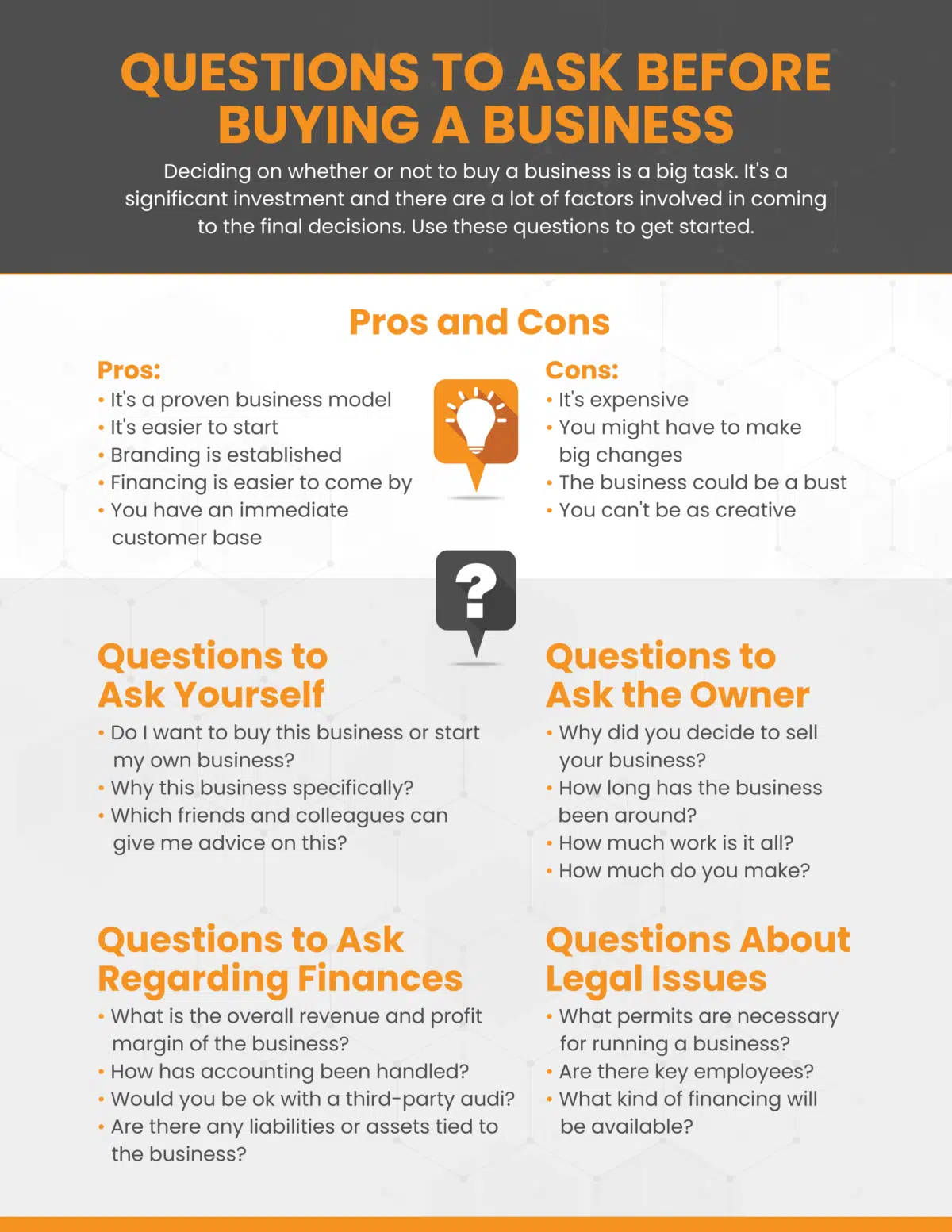

What To Ask Before Buying A Business

Thinking of buying a business? Don't leap without looking. Due diligence is critical to avoiding financial disaster.

This guide provides essential questions to ask before signing on the dotted line, ensuring you're buying opportunity, not a liability. Failure to properly investigate can lead to unexpected debts, legal battles, and a business that never thrives.

Financial Due Diligence: Unveiling the Truth

Reviewing Financial Records is paramount.

Ask for at least three years of Profit and Loss statements, balance sheets, and cash flow statements. Verify the accuracy of these documents with a qualified accountant.

Inconsistencies or unexplained fluctuations should raise immediate red flags.

Key Questions:

What are the business's revenue streams and their consistency?

What are the business's operating expenses and are they reasonable?

Are there any outstanding debts or liabilities, including loans, leases, or pending lawsuits?

Operational Assessment: Understanding the Engine

Go beyond the numbers and understand the business's day-to-day operations.

This includes assessing the quality of assets, efficiency of processes, and the strength of the team.

Talk to employees and customers to gain firsthand insights.

Critical Inquiries:

What is the condition of the business's physical assets (equipment, inventory, property)?

What are the key operational processes, and how efficient are they?

How reliable are the supply chains, and are there alternative suppliers?

What is the employee turnover rate, and what are the reasons for it?

Legal and Regulatory Compliance: Avoiding Pitfalls

Ensuring the business is operating legally and ethically is vital.

This involves reviewing all relevant licenses, permits, and contracts.

Consult with an attorney to identify any potential legal risks or liabilities.

Important Legal Questions:

Are all necessary licenses and permits current and transferable?

Are there any pending lawsuits or legal claims against the business?

What are the terms of the lease agreement, and is it transferable?

Are there any environmental regulations affecting the business?

Market Analysis: Gauging the Landscape

Understand the business's market position and future prospects.

Analyze the competitive landscape, market trends, and customer demographics.

Assess the long-term viability of the business in the current market environment.

Market Insight Questions:

Who are the business's main competitors, and what are their strengths and weaknesses?

What are the current market trends, and how are they affecting the business?

What is the business's market share, and how has it changed over time?

What are the customer demographics, and how loyal are they?

Seller's Discretionary Earnings (SDE): Understanding the True Profit

SDE represents the total financial benefit a single owner-operator would derive from the business.

It is a crucial metric for valuing small businesses.

Calculate and verify the SDE to determine the true profitability of the business.

SDE Calculation Questions:

What is the owner's salary and benefits?

What are the one-time or non-recurring expenses included in the financial statements?

What are the personal expenses paid by the business?

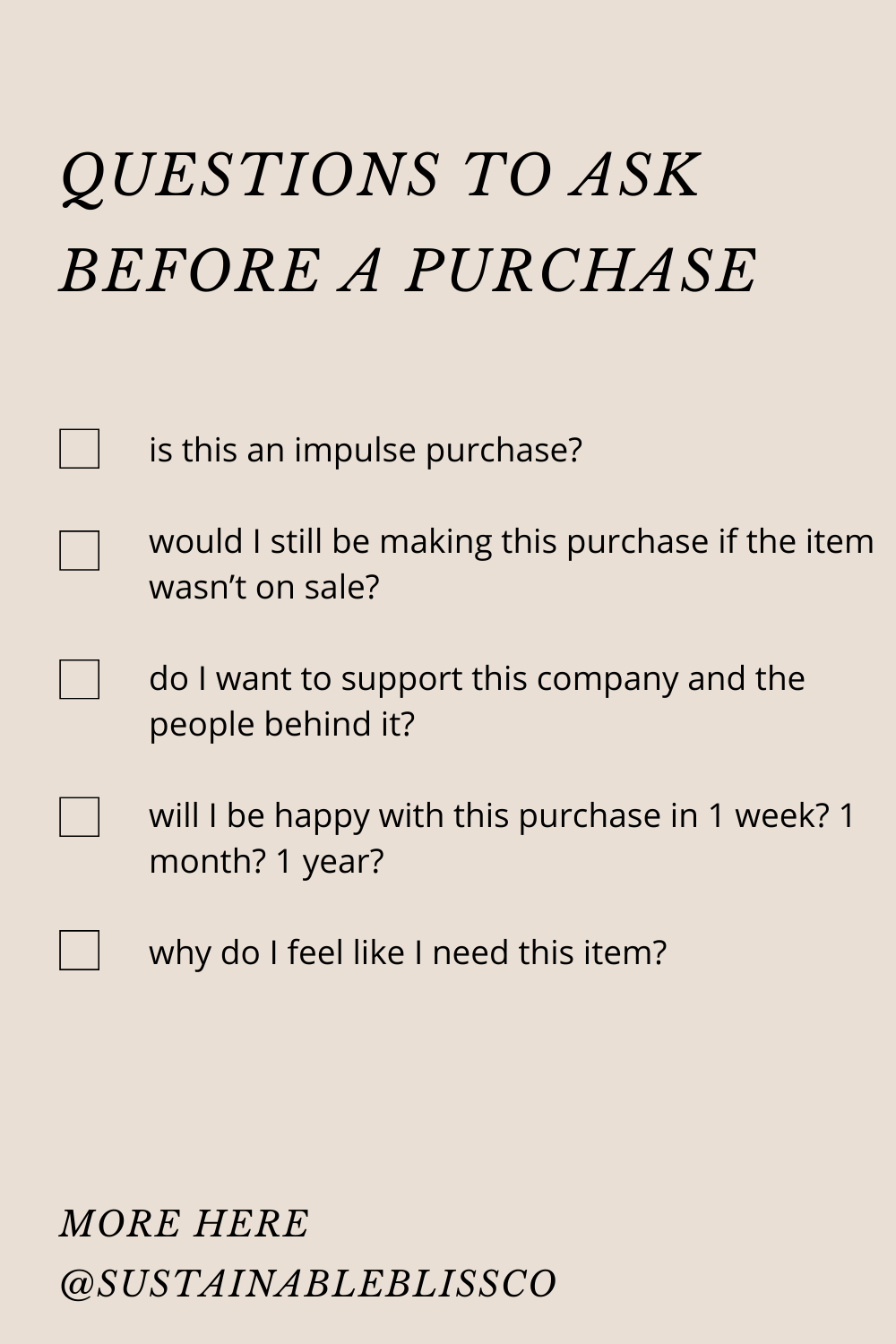

Next Steps: Proceed with Caution

Buying a business requires thorough investigation and professional guidance.

Engage with legal and financial advisors to navigate the complexities of the transaction.

Don't rush the process; due diligence is an investment that can save you from costly mistakes.

Continue gathering information, verifying data, and seeking expert advice until you are confident in your decision. Your future success depends on it.

![What To Ask Before Buying A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=600&name=3 questions to ask yourself before buying a business.png)

+(59).png)