What Is The Beta Of The Following Portfolio

Understanding portfolio risk is paramount for investors of all levels. One key metric used to gauge this risk is beta, a measure of a portfolio's volatility relative to the overall market.

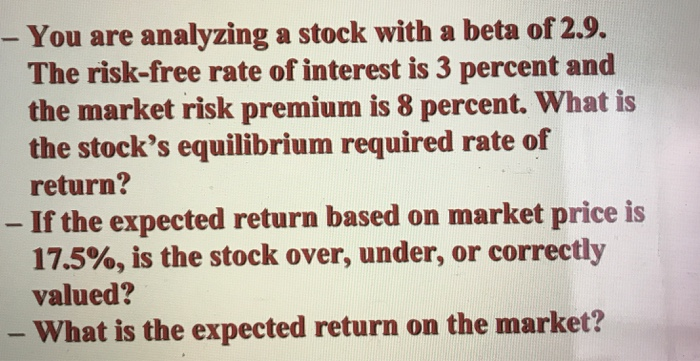

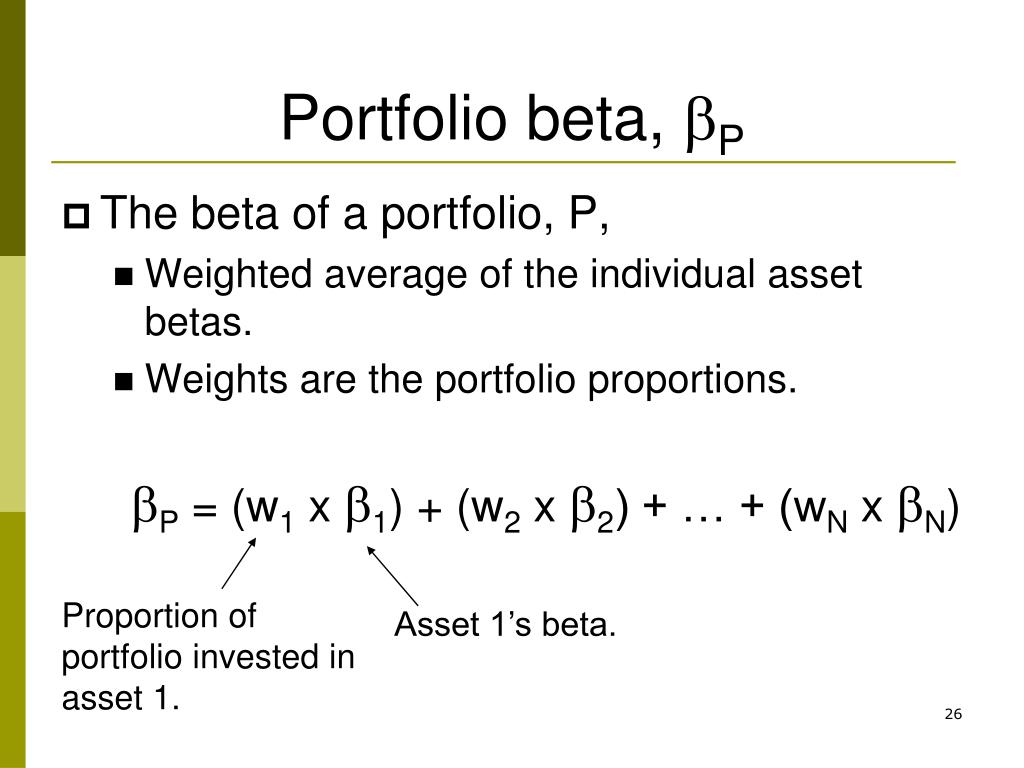

Beta essentially tells you how much a portfolio's value is expected to change for every 1% change in the market, providing a valuable tool for assessing and managing investment exposure. A detailed calculation is required to determine a portfolio's beta. This analysis involves examining the beta of each asset within the portfolio and weighting it by its proportion of the total portfolio value.

Portfolio Beta: A Deep Dive

The calculation of portfolio beta is a weighted average of the betas of the individual assets it comprises. This approach reflects the relative contribution of each asset to the portfolio's overall risk profile.

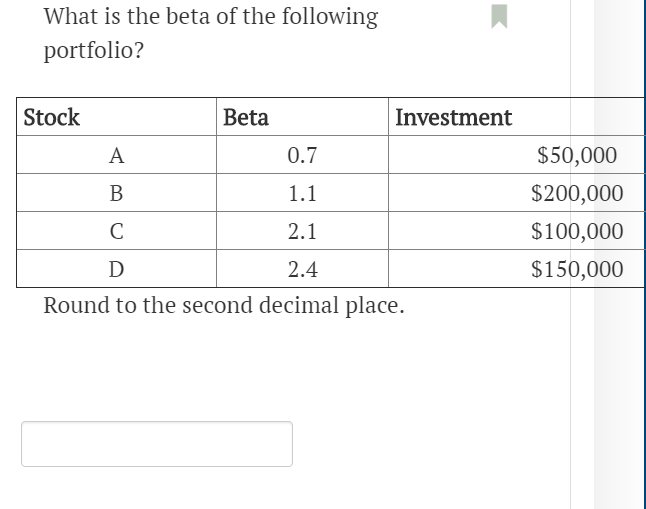

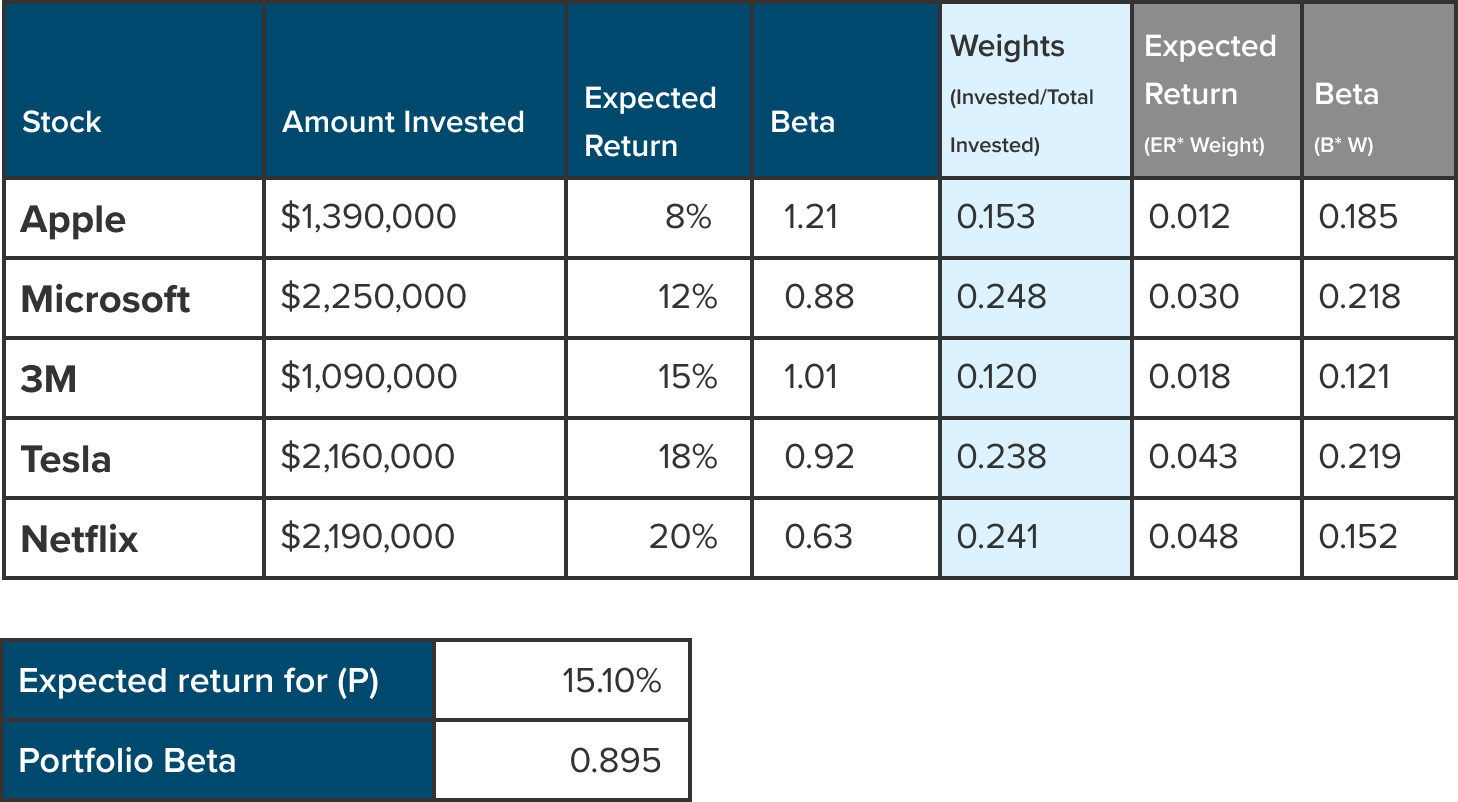

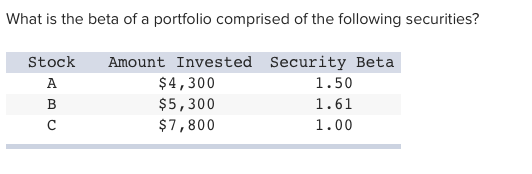

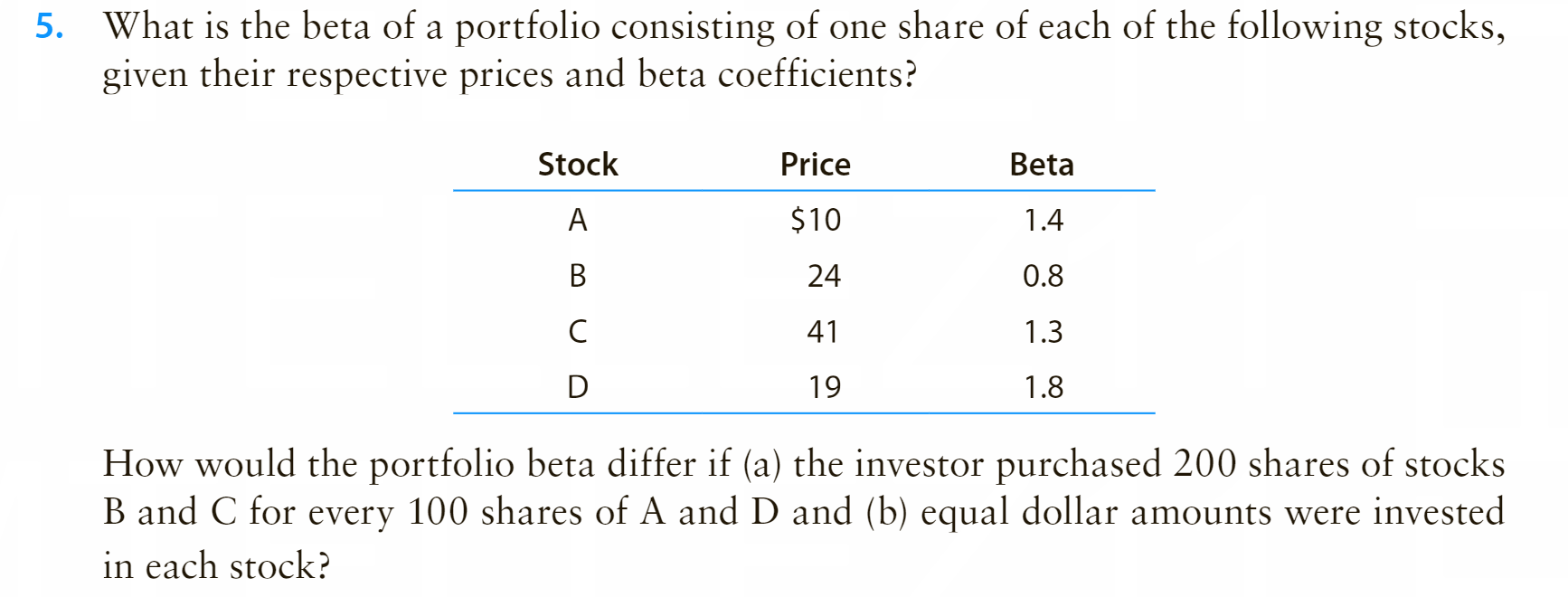

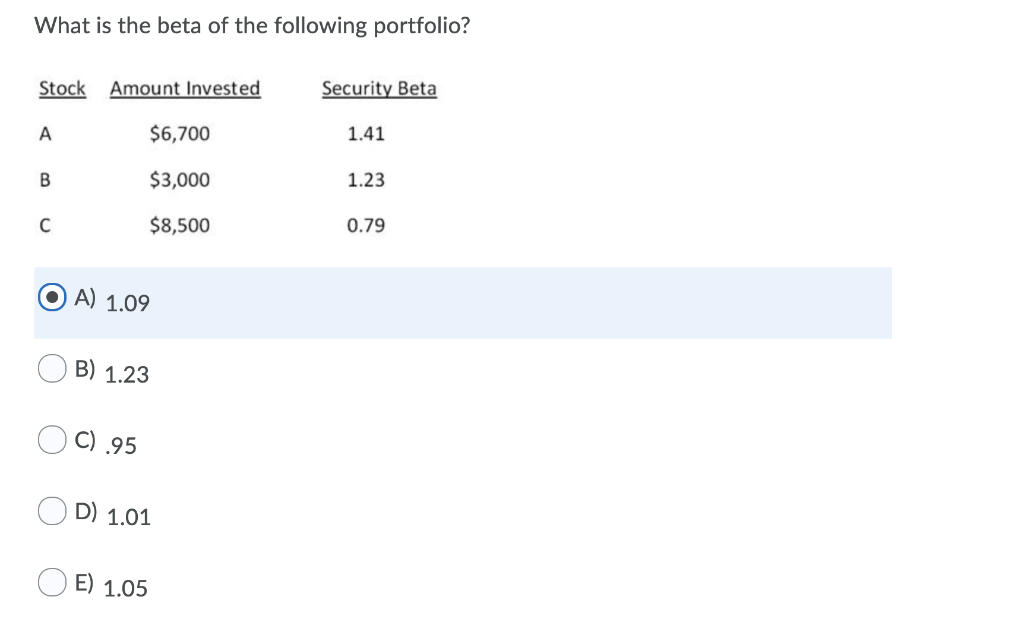

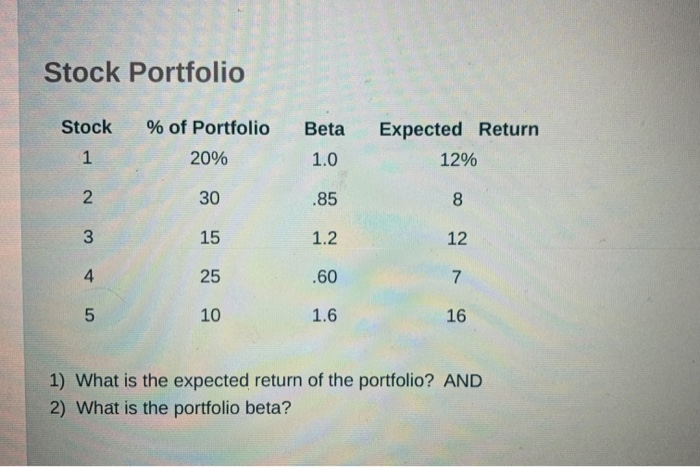

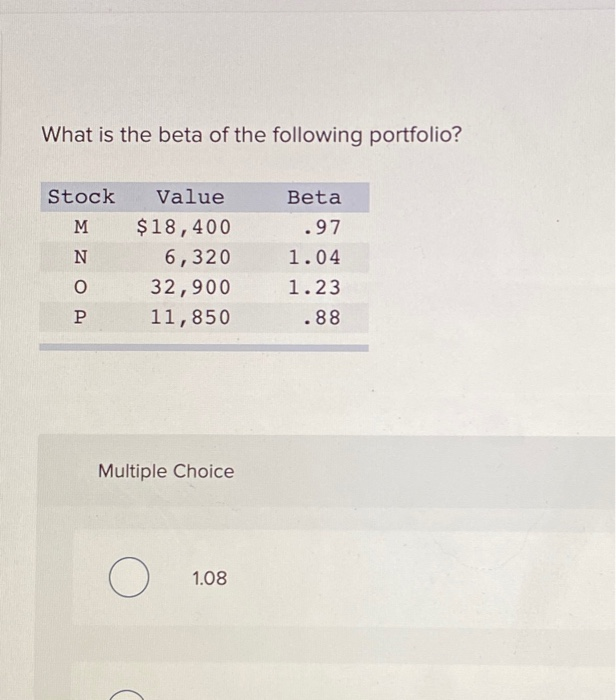

Let's consider a hypothetical portfolio consisting of the following assets and their respective betas and weights:

Example Portfolio Composition

Asset A: 30% of portfolio, Beta = 0.8 Asset B: 20% of portfolio, Beta = 1.2 Asset C: 50% of portfolio, Beta = 1.5

To calculate the portfolio beta, we multiply each asset's beta by its portfolio weight and then sum the results.

Portfolio Beta = (0.30 * 0.8) + (0.20 * 1.2) + (0.50 * 1.5) Portfolio Beta = 0.24 + 0.24 + 0.75 Portfolio Beta = 1.23

In this example, the portfolio beta is 1.23. This indicates that for every 1% change in the market, the portfolio is expected to change by 1.23% in the same direction.

Interpreting the Beta Value

A beta of 1 indicates that the portfolio's price will move exactly in line with the market. A beta greater than 1 suggests the portfolio is more volatile than the market, meaning it will experience larger price swings.

Conversely, a beta less than 1 indicates lower volatility than the market. Negative beta are also possible, meaning the portfolio moves in the opposite direction of the market, though such investments are rare.

Significance for Investors

Understanding portfolio beta allows investors to strategically manage their risk exposure. Investors with a higher risk tolerance may be comfortable with portfolios having higher betas, aiming for potentially greater returns.

More risk-averse investors might prefer portfolios with lower betas, accepting potentially lower returns in exchange for greater stability. Portfolio beta is a key component of modern portfolio theory.

The beta of individual assets can be found on financial websites or through brokerage platforms.

Factors Affecting Beta

Several factors can influence the beta of a security or portfolio, including the industry it operates in, its financial leverage, and its management's decisions. Companies in cyclical industries, such as automotive or construction, tend to have higher betas.

This is because their performance is more closely tied to the overall economic cycle. Companies with high levels of debt also typically have higher betas.

Management decisions, such as mergers and acquisitions, can also temporarily affect a company's beta. Regularly monitoring and adjusting portfolio beta is crucial for maintaining a desired risk profile.

Limitations of Beta

While beta is a useful risk measure, it has limitations. It relies on historical data, which may not be indicative of future performance. A security's beta can change over time due to various factors.

Furthermore, beta only measures systematic risk, which is the risk that cannot be diversified away. It doesn't account for unsystematic risk, which is specific to a particular company or industry.

Investors should consider beta alongside other risk measures and perform thorough due diligence before making investment decisions.

Conclusion

Calculating and interpreting portfolio beta is an essential part of sound investment management. By understanding this metric, investors can make more informed decisions about their portfolio's risk exposure.

It allows them to align their investments with their risk tolerance and financial goals. It's just as important to understand the limitations of using beta to define risk in portfolios.

Remember, beta is just one tool in the toolbox. Using it with other risk measurement tools can lead to a better understanding of the risk levels within a portfolio.