What Is Owner's Draw In Accounting

For business owners operating as sole proprietorships or partnerships, understanding how they compensate themselves is crucial. Unlike employees who receive salaries, these owners utilize a mechanism called an owner's draw. This concept is fundamental to grasping the financial health and tax obligations of such businesses.

This article delves into the intricacies of owner's draws, explaining what they are, how they differ from salaries, and their implications for business accounting and taxation. It aims to provide clarity for both current and aspiring business owners navigating the complexities of self-employment finances.

What Exactly is an Owner's Draw?

An owner's draw is essentially a withdrawal of funds from a business by its owner(s) for personal use. It's the way sole proprietors and partners take money out of their business without the complexities of payroll. Think of it as taking money out of your business's checking account to pay for your personal expenses.

The key distinction is that an owner's draw is not considered a salary or wage. Instead, it represents a distribution of the business's profits to the owner. Therefore, it is not subject to payroll taxes like Social Security and Medicare taxes that would be withheld from an employee's paycheck.

However, this doesn't mean the owner escapes these taxes entirely. They will still be responsible for self-employment taxes, calculated on their overall business profits.

Owner's Draw vs. Salary: Understanding the Differences

The primary difference between an owner's draw and a salary lies in the business structure. Sole proprietorships and partnerships typically utilize owner's draws, while corporations (S-Corps and C-Corps) usually pay their owners who are also employees a salary.

Salaries are subject to payroll taxes (Social Security, Medicare, and income tax withholding) and are deductible expenses for the corporation. Owner's draws, on the other hand, are not deductible business expenses.

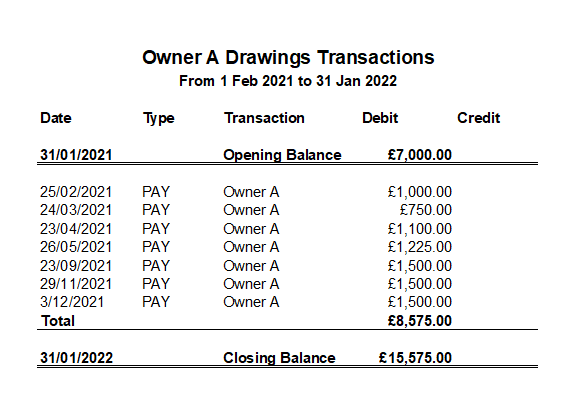

Another key difference is that salaries are typically fixed and predictable. Owner's draws, conversely, can fluctuate based on the business's available cash flow and profitability. An owner might take larger draws during profitable periods and smaller draws, or none at all, during leaner times.

Accounting for Owner's Draws

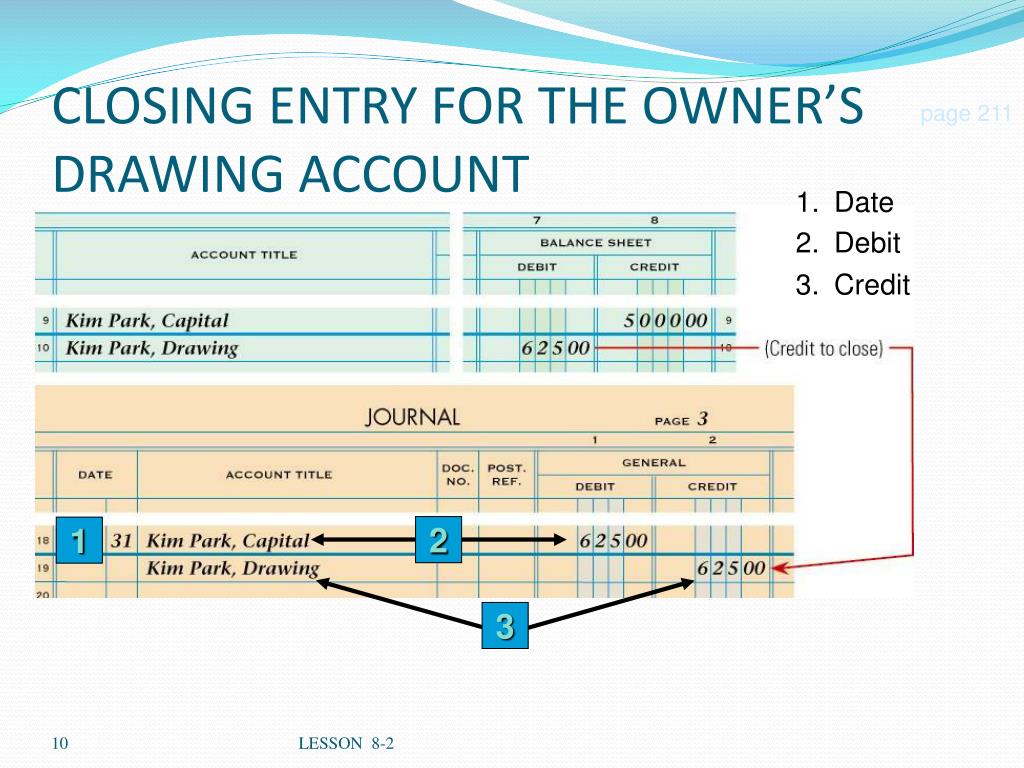

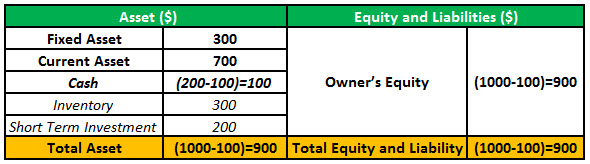

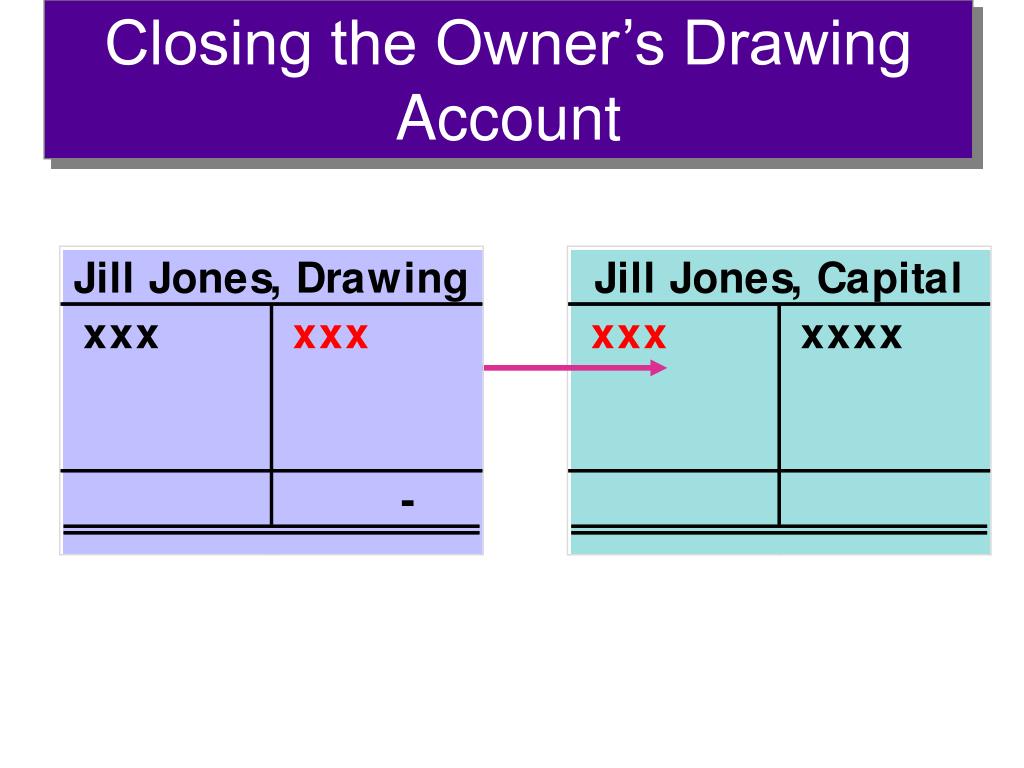

From an accounting perspective, owner's draws are recorded as a debit to the owner's equity account and a credit to the cash account. This reflects the decrease in the business's cash and the corresponding reduction in the owner's claim on the business's assets.

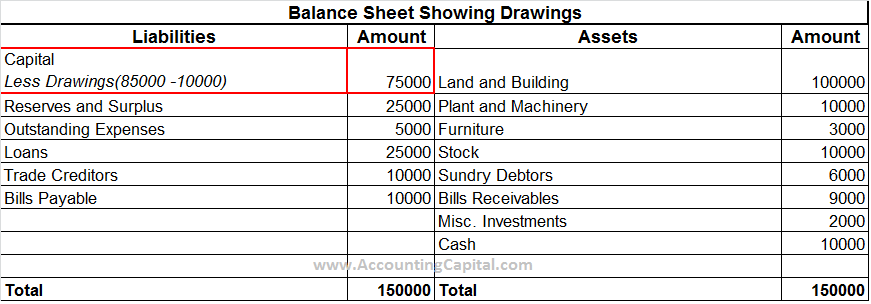

Because owner's draws are not business expenses, they do not appear on the income statement. They are, however, reflected on the balance sheet in the equity section. It's essential to accurately track owner's draws to maintain accurate financial records and ensure compliance with tax regulations.

Tax Implications of Owner's Draws

As previously mentioned, owner's draws are not subject to payroll taxes at the time of withdrawal. However, the business's profits, from which the draws are derived, are subject to self-employment taxes. These taxes cover Social Security and Medicare contributions for self-employed individuals.

The IRS requires self-employed individuals to pay estimated taxes quarterly, based on their anticipated income. It's crucial to accurately estimate your business's profits and pay estimated taxes to avoid penalties at the end of the year. Several online resources and accounting software can aid in calculating estimated tax liabilities.

Properly documenting and tracking owner's draws is crucial for accurate tax reporting.

Consulting with a qualified accountant or tax advisor is highly recommended to ensure compliance with all applicable tax laws.

Impact on Business Financial Health

While owner's draws provide a means for owners to access business funds, excessive or poorly planned draws can negatively impact the business's financial health. Overly large draws can deplete cash reserves, hindering the business's ability to meet its obligations or invest in growth opportunities.

A well-defined budget and cash flow forecast can help owners determine a sustainable level of draws. Regularly monitoring the business's financial performance and adjusting draw amounts accordingly is vital for maintaining a healthy balance between personal needs and business stability.

Ultimately, understanding owner's draws is paramount for anyone operating a sole proprietorship or partnership. By comprehending the nuances of this concept, business owners can effectively manage their finances, ensure tax compliance, and maintain the long-term viability of their enterprises.