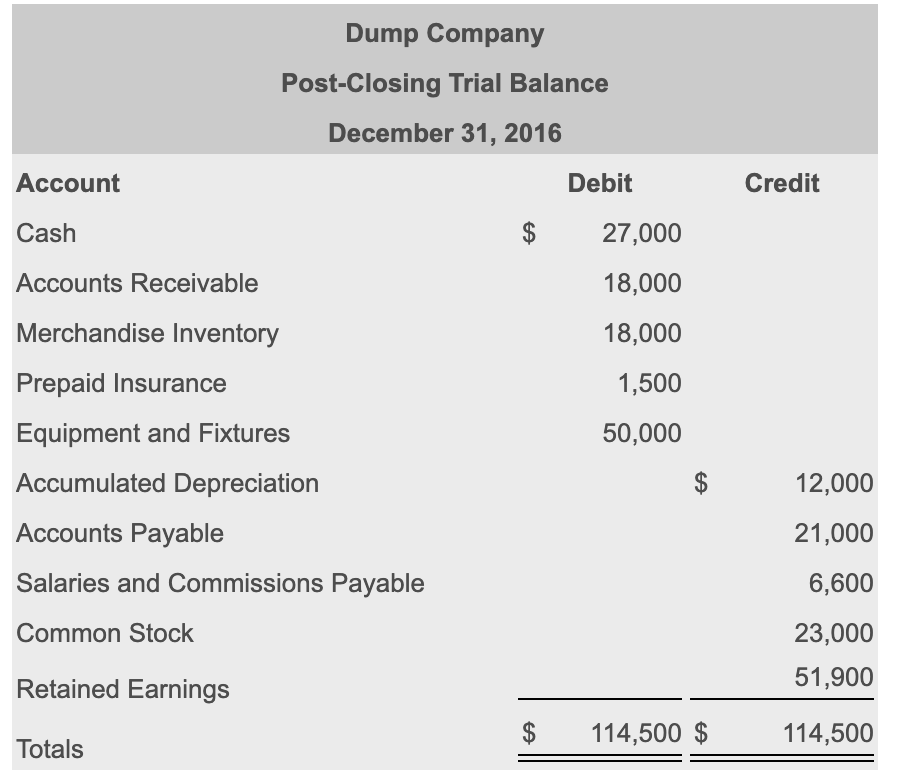

Asset accounts represent what a company owns. Common examples include cash, accounts receivable (money owed to the company by customers), inventory, prepaid expenses, land, buildings, equipment, and investments. These figures are presented at their ending balances after all relevant adjustments and closing entries have been made.

For instance, if a company had $50,000 in its cash account before closing and made a closing entry debiting cash by $10,000 (perhaps from revenue collection), the post-closing trial balance would reflect a cash balance of $60,000. The integrity of asset valuation is central to accurate balance sheet reporting.

Liability Accounts

Liability accounts reflect what a company owes to others. Examples include accounts payable (money owed to suppliers), salaries payable, unearned revenue, notes payable, and bonds payable. These balances represent the company's obligations at the end of the accounting period.

For example, if a company has $20,000 in accounts payable and no further transactions affect this account during the closing process, the post-closing trial balance will show a balance of $20,000. Accurate liability representation is fundamental for understanding a company's financial solvency.

Equity Accounts

Equity accounts represent the owners' stake in the company. The most common equity accounts are common stock, retained earnings, and additional paid-in capital. These accounts reflect the cumulative profitability and investment in the business over time.

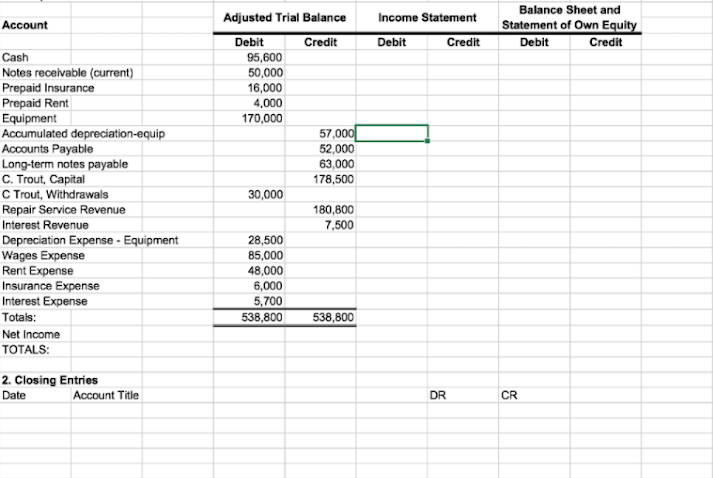

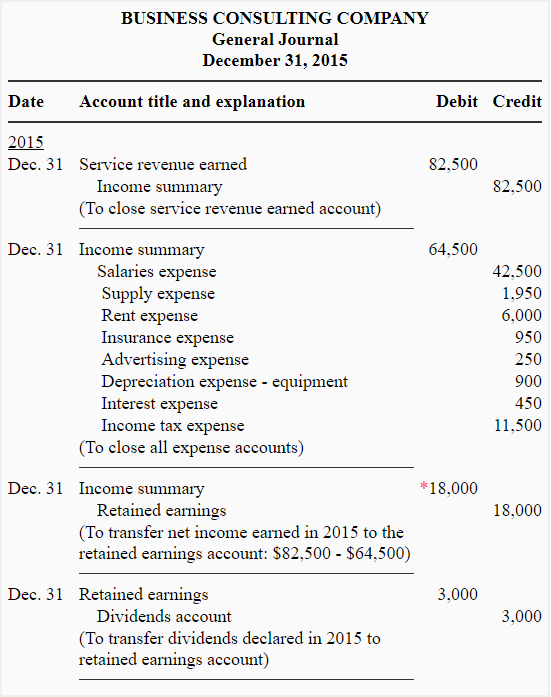

Retained earnings, specifically, represent the accumulated profits of the company less any dividends paid out. The closing process transfers the net income (or net loss) from the income statement to the retained earnings account, adjusting the equity balance accordingly. The balance in retained earnings will appear on the post-closing trial balance.

What Is NOT Included

Crucially, the post-closing trial balance does not include any temporary accounts. These accounts, also known as nominal accounts, are used to track revenues, expenses, gains, and losses during the accounting period.

Temporary accounts are closed out at the end of the period, meaning their balances are transferred to retained earnings (or another appropriate equity account). Therefore, accounts like sales revenue, cost of goods sold, salaries expense, and depreciation expense will not appear on the post-closing trial balance.

The absence of temporary accounts ensures that the post-closing trial balance only shows the balances that will carry over into the next accounting period. This clear delineation between permanent and temporary accounts is essential for maintaining accurate financial records.

Significance and Impact

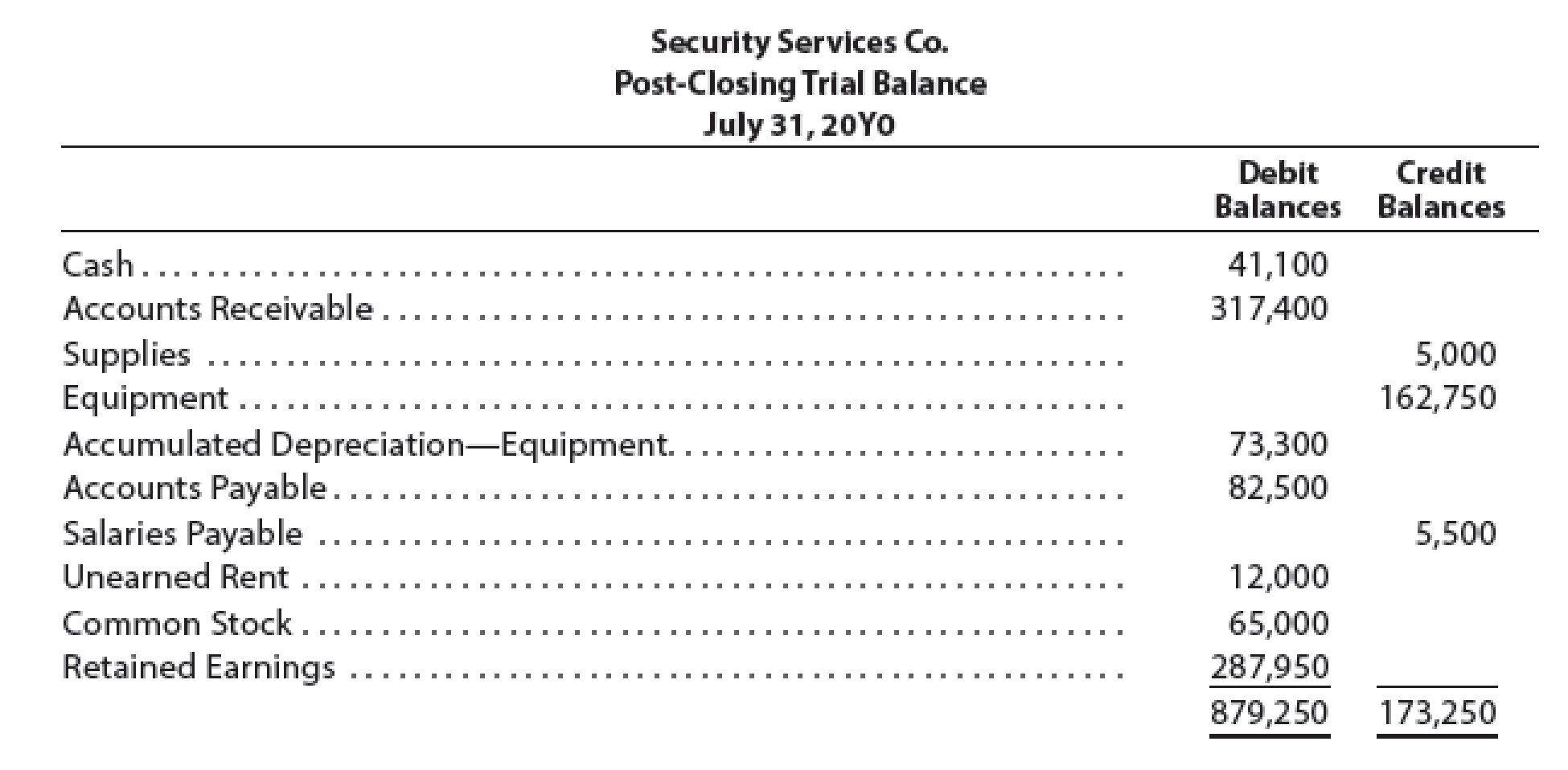

The post-closing trial balance serves as a vital control mechanism in the accounting process. It ensures that the total debits equal the total credits, verifying the accuracy of the closing entries and the overall balance of the general ledger.

Without a balanced post-closing trial balance, financial statements would be unreliable. It is a crucial step in producing credible financial reports. It is also essential for auditors to assess the fairness and accuracy of a company’s financial position.

By confirming the equality of debits and credits, the post-closing trial balance provides assurance to stakeholders – including investors, creditors, and management – that the company's financial information is accurate and reliable.

"The post-closing trial balance is more than just a list of accounts; it's a testament to the integrity of the accounting process,"says Susan Miller, a CPA and accounting professor.

Example Scenario

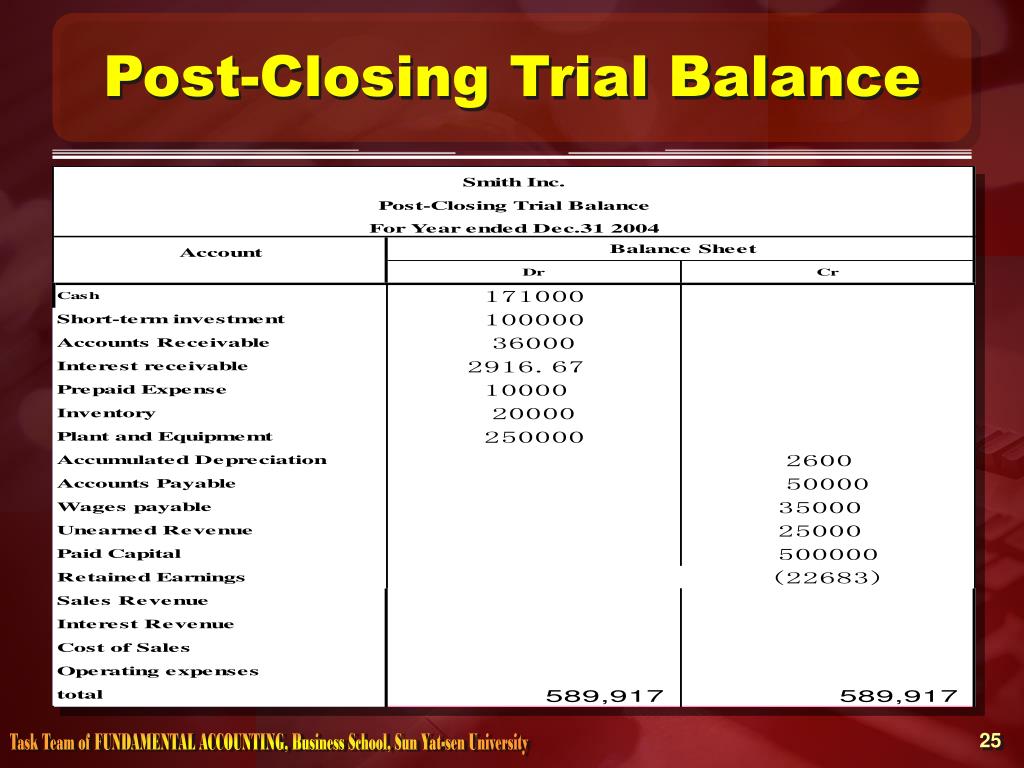

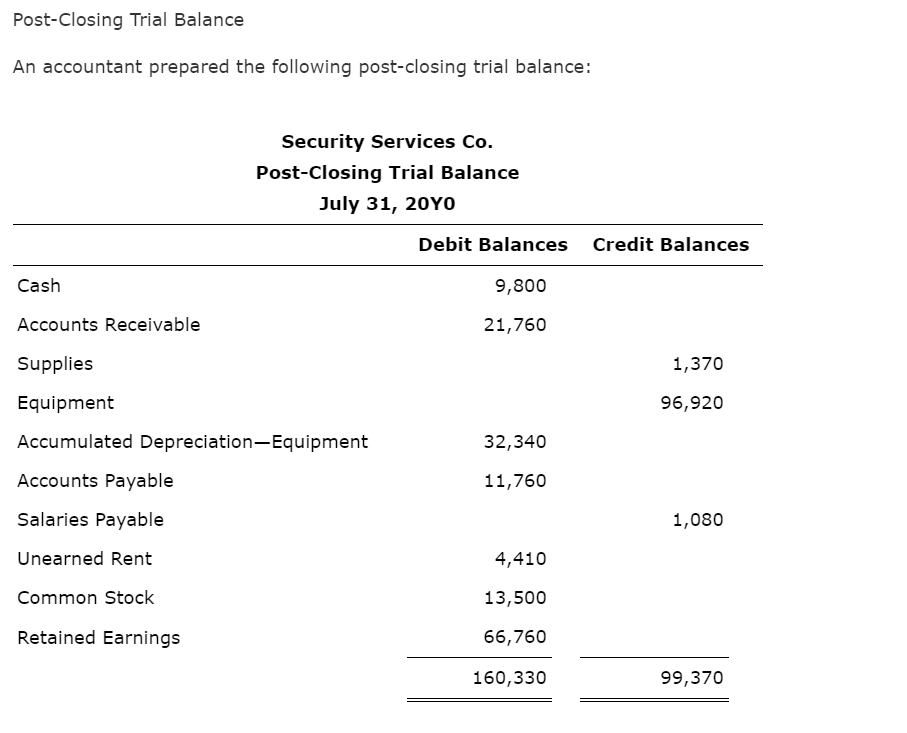

Imagine a small retail business, "Sunshine Goods," preparing its year-end financial statements. After posting all adjusting and closing entries, Sunshine Goods generates a post-closing trial balance.

This balance sheet shows balances for Cash, Accounts Receivable, Inventory, Equipment, Accounts Payable, and Retained Earnings. Notably absent are Sales Revenue and Salaries Expense, as these temporary accounts have been closed out to Retained Earnings.

If the total debits (assets) on the post-closing trial balance equal the total credits (liabilities and equity), Sunshine Goods can proceed with confidence in preparing its balance sheet. Should the debits and credits not match, Sunshine Goods must thoroughly investigate and correct the errors before generating the financial statements.

Conclusion

In summary, the post-closing trial balance provides a critical confirmation of the accuracy of the general ledger after the closing process. By including only permanent accounts and excluding temporary accounts, it serves as a clean slate for the next accounting period.

Understanding its purpose and components is essential for anyone involved in financial reporting. Maintaining a balanced post-closing trial balance is the cornerstone of accurate and reliable financial statements.

Accurate financials foster trust in companies. By producing reliable reports, the integrity and well-being of financial institutions is enhanced.