What Is The Minimum Credit Score For A Discover Card

Imagine you're finally ready to take that dream vacation, or perhaps you're eyeing that new gadget that promises to streamline your life. A credit card can be the key, unlocking these possibilities and offering rewards along the way. But what if a credit card feels like a distant dream, shrouded in the mystery of credit scores?

Understanding the credit score requirements for specific cards, like those offered by Discover, is crucial for anyone looking to build or rebuild their creditworthiness. This article aims to demystify the process, focusing on the minimum credit score needed to get a Discover card, providing clarity for those navigating the world of personal finance.

Navigating the Credit Score Landscape

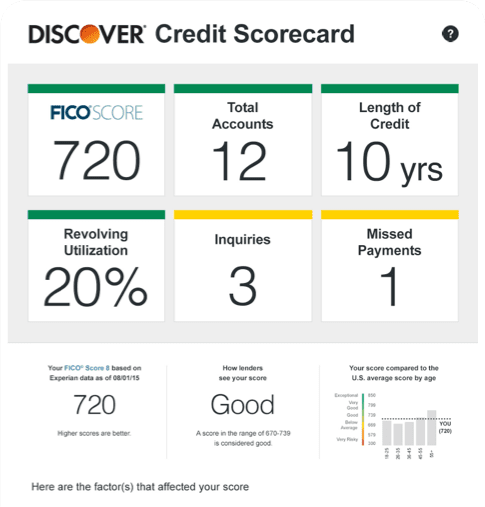

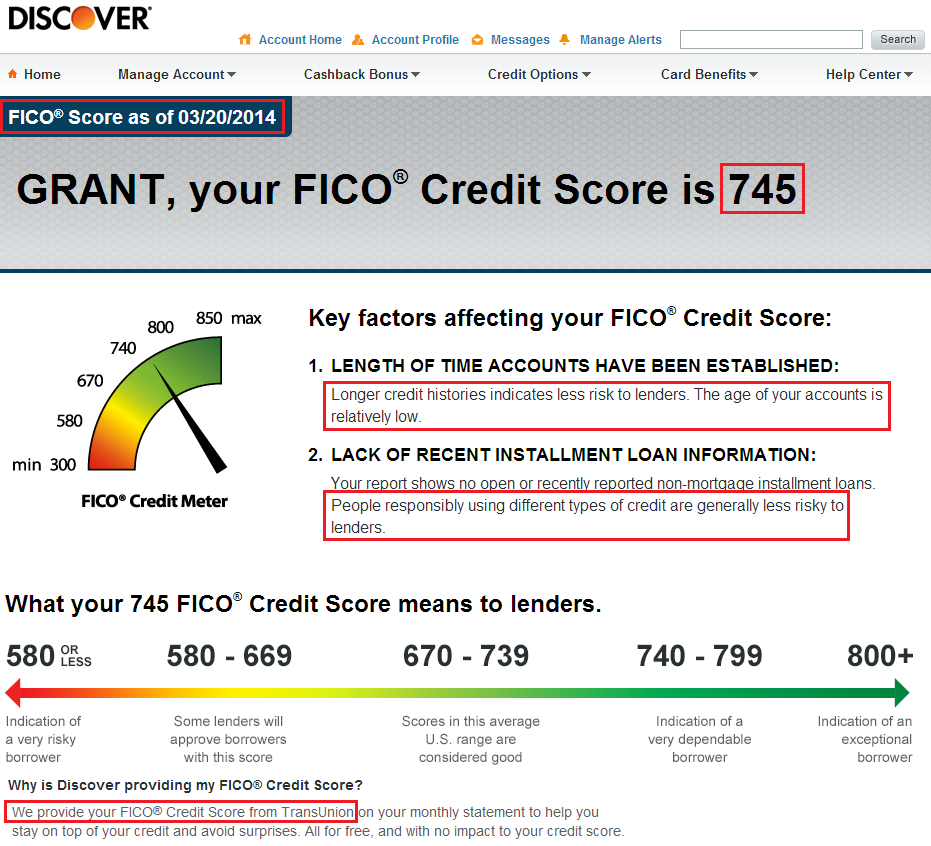

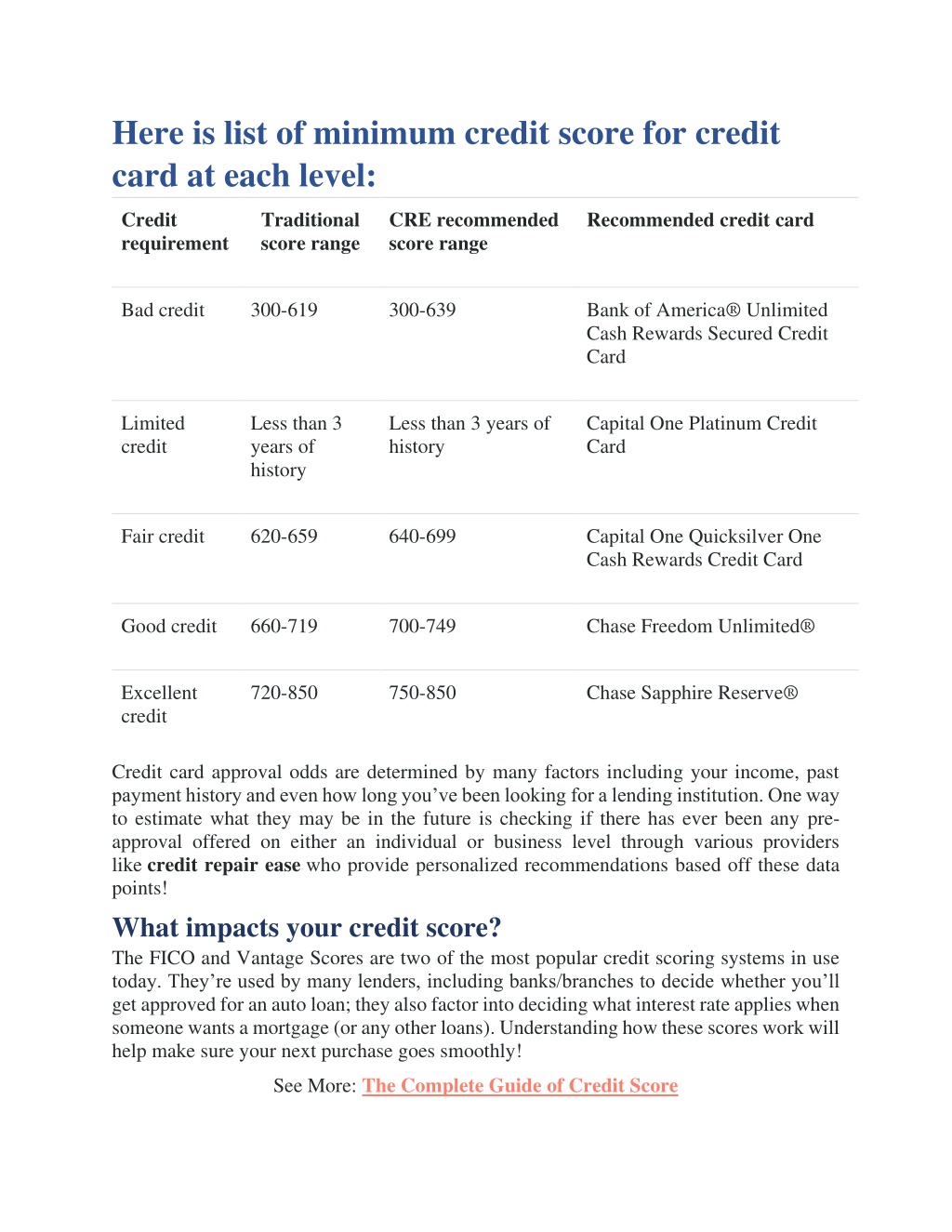

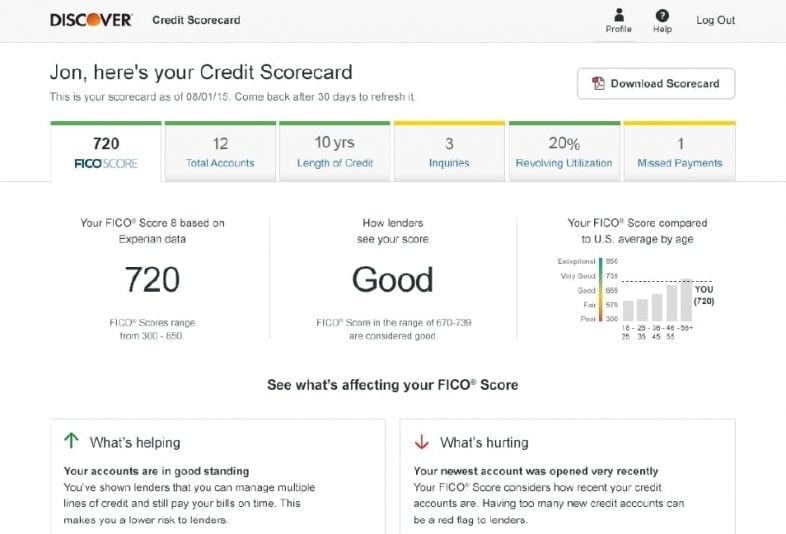

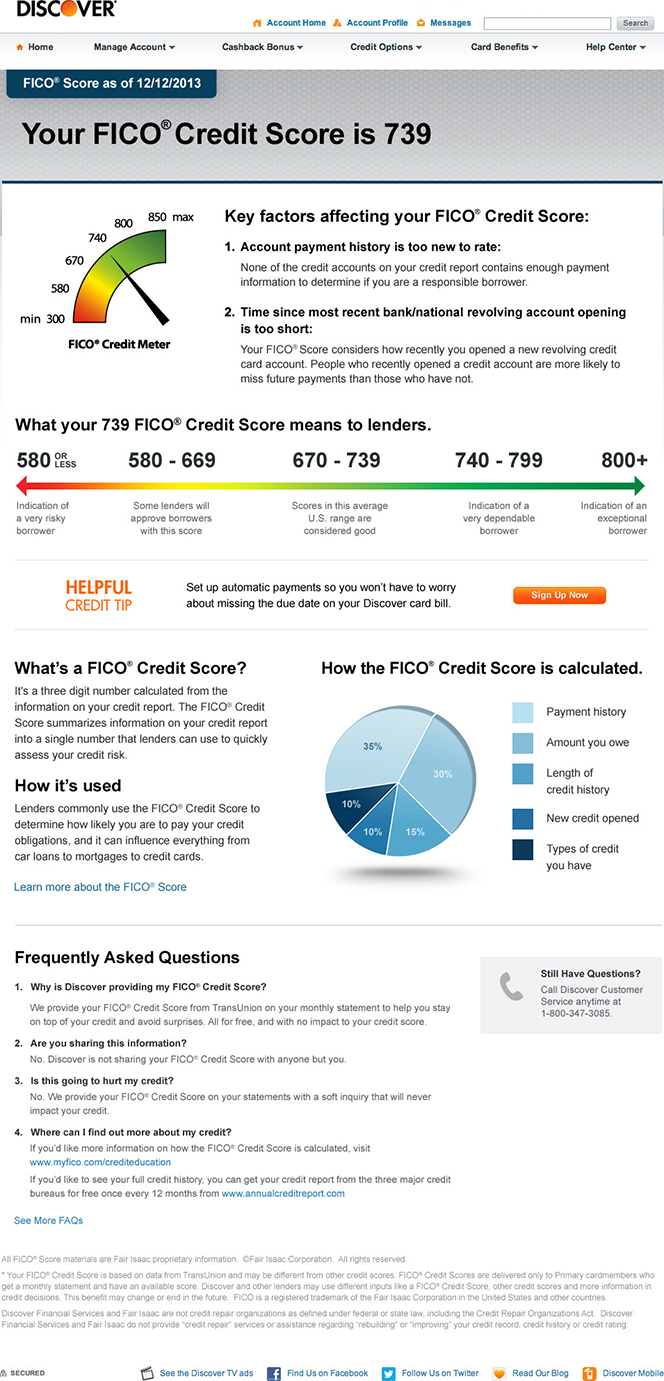

Before diving into the specifics of Discover cards, it's essential to understand the general credit score ranges. The most commonly used credit scoring model is FICO, which ranges from 300 to 850. These scores are generally categorized as follows:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Exceptional: 800-850

The Discover Card Spectrum

Discover offers a range of credit cards designed to cater to different credit profiles. This is good news for those with less-than-perfect credit. However, the specific card you qualify for will depend on your individual credit history.

While there's no publicly stated minimum credit score for all Discover cards, a "fair" credit score (580-669) might be enough to qualify for some of their entry-level cards, such as the Discover it® Secured Credit Card.

Secured vs. Unsecured Discover Cards

Secured credit cards, like the Discover it® Secured Credit Card, are designed for those with limited or damaged credit histories. These cards require a security deposit, which typically acts as your credit limit. They can be a great way to build or rebuild credit.

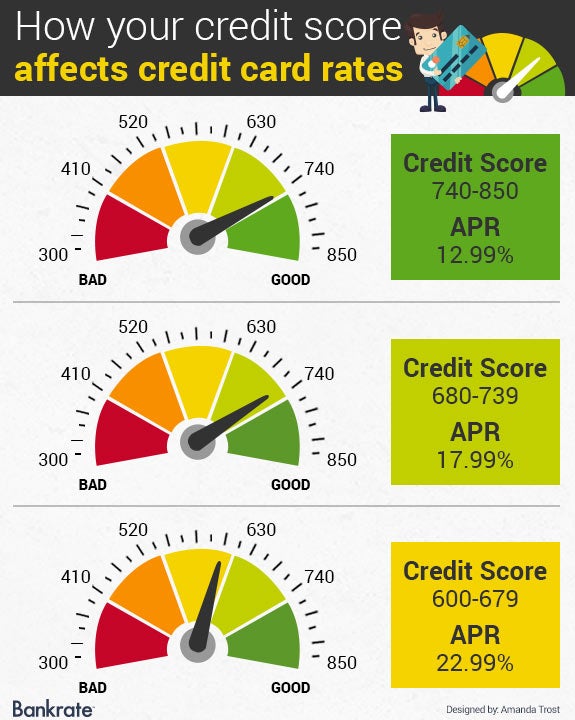

Unsecured credit cards, on the other hand, do not require a security deposit. These cards are generally offered to individuals with "good" to "excellent" credit scores. A score of 670 or higher is usually necessary for unsecured Discover cards.

The Importance of a Good Credit History

Even if you qualify for a card with a lower credit score, striving for a higher score can unlock more favorable terms. This includes lower interest rates, higher credit limits, and access to better rewards programs.

Building a good credit history involves several key factors: paying your bills on time, keeping your credit utilization low, and avoiding opening too many accounts at once. Regularly monitoring your credit report is also essential.

Beyond the Score: Other Factors

While your credit score is a major factor, Discover, like other credit card issuers, also considers other aspects of your financial profile. These include your income, employment history, and overall debt-to-income ratio.

A stable income and a low debt-to-income ratio can increase your chances of approval, even if your credit score isn't perfect.

"Credit scores are an important part of the financial landscape, but they're not the only factor. We look at the whole picture," – A Discover representative once stated during a financial literacy seminar.

Ultimately, obtaining a Discover card is within reach for many, regardless of their current credit situation. Starting with a secured card and diligently building credit can pave the way for more rewarding options in the future. Remember, responsible credit management is a journey, not a destination.