What States Allow Reverse Mortgage At Age 55

Urgent Update: A growing number of Americans are seeking financial flexibility earlier than traditional retirement age. This article reveals the states where homeowners as young as 55 can access reverse mortgages, offering a crucial lifeline for some.

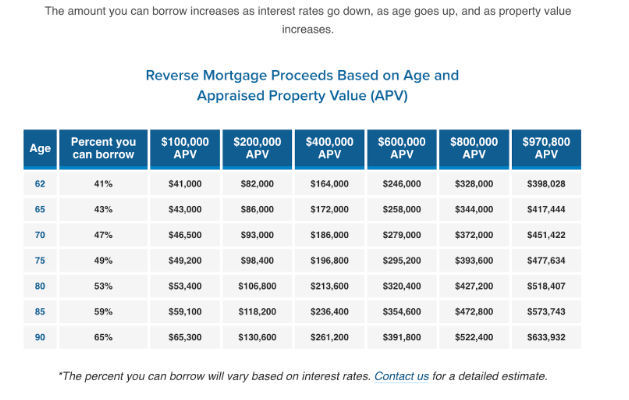

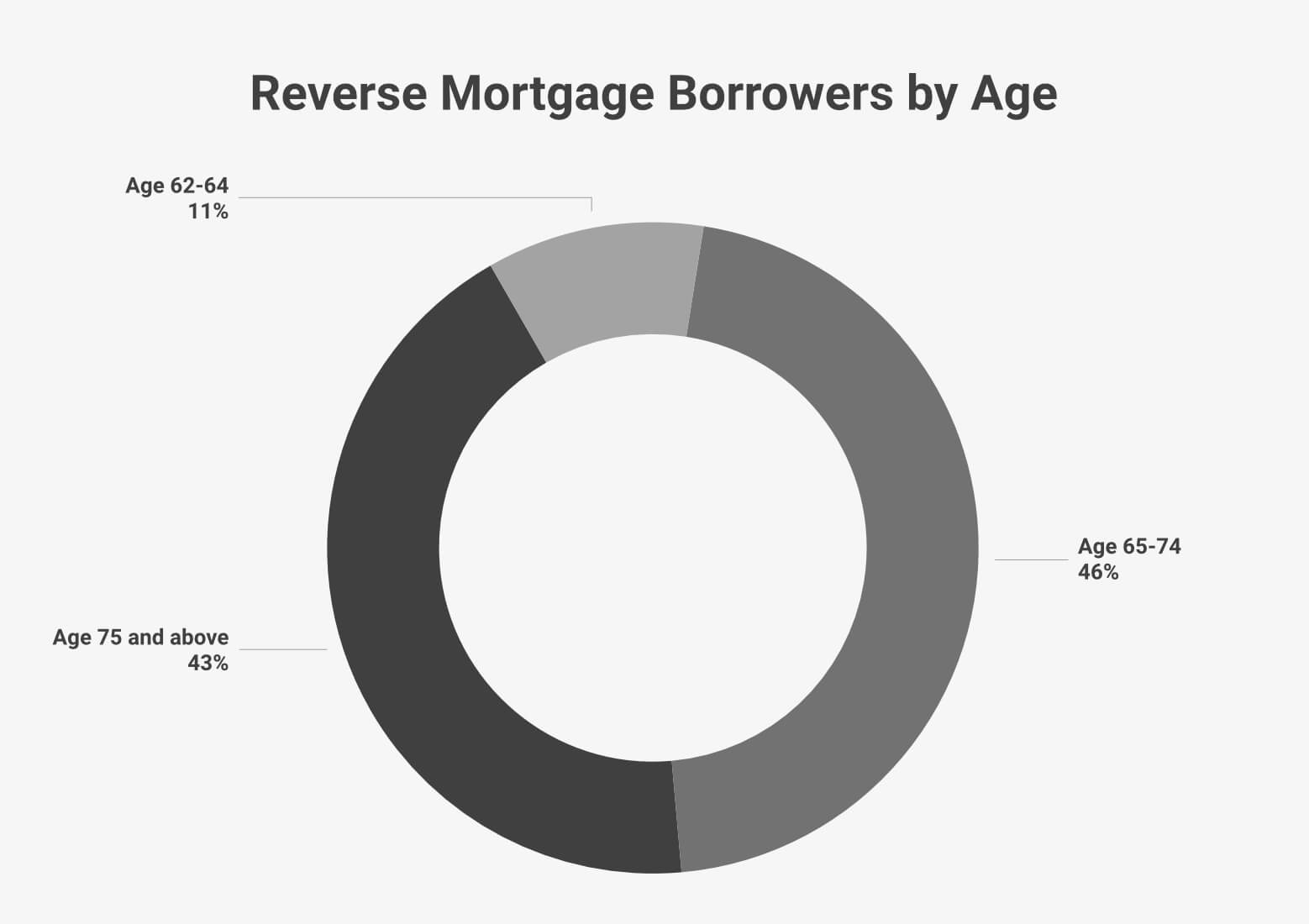

Reverse mortgages, traditionally aimed at seniors 62 and older, are now accessible to younger homeowners in select states, providing a way to tap into home equity without selling. Understanding where these options exist is critical for those seeking financial solutions before traditional retirement age.

States Offering Reverse Mortgages at 55: A Breakdown

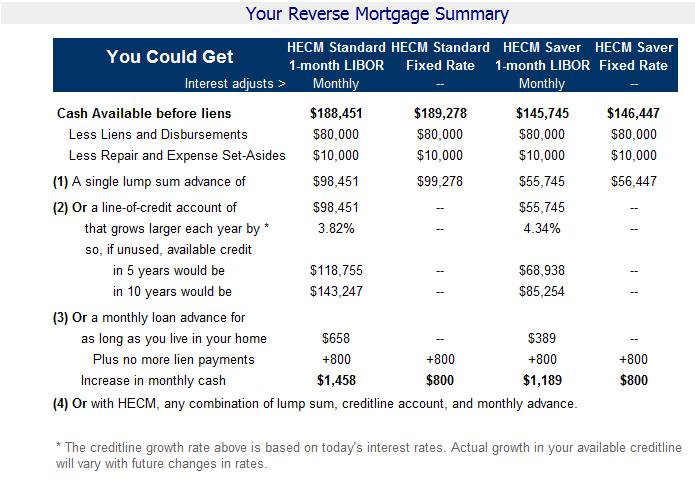

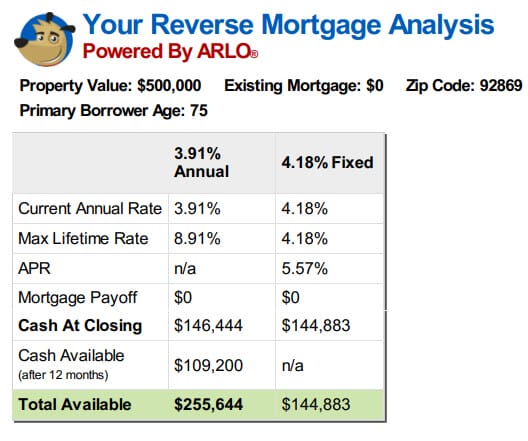

Currently, the landscape for reverse mortgages at age 55 is limited, primarily relying on proprietary or private reverse mortgage products. These differ significantly from the government-insured Home Equity Conversion Mortgage (HECM), which has a minimum age of 62.

Texas is one key state where certain lenders offer proprietary reverse mortgages to individuals as young as 55. These products often have different terms, higher interest rates, and may come with unique features compared to HECMs.

Several other states may have lenders offering reverse mortgages to those under 62, but these offerings are often regional and dependent on the specific lender's policies. Researching local mortgage providers is crucial.

How to Find These Options

The first step is contacting local mortgage brokers and lenders. Inquire specifically about proprietary reverse mortgage products for homeowners aged 55 and older.

Online searches using terms like "reverse mortgage age 55" combined with your state name can also yield results. Be cautious and verify the legitimacy of any lender you find online.

Consider consulting with a financial advisor. They can help you assess whether a reverse mortgage is the right financial decision for your individual circumstances.

Understanding the Risks and Benefits

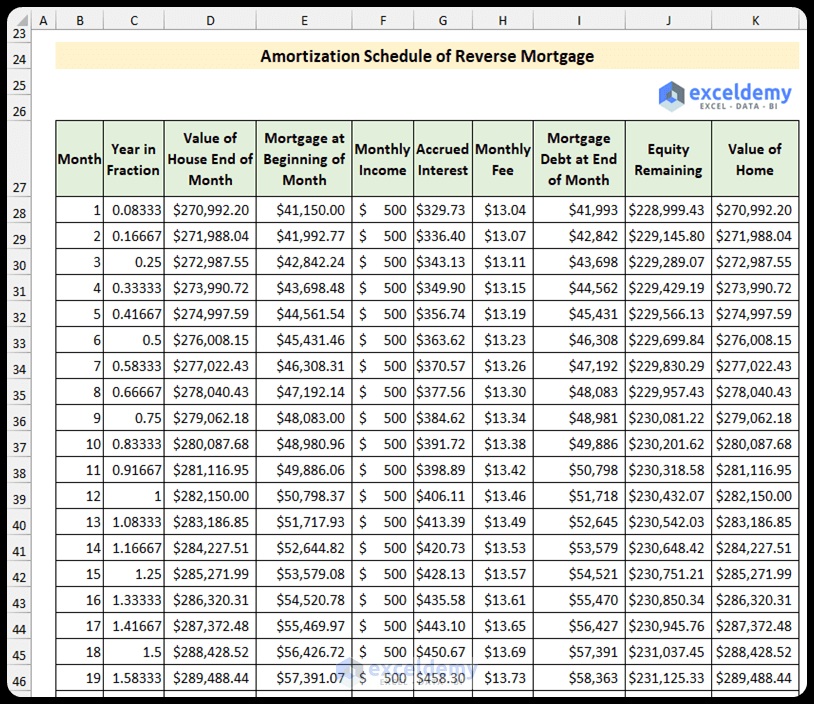

Reverse mortgages can provide a valuable source of income or funds for unexpected expenses. However, they also come with significant risks.

One major risk is the potential for foreclosure. If you fail to pay property taxes, homeowners insurance, or maintain the home, the lender can foreclose on the property.

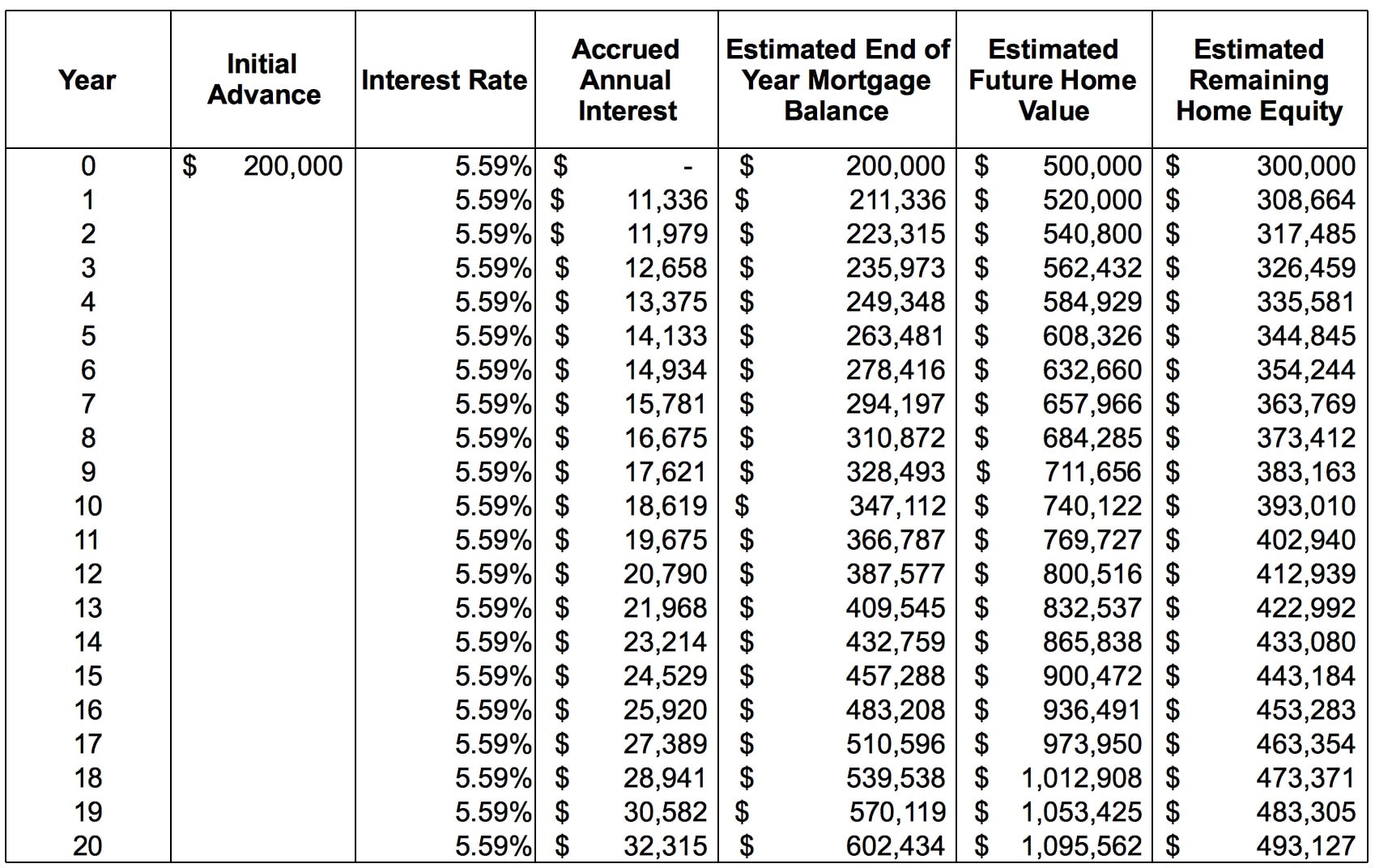

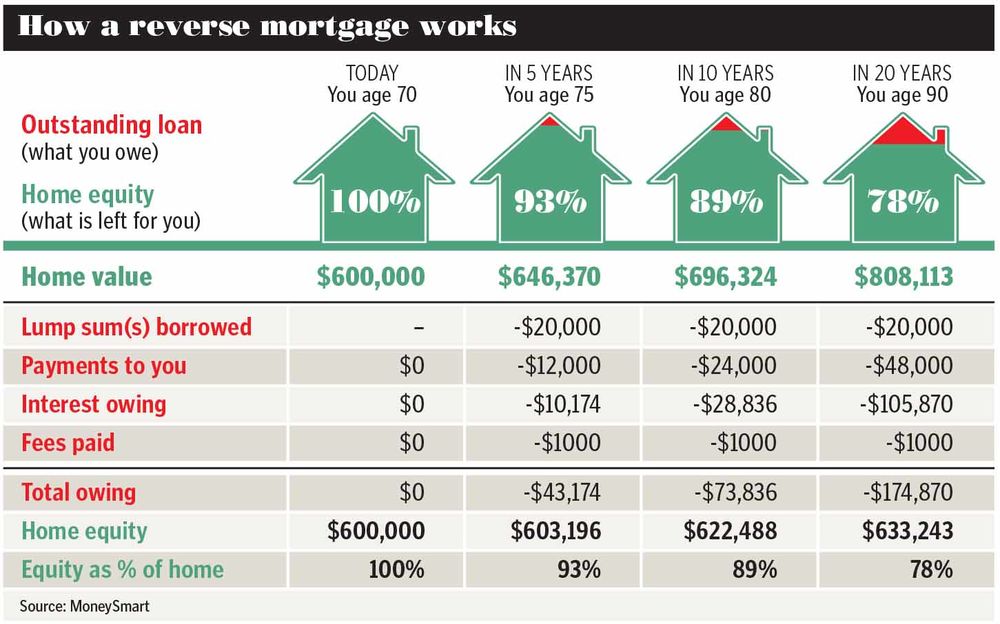

Interest accrues on the loan balance over time, reducing the equity in your home. This can impact your ability to pass the home on to your heirs.

Proprietary reverse mortgages often have higher interest rates and fees compared to HECMs. Be sure to carefully compare the costs and terms before making a decision.

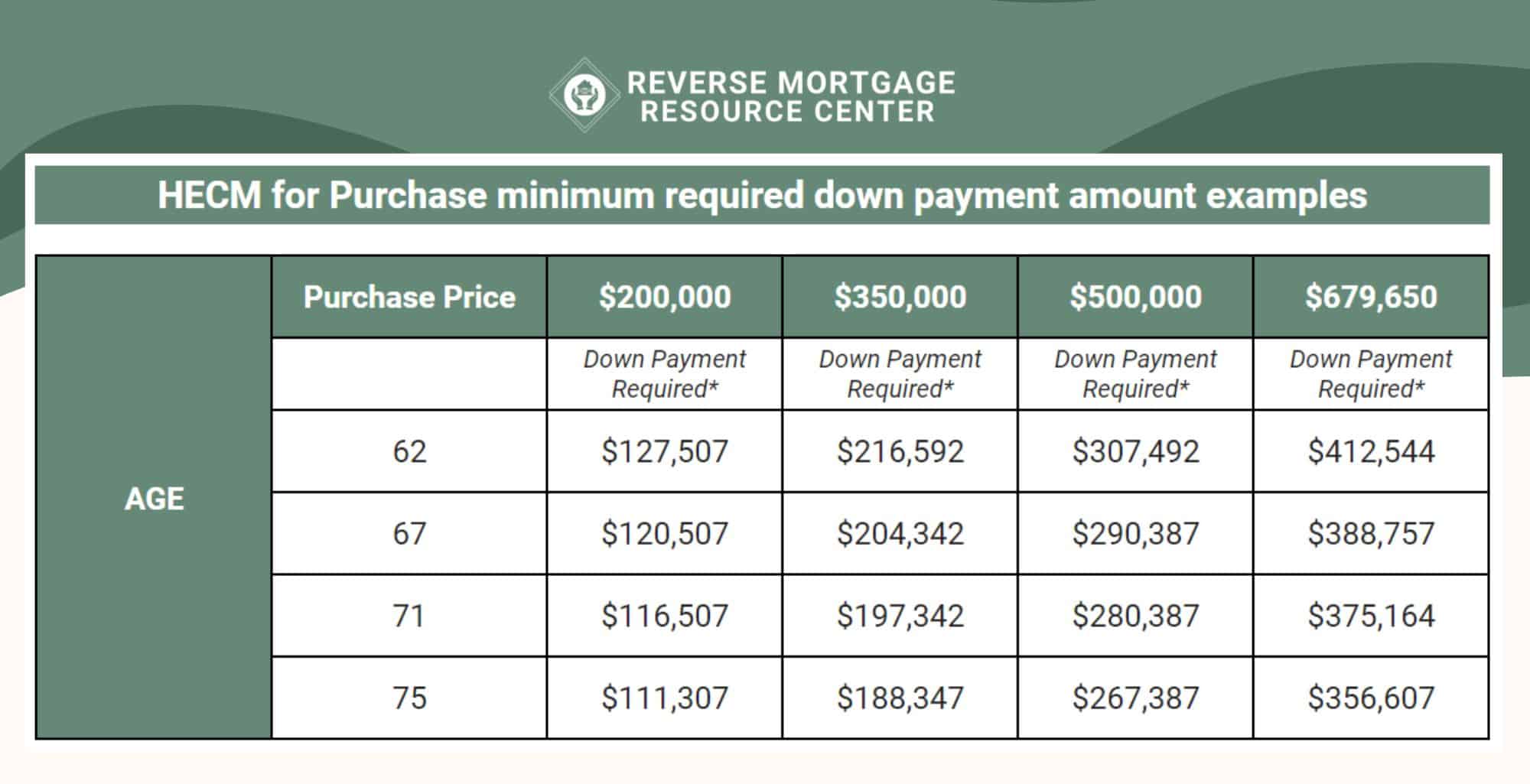

HECM vs. Proprietary Reverse Mortgages

The Home Equity Conversion Mortgage (HECM) is insured by the Federal Housing Administration (FHA). This provides some protection to borrowers.

Proprietary reverse mortgages are not insured by the government. This means they may carry a higher level of risk.

HECMs have standardized terms and are subject to stricter regulations. Proprietary reverse mortgages can vary significantly from lender to lender.

The maximum claim amount for a HECM is capped, while proprietary reverse mortgages may offer higher loan amounts, but at a higher cost.

Important Considerations Before Applying

Before pursuing a reverse mortgage at 55, carefully assess your financial situation. Consider all available options, including downsizing, borrowing from retirement accounts, or seeking other forms of financing.

Attend a counseling session with a HUD-approved agency. This is required for HECMs and is highly recommended for proprietary reverse mortgages as well.

Read all loan documents carefully and ask questions about anything you don't understand. Ensure you fully comprehend the terms and conditions of the loan before signing.

Be aware of potential scams and predatory lending practices. Work with reputable lenders and consult with trusted financial professionals.

The Future of Reverse Mortgages for Younger Homeowners

The availability of reverse mortgages for those under 62 is likely to evolve. As more people seek financial solutions earlier in life, the demand for these products may increase.

Keep informed about changes in regulations and the emergence of new proprietary reverse mortgage products. Consult with financial professionals to stay updated on the latest developments.

The landscape of reverse mortgages for younger homeowners is still developing. Vigilance and informed decision-making are key.

![What States Allow Reverse Mortgage At Age 55 10 Best States to Buy a House This Year [2024] - District Lending](https://districtlending.com/wp-content/uploads/2024/06/Reverse-Mortgage-PROS-and-CONS-scaled.jpg)