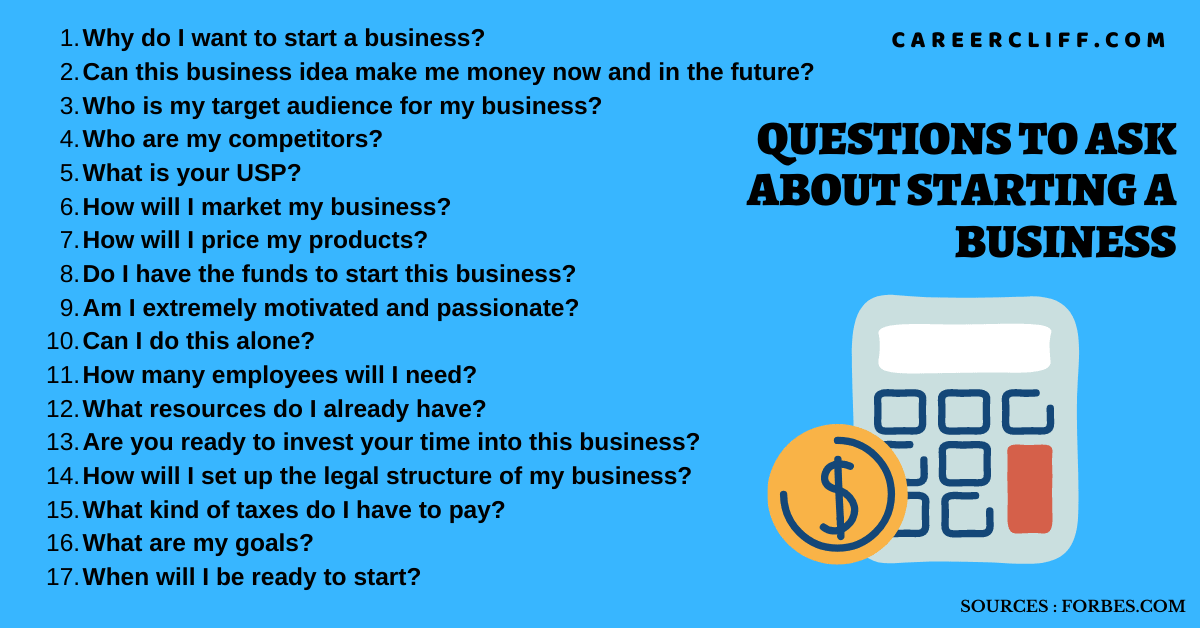

What Questions Should You Ask When Buying A Business

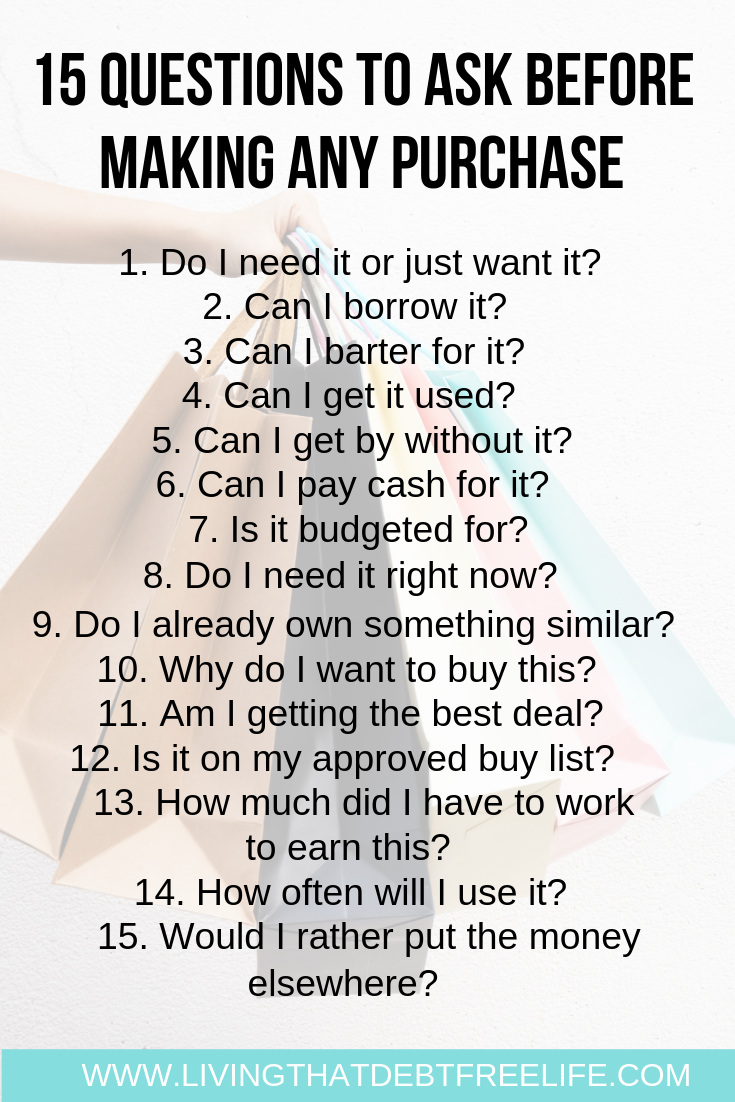

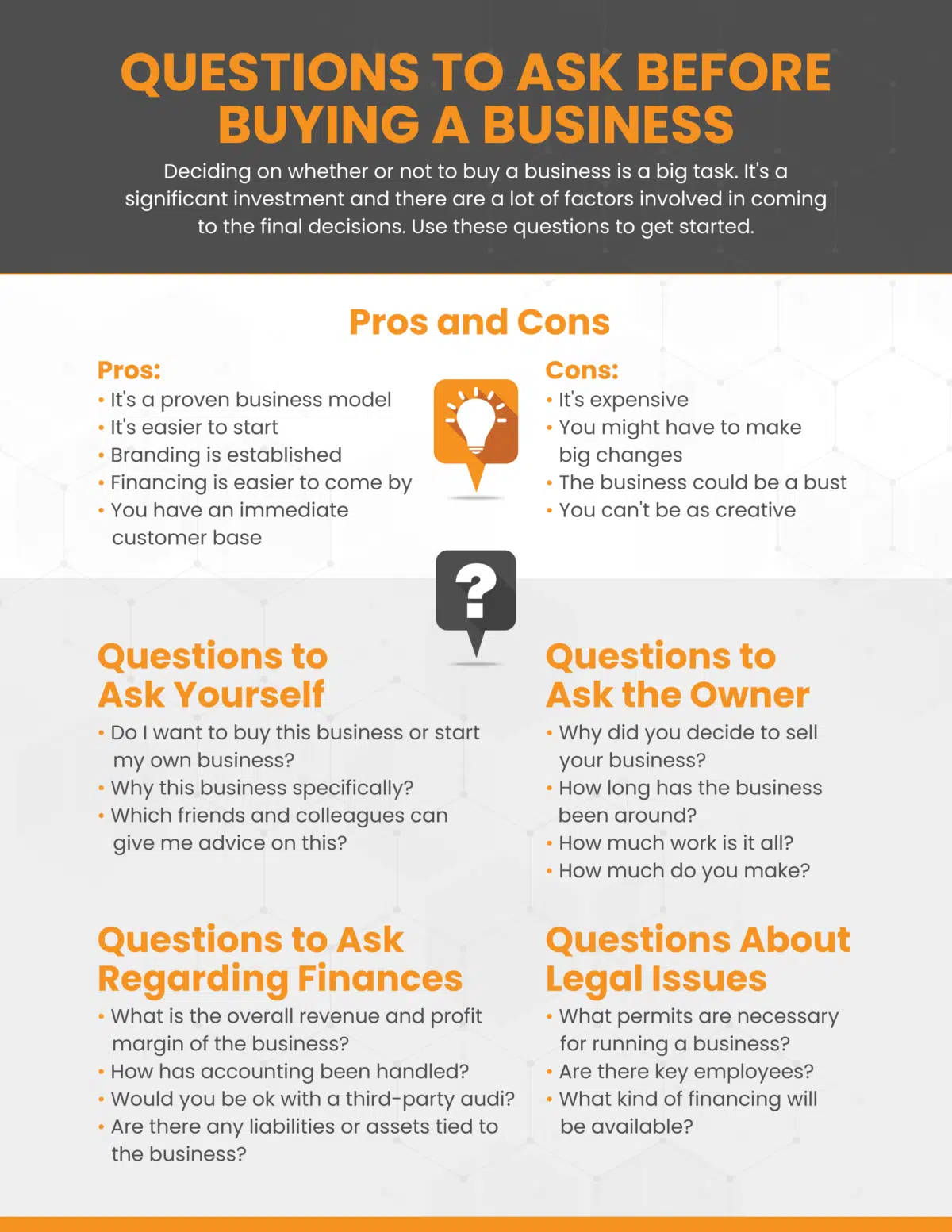

Considering buying a business? Don't leap before you look. Due diligence is paramount; asking the right questions can save you from financial disaster.

Acquiring a business is a monumental decision demanding meticulous investigation. This guide outlines essential questions to ask, ensuring you're equipped to make an informed and profitable investment. Protect yourself: inadequate scrutiny can turn your dream into a nightmare.

Financial Health: Peering Behind the Numbers

Request at least the past three years of financial statements, including profit and loss statements, balance sheets, and cash flow statements. Scrutinize these meticulously. Look for anomalies, trends, and potential red flags.

What are the actual revenues and profits, not just projections? How has profitability trended over time? Request access to tax returns. Verify the accuracy of reported figures.

What are the business's outstanding debts and liabilities? Obtain a detailed schedule of all loans, leases, and other obligations. What are the terms and conditions of these obligations?

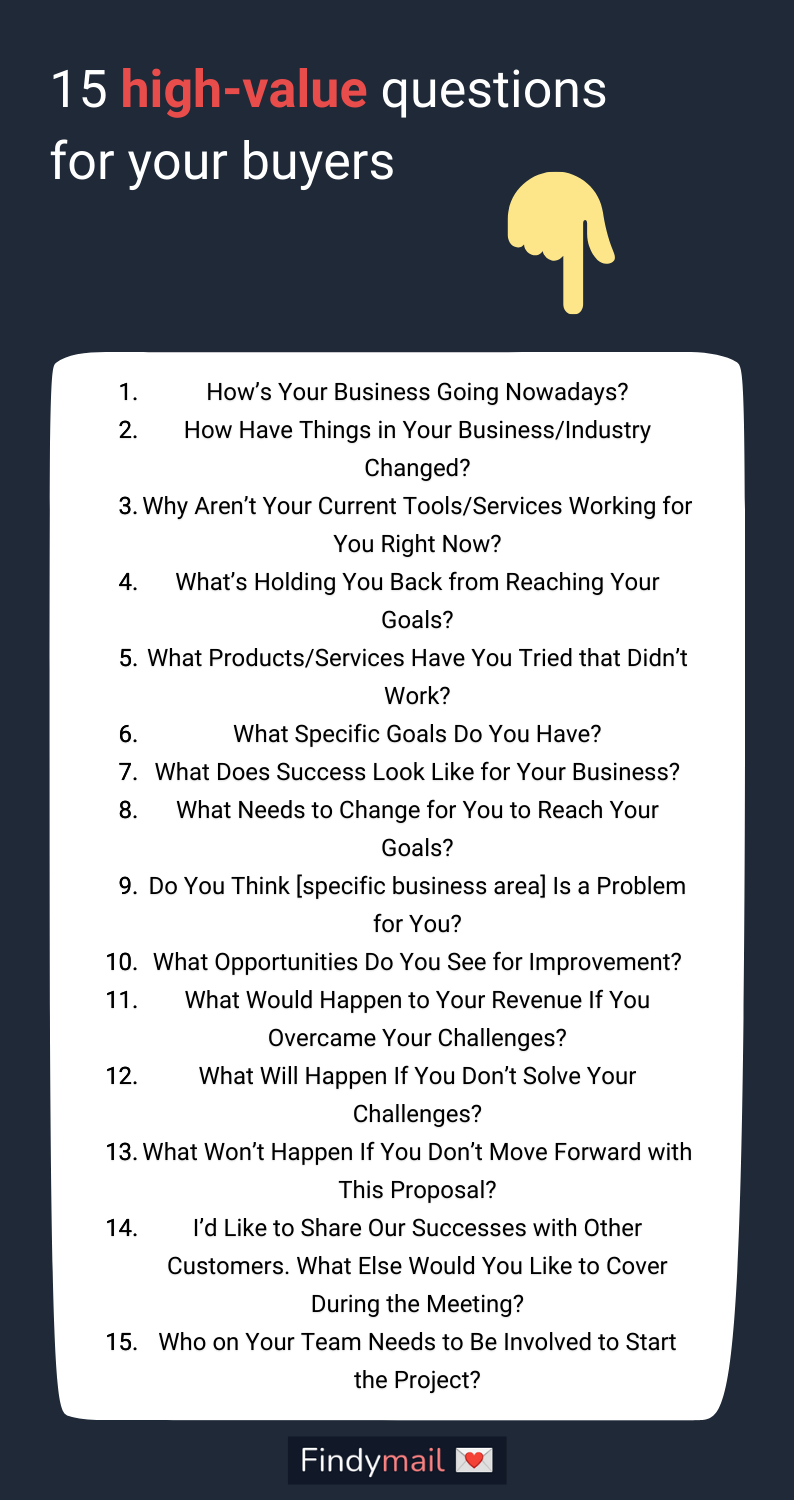

Operations and Assets: Understanding the Day-to-Day

Understand the business's operational model. What are the key processes and workflows? Are there any bottlenecks or inefficiencies?

What are the conditions of the physical assets? Engage a qualified appraiser to assess their value and identify any deferred maintenance. Conduct a physical inventory. Ensure what you see matches the records.

What intellectual property does the business own or license? Is it adequately protected? Are there any pending lawsuits or claims relating to intellectual property?

Customers and Competition: Assessing Market Position

Who are the business's key customers? What is the customer retention rate? A high customer turnover rate may indicate underlying problems.

Analyze the competitive landscape. Who are the main competitors? What are their strengths and weaknesses? What is the business's competitive advantage?

According to a 2023 report by the Small Business Administration (SBA), approximately 30% of acquired businesses fail within the first two years due to inadequate due diligence. Avoid becoming a statistic.

Legal and Regulatory Compliance: Ensuring a Clean Slate

Is the business in compliance with all applicable laws and regulations? Request copies of all permits and licenses. Verify their validity.

Are there any pending lawsuits, claims, or investigations against the business? Conduct a thorough background check on the business owner and key employees. What are the potential liabilities?

What are the terms of the lease agreement (if applicable)? What are the options for renewal? Ensure the lease terms are favorable.

Employees and Management: Evaluating Human Capital

What is the organizational structure of the business? Who are the key employees? What are their roles and responsibilities?

What are the employee retention rates? High turnover can signal problems with management or working conditions.

"Employee satisfaction is critical to business success,"says Dr. Anita Brown, a business acquisition consultant.

How will the current management team transition after the acquisition? Will they stay on board? Their expertise may be crucial for a smooth transition.

The Deal Structure: Understanding the Fine Print

What is the proposed purchase price and terms? Negotiate carefully. Don't be afraid to walk away if the terms are not favorable.

What is included in the sale? Assets, liabilities, goodwill, and intellectual property. Make sure everything is clearly defined in the purchase agreement. What are the contingencies of the deal?

Will the seller provide any warranties or guarantees? What are the remedies if these warranties are breached? Secure legal counsel before finalizing any agreement.

The next step: consult with experienced legal and financial advisors. Their expertise can help you navigate the complexities of business acquisition and protect your investment. Thorough due diligence is not an option; it is a necessity.

![What Questions Should You Ask When Buying A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)