What Is My Business Partner Number

Navigating the complexities of business registration often leads entrepreneurs to a crucial question: What exactly is my Business Partner Number? This seemingly simple query unlocks access to a wealth of information and functionality, but confusion surrounding its purpose and location can cause significant delays and frustration.

The Business Partner Number, often abbreviated as BPN, serves as a unique identifier assigned to your business by various governmental agencies. Understanding its role and how to locate it is paramount for compliance, accessing services, and maintaining accurate business records. This article aims to clarify the significance of the BPN, guide you through the process of finding it, and highlight its importance in various business-related activities.

What is a Business Partner Number?

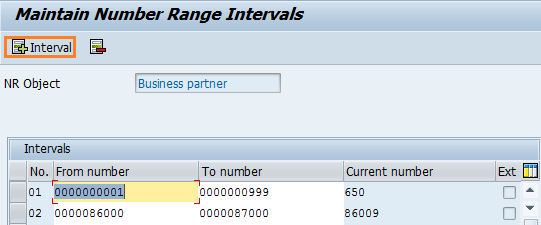

A Business Partner Number is essentially a business's fingerprint within a specific governmental system. Think of it as a social security number, but for your company. It allows government agencies to track and manage your business's interactions with them.

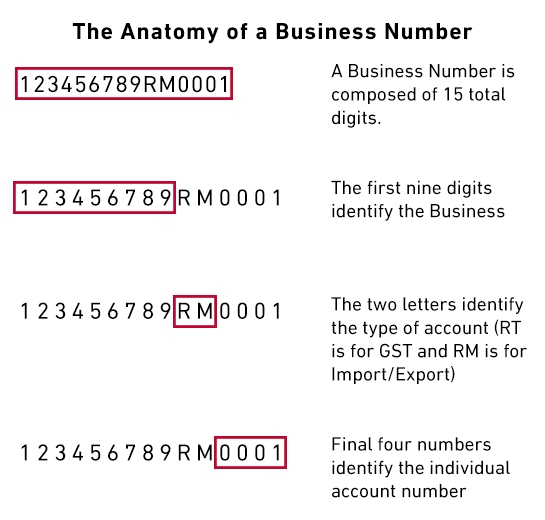

The specific agency assigning the BPN, and therefore its format and purpose, can vary widely depending on the jurisdiction. For example, in Canada, the Business Number (BN) is a nine-digit identifier used by the Canada Revenue Agency (CRA) for tax-related purposes.

Where Can I Find My Business Partner Number?

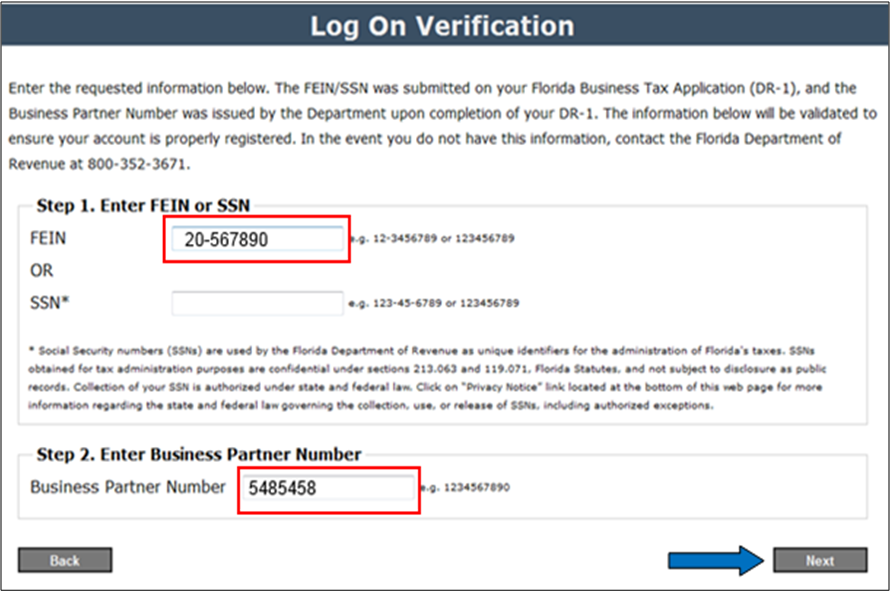

The location of your BPN depends entirely on which agency issued it. Start by considering which government bodies your business interacts with most frequently.

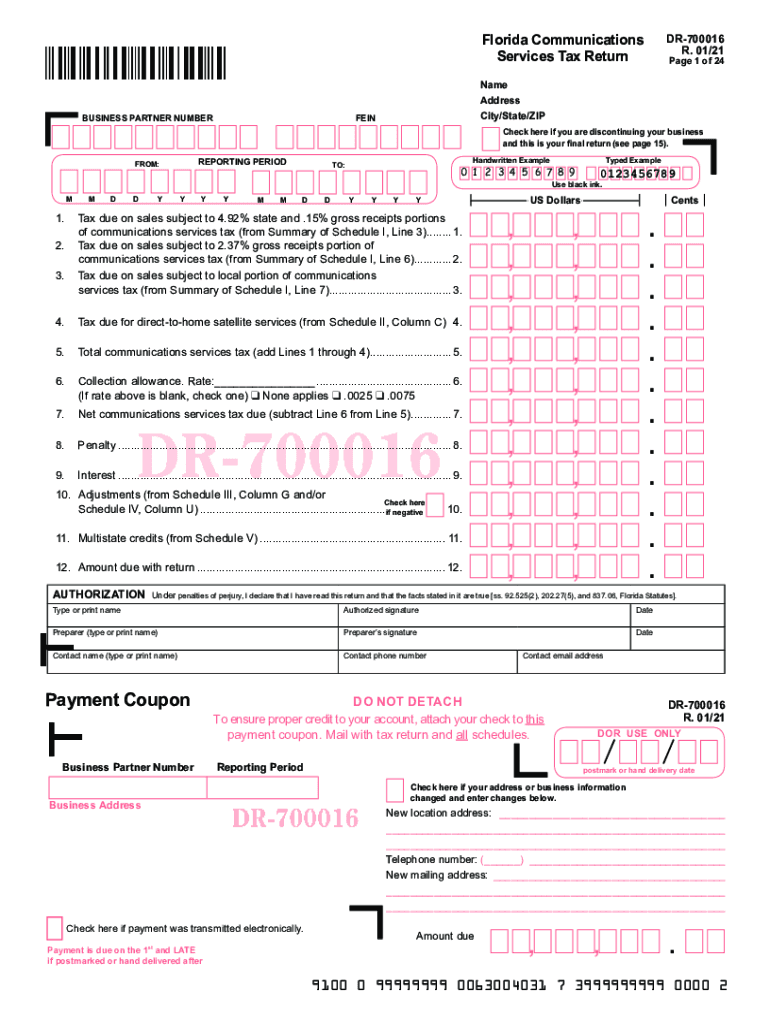

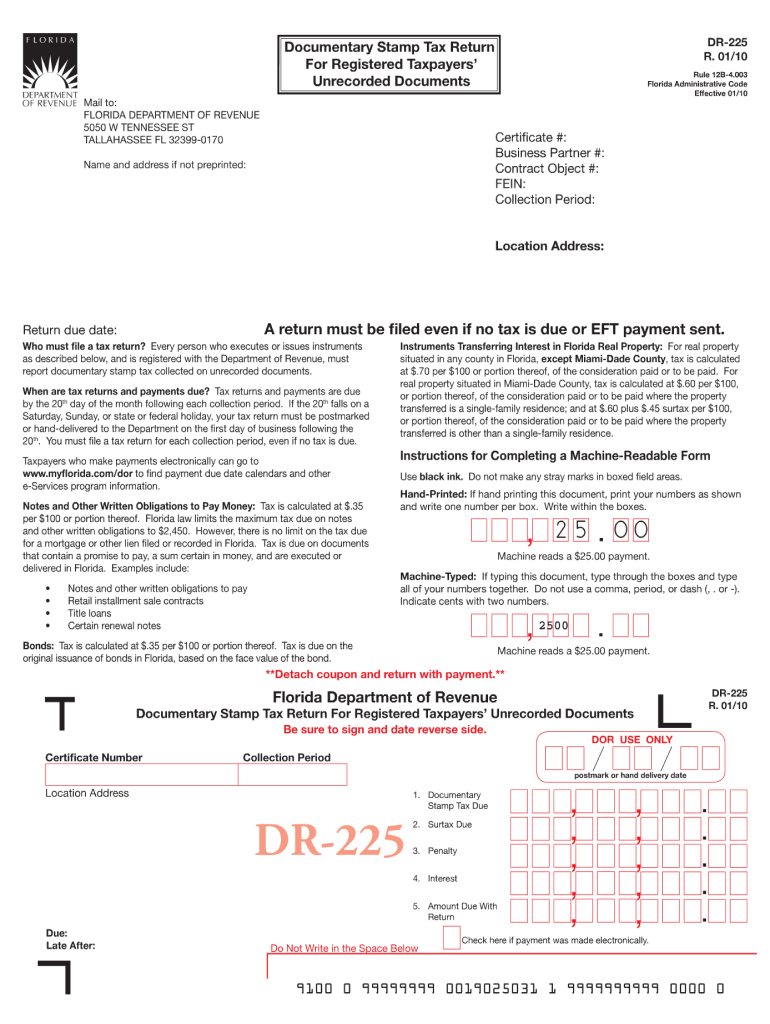

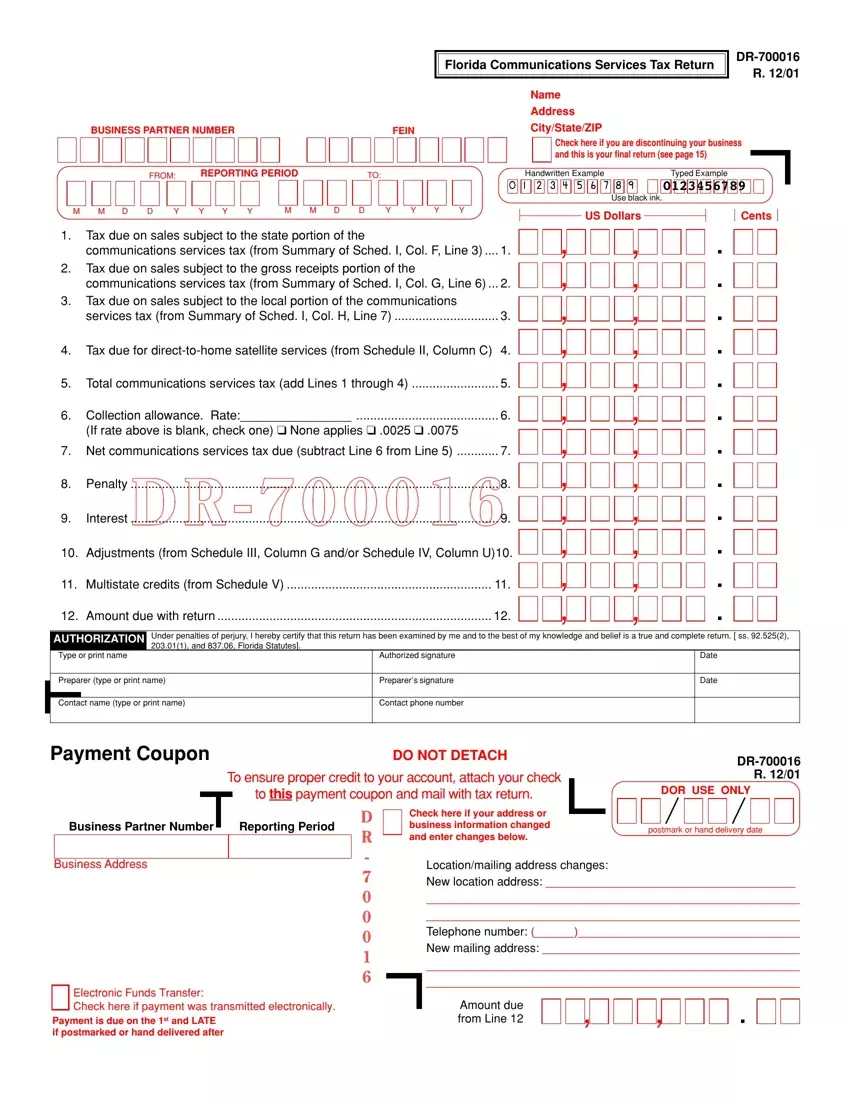

Tax Documents: Perhaps the most common place to find your BPN is on official tax documents. Look for it on your income tax returns, payroll remittances, or any correspondence from the relevant tax authority.

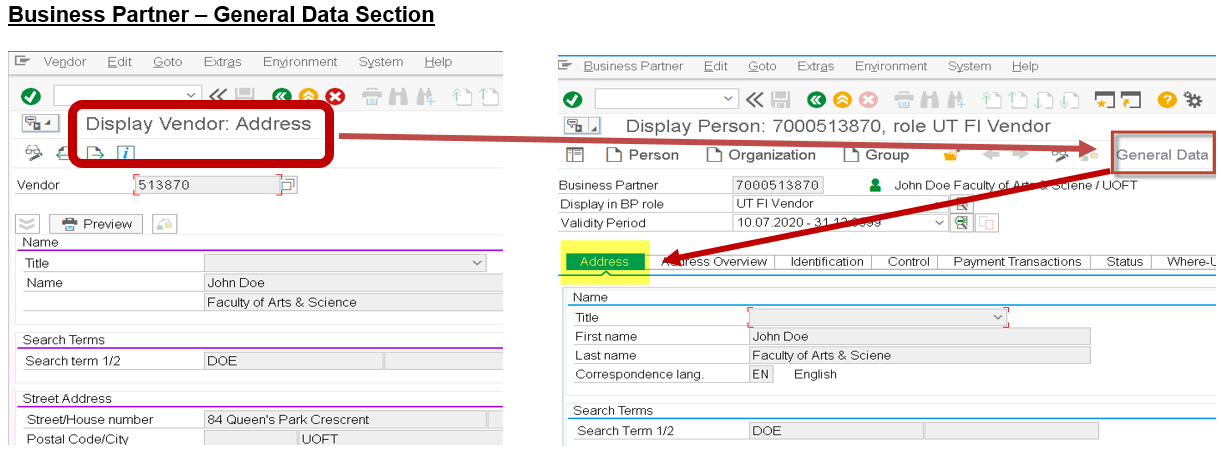

Registration Documents: Your original business registration documents are another prime location. These documents, often issued by the state or provincial government, officially recognize your business's existence and will typically include your BPN.

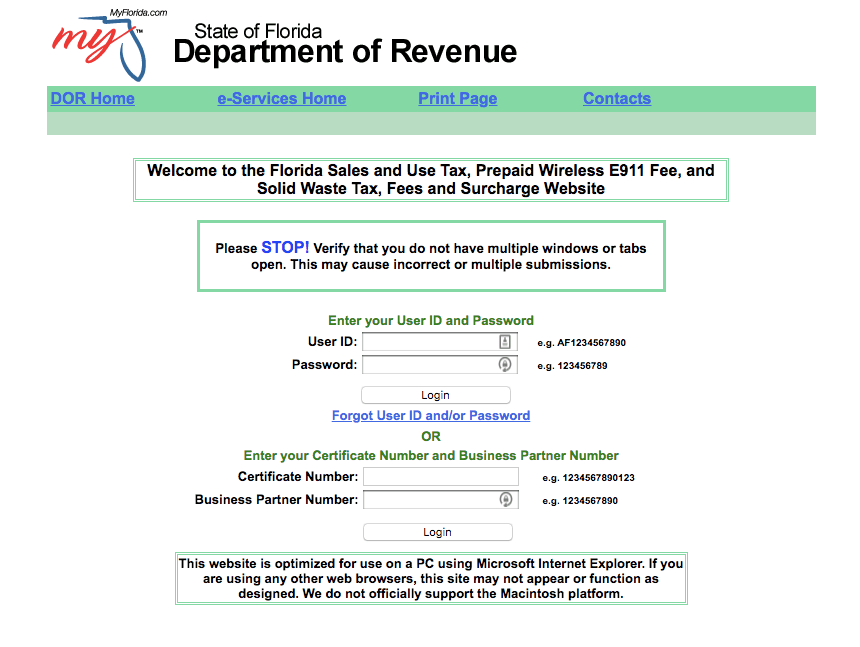

Online Business Registries: Many jurisdictions maintain online business registries that are publicly accessible. By searching your business name, you can often retrieve your BPN and other relevant information.

Correspondence with Government Agencies: Any communication you've received from government agencies, such as letters, notices, or permits, may contain your BPN. Scrutinize these documents carefully.

Banking Documents: In some cases, your BPN may be included on your business banking documents, particularly if you've used it to set up accounts or apply for loans.

Why is My Business Partner Number Important?

The BPN isn't just an arbitrary number; it's a key to accessing numerous essential services and fulfilling your legal obligations. Compliance with regulations is paramount.

Tax Filing: As mentioned, your BPN is crucial for filing your business taxes accurately and on time. Using the correct BPN ensures that your payments are properly credited and that you avoid penalties.

Government Programs: Many government programs and incentives require you to provide your BPN. Whether you're applying for grants, loans, or tax credits, your BPN will be necessary.

Import/Export Activities: Businesses involved in importing or exporting goods typically need to provide their BPN to customs authorities. This helps track shipments and ensure compliance with trade regulations.

Permitting and Licensing: Applying for permits and licenses often requires your BPN. This allows the issuing agency to verify your business's legitimacy and track your compliance with relevant regulations. Failure to provide a valid BPN could result in delays or denial of your application.

Opening Business Bank Accounts: Banks may require your BPN to open a business bank account. This helps them verify your business's identity and comply with anti-money laundering regulations.

What if I Can't Find My Business Partner Number?

Losing track of your BPN can be a source of considerable anxiety. However, there are several avenues you can pursue to recover it.

Contact the Issuing Agency: The most direct approach is to contact the agency that you believe issued the BPN. Be prepared to provide information about your business, such as its legal name, address, and date of incorporation, to help them locate your record.

Consult with an Accountant or Lawyer: Tax professionals and business lawyers are often familiar with the process of locating BPNs. They may be able to access the information through their professional networks or guide you through the appropriate channels.

Review Old Records: Thoroughly search your old business records, including tax returns, registration documents, and correspondence with government agencies. The BPN may be hiding in plain sight.

Looking Ahead

As governments increasingly digitize their services, the importance of the Business Partner Number will only continue to grow. Efficient and accurate use of the BPN will become ever more critical.

Businesses should prioritize maintaining accurate records of their BPN and other key identifiers. This proactive approach will save time and effort in the long run and ensure compliance with regulations. Keeping this information readily accessible is a best practice.

Understanding and managing your Business Partner Number is an essential aspect of running a successful and compliant business. By following the steps outlined in this article, you can confidently navigate the complexities of business registration and access the services you need to thrive in today's dynamic marketplace.

Ignorance of your BPN is not an excuse for non-compliance.