What Is The Fhlb Rate Today

Imagine a crisp autumn morning, the scent of coffee swirling in the air, and the quiet hum of financial news playing in the background. You're settling in, ready to tackle the day, and a thought pops into your head: “What exactly is the FHLB rate today?” It's a question that echoes in the minds of community bankers, housing advocates, and anyone keeping a close eye on the pulse of the mortgage market.

This article aims to demystify the FHLB rate, providing a clear snapshot of its current standing and shedding light on its profound impact on the housing finance landscape.

Understanding the FHLB System

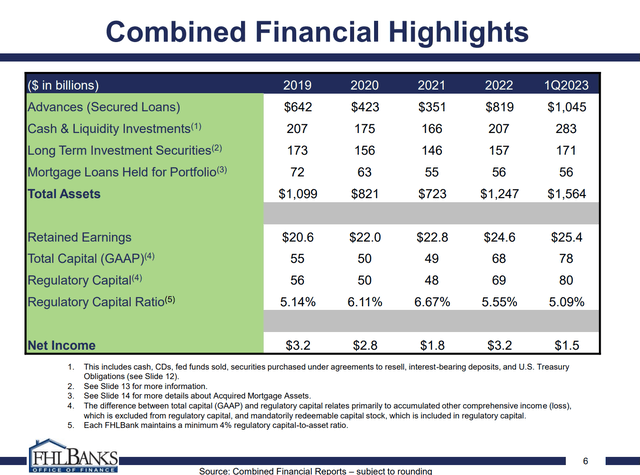

The Federal Home Loan Bank (FHLB) System is a cooperative, government-sponsored enterprise established in 1932. Its primary mission is to enhance the availability of credit to community banks and other financial institutions. These institutions, in turn, use these funds to support mortgage lending and community development initiatives.

Essentially, the FHLB acts as a wholesale bank for its member institutions. Think of it as a financial intermediary, channeling funds from the capital markets to local lenders.

How the FHLB System Works

The FHLB System comprises eleven regional banks, each serving a specific geographic area. These banks are owned by their member institutions, who purchase stock in their regional FHLB.

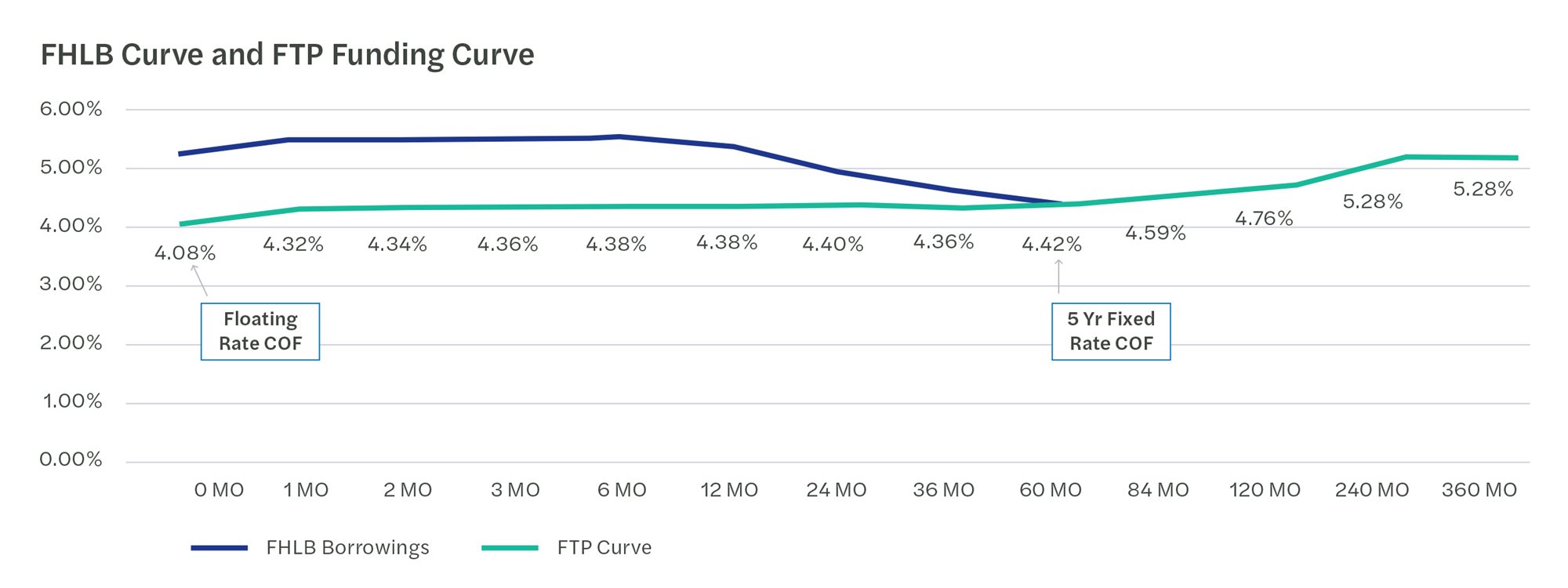

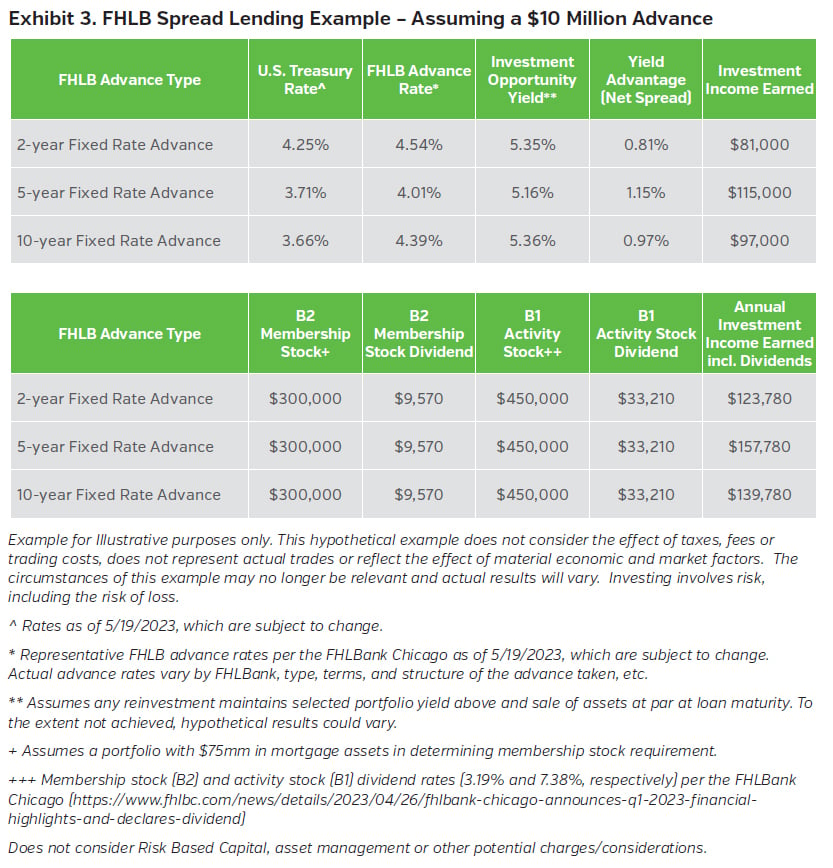

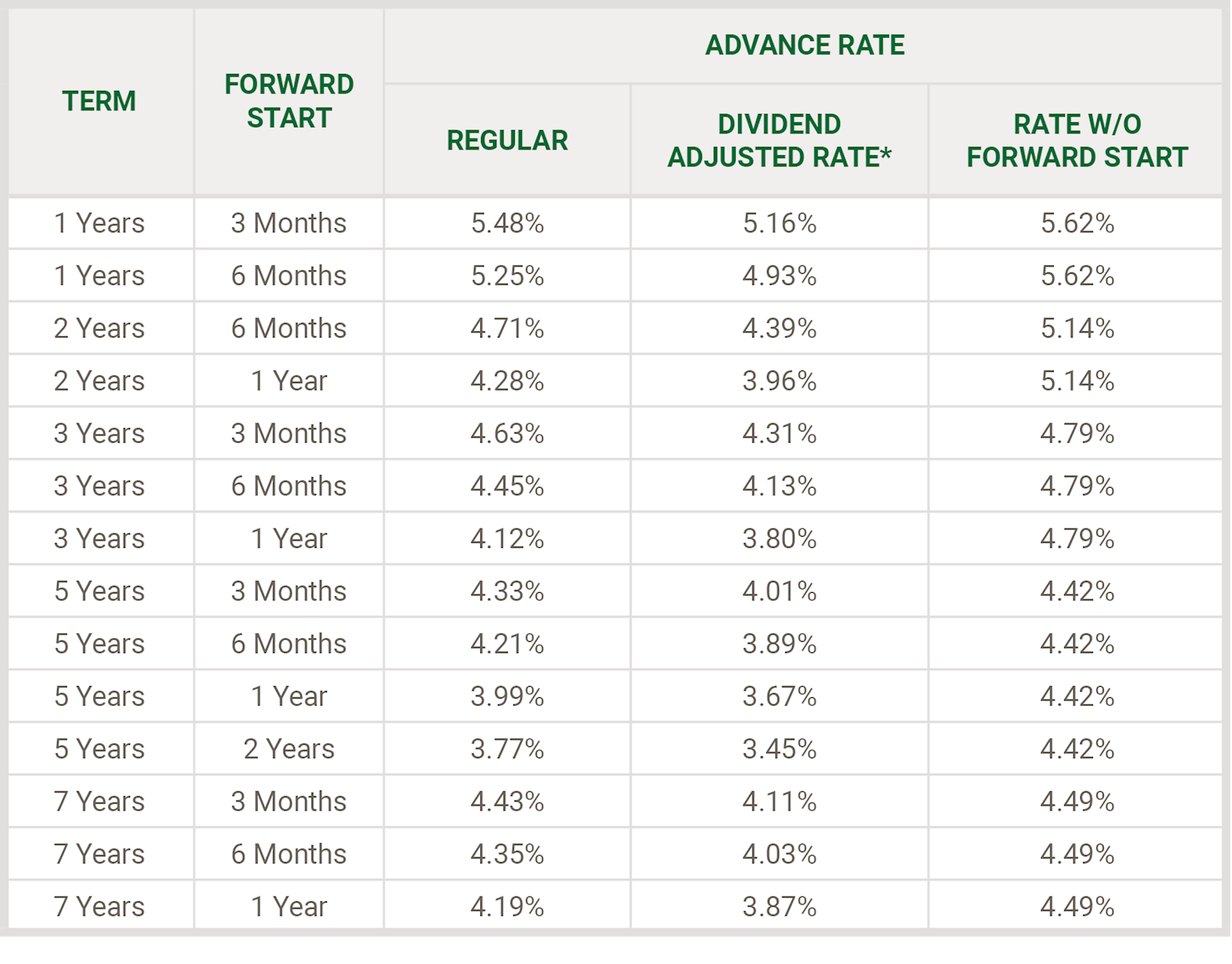

Members can then access funding through advances, which are collateralized loans provided by the FHLB. These advances come in various forms and maturities, allowing members to tailor their borrowing to their specific needs. The FHLB rate is the interest rate charged on these advances.

These advances are crucial for smaller banks who might not have the same access to capital that bigger banks do. This, in turn, helps keep mortgage rates competitive and accessible to a larger range of borrowers.

The FHLB Rate Today: A Snapshot

Obtaining the exact, real-time FHLB rate requires checking directly with the relevant regional FHLB. Each regional bank sets its own rates based on market conditions and its specific funding needs.

You can find the websites for each regional FHLB with a quick online search. Look for sections dedicated to 'Advances' or 'Funding' where rates are typically published.

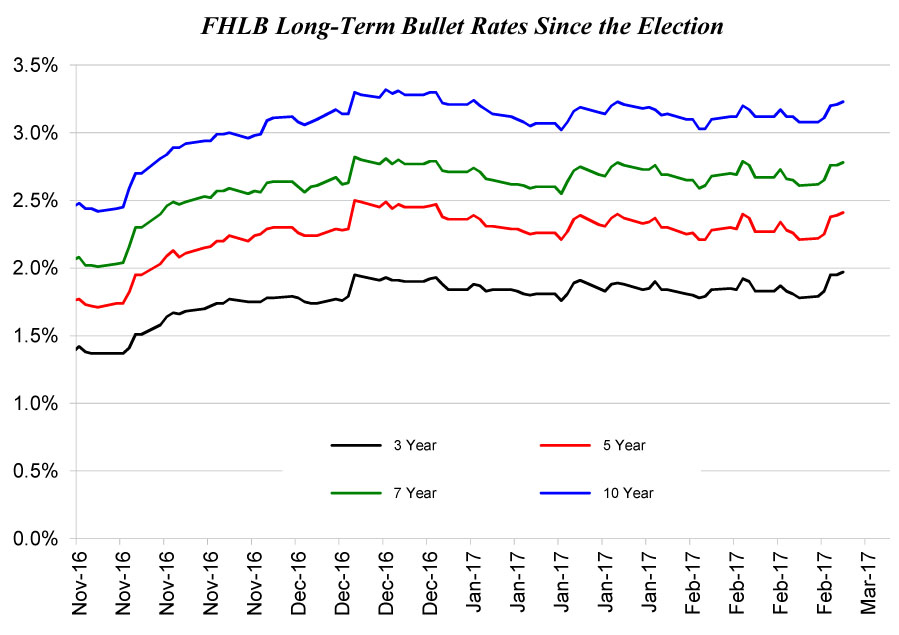

It's important to understand that there isn't one single "FHLB rate," but rather a spectrum of rates depending on the type and term of the advance.

Factors Influencing FHLB Rates

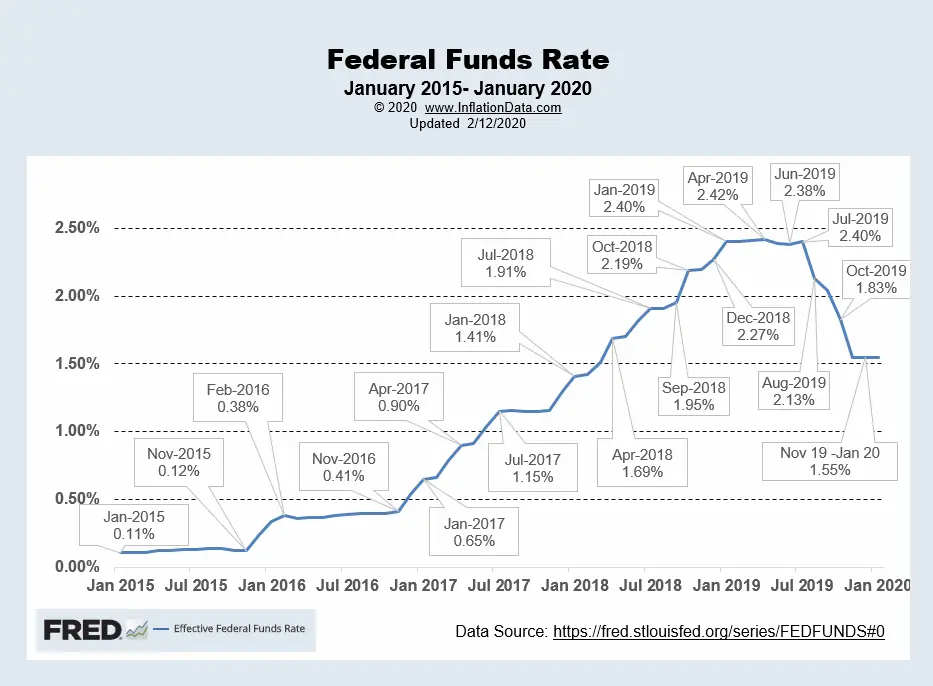

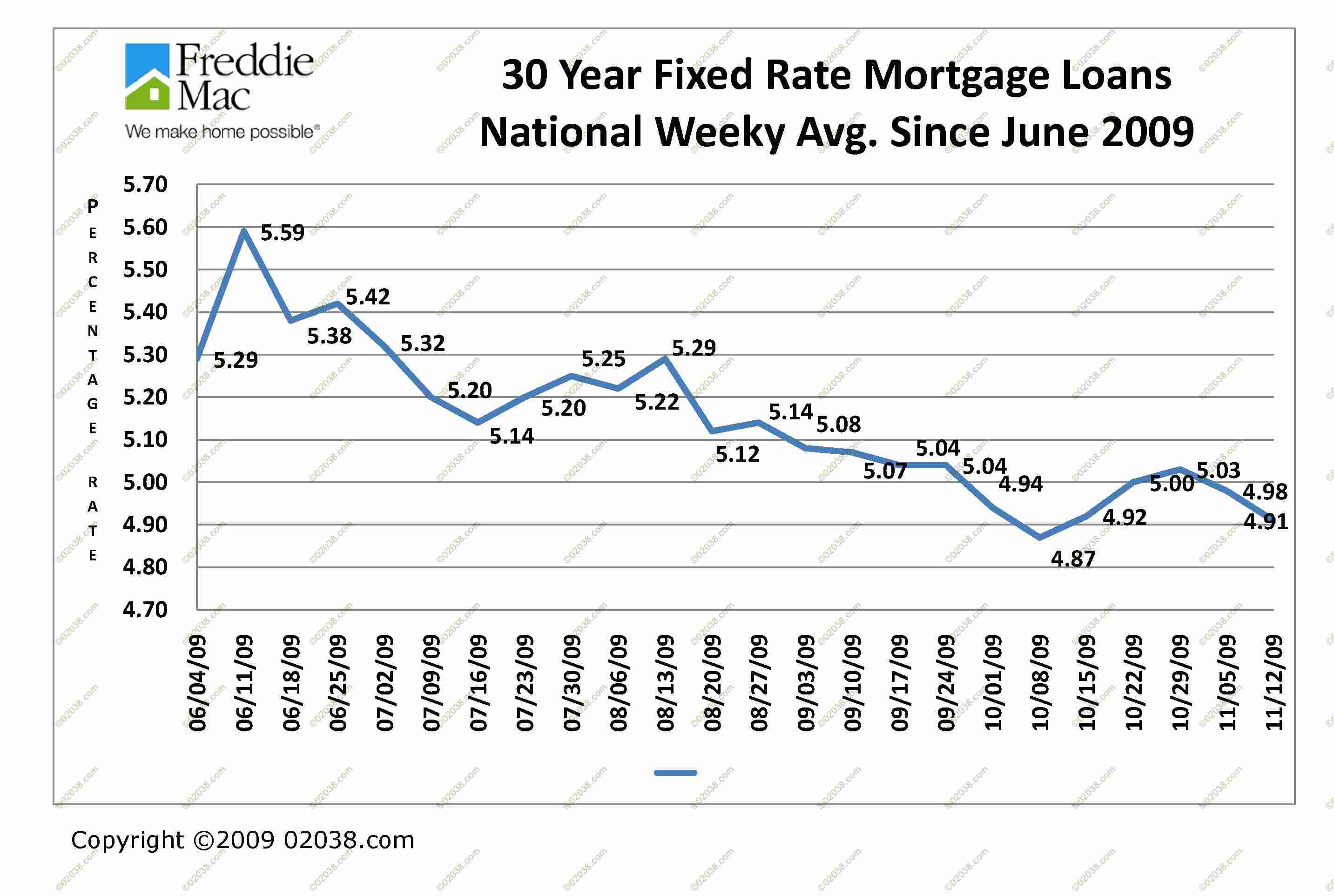

Several factors influence the rates set by the FHLB, reflecting the broader economic environment. Interest rate benchmarks set by the Federal Reserve play a critical role.

The overall health of the economy, including inflation and unemployment figures, impacts investor confidence and the demand for credit. Market liquidity also plays a part. When there's plenty of cash flowing through the system, rates tend to be lower.

Furthermore, each regional FHLB's own financial condition and funding needs will influence its rate offerings.

The Significance of the FHLB Rate

The FHLB rate isn't just another number on a financial spreadsheet. It has ripple effects throughout the housing market and the broader economy.

Firstly, it directly affects the cost of funds for community banks. Lower FHLB rates translate to cheaper funding for these institutions, potentially leading to lower mortgage rates for consumers.

Secondly, the FHLB plays a vital role in ensuring liquidity in the mortgage market. By providing a stable source of funding, it helps to prevent credit crunches and keeps the housing market functioning smoothly.

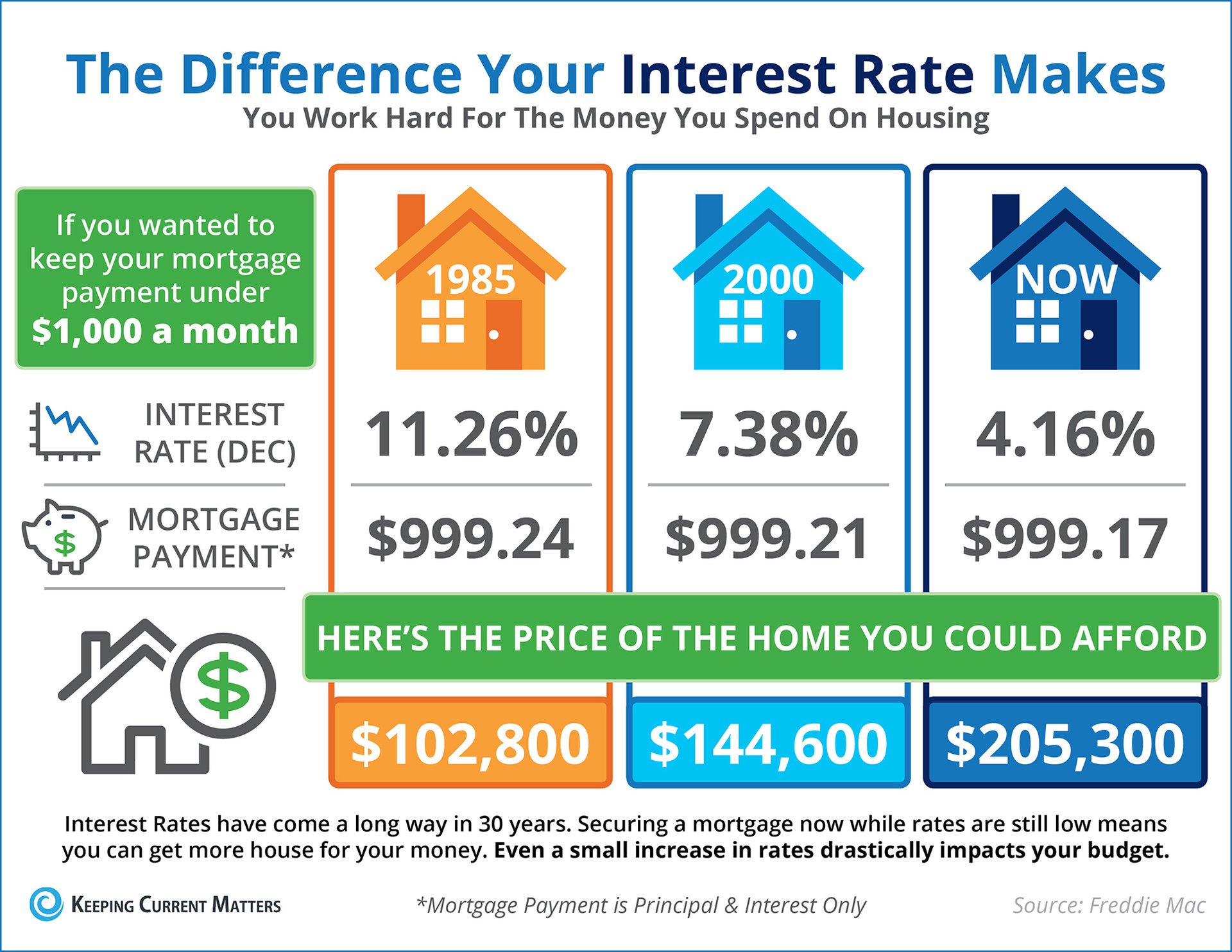

Impact on Mortgage Rates and Housing Affordability

While the FHLB rate isn't the only factor determining mortgage rates, it's certainly a significant one. Community banks, which rely heavily on FHLB advances, are often key players in offering mortgages to first-time homebuyers and those in underserved communities.

Therefore, changes in the FHLB rate can have a direct impact on housing affordability. When FHLB rates rise, community banks may need to increase their mortgage rates to maintain profitability, making it more expensive for people to buy homes.

Conversely, lower FHLB rates can ease the pressure on mortgage rates, boosting affordability and stimulating homeownership.

FHLB and Community Development

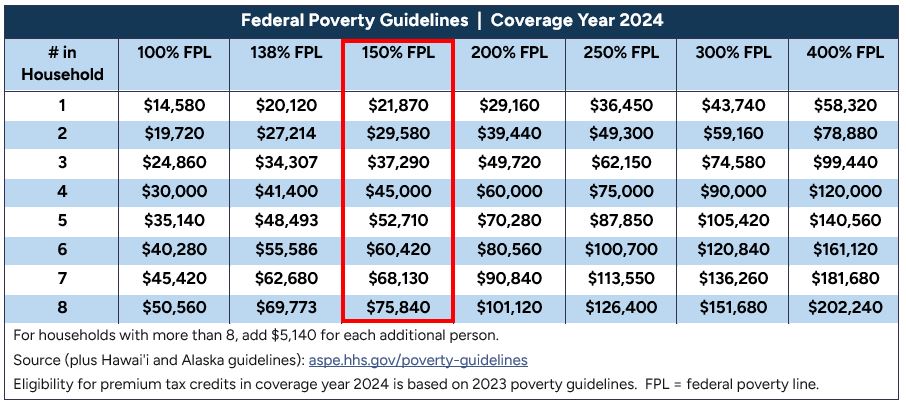

The FHLB System is also actively involved in community development initiatives. Many regional banks offer special programs and funding options to support affordable housing projects and economic development in their communities.

These initiatives often target areas with high poverty rates or a shortage of affordable housing. By providing funding and expertise, the FHLB helps to revitalize these communities and create opportunities for residents.

For example, some FHLBs offer grants or subsidized loans to developers who build affordable housing units or rehabilitate existing properties.

Staying Informed and Seeking Expert Advice

Keeping abreast of the latest FHLB rate trends requires staying informed about economic news and monitoring the announcements of the Federal Reserve. The statements from the Federal Open Market Committee (FOMC) provide valuable insights into the Fed's monetary policy outlook.

Following reputable financial news outlets and industry publications can also help you stay up-to-date on market developments.

If you're a community banker or a housing professional, consulting with a financial advisor can provide tailored guidance on how to navigate the FHLB system and manage interest rate risk.

"The FHLB System plays a vital role in supporting community lenders and promoting affordable housing across the country," - a statement from a regional FHLB president.

Looking Ahead: The Future of the FHLB System

The FHLB System continues to evolve to meet the changing needs of the housing market and the financial industry. In recent years, there has been increased scrutiny and debate about the role and governance of the FHLB system.

Some policymakers have called for reforms to strengthen the system's oversight and ensure that it is fulfilling its mission effectively.

Despite these challenges, the FHLB System remains a critical component of the housing finance landscape. Its ability to provide stable and affordable funding to community lenders is essential for supporting homeownership and community development across the country.

The FHLB is a cornerstone in local and national economics, and it is important to know and understand the role that it plays.