What Is The Simple Definition Of A Mortgage

:max_bytes(150000):strip_icc()/mortgage-69f02f04cdae4863806bd0455255106e.png)

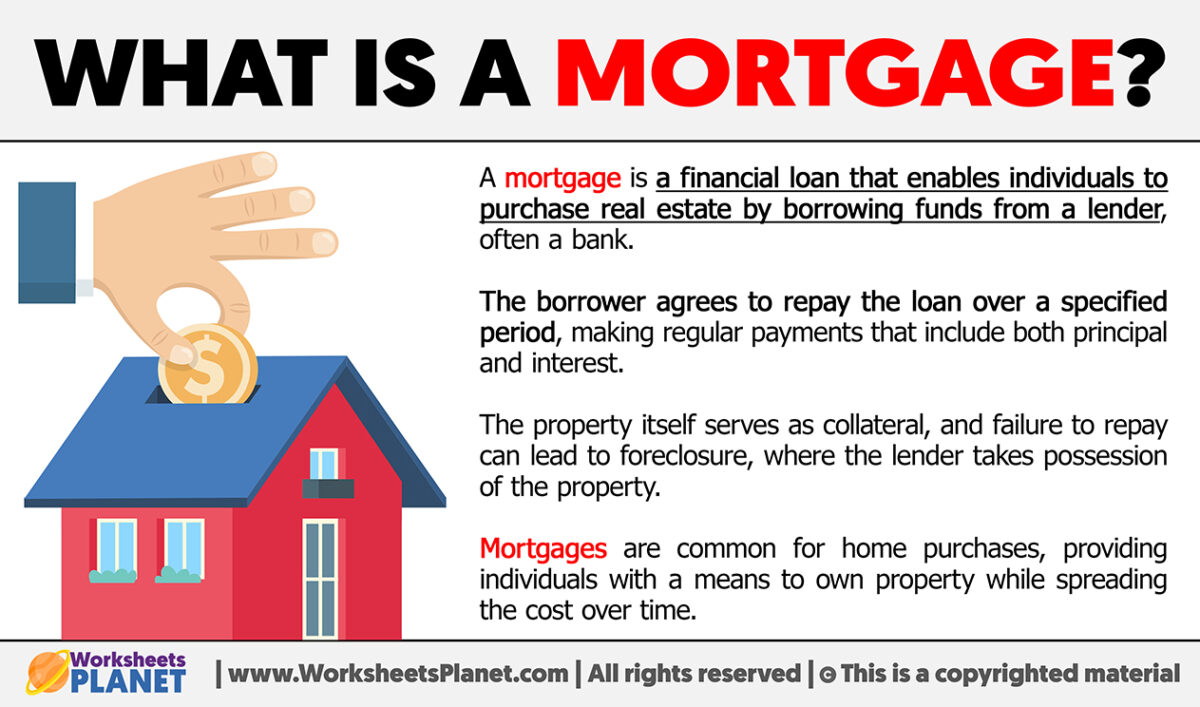

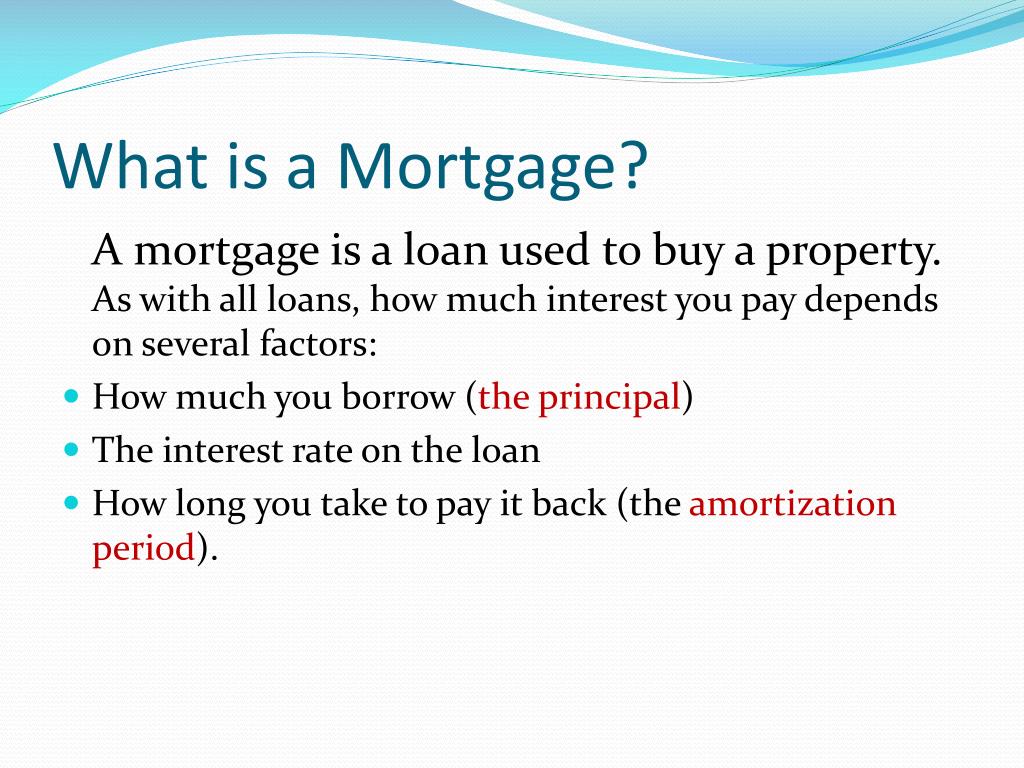

Navigating the world of homeownership can be daunting, especially when confronted with financial jargon. One term that often surfaces is "mortgage," a fundamental component of buying property for many.

At its core, a mortgage is a loan specifically designed to finance the purchase of real estate. This article breaks down the simple definition of a mortgage, its key components, and its impact on potential homeowners.

Understanding the Basics

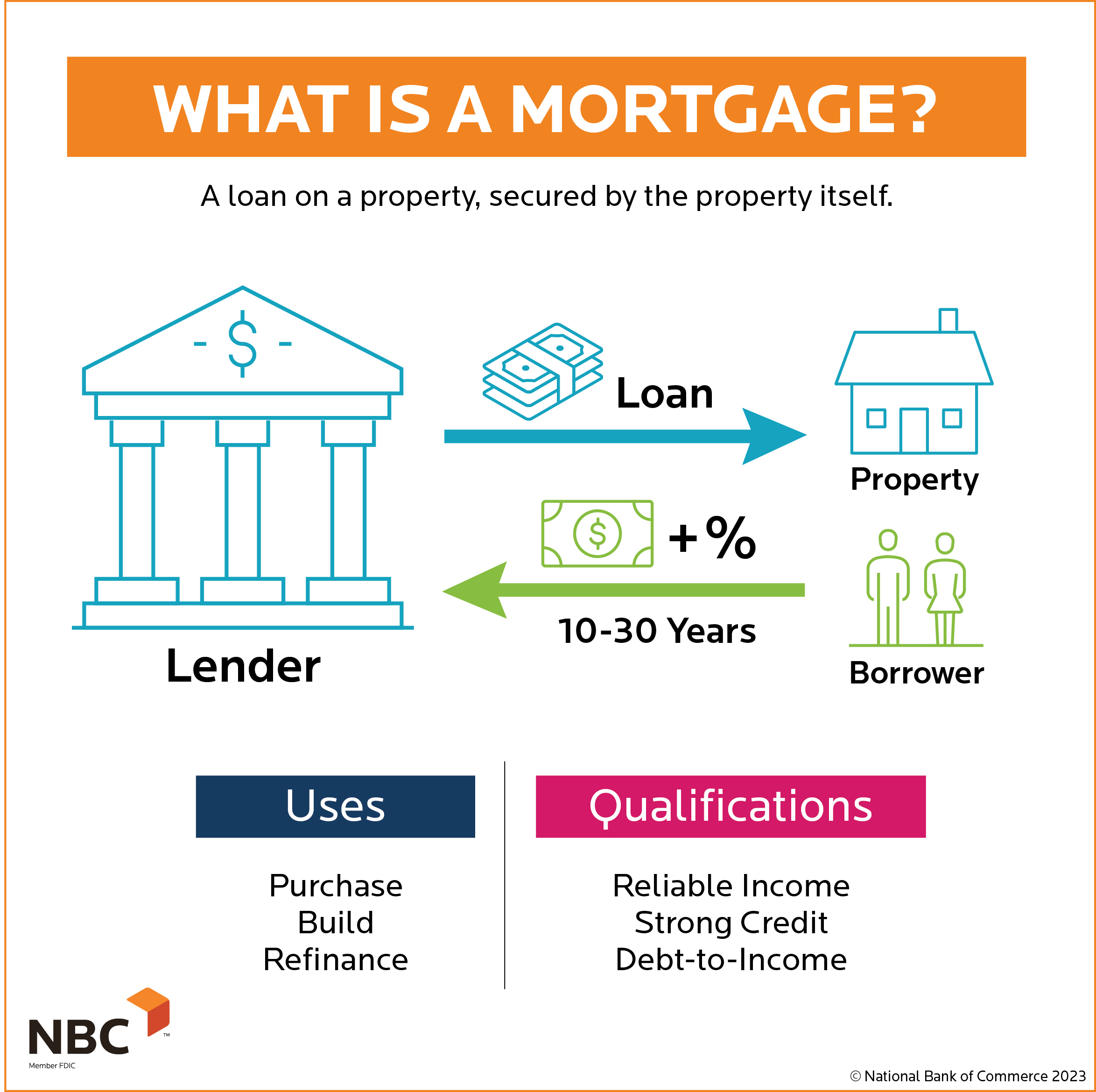

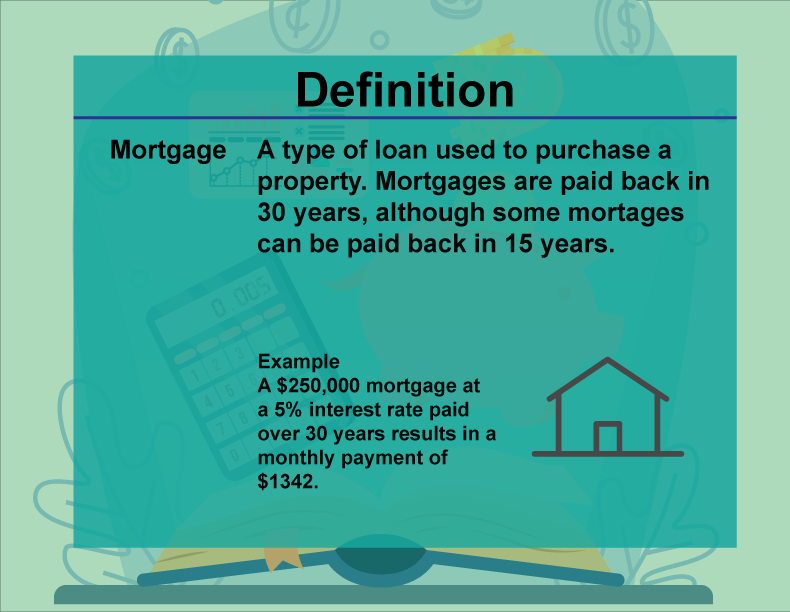

Simply put, a mortgage is a loan you take out to buy a home. It's an agreement between you (the borrower) and a lender (usually a bank or credit union), where you receive a sum of money to purchase a property. In return, you agree to repay the loan over a specified period, typically with interest.

The purchased property serves as collateral for the loan. If you fail to make payments, the lender has the right to foreclose on the property and sell it to recoup their losses.

Key Components of a Mortgage

Several elements define a mortgage agreement.

The principal is the original amount of money borrowed. The interest rate is the percentage the lender charges for lending the money. This is usually expressed as an annual percentage rate (APR).

The loan term refers to the length of time you have to repay the loan, commonly 15, 20, or 30 years. Monthly payments are the regular installments you make to the lender, covering both principal and interest.

Escrow is an account managed by the lender to pay property taxes and homeowners insurance. These costs are often included in your monthly mortgage payment.

Different Types of Mortgages

Various types of mortgages cater to different needs and financial situations.

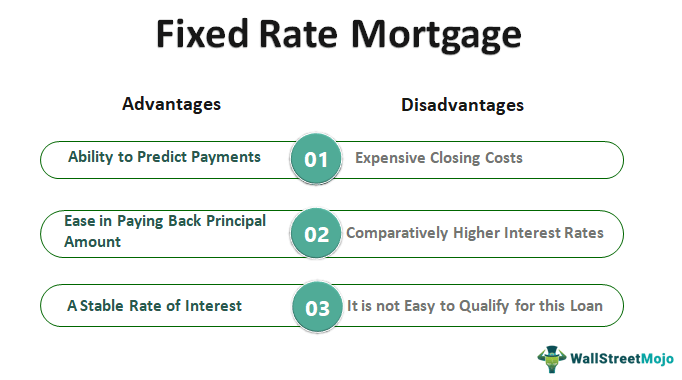

Fixed-rate mortgages have an interest rate that remains the same throughout the loan term, providing predictable monthly payments. Adjustable-rate mortgages (ARMs) have an interest rate that can change periodically based on market conditions.

According to the Consumer Financial Protection Bureau (CFPB), understanding the differences between these mortgage types is crucial for making informed decisions. Government-backed mortgages, like Federal Housing Administration (FHA) loans, offer options for borrowers with lower credit scores or smaller down payments.

The Impact of a Mortgage

Securing a mortgage has a significant impact on both individuals and the economy.

For individuals, it's often the key to homeownership, allowing them to build equity and secure their financial future. Equity is the difference between the home's value and the outstanding mortgage balance.

The mortgage industry also plays a vital role in the housing market. Mortgage rates and availability influence the demand for homes and the overall health of the economy. According to the National Association of Realtors (NAR), mortgage rates are a key driver of home sales.

Conclusion

In its simplest form, a mortgage is a loan that allows individuals to purchase a home by borrowing money from a lender. It involves understanding key components like principal, interest rate, and loan term. Selecting the right mortgage type is a critical step towards achieving financial stability and homeownership.