What Is Meant By Comparability When Discussing Financial Accounting Information

In the high-stakes world of finance, where billions of dollars change hands daily, the reliability and relevance of financial information are paramount. But beyond accuracy and timeliness lies another crucial characteristic: comparability. Without it, investors, creditors, and other stakeholders are left adrift, unable to effectively assess and compare the financial performance of different companies, hindering informed decision-making and potentially destabilizing markets.

Comparability, in the context of financial accounting information, refers to the quality that enables users to identify similarities and differences between two or more sets of economic phenomena. This means that financial statements, prepared using standardized accounting principles and practices, should allow stakeholders to make meaningful comparisons across different companies, industries, and even time periods, fostering a transparent and efficient allocation of capital. This article delves into the nuances of comparability, exploring its significance, challenges, and the ongoing efforts to enhance it globally.

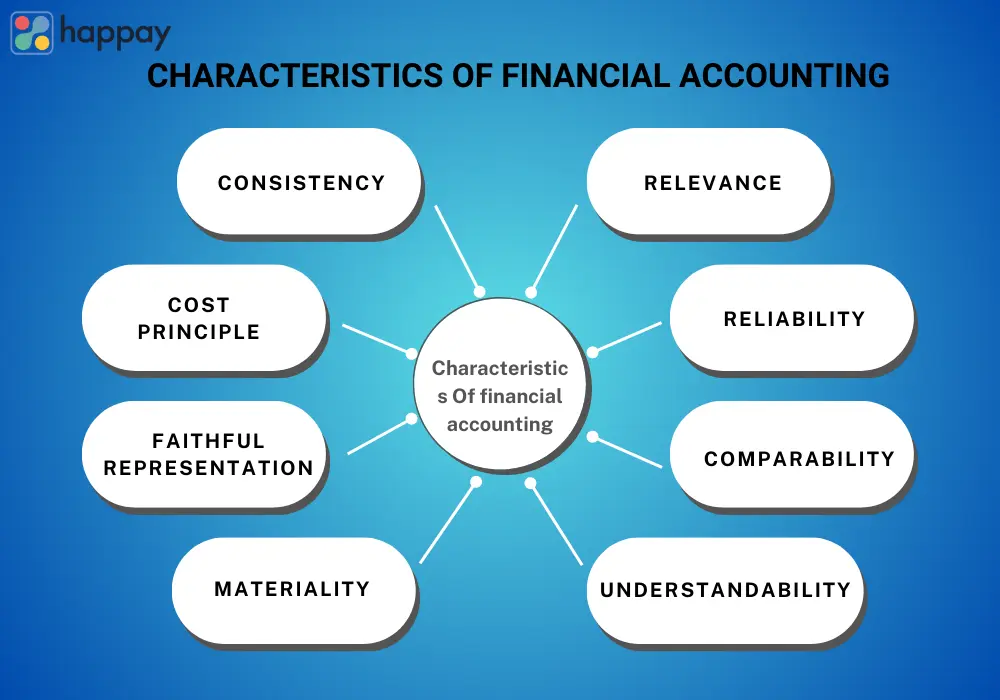

The Core of Comparability

At its heart, comparability is about leveling the playing field. It's about ensuring that companies are not using accounting gimmicks or inconsistent methods to artificially inflate their performance or obscure their true financial position.

The International Financial Reporting Standards (IFRS) Foundation emphasizes comparability as one of the fundamental qualitative characteristics of useful financial information. Their framework states that comparable information allows users to "identify and understand similarities in, and differences among, items."

Types of Comparability

Comparability isn't a monolithic concept. It branches into several distinct, yet interconnected, facets:

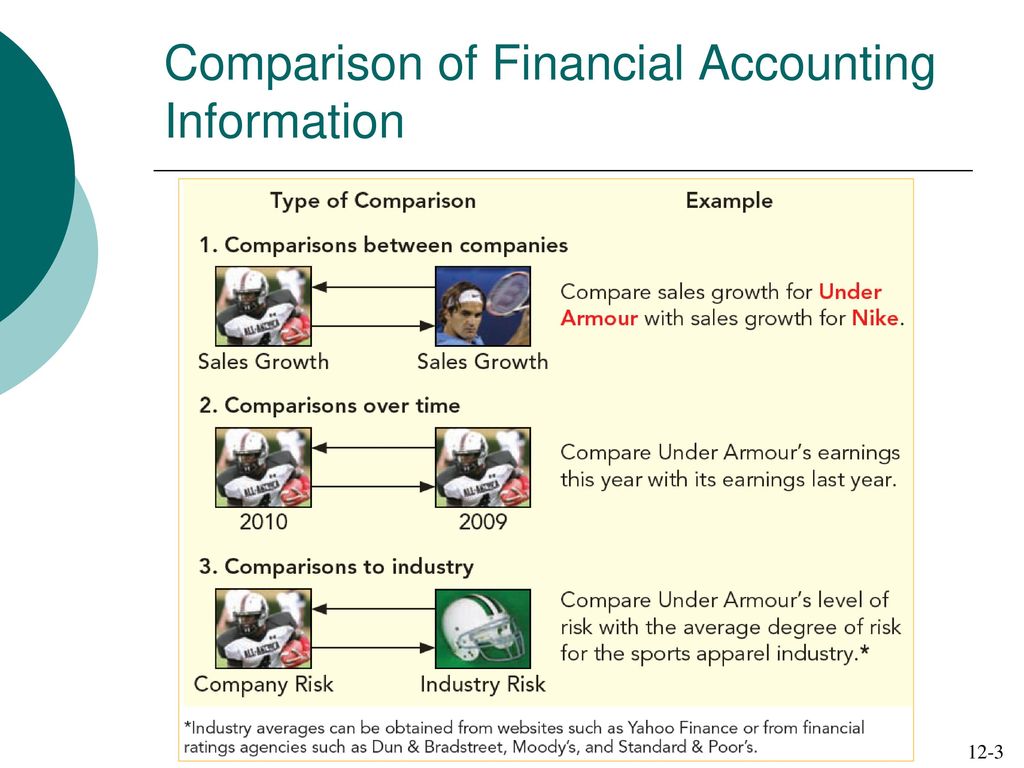

Inter-company comparability: This is perhaps the most commonly understood form of comparability. It enables investors to compare the financial performance and position of different companies within the same industry or across industries. Standardized accounting practices are critical for this type of analysis.

Intra-company comparability: Also known as horizontal analysis, this type focuses on comparing a company's financial performance over different periods of time. This allows stakeholders to identify trends, assess growth, and evaluate the effectiveness of management decisions over time.

Consistency: A critical underpinning of both inter- and intra-company comparability is consistency in the application of accounting principles. This means that a company should use the same accounting methods from period to period, unless there is a justifiable reason to change.

The Importance of Comparability

The benefits of comparable financial information are far-reaching and impact a wide range of stakeholders.

For investors, comparability empowers them to make informed investment decisions. By comparing the financial performance of different companies, investors can identify those with the strongest growth potential, the most efficient operations, and the best risk profiles. This facilitates the efficient allocation of capital and helps investors achieve their financial goals.

For creditors, comparability is essential for assessing the creditworthiness of borrowers. By analyzing and comparing the financial statements of potential borrowers, creditors can determine their ability to repay loans and manage their debt effectively. This reduces the risk of loan defaults and helps to maintain the stability of the financial system.

For regulators, comparability enhances their ability to monitor and regulate the financial markets. By analyzing financial statements prepared using standardized accounting principles, regulators can identify potential risks and vulnerabilities in the system and take corrective action to prevent financial crises.

For companies themselves, comparability promotes efficiency and competitiveness. By benchmarking their performance against their peers, companies can identify areas where they can improve their operations and become more competitive. This ultimately leads to greater profitability and shareholder value.

Challenges to Achieving Comparability

Despite its importance, achieving perfect comparability is a complex and ongoing challenge.

Different Accounting Standards: The existence of different sets of accounting standards, such as IFRS and U.S. Generally Accepted Accounting Principles (GAAP), creates a major hurdle to international comparability. While there has been significant convergence between IFRS and GAAP in recent years, significant differences still remain, making it difficult to directly compare the financial statements of companies that use different standards.

Accounting Choices: Even within the same set of accounting standards, companies often have choices about how to account for certain transactions or events. For example, companies may choose different depreciation methods or different inventory valuation methods. These choices can significantly impact the reported financial results and reduce comparability. "While accounting standards aim to provide guidance, judgment is inevitable," states a recent report by Deloitte, emphasizing the challenge of subjective interpretation.

Industry-Specific Practices: Certain industries have unique accounting practices that can make it difficult to compare companies across different sectors. For example, the accounting for oil and gas reserves is significantly different from the accounting for software development costs. This requires users to have specialized knowledge of industry-specific accounting practices in order to make meaningful comparisons.

Cultural and Legal Differences: Cultural and legal differences across countries can also impact comparability. For example, the level of enforcement of accounting standards may vary from country to country. Similarly, legal requirements for disclosure may differ, affecting the amount and quality of information available to users.

Efforts to Enhance Comparability

Recognizing the importance of comparability, accounting standard setters and regulators around the world have been actively working to enhance it.

Convergence of Accounting Standards: The IASB and the FASB have undertaken a major project to converge IFRS and GAAP. While complete convergence has not been achieved, significant progress has been made in aligning the two sets of standards. This has greatly improved international comparability.

Improved Disclosure Requirements: Accounting standards have been continuously updated to require more detailed and transparent disclosures. This helps users to understand the accounting choices made by companies and to make more informed comparisons. Disclosures related to significant accounting policies, judgments, and estimates are particularly important for comparability.

Increased Enforcement: Regulators are actively working to strengthen the enforcement of accounting standards. This helps to ensure that companies are complying with the standards and that financial statements are reliable and comparable. Strong enforcement is critical for maintaining investor confidence in the financial markets.

"The goal is to create a global language for financial reporting," says a representative from the SEC, highlighting the long-term vision for comparability.

Looking Ahead

The pursuit of greater comparability in financial accounting information is an ongoing journey. While significant progress has been made, challenges remain. Future efforts will likely focus on further converging accounting standards, improving disclosure requirements, and strengthening enforcement.

Technological advancements, such as the increased use of data analytics and artificial intelligence, may also play a role in enhancing comparability. These technologies can help users to analyze and compare large amounts of financial data more efficiently and effectively. Ultimately, the goal is to create a financial reporting system that provides stakeholders with the information they need to make informed decisions and allocate capital efficiently.

:max_bytes(150000):strip_icc()/financialaccounting-a86bd23c64304822a8469c58ee29379a.jpg)