What Is The Best Monthly Dividend Stock

Imagine a steady stream of income flowing into your account each month, like a gentle waterfall replenishing a serene pond. This isn't a fantasy; it's the potential reality offered by monthly dividend stocks. The allure of a consistent, passive income is captivating, but the question remains: Which one reigns supreme?

The quest for the "best" monthly dividend stock is a common pursuit among investors seeking reliable income. However, the reality is nuanced. There isn't a single "best" option, as the ideal choice depends heavily on individual risk tolerance, investment goals, and the specific economic climate. This article will explore the landscape of monthly dividend stocks, offering insights to help you navigate this rewarding but complex terrain.

Understanding Monthly Dividend Stocks

Traditionally, companies distribute dividends quarterly. Monthly dividend stocks, however, offer a payout every month. This is particularly attractive to retirees or those seeking a predictable income stream to cover living expenses.

This regular income can also be psychologically beneficial, providing a consistent reminder of your investment success. However, it's important to remember that dividends are never guaranteed and can be reduced or eliminated by the company.

Key Considerations Before Investing

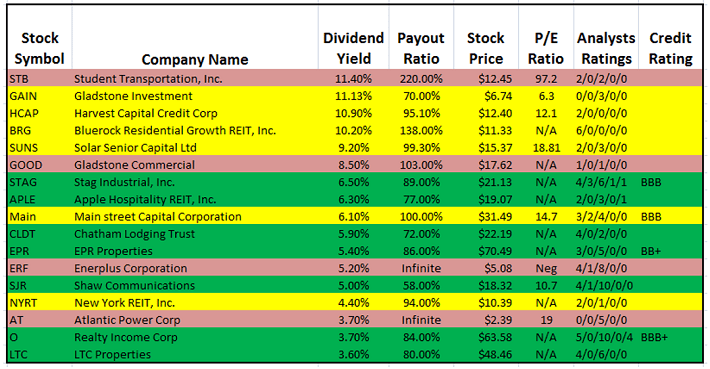

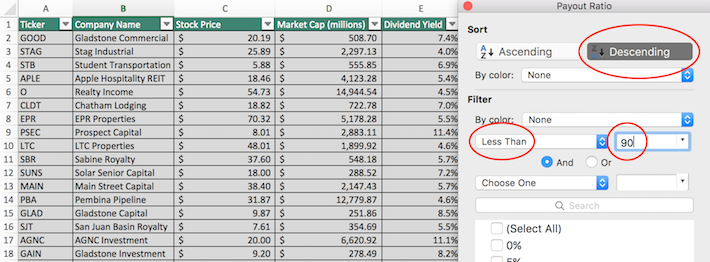

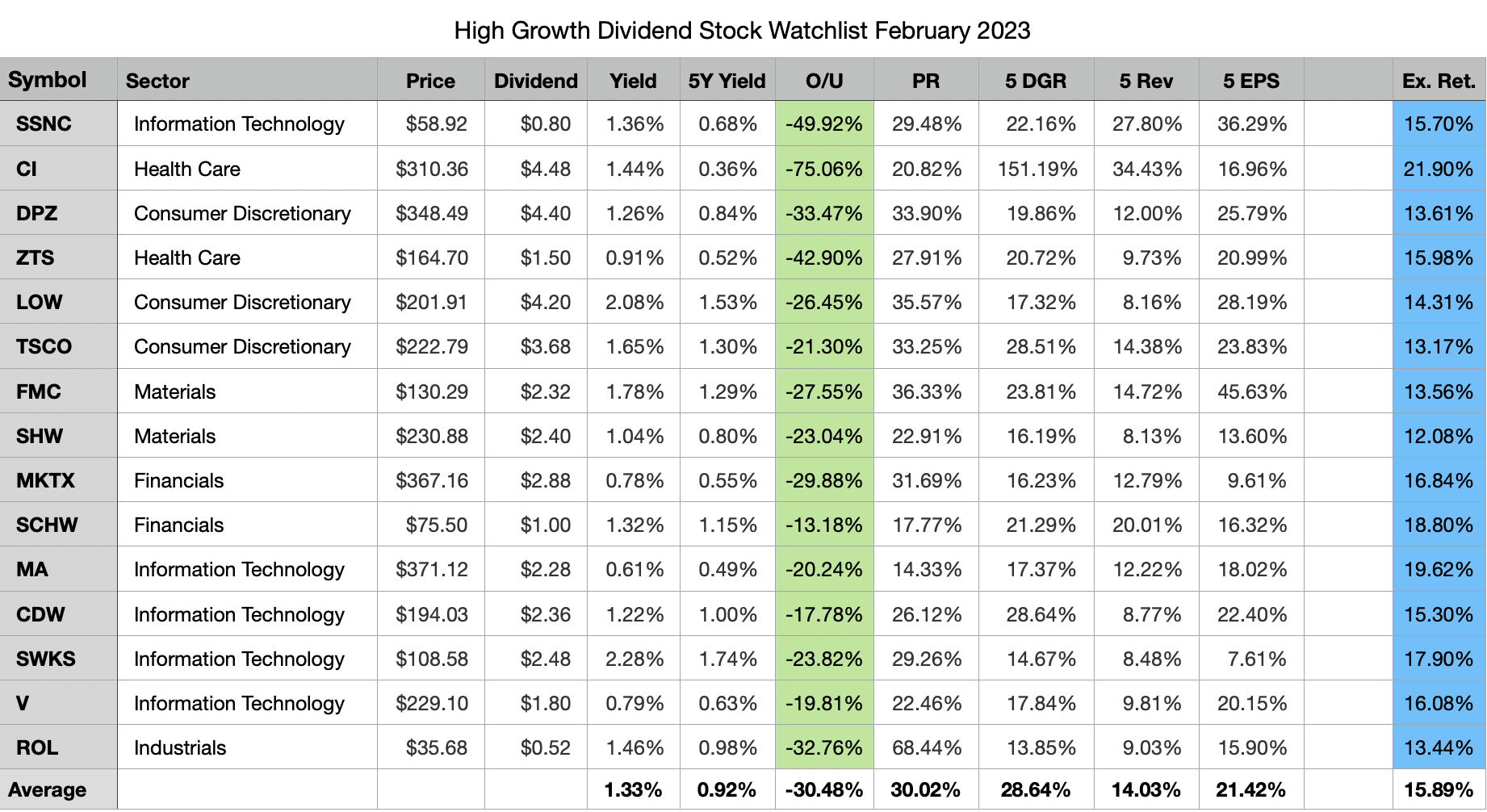

Before diving into specific stocks, several factors warrant careful consideration. Dividend yield, the annual dividend payment expressed as a percentage of the stock price, is a crucial metric. However, a high yield isn't always a positive sign; it could indicate financial instability.

Evaluate the payout ratio, which represents the percentage of earnings paid out as dividends. A high payout ratio may signal that the company is struggling to reinvest in its growth.

Examine the company's financial health and track record. Consistent profitability and a history of dividend payments are reassuring indicators.

Popular Monthly Dividend Stock Categories

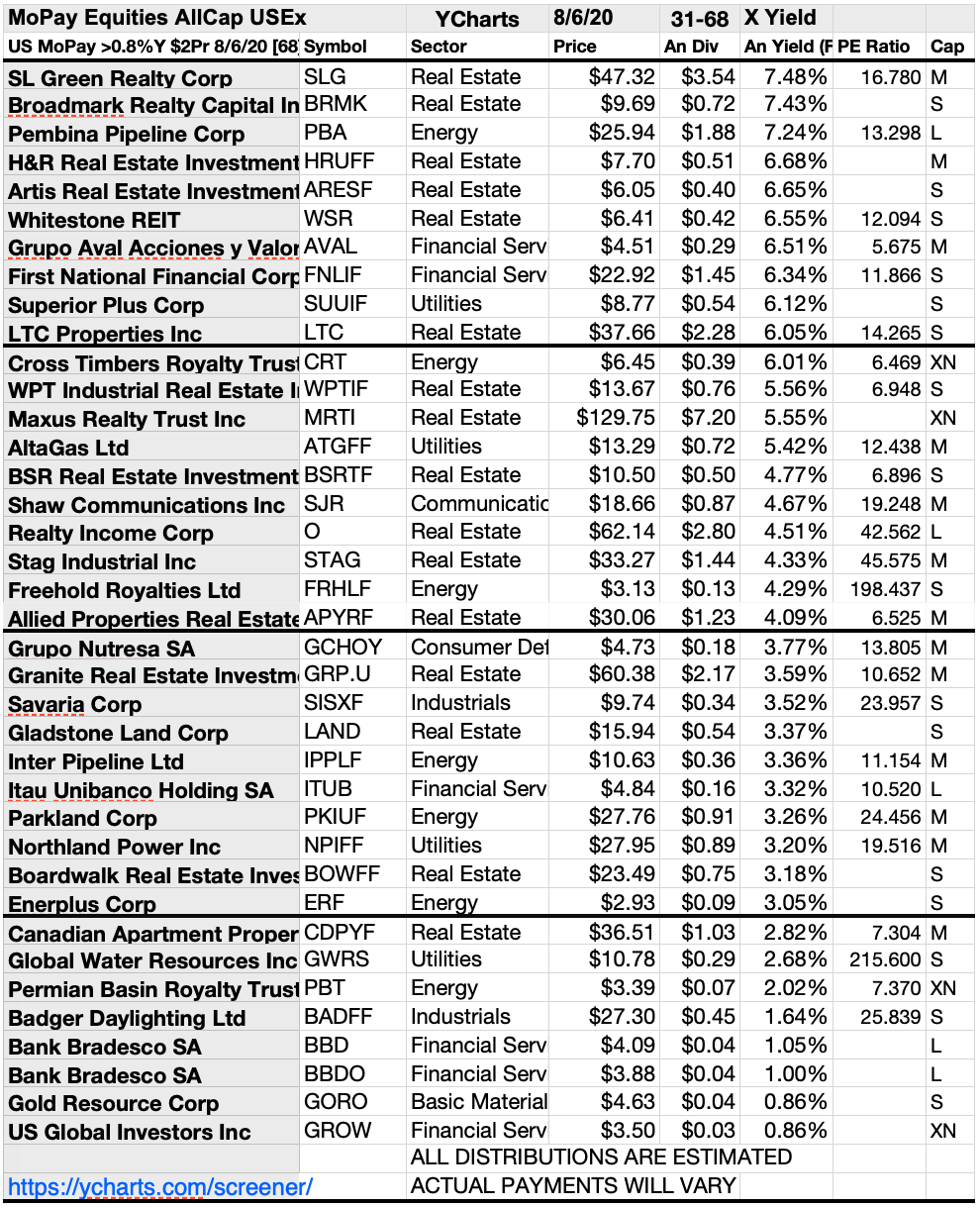

Several types of companies often offer monthly dividends. These include Real Estate Investment Trusts (REITs), Business Development Companies (BDCs), and Closed-End Funds (CEFs).

REITs own and operate income-producing real estate. They are required to distribute a significant portion of their taxable income to shareholders, making them attractive for dividend seekers.

BDCs invest in small and medium-sized businesses, often providing debt financing. Their dividend yields can be quite high, but they also carry higher risk.

CEFs are investment companies that manage a portfolio of assets. They can distribute income from dividends, interest, and capital gains.

Spotlight on Potential Monthly Dividend Stocks

While I can't provide financial advice, I can point out some examples of companies frequently discussed in the context of monthly dividends. It is crucial to conduct your own thorough research before making any investment decisions.

Examples include Realty Income (often referred to as "The Monthly Dividend Company"), a well-established REIT with a long history of consistent dividend payments. Another example could be STAG Industrial, a REIT focused on industrial properties.

Additionally, certain CEFs, like those managed by PIMCO, are known for their monthly distributions. Remember that past performance is not indicative of future results.

“The key to successful investing is to understand your risk tolerance and invest accordingly. Don't chase high yields without fully understanding the underlying risks." - A hypothetical investment expert

The Importance of Due Diligence

Investing in monthly dividend stocks can be a rewarding strategy. However, it requires careful research and a thorough understanding of the associated risks.

Diversification is key. Don't put all your eggs in one basket; spread your investments across different sectors and asset classes.

Stay informed about market conditions and the specific companies you invest in. Regularly review your portfolio and make adjustments as needed.

Ultimately, the "best" monthly dividend stock is the one that aligns with your individual investment goals and risk tolerance. It's a personal journey, not a one-size-fits-all solution.