What Is The One Stock Motley Fool Is Recommending

The market is a turbulent sea, and investors are constantly searching for the lighthouse that guides them to safe harbor. The Motley Fool, a well-known investment advisory firm, has long served as a beacon for both novice and seasoned investors. Their stock recommendations are closely watched, often triggering significant market activity.

With a plethora of choices, their latest "top stock" pick is under intense scrutiny, as investors weigh whether to align their portfolios with the Fool's expert opinion.

The Nut Graf: Palantir Technologies (PLTR) - A Closer Look

The Motley Fool is reportedly recommending Palantir Technologies (PLTR) as a compelling investment opportunity for long-term growth. Palantir, a data analytics company known for its work with government agencies and commercial enterprises, has captured the attention of investors due to its innovative technology and expanding market reach.

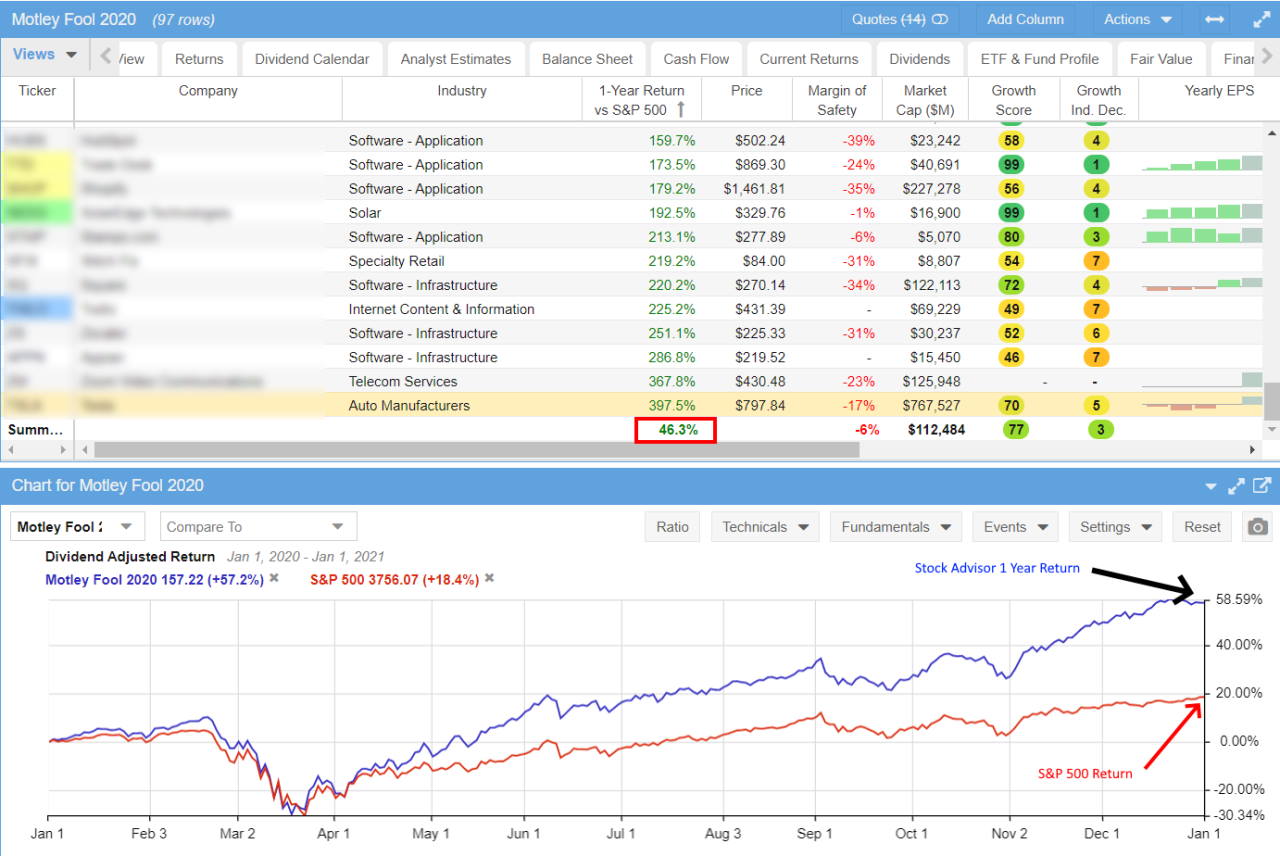

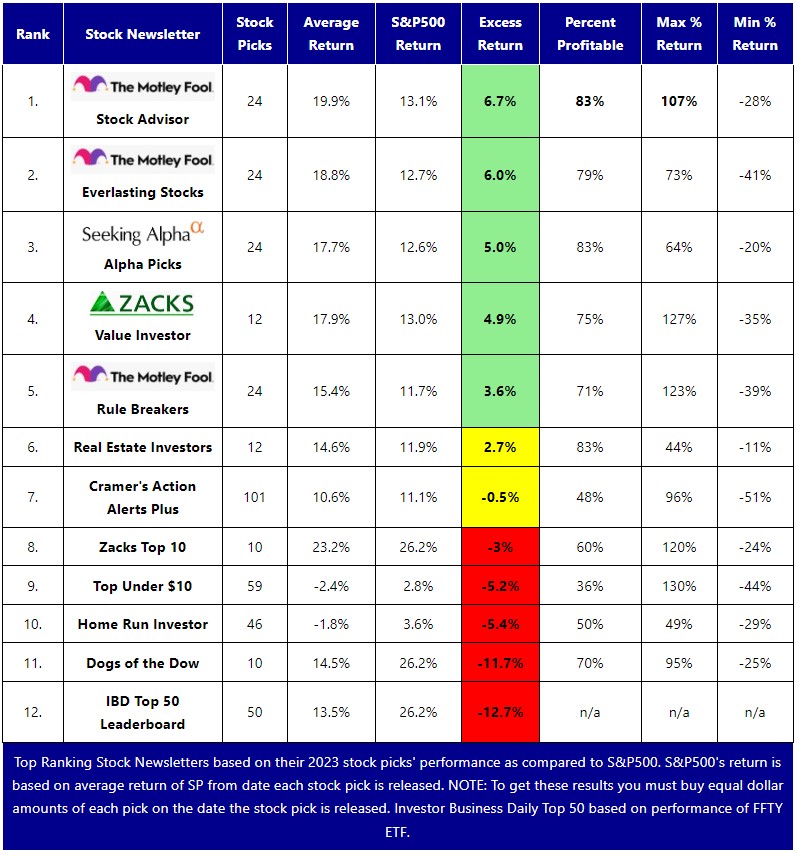

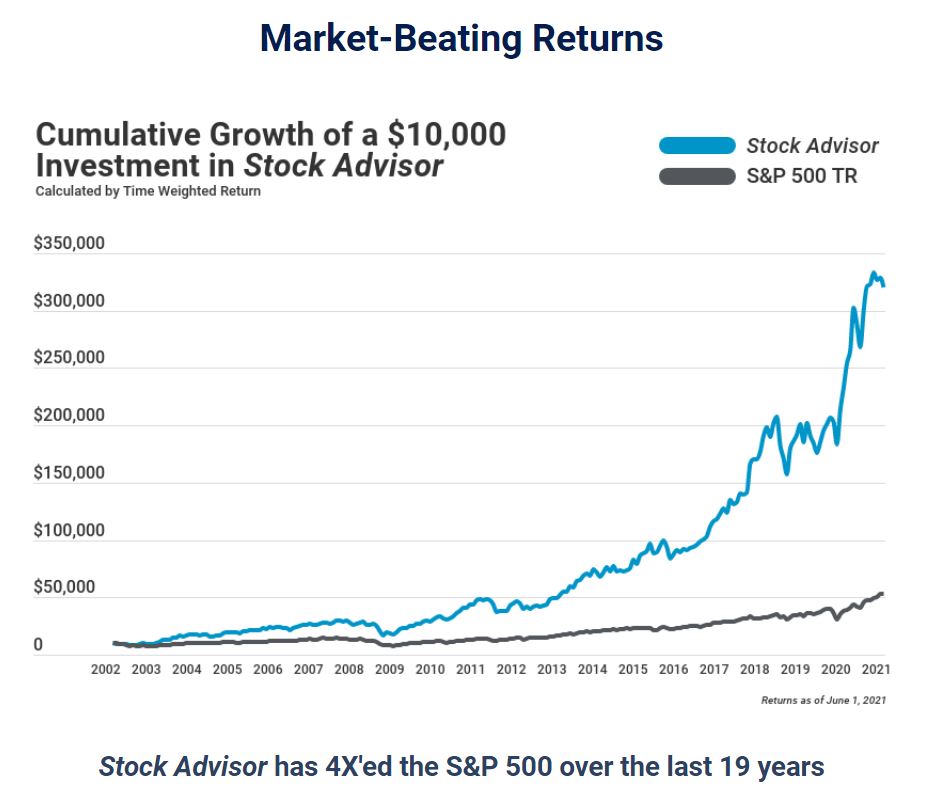

This recommendation, reportedly made within the firm's flagship *Stock Advisor* service, suggests that the Fool believes Palantir's current market position and future prospects warrant serious consideration.

Palantir's Business Model and Growth Drivers

Palantir operates primarily through two main platforms: Gotham, designed for government intelligence and defense, and Foundry, tailored for commercial clients. Gotham enables agencies to integrate and analyze disparate datasets, aiding in intelligence gathering and operational efficiency.

Foundry offers similar capabilities to businesses, helping them optimize supply chains, manage risks, and improve decision-making. Palantir's business model involves selling customized software platforms and services, often through multi-year contracts, creating a recurring revenue stream.

The company's growth is being fueled by increased demand for data analytics solutions, particularly in sectors such as healthcare, finance, and manufacturing. The ongoing digital transformation of these industries creates a favorable environment for Palantir's services.

Financial Performance and Market Sentiment

Palantir's recent financial performance has shown a trajectory of significant growth. In its latest earnings report, the company reported strong revenue growth and expanding margins, exceeding analysts' expectations. According to Palantir's Q1 2024 report, revenue was $634 million, up 21% year-over-year.

Market sentiment towards Palantir is largely positive, with many analysts highlighting the company's unique technology and potential for long-term growth. However, some caution that Palantir's valuation is high, reflecting the market's expectations for future growth.

Investors are advised to consider Palantir’s profitability, which although improving, is still subject to fluctuations depending on contract size and sales expenditure.

Risks and Challenges

Despite its promising outlook, Palantir faces several risks. The company's reliance on government contracts makes it vulnerable to changes in government spending and policy. Any reduction in defense or intelligence budgets could negatively impact Palantir's revenue.

Moreover, Palantir faces competition from other data analytics providers, including established tech giants and specialized startups. Competition can affect profitability due to pricing pressures. Securing and retaining customers in a competitive market also adds pressure on the company.

Palantir's association with controversial government projects has also drawn criticism from privacy advocates. Reputation and ethical considerations are vital and these issues could affect investor and customer confidence.

Investor Considerations

The Motley Fool's recommendation of Palantir should not be taken as a guaranteed path to riches. Investors should conduct their own thorough research and consider their individual risk tolerance before investing in any stock.

Assess your own financial goals and investment horizon. Palantir is a growth stock, so it may be more suitable for investors with a long-term perspective. Remember that high-growth stocks can experience significant price volatility.

Diversification is crucial to consider. It is highly recommended to spread your investments across a variety of sectors and asset classes to reduce overall portfolio risk.

Conclusion: A Promising Opportunity with Inherent Risks

Palantir Technologies presents a compelling investment opportunity, driven by its innovative technology, growing market presence, and strong financial performance. The Motley Fool's recommendation reflects the company's potential for long-term growth.

However, investors should be aware of the risks associated with Palantir, including its reliance on government contracts, competition, and ethical considerations.

"Investing in the stock market involves risks, and there is always the potential for loss."

Ultimately, the decision to invest in Palantir should be based on a careful assessment of your own investment goals and risk tolerance. If you're considering investing in Palantir after reading about The Motley Fool's recommendation, do your due diligence.