What Is Pos Transaction In Citibank

In today's increasingly cashless society, Point of Sale (POS) transactions have become ubiquitous, facilitating seamless payments for goods and services. But what exactly constitutes a POS transaction within the context of a major financial institution like Citibank, and how does it impact its customers?

This article aims to demystify Citibank POS transactions, exploring their mechanics, security features, and overall significance in the bank's service offerings.

Understanding POS Transactions

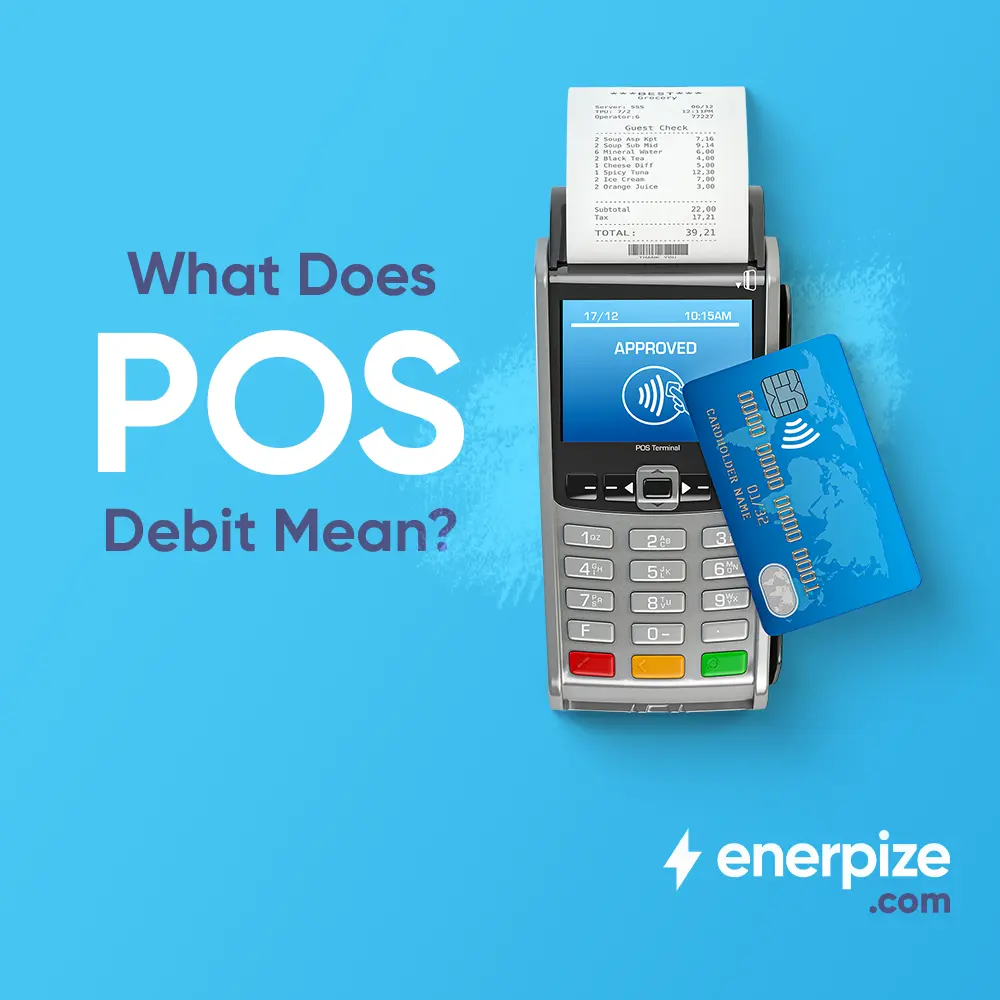

A POS transaction, at its core, refers to any payment made at a physical or virtual point of sale using a Citibank-issued debit or credit card.

This includes purchases made in brick-and-mortar stores, online retailers, restaurants, and other establishments that accept card payments.

It also encompasses transactions made through mobile wallets like Apple Pay or Google Pay, when linked to a Citibank account.

Key Components of a Citibank POS Transaction

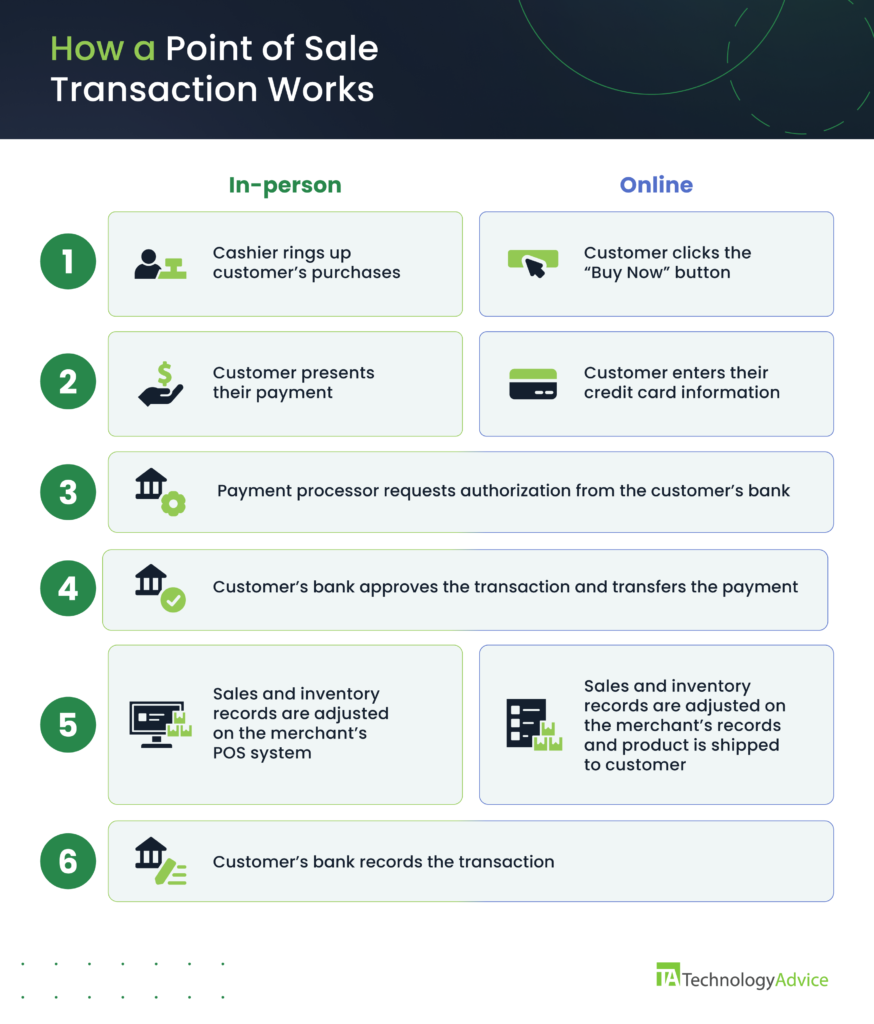

Several key elements are involved in a typical Citibank POS transaction. These include the cardholder, the merchant, the POS terminal, and the acquiring bank (the merchant's bank) and the issuing bank (Citibank).

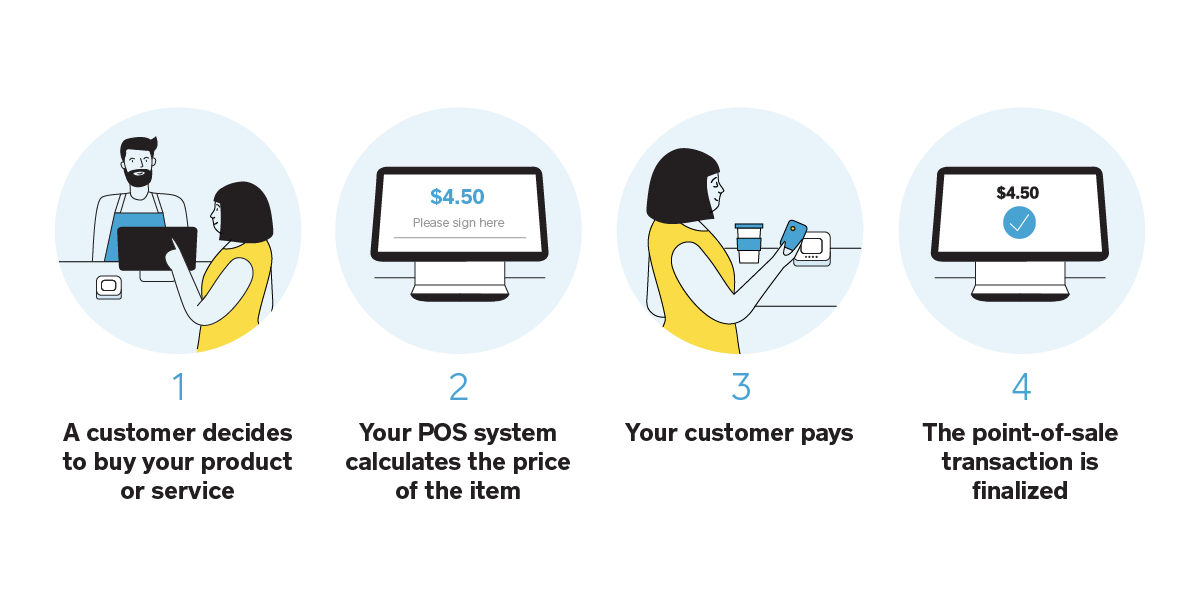

The process begins when the cardholder presents their Citibank card at the point of sale.

The merchant then uses a POS terminal to read the card information, which can be done through a magnetic stripe swipe, EMV chip insertion, or contactless (NFC) tap.

The POS terminal then securely transmits the transaction details to the acquiring bank, which in turn forwards the information to Citibank for authorization.

If the transaction is approved, Citibank authorizes the payment, and the funds are transferred from the cardholder's account to the merchant's account.

Security Measures and Fraud Prevention

Citibank employs a range of security measures to protect cardholders from fraud and unauthorized transactions. These include EMV chip technology, which generates a unique transaction code for each purchase.

Furthermore, Citibank utilizes advanced fraud detection systems that monitor transactions in real-time, flagging suspicious activity for investigation.

Cardholders are also encouraged to enroll in Citibank's fraud alert services, which provide notifications for unusual transactions.

These alerts allow customers to quickly identify and report any unauthorized activity, minimizing potential losses.

Impact on Citibank Customers

Citibank POS transactions offer convenience and flexibility to customers, enabling them to make purchases quickly and easily both in-person and online.

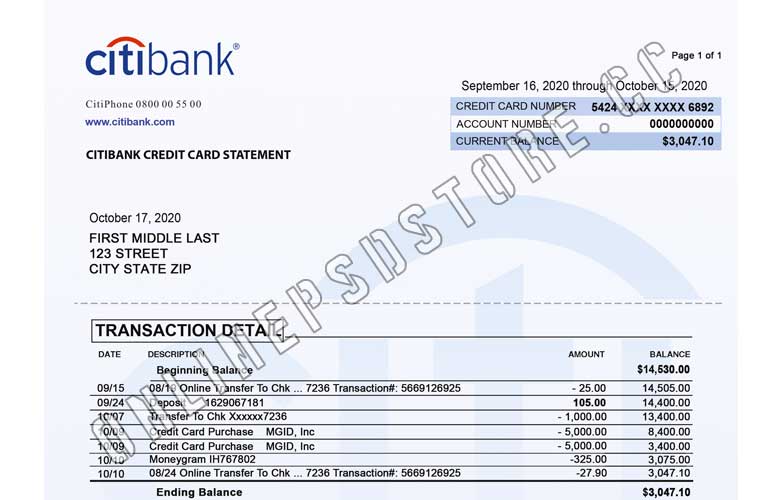

However, it's crucial for cardholders to practice responsible spending habits and monitor their account activity regularly.

Overspending or failing to keep track of transactions can lead to debt and financial difficulties.

Citibank also provides resources and tools to help customers manage their finances effectively, including budgeting tools and spending trackers.

"We are committed to providing our customers with a secure and convenient payment experience," states a Citibank spokesperson. "Our robust security measures and fraud prevention systems are designed to protect cardholders from unauthorized transactions and ensure peace of mind."

The Future of POS Transactions

The landscape of POS transactions is constantly evolving with the emergence of new technologies and payment methods.

Mobile wallets, contactless payments, and biometric authentication are becoming increasingly popular.

Citibank is actively investing in these innovative solutions to enhance the customer experience and stay ahead of the curve in the digital payment space.

As POS technology continues to advance, Citibank will likely play a key role in shaping the future of how people pay for goods and services.

Ultimately, understanding how Citibank POS transactions work, the security measures in place, and their implications for cardholders is crucial for navigating the modern financial landscape responsibly and effectively.

![What Is Pos Transaction In Citibank What is Point of Sale (POS) Transaction? [Types & Example]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2023/08/3-Common-POS-Transactions-Types.png)

![What Is Pos Transaction In Citibank What is Point of Sale (POS) Transaction? [Types & Example]](https://cdn-resources.highradius.com/resources/wp-content/uploads/2021/05/og-img3.3.jpg)