What Is The Minimum Credit Limit For Capital One

Imagine the thrill of finally being approved for your first credit card. The anticipation builds as you wonder what spending power you’ll unlock. Will it be enough to cover that emergency car repair, or perhaps finally book that weekend getaway you've been dreaming about? The initial credit limit can feel like a gateway to financial freedom, but also raises the question: what's the minimum I can realistically expect?

The minimum credit limit for a Capital One card can vary significantly, generally starting around $300. However, several factors play a crucial role in determining the exact amount you'll be approved for. These include your credit history, income, and overall creditworthiness.

Capital One: A Credit Card Leader

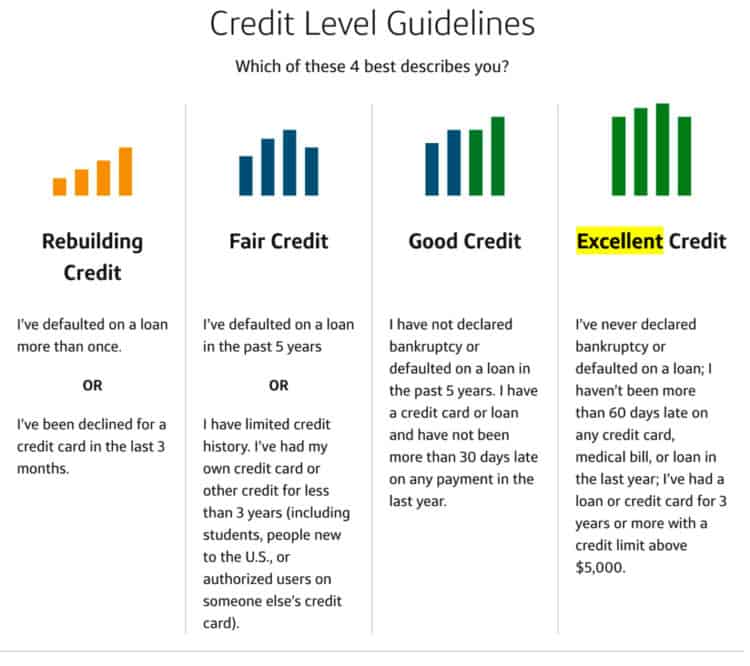

Capital One has established itself as a major player in the credit card industry. They offer a diverse range of cards designed to cater to various needs and credit profiles. This includes options for those with excellent credit, fair credit, or even those looking to rebuild their credit.

Their commitment to accessibility has made them a popular choice for many. Especially individuals seeking to build or improve their credit scores.

Understanding Credit Limits

A credit limit is the maximum amount you can charge to your credit card. It's essentially a line of credit extended by the card issuer. This limit is determined by assessing your ability to repay the borrowed funds.

For Capital One, the minimum credit limit typically begins around $300. Some cards, particularly those aimed at individuals with limited or fair credit history, may start at this level.

Factors Influencing Your Credit Limit

Your credit score is a primary factor in determining your credit limit. A higher score generally translates to a higher limit, as it signifies a lower risk to the lender.

Your income is another crucial element. Capital One needs to assess your ability to repay your debts. A stable and sufficient income demonstrates your capacity to handle credit responsibly.

Your credit history, including the length and type of credit accounts you've managed, also plays a significant role. Responsible management of past credit accounts builds trust with lenders.

Building Credit with Capital One

Capital One offers several cards specifically designed for those with limited or no credit history. These cards often come with lower initial credit limits, providing a stepping stone to building credit.

Using these cards responsibly, making timely payments, and keeping your credit utilization low, are key to improving your credit score. This, in turn, can lead to higher credit limits in the future.

Beyond the Minimum: Increasing Your Credit Limit

After several months of responsible card use, you can request a credit limit increase from Capital One. They will review your account and credit history to determine if you qualify.

Maintaining a good payment history and demonstrating responsible credit behavior are essential for a successful request. Showing that you can manage your existing credit well increases your chances of approval.

Tips for Managing Your Credit Limit

It's crucial to manage your credit limit responsibly. Avoid maxing out your card, as this can negatively impact your credit score.

Keep your credit utilization below 30% of your total credit limit. This demonstrates responsible credit management to lenders.

Setting up automatic payments can help ensure you never miss a payment. This will protect your credit score and avoid late fees.

In conclusion, while the minimum credit limit for a Capital One card is generally around $300, remember that it's just a starting point. By focusing on responsible credit habits, you can gradually increase your credit limit and unlock greater financial flexibility. The key is to view your credit card as a tool for building a strong financial future, not just a means of immediate spending.