What Is The Main Reason Businesses Fail

.jpg)

Imagine a bustling marketplace, vibrant with energy and dreams. Each stall represents a business, a hopeful venture brimming with potential. Some thrive, their owners smiling and engaging with eager customers. But others stand silent, their shutters drawn, tales of ambition cut short.

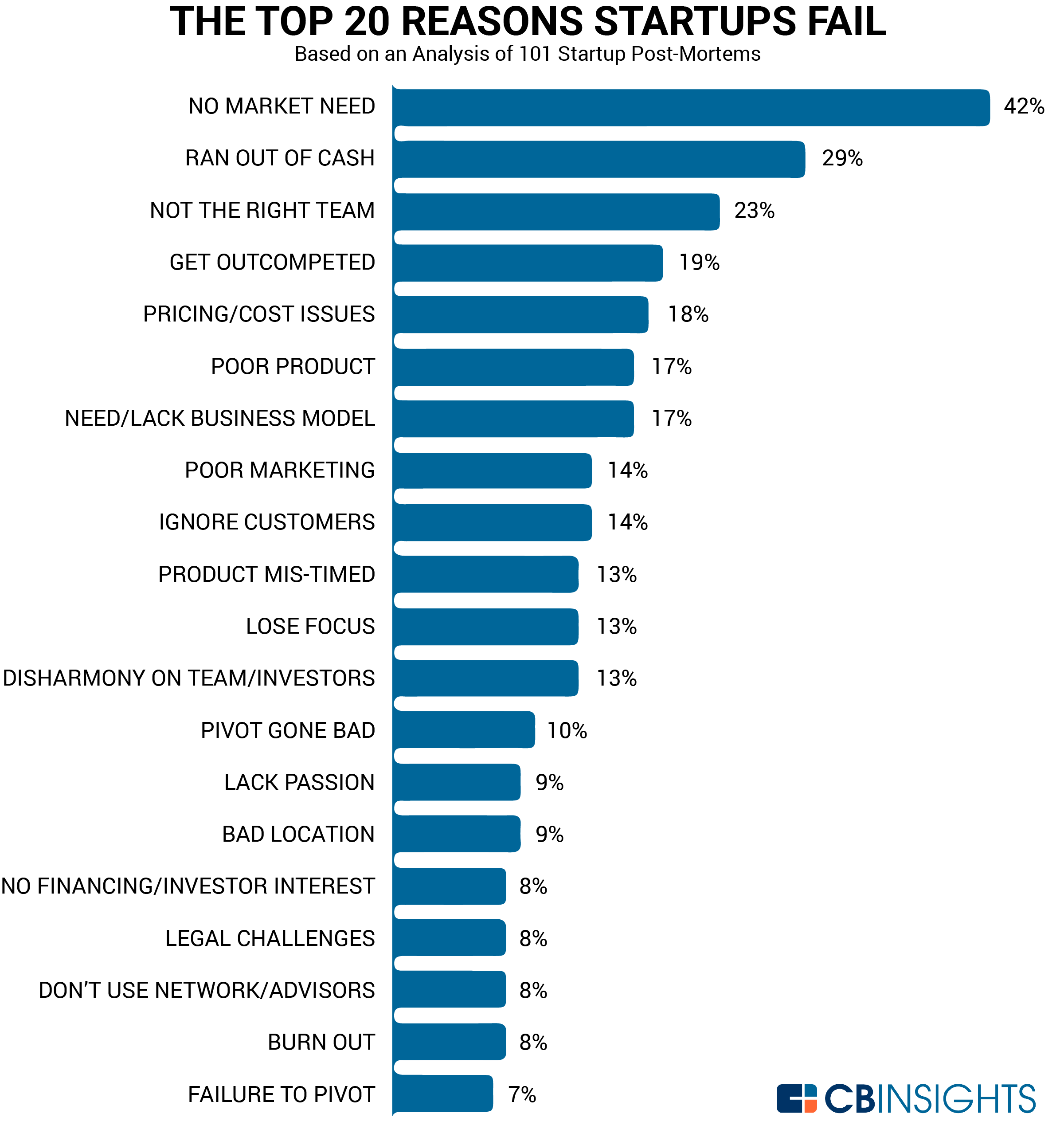

The question lingering in the air is: why do some businesses flourish while others falter? What is the main reason businesses fail? The answer, while multifaceted, often boils down to one core issue: a lack of effective cash flow management.

Cash flow, the lifeblood of any business, is the movement of money in and out. It’s not just about profitability, but about having enough liquid assets available to meet immediate obligations. A profitable business can still fail if it runs out of cash.

The Significance of Cash Flow

Understanding cash flow is paramount for any entrepreneur. Poor cash flow can cripple even the most innovative businesses. It impacts the ability to pay employees, purchase inventory, and invest in growth.

Without sufficient cash, businesses may struggle to meet their financial obligations. This can lead to debt accumulation, missed opportunities, and ultimately, closure.

Breaking Down the Issue

So, how does a lack of cash flow management manifest itself? Several factors contribute to this widespread problem.

Poor Financial Planning

Many startups launch without a comprehensive financial plan. They might underestimate expenses, overestimate revenue projections, or fail to account for unexpected costs.

According to a study by U.S. Bank, 82% of business failures are due to poor cash flow management. This often stems from inadequate budgeting and forecasting.

Inadequate Pricing Strategies

Setting prices that are too low can attract customers but leave little room for profit. Ignoring costs, failing to factor in overhead, and engaging in price wars can rapidly drain a business's resources.

Conversely, setting prices too high may alienate potential customers. Finding the right balance is crucial for sustainable profitability and healthy cash flow.

Inefficient Inventory Management

Holding too much inventory ties up cash. It also exposes businesses to the risk of obsolescence and storage costs. Overstocking is a common pitfall for retailers and manufacturers.

Conversely, running out of inventory can lead to lost sales and dissatisfied customers. Effective inventory management systems are essential for optimizing cash flow.

Delayed Payments from Customers

Businesses that extend credit to customers often face the challenge of delayed payments. Late payments disrupt cash flow, making it difficult to meet obligations.

According to Experian, late payments are a major concern for small businesses. Invoice factoring, or offering early payment discounts, can mitigate this risk.

Uncontrolled Expenses

Overspending on non-essential items can quickly erode a business's cash reserves. Keeping a close eye on expenses and implementing cost-cutting measures is crucial for maintaining a healthy financial position.

Regularly reviewing financial statements and identifying areas where costs can be reduced is essential.

Turning the Tide

While the statistics may seem daunting, businesses can take proactive steps to improve their cash flow management. Implementing robust financial planning, adopting efficient inventory management systems, and establishing clear payment terms are all vital.

Seeking guidance from financial advisors can provide valuable insights. This is particularly important for entrepreneurs who lack formal financial training.

Ultimately, recognizing the importance of cash flow and taking concrete steps to manage it effectively is the key to long-term success. It’s about navigating the marketplace with informed decisions, ensuring that the lifeblood of the business continues to flow, sustaining growth and fulfilling the initial dream.